A Pullback Is "Likely" Approaching

With the market continuing higher today, it still has retained the potential for the yellow count. So, no matter how much I would like to take it off the chart, I have to respect what the market is saying at this time.

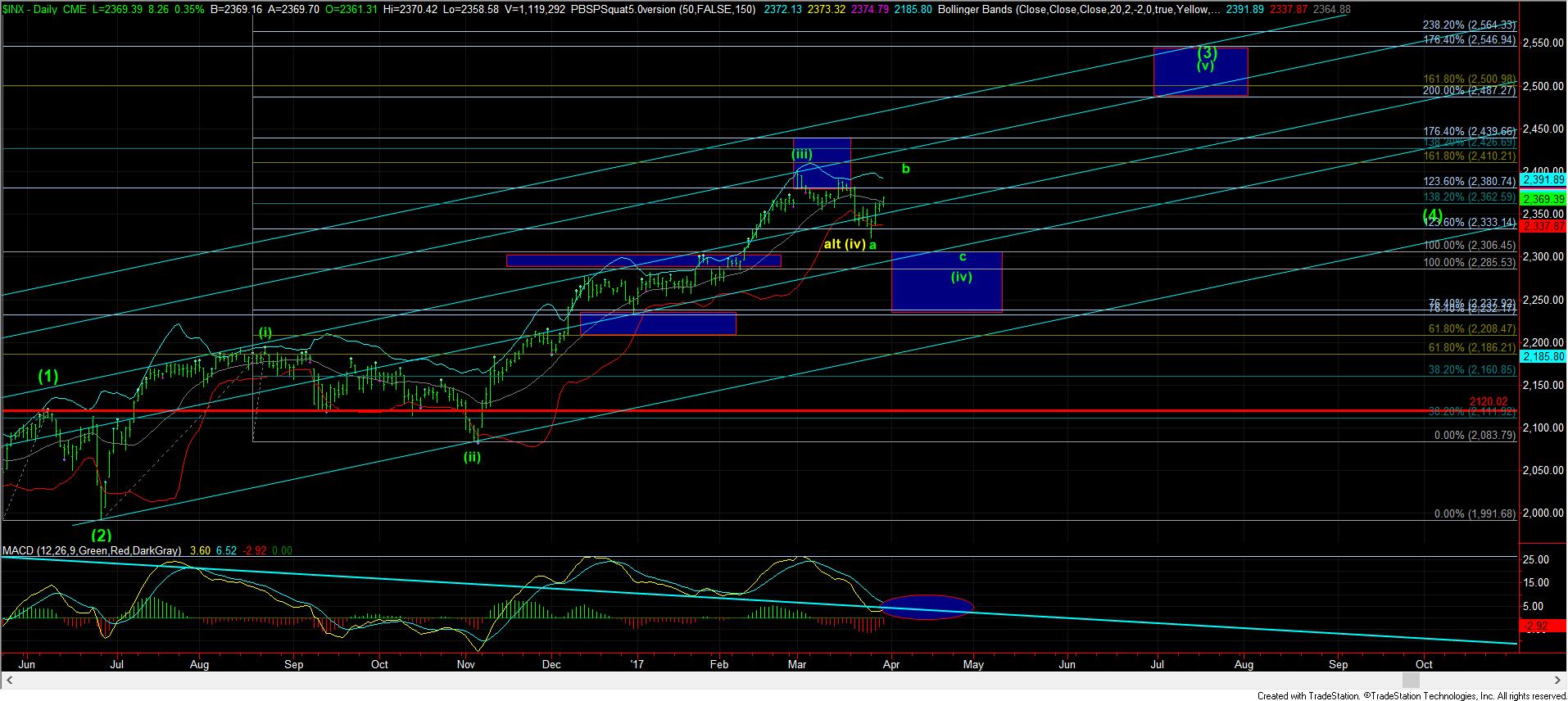

The micro rally has us in an ending diagonal for either wave v of 3 off the lows, or all of an (a) wave of the green b-wave. The top to this move should be between 2375-2380SPX, and then we should see a pullback. The depth of the next pullback will give us more insight as to whether we can eliminate the yellow count or not. A break of the 1.00 extension at 2358SPX would suggest that the pullback is not a 4th wave, but, rather, a (b) wave.

So, for now, my preference still remains the green count, and, as we have discussed so many times, it still even has the potential to make a higher high. But, I would much rather see a (b) wave begin quite soon, and potentially even last for the majority of next week in a sideways grind.

And, for those of you with longer term time frames, if we break the 2358SPX level within the next trading day or two, it would suggest your next longer time frame buying opportunity may be weeks away, while we still have to complete the b-wave, and then drop down in a c-wave. So, not completing a 5 wave structure in this region is a strong signal that this wave (iv) still has time to go.