Another Diagonal - Market Analysis for Sep 16th, 2025

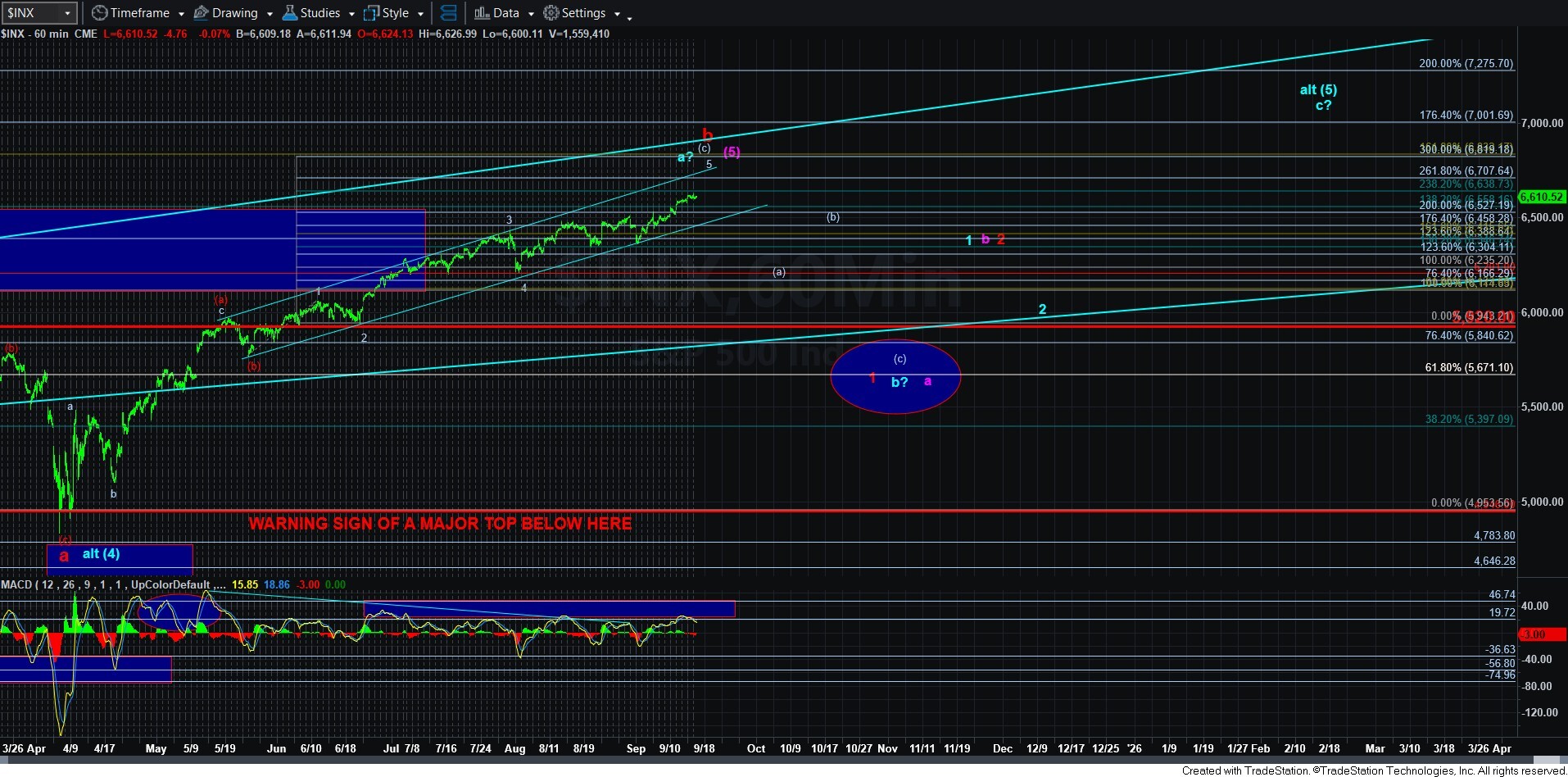

I cannot ever remember a time where I have seen so many diagonals within diagonals as compared to what we are seeing today in the SPX. And, the current structure seems to want to push even higher with a bigger diagonal, as I outlined recently.

With the market moving through the resistance noted in the futures, I am forced to assume that this last 5-wave structure is taking shape as a larger diagonal, as outlined in the 15-minute futures chart. This means that we would need to break down below the wave ii in the 6508ES region in order to invalidate this potential.

In the meantime, and in following the bigger ending diagonal, I am going to assume that we will see overlap into wave i, which is most common in diagonals, which means we will likely dip into the top of the support box. But, since we did not reach the ideal target for wave iii (the 1.236 extension), I am not sure if wave iii is even done yet.

Overall, for now, I have to assume the market is going to attempt to make a run at the 6800ES region unless we see a break down below the 6500ES region. Should we see a nice a-b-c pullback structure into the top of the support box, it could represent a nice long entry for those that would want to trade for the potential 200 point rally for wave v.