A Little More SPX Clarity

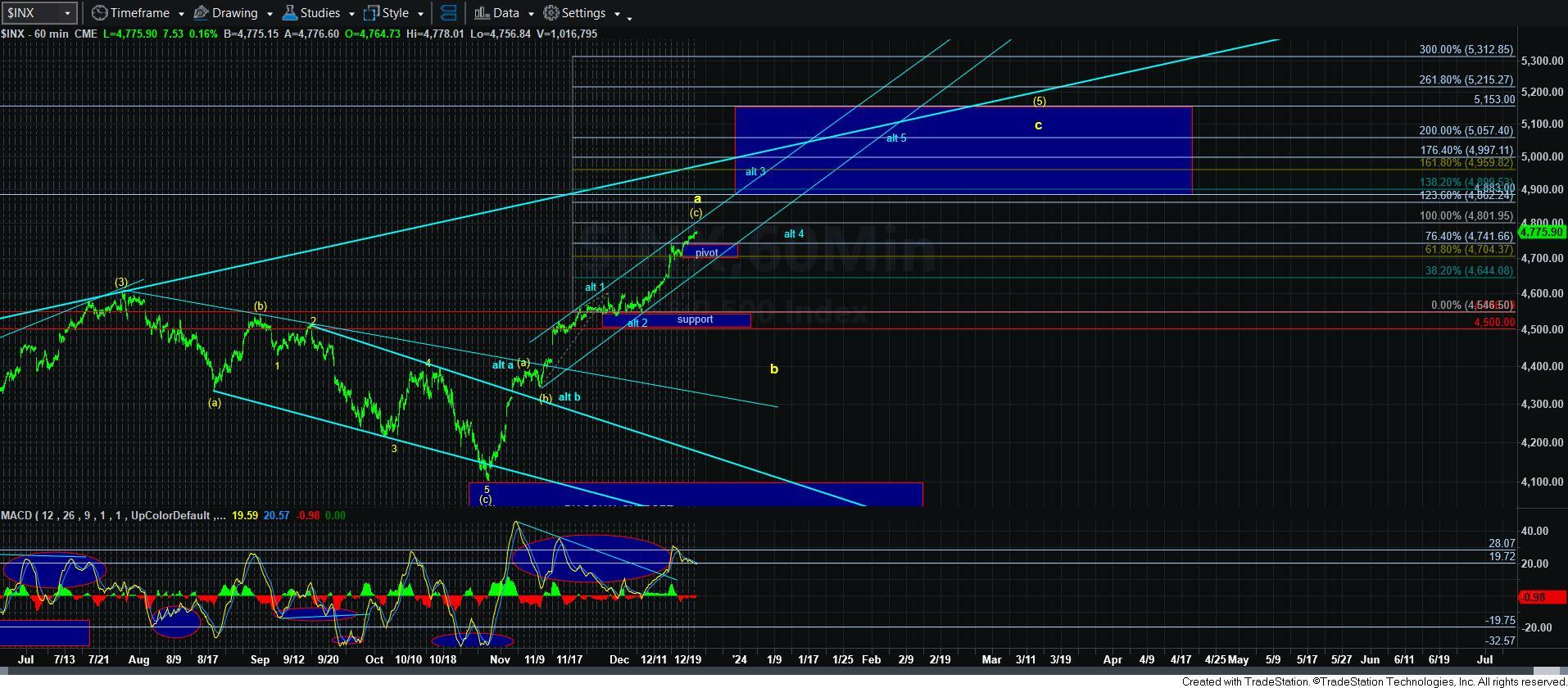

With the SPX extending a bit more today, it has now taken a step closer within being able to align with the IWM counts. That means we are getting closer to being able to consider the SPX within wave iii of 3 of the larger degree c-wave rally within wave [5] in the SPX. However, it is not as similarly extended as IWM. Allow me to explain.

But, before I begin, I want you to note that some of the calculations and levels have been adjusted in IWM due to a .73 dividend that was issued today and dropped the price accordingly. So, I had to adjust the supports and targets.

Based upon Fibonacci Pinball, wave iii of 3 will usually extend to the 1.00-1.236 extension of waves 1 and 2. Sometimes, when iii gets very extended, it can push towards the 1.382 extension.

As we can see from the daily and 60-minute charts of the IWM, we are now at the 1.382 extension of waves 1 and 2, and I am counting this as a very extended wave iii of 3. However, the SPX is only now approaching its 1.00 extension, which is in the 4800SPX region. But, it is still a bit shy of that target. However, I think we are close enough for me to now apply somewhat of the same count in SPX that I have in IWM. The big difference remains that the IWM is in wave iii of 3 of a standard Fibonacci Pinball 5-wave structure off the October low, whereas the SPX would be in wave iii of 3 within its c-wave rally of the 5th wave in the ending diagonal.

Based upon this path, I am going to assume the 4th wave of one lesser degree is the lower end of support for a wave iv pullback in SPX, which resides in the 4694SPX region. Therefore, a break down below that support at this time would open the door to the potential of the yellow b-wave.

In the IWM, we clearly have extended in wave iii of 3. That now makes the 189-194.50 region the wave iv support on what I would expect is the impending pullback. OF course, should 189 break, then we would move into the yellow count of an ending diagonal, as outlined the other day.

The main point, which I outlined in our live video this morning, is that the upside does not look complete, despite how extended we have become. Moreover, a pullback is likely well overdue. The question now is if that pullback will break below 4694SPX and 189IWM. As long as those supports are held, then we have a path in a more direct fashion up towards the 4997-5057SPX region to complete this c-wave of wave [5] and the 213/214 region in IWM. Of course, should we see more significant extensions in IWM, then we can even make an attempt at the .764 retracement of the larger degree a-wave decline which is in the 225 region overhead. For now, I am sticking with the lower target unless wave v of 3 extends north of 210.