All Of b Or 4440SPX Still On Target?

Earlier this week, I sent out an update entitled "Tracking Wave 4." Within that update, I noted that the market had a minimum completion for a 5-wave decline in the [c] wave of the a-wave we were tracking once we broke below 4287SPX. In other words, we were looking for a bottoming, and a rally to begin in the very near term.

Clearly, it did not take long, as the next day we took back all the decline we experienced on Monday. But, at the time we were sitting at the lows, I outlined the following:

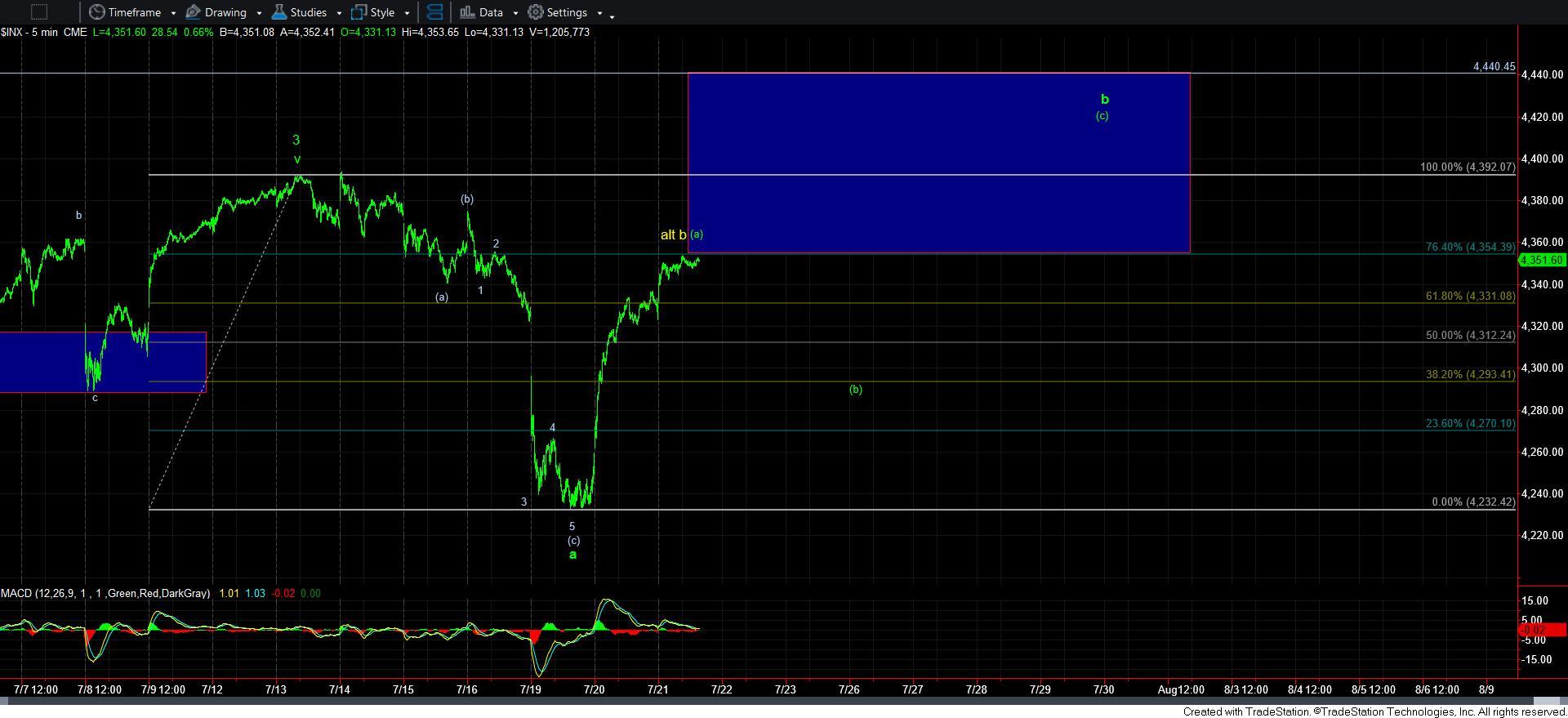

“Normally, the b-wave target is generally the .618 retracement of the a-wave. However, in our case, due to how extremely oversold we are, I am setting my minimum target for the b-wave at the .764 retracement of the a-wave. Yet, I still think there is strong potential to rally back to the 4440SPX region. Remember, when the standard impulsive structure fails to meet a target, it is quite common to see the b-wave of the ensuing corrective structure strike the target that was missed by the prior impulsive structure. So, for this reason, along with the strongly oversold condition evident in the market, I think the 4440SPX is a reasonable target.”

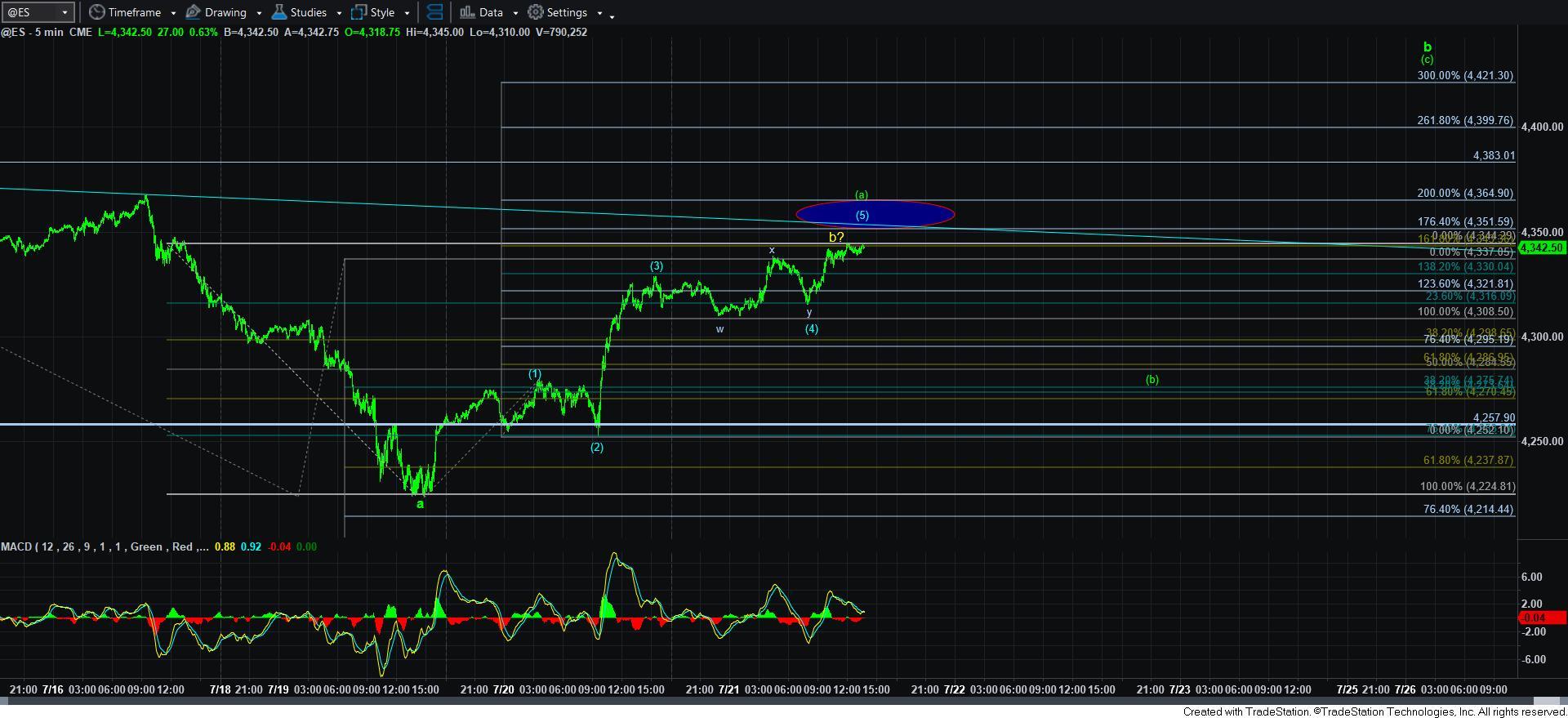

As you can all see from the attached 5-minute SPX chart, the .764 retracement was in the 4350SPX region, and that is where we find ourselves less than two days after we struck the bottom of the a-wave. So, is this all the b-wave that we get?

There is no question that we are now in a position of much greater risk. And, yes, a c-wave decline can begin at any time now, especially since we hit the minimum target I outlined earlier this week. However, I still believe there is more bullishness in the market in the near term before we may be ready for that next decline. And, I am still quite focused on that 4440SPX region target.

Moreover, there is some potential to even consider the rally off this week’s low as a 5-wave structure. That would become a much greater probability if the ES can extend through the 4351ES region, as that would take us to a minimum Fibonacci Pinball standard target of the 1.764 extension of waves (1)(2) off the recent low. And, if that should occur, it makes it much likelier that we will see higher levels in the coming week or two, but after we see a corrective pullback.

Now, I want to remind you that an [a] wave can certainly be a 5-wave structure. While it is not a common occurrence, in the lesser circumstances, we do see them take shape as a 5-wave structure. Therefore, if we do see that 5 wave structure take us to at least the 4351ES+ region, then I will say that the 4440SPX region becomes much more likely after we see a corrective pullback.

In either case, I think we are approaching a point where a pullback has become likely. My expectation at this time is that this pullback will be a corrective pullback, and point us to higher levels, and ideally the 4440SPX target I have held for some time.

However, if the next decline is a CLEAR 5-wave impulsive decline, then I will have to consider the yellow count much more seriously, and will provide you the set up which will then point us lower sooner rather than later.