A Lot Of Waiting But Not Much Has Changed

The market has been hovering near the highs that were struck last week for the past several days as the market participants seemingly were waiting for the FMOC meeting this afternoon. While we did see a bit of minor intraday volatility after the announcement we are ending the day relatively flat with really not much change from where we have been over the past several days.

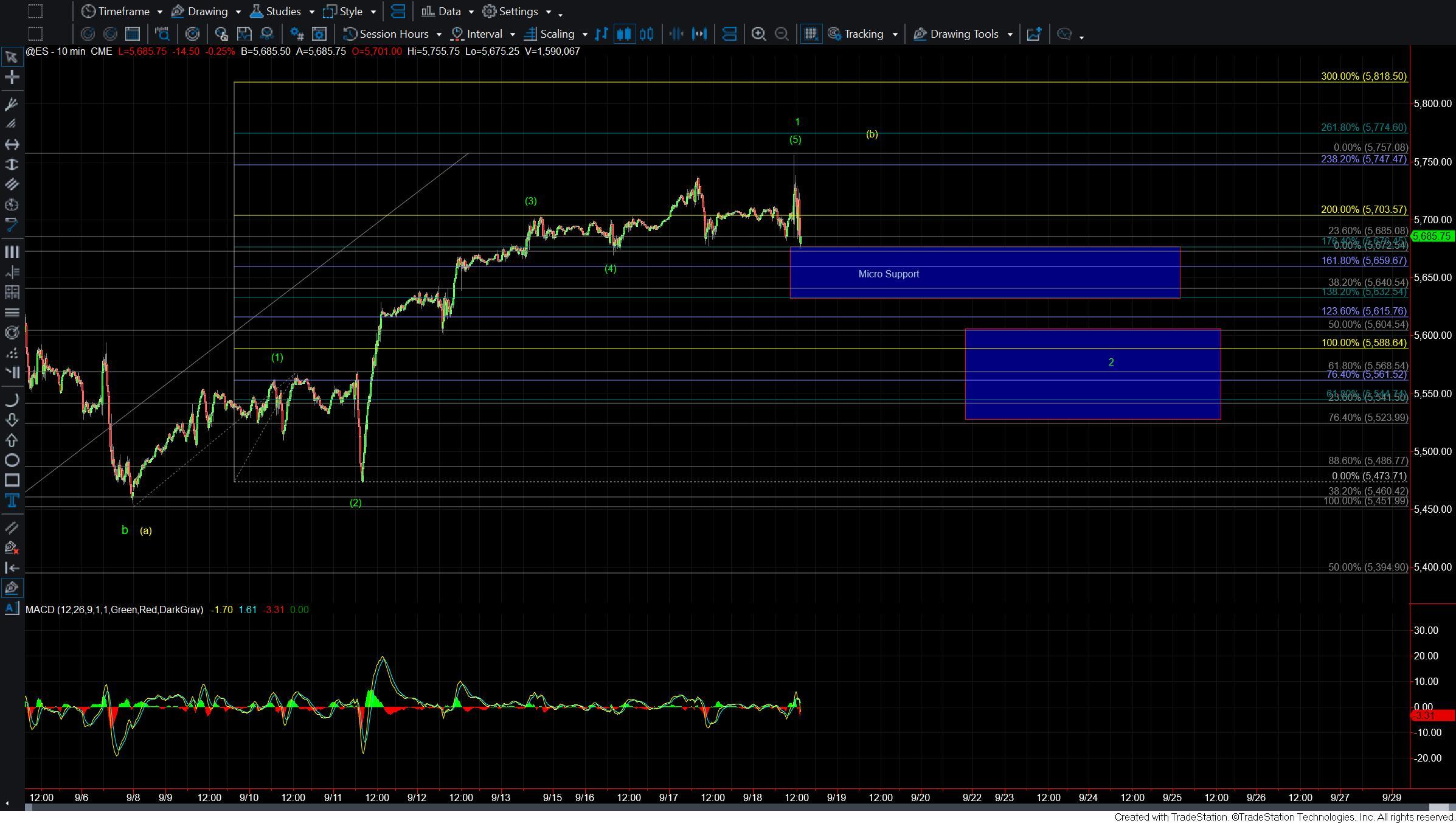

Drilling down to the 10min ES chart the market is still sitting over micro support at the 5672-5640 zone. As long as that zone holds we do not have any signal of even a local top being struck just yet. We would need to see this zone broken to signal that we have put in at least a top in the green wave 1. From there we would watch larger degree support down near the 5600-5323 zone. As long as that zone holds then another higher high is still very much in the cards as part of a larger wave 3 of c up to finish off the larger degree pattern.

Should we begin to see a break under that zone while doing so on a five wave move to the downside then it would open the door for this to have topped in the yellow wave (b) still needing a wave (c) down under the 9/8 low before moving higher once again. Under the yellow count ideally we should hold over the 5329-5248 zone below and a move under that zone would be an early signal that we have put in a larger degree top in all of our wave (5).

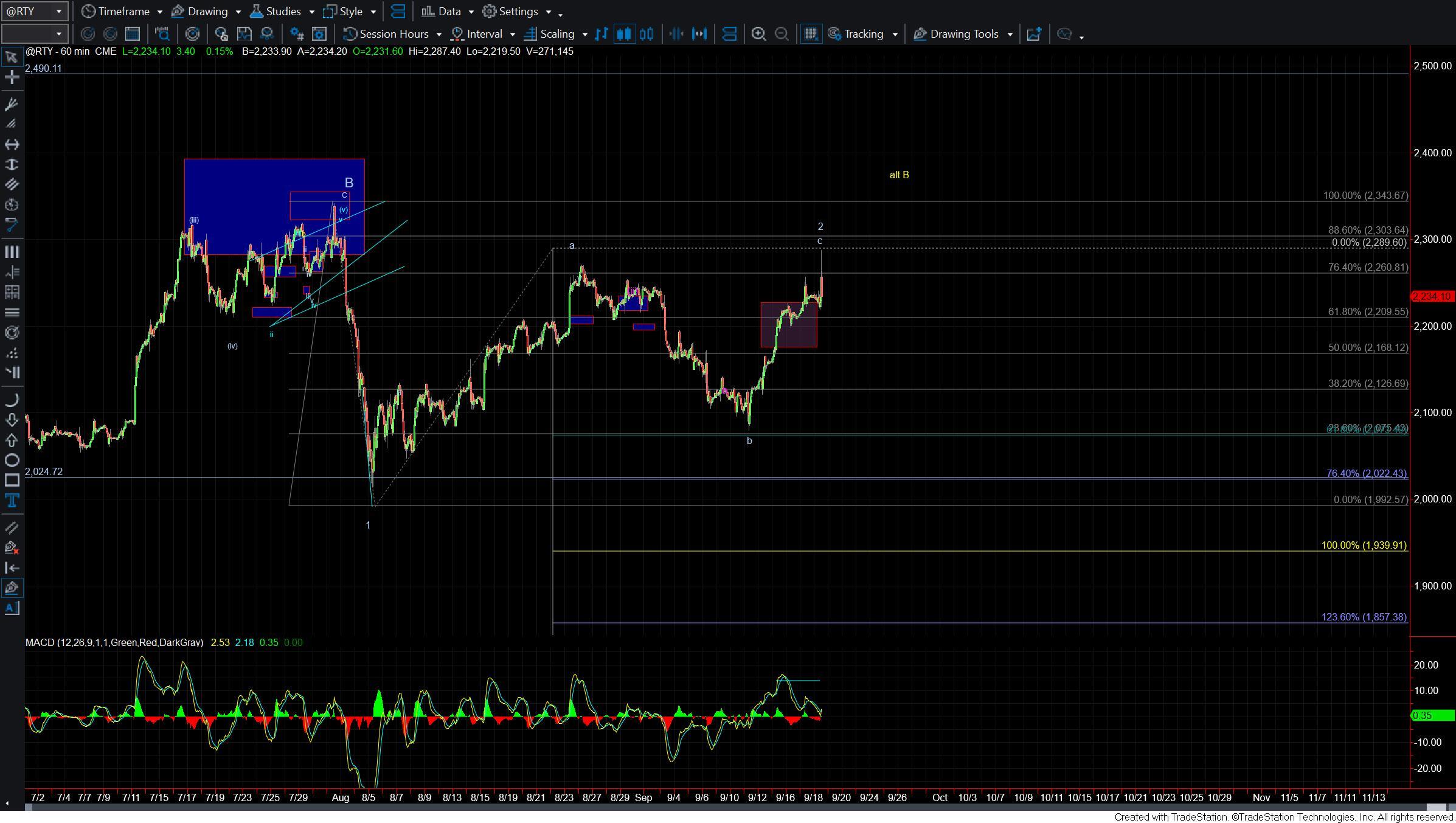

While we do have a lot of work to do before that larger degree topping count is confirmed on the ES/SPX I still remain cautious as to the larger degree top being in place largely based upon the primary count I am watching on the RTY. Should the RTY see a break back over the 2343 level then it would take out the most immediately bearish path on this chart but as long as that level holds I still remain cautious on this chart.

So while from a wave count perspective not too much has changed we have our parameters laid out fairly well here and the next couple weeks will likey tell us the direction the market is going to take as we move into the Fall trading season.