Are We Finally Setting Up For New All Time Highs?

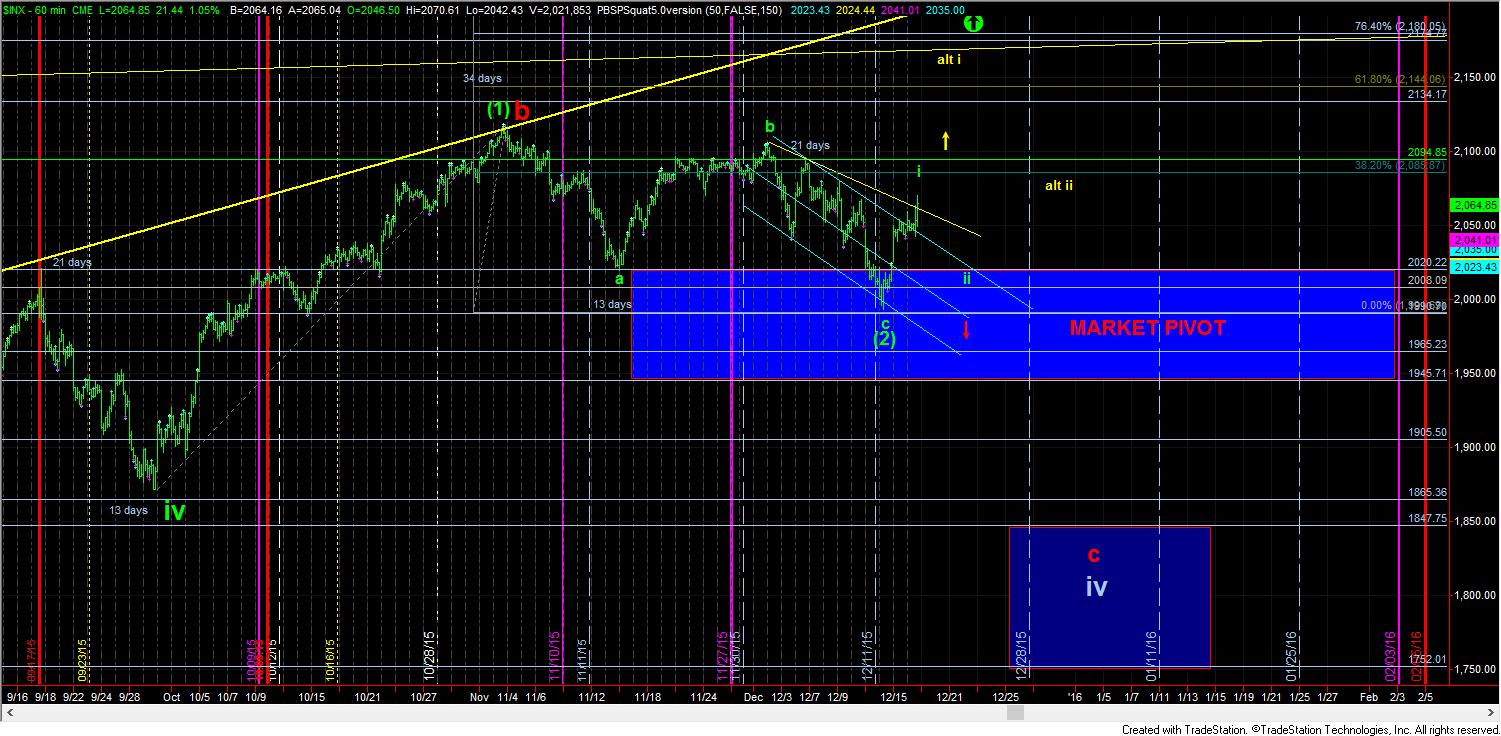

With the slight move thus far through the 2070SPX level, the market has provided us with what looks like a 5 wave structure off what we formerly counted as an alt-(2). As long as we remain below 2095SPX, that will be the count I now follow, with wave (2) now being in place. This means that we are likely setting up for a “Santa-Rally” to take us to new all-time highs.

But, for now, it is only a set up. Remember, what we need to confirm the major rally we want to see to 2300+. First, we need a completed wave I, followed by a corrective pullback in wave ii, and then a break out over the top of wave i. This far, we have not confirmed a top yet in a wave i. In fact, this wave I can even extend as high as the 2160SPX region if we see a break out this week over 2095SPX. But, the market will clearly have to prove that to me with a strong upside move into tomorrow to even consider that bigger wave I in yellow.

Ultimately, this means that the low we made on Monday is our benchmark between the bullish and bearish potential in this market. As long as we maintain over that level – and, truthfully, I would not even want to see us approach that region in this set up – then we have to maintain a bullish bias in the market, especially with the strong indication that a 5 wave structure has been completed off that low.

For now, I will await the completion of a wave I and ii in a wave (3) - as I need confirmation to become uber-bullish for our targets over 2300. As long as we remain below 2085/95SPX resistance, we should be completing that wave I today, or tomorrow morning at the latest. But, a move through resistance tells me we will likely target the .618 extension for that wave I of (3). Remember, wave I of (3) will either target the .382 extension region, or the .618 extension region. So, we are seeking confirmation as to which one this market will now chose.

For now, I will remain cautiously optimistic.