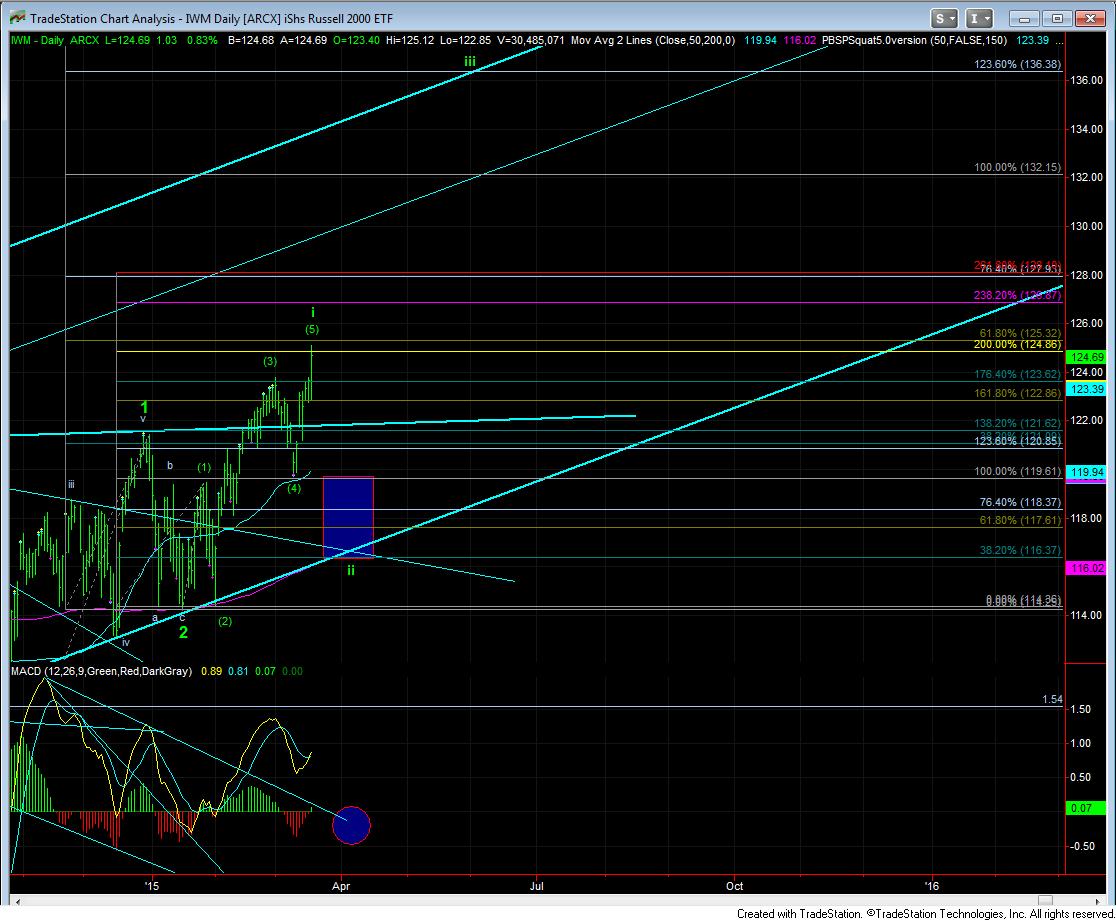

Are We Breaking Out In Wave III?

I know this rally today has gotten everyone’s juices flowing, as we have been looking for this market to attack the 2200 region since last year. Furthermore, I said that I am going to be EXTREMELY bullish on this market for 2015 if we see the IWM make a higher high relative to last week. Well, here we are. And, yes, I am VERY bullish for 2015.

However, remember that my ideal pattern called for the IWM to make a higher high in a wave (5) of wave I within wave 3. And, that 5 wave structure usually targets the 2.00 extension within that 5 wave move. That is what we struck today. Furthermore, the wave i of 3 usually targets the .618 extension of waves 1 and 2, and that is just above the level we struck today. So, can the market continue to extend? Sure. But, I would need to see a strong break out over 128 in the IWM to convince me that we are in wave iii of 3.

Furthermore, I posted something early this morning as the market was pulling back before the Fed announcement:

there is an evil scenario potentially playing out in the ES. And, it all depends on where we go, assuming we go higher. Should the market hold the 2054/56ES region and then rally all the way up to the 2098ES region directly in a 5 wave move, that would be a larger degree (b) wave for me, with waves a and c being equal. That would then set up a drop to the .618 retracement level where yellow waves (a) and (c) would be equal. Yes, this means we get an a=c higher for (b) and then an (a)=(c) lower for a bigger b - AND we strike the .618 retracement, which we came shy of the first time down.

In fact, this scenario is so perfect, it makes it hard to believe that the market will play out this way. But, I do want to point out this potential, in case we go directly to 2098ES, which will, undoubtedly, make everyone believe we are breaking out. Just keep this in mind for now, as we have much to prove before we can even attempt a trade on this.

Well, at the end of the day, the market topped at the 2099Es region. Does that mean we have a (b) wave top on our hands? No. It means we have to be on the lookout for such potential. And, the major signal for this to be happening is a break down below the 2078ES level. If the market does break down below 2078ES, then I will be targeting the 2020ES region – the .618 retracement level – at which time, I will be looking to get VERY bullish on the long side. This would also coincide with a wave ii pullback in the IWM.

So, we are at a cross roads. We have been bullish all year, and there is no reason to change our posture. However, the only question at hand is if a bigger pullback will be taking us down for the next few weeks before the bigger move higher begins or not. And, should the market remain below 2110ES, and break below 2078ES, then my answer to that question is that we will get that bigger pullback.