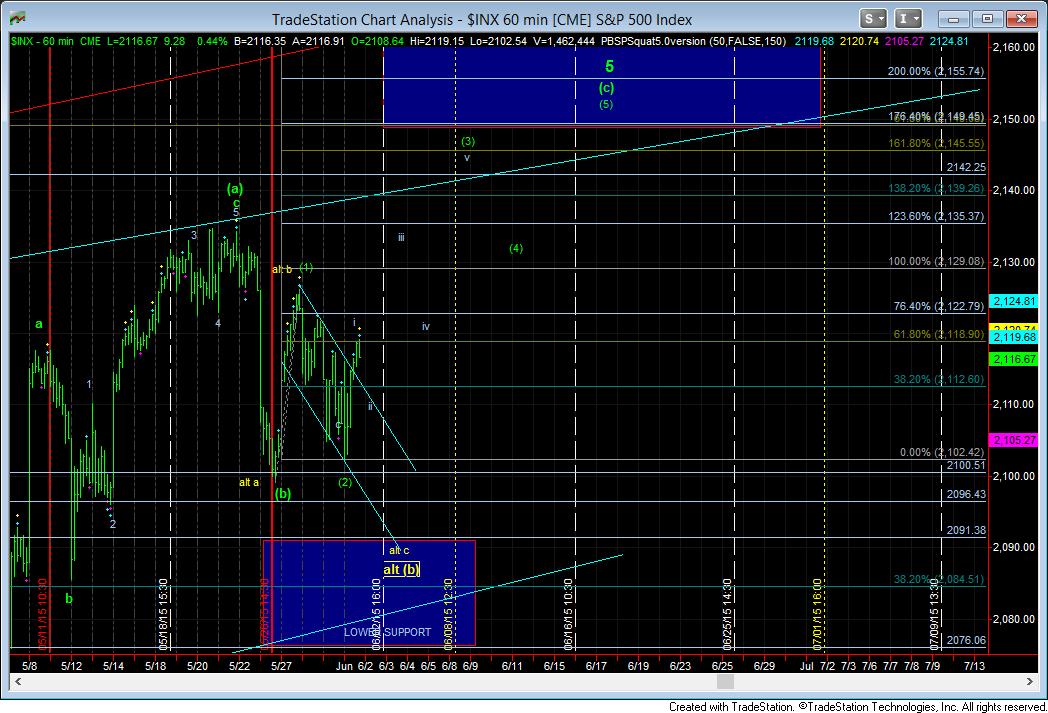

Are We Heading To 2150 Now?

As per the weekend analysis, with the 2100SPX line in the sand holding today, the market has moved up to the .618 extension within its Fibonacci Pinball structure. This means we should see a corrective pullback from here, which will likely test the top of the break out channel.

The most likely path towards the 2150 region has been added to the attached chart. As long as the next pullback is corrective and does not break today’s low, I am looking for us to head up to the 2130SPX region, which will then provide us with another corrective pullback/consolidation in wave iv of (3). That will likely be what we see tomorrow.

So, for now, as long as we do not breach today’s lows, I am looking up for the next week, with the top to this structure potentially completing by next week.

And, as you know, should we break below today's lows, then the alternative count noted in yellow will be applicable. However, the pattern is much more suggestive of further highs to be seen later this week.