Added Thoughts - Market Analysis for Nov 23rd, 2021

I wanted to add a few thoughts to what Mike said this afternoon, which I posted as an alert in the trading room. My counts are just slightly different than Mikes, but they all resolve in the same manner as long as we hold support.

With the break of the bigger diagonal I was tracking yesterday, it has forced me to consider alternatives, as I outlined last night.

For now, I think I prefer to consider wave iii as completed at this time. But, I may be doing so for risk management purposes, as I will explain below.

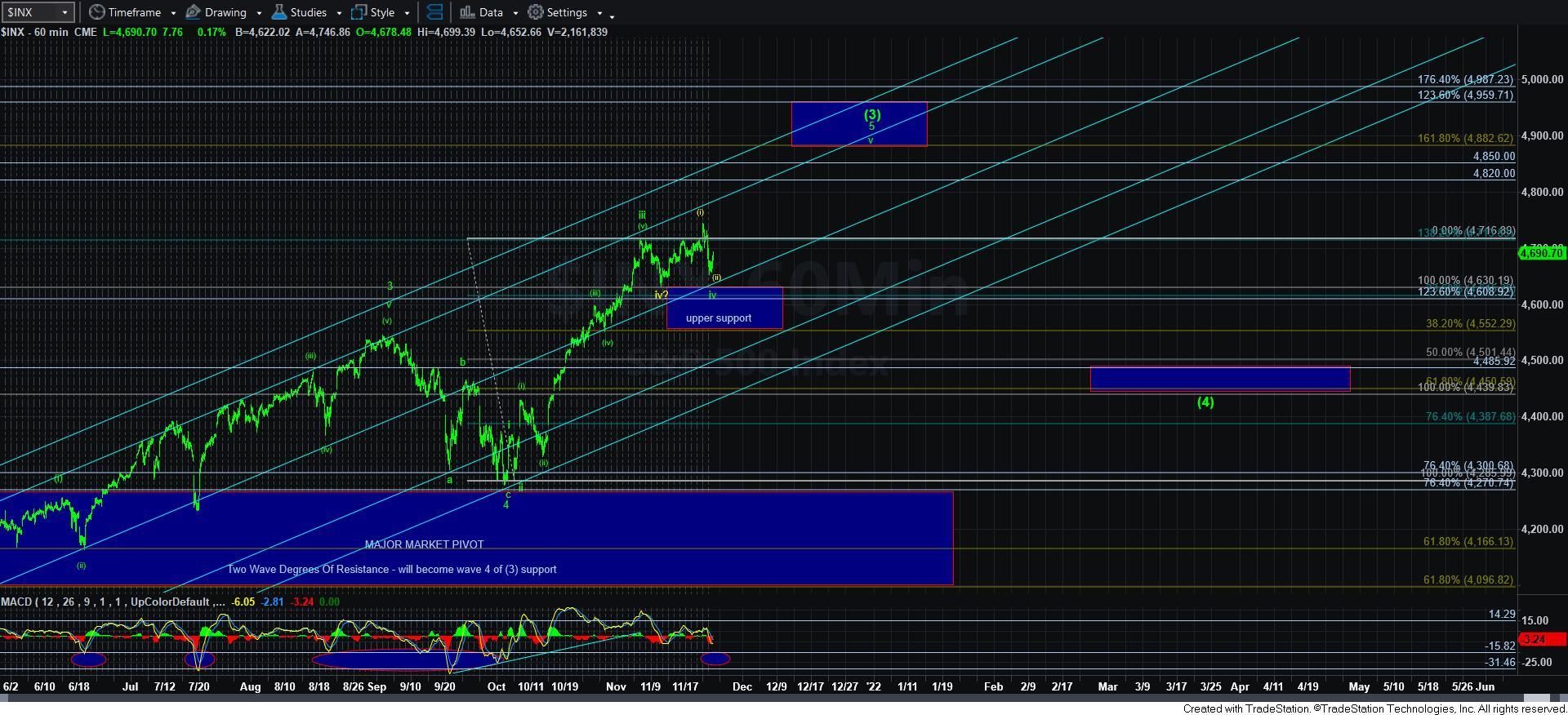

In order to solidify the green count as shown – which means we are in wave iv of 5 of [3], it really needs one more lower low for an ideal c-wave down, as c-waves are 5-wave structures. If we do not get that, then I have to note the alternative presented in yellow. This suggests that the recent rally from which we have been pulling back was a leading diagonal for wave (i) of v of 5 of (3), with the pullback low we hit today being wave (ii), since it really counts best as 3 waves down. In fact, this actually provides us with a 2.00 extension exactly to the bottom of the target box overhead. But, we will need to move through 4700ES to suggest this is the appropriate count.

In truth, this is an academic exercise as this point to me. Either one is pointing to the box overhead to me, but the question is one of micro path – and whether we get a lower low before we begin the rally to 4882SPX next. Also, do consider that if we get that lower low in SPX, we will likely strike the oversold region on the 60-minute MACD.

The other minor point I want to prepare you for is that in the event we rally towards that next higher box overhead, I will place an alternative count on the chart that that high is only the end of wave iii of 5 of [3], and still needing one more iv-v to complete all of wave (3) at 4960SPX. But, in my own personal positioning, I will be treating a strike of that box as all of (3) - not from a shorting perspective, but from a cash raise perspective.