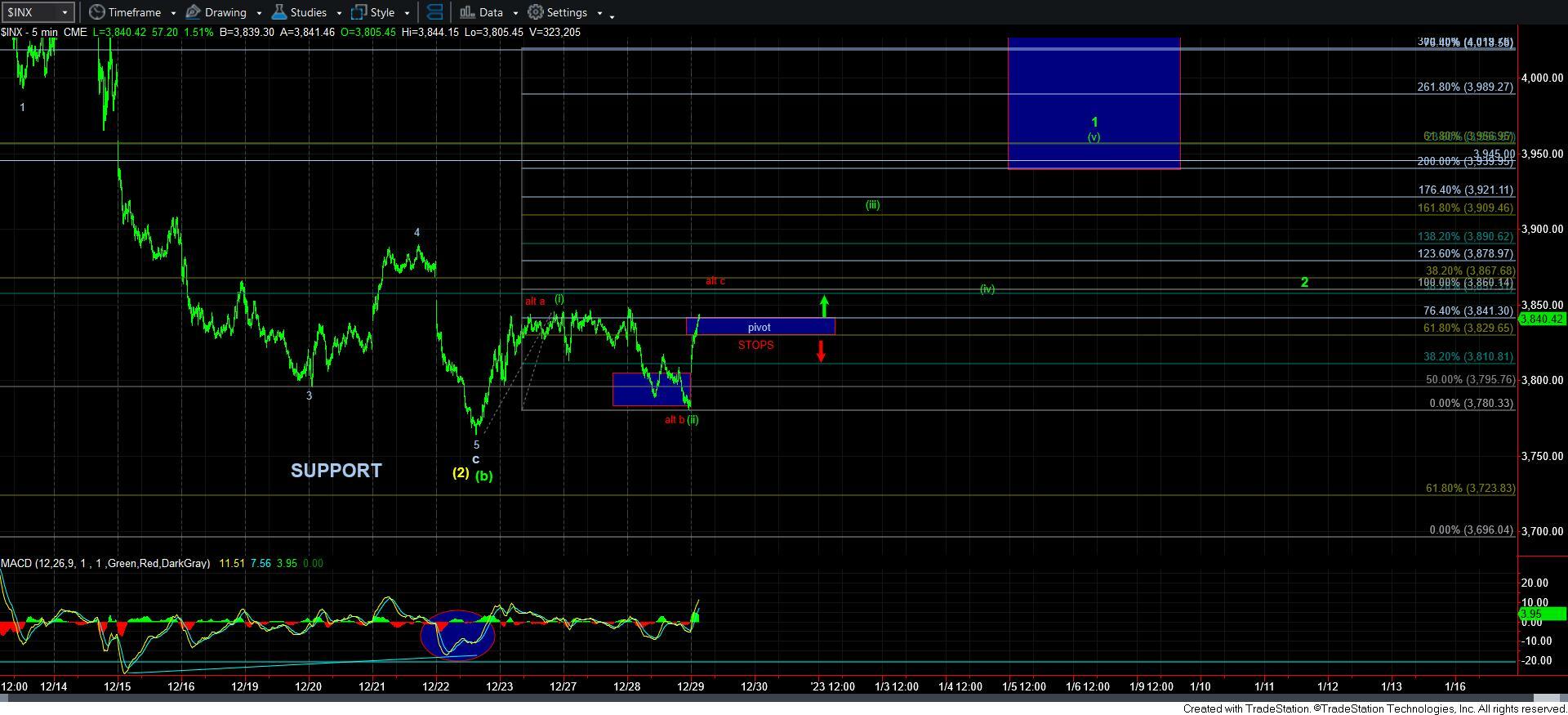

Approaching Important Resistance - Market Analysis for Dec 29th, 2022

While the market held its support yesterday, we are now approaching another big test. Normally, when we set up for wave (iii), the wave i of (iii) targets the .382-.618 extension. However, if the market blows through the .764 extension and goes directly to the 1.00 extension, that is a warning that we may just be seeing an a-b-c corrective rally off the low.

Therefore, I wanted to prepare you early before it happens, as the market may be trying to reach the 1.00 extension directly. Should we get to the 1.00 extension, and then break down below the pivot impulsively, then it is an early signal that we can potentially break down to at least the 3720SPX region, and potentially extend back down to the 3600SPX region. So, if we do move up to the 1.00 extension directly, you may want to move your stops up just to below the pivot - as I show on the 5 minute chart.

The other option is that you can cash in at the 1.00 extension and always get back in at the wave 2 pullback, as it will likely come back down to the same region once all of wave 1 completes.

The main point of this update is for risk management purposes, and I want you to realize the additional risk if the market goes directly to the 1.00 extension - - especially if it then breaks back below the pivot.