Are We Done With The Pullback?

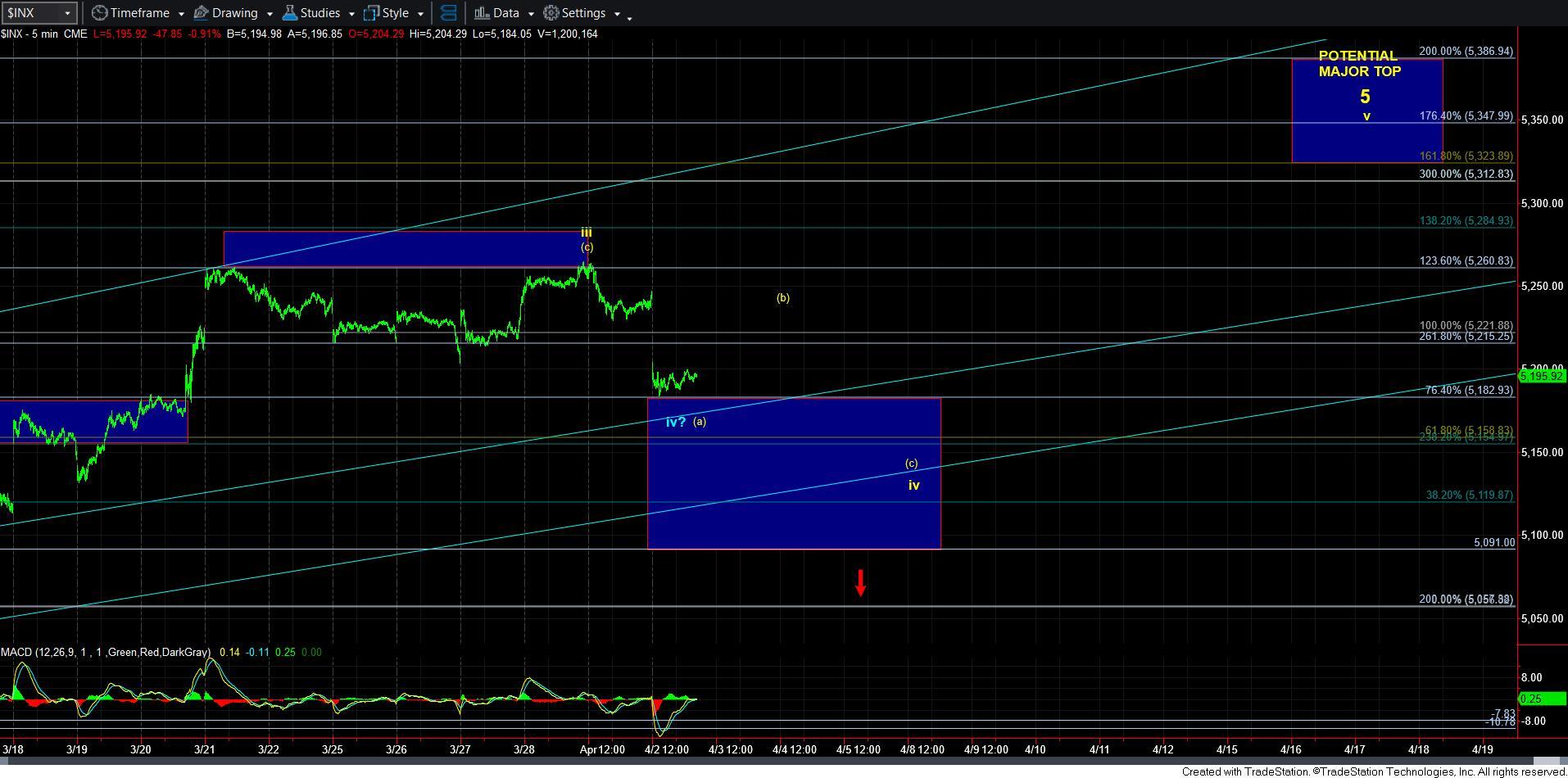

While the market struck our resistance on the 5-minute chart at the open this week, we have now pulled back to the support/target box for wave iv. And, the question now is if this represents all of wave iv?

As you can see from the attached SPX chart, I am tracking this as an [a] wave within an expected more protracted wave iv. Also, take note that the ES chart shows that even within this [a] wave, until we actually get through the 5260ES region (.382 retracement of wave 3 of the c-wave down), a lower low is a reasonable expectation before the decline today completes.

But, once we complete this decline, the question will turn to if the wave iv is done? Now, in a normal circumstance, I would be expecting the [b] and [c] waves as outlined on the 5-minute SPX chart. However, I just want to note that there is some potential that this decline could have been all of the wave iv. You see, if the IWM structure is still going to push higher one more time, then this decline has to be done in this region.

Of course, it is entirely possible that the IWM has already topped and the SPX will make a higher high while the IWM simply sees a corrective bounce. However, since I do not have a full 5-wave decline off the high in the IWM YET, I cannot make that assumption.

The other factor which makes this more difficult than a standard Fibonacci Pinball structure is that all waves in a diagonal take shape as 3-wave structures. And, since the a-wave of wave v would likely be 3 waves, it will be basically indistinguishable from a corrective [b] wave rally in an ongoing wave iv, as b-waves are also 3-wave structures.

I want to also add a point I made earlier today in an intra-day alert:

“Interestingly, SPX has broken down below the uptrend channel created since the start of the c-wave rally. But, again, until we actually break down below 5091SPX, I have no strong signal a top has potentially been struck. We are dealing with a smaller diagonal up here, so I do not want to be premature.

Also, this brings me to a point I make quite often . . trend channels are among the lowest level of reliable technical analysis, so I do not rely upon them, even though I will use them.”

So, the one conclusion which I continue to proffer is that as long as the market holds 5091SPX, the bulls remain in charge, and we likely continue higher to 5300+.