A Little More Detail

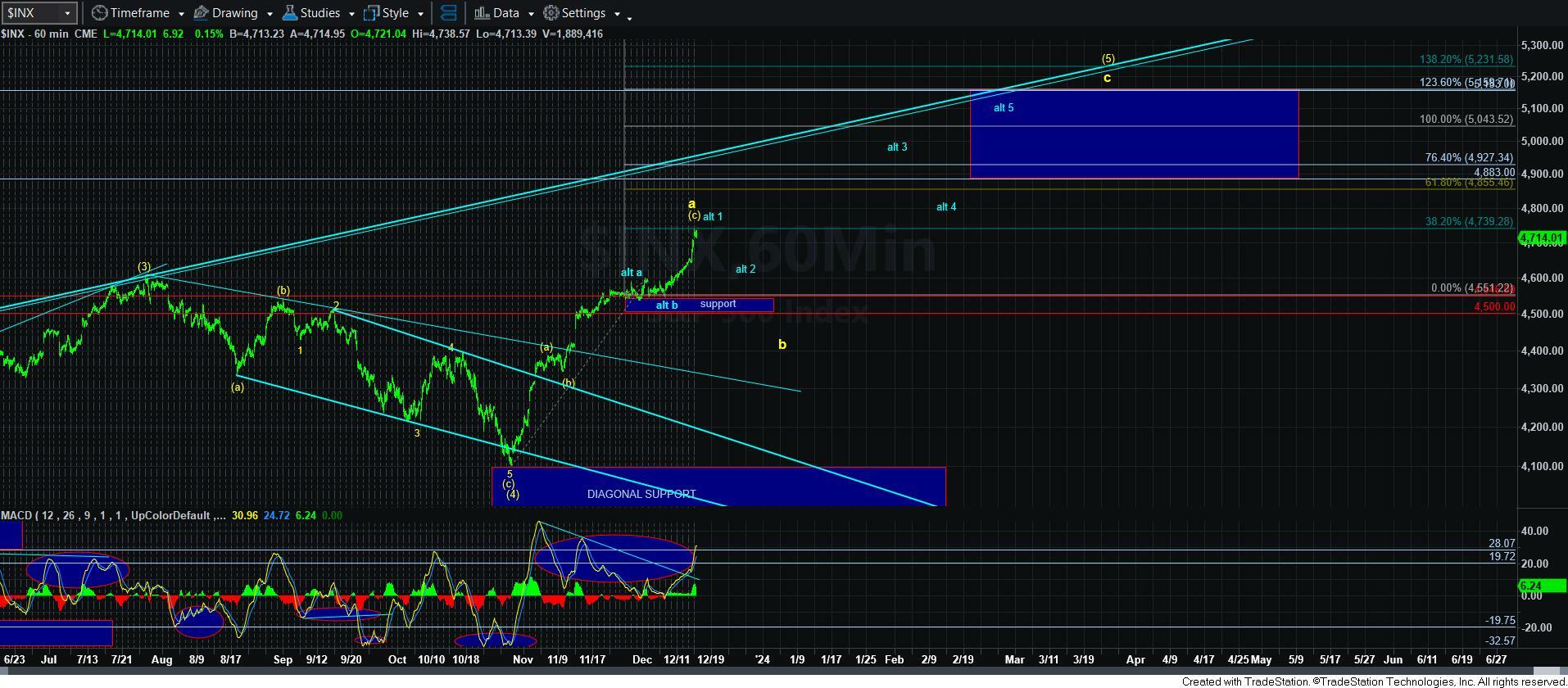

As you know, I have been looking for the market to complete an [a][b][c] rally for the a-wave of this 5th wave in an ending diagonal, which began in October of 2022. And, it has been a very complex structure we have been tracking rather accurately since having caught the bottom back on October 13, 2022.

However, we have been dealing with 3-wave sub-structures during this diagonal, as that is the most common structure we see in diagonals. And, that has increased the complexity significantly.

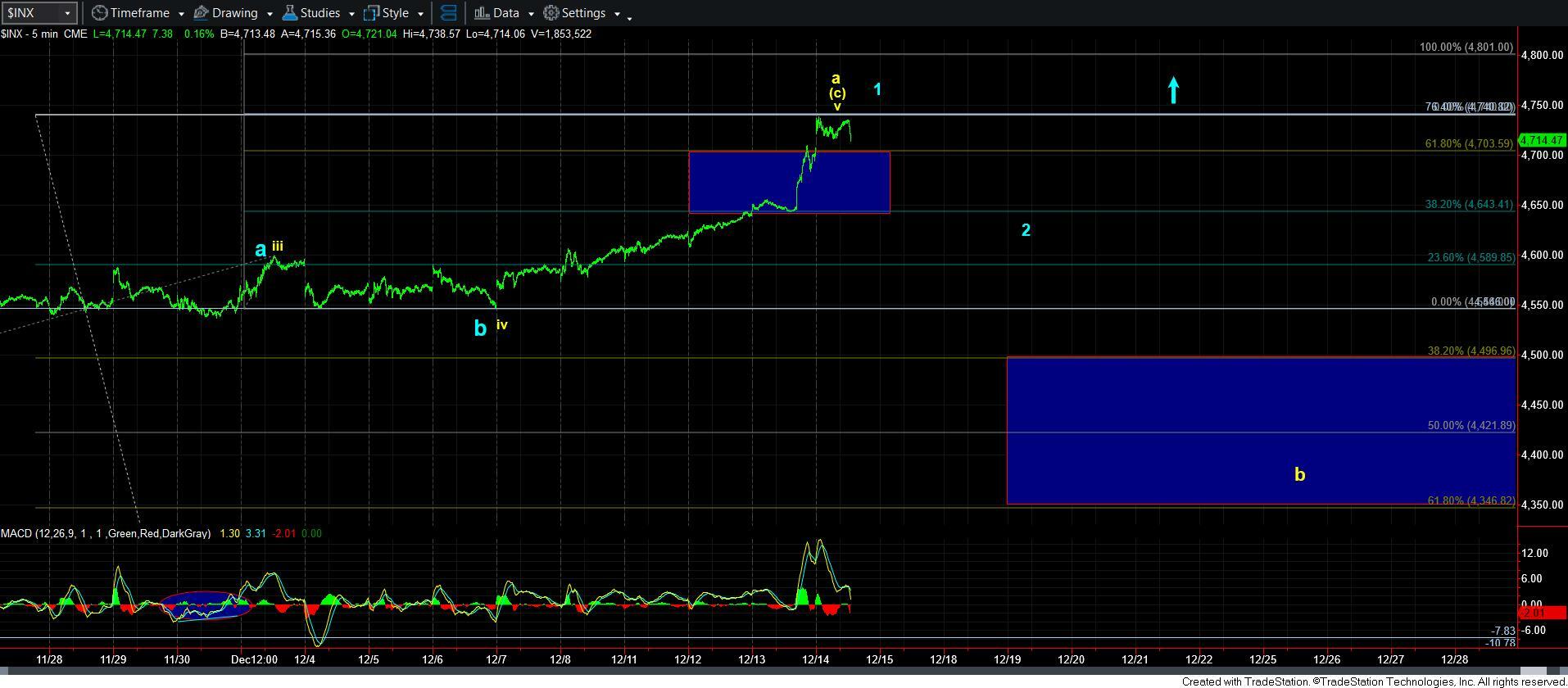

So, once the market invalidated the prior green count, I have been looking for this a-wave to top and provide us with a standard b-wave pullback. But, we are starting to get a bit extended to view this structure as part of the a-wave.

Therefore, I have two competing issues I want you to understand. First, in order for me to assume that the b-wave is done, then I have to accept a [b] wave within the a-wave, as well as the b-wave itself as being a retracement of less than .236 during this entire rally. We did not even see retracements this shallow off the low struck in 2020. That should highlight just how unusual a move like this would be if the b-wave has indeed completed at that last small consolidation, which is outlined in blue.

Second, if I am to retain an a-wave structure in yellow, it would mean that this is a very extended 5th wave in the [c] wave of that a-wave. As I explained earlier this week, it is quite common to see a 5th wave extend to where it is equal to .618 the size of waves 1-3. In our case, that .618 ratio pointed to the 4703 region. However, we have now exceeded that, which puts to question this being a wave v in the [c] wave of the a-wave in yellow. And, now, we are approaching the .764 extension in the 4741SPX region. Should we exceed that level, and move through 4750, then it is makes it unlikely that this is wave v of the [c] wave of the yellow a-wave, as it is extraordinarily rare to see a 5th wave of that size relative to waves 1-3, other than in commodities.

So, my struggle from an analytical standpoint is if I accept an unusual b-wave pullback or if I accept a VERY extended 5th wave to the [c] wave of the a-wave. Therein lies the issue with which we are all now grappling.

Now, if the market does not take us beyond the 4740-50SPX resistance overhead, and begins to break down, we will need to break down below 4618-4645SPX to make the 1-2 in blue even less likely. And, of course, breaking below 4546SPX would confirm the yellow b-wave.

To add to the mix, I am again tracking the IWM daily chart, and have added a potential 5-wave Fib Pinball structure. It, too, is a bit out of the ordinary. First, the 5th wave of what I have outlined as wave 1 is an exceptionally large 5th wave. Second, the 2nd wave is exceptionally small as well. But, if I am to maintain these assumptions, then wave iii of 3 struck the 1.236 extension of waves 1-2 on the nose today. And, as long as that wave iii box hold, I would expect a corrective pullback to the pivot. As long as that pivot holds, then I would expect a rally in wave v of 3 to 207+. Should the pivot break, then we likely have a more complex structure taking shape in IWM, but still likely pointing us up to the 200+ region in a much larger degree w-x-y structure, with the break below the pivot being a b-wave pullback in the y-wave. I will outline this further should we see such a break-down.

As you can see from this outline, we are dealing with structures that are truly out of the ordinary for equity markets. And, while the wave structures are not terribly clear, we do have our Fibonacci Pinball ratios acting as guidelines to assist us in making this determination between the two paths we have before us. And, while I have been strongly cautioning against shorting (unless the market had been able to provide us with a 5-wave decline in the former green count which is now invalidated), I am going to offer even further caution if we do break out over 4750.