Will EOS Kill Ethereum? PT 2

[Just realized I didn't post this last night. Must have been tired]

In Part I of this series, I discussed how some investors and developers have questioned whether EOS posed a threat to Ethereum. Specifically, would EOS ‘kill’ Ethereum? Would EOS bring both blockchain activity and its price to zero?

I discussed how the speed concerns with EOS can affect the scalability of Ethereum, both because it lacks the transaction capacity and because the speed directly impacts usability. For instance, some projects that need a fast transaction speed may choose not to develop on Ethereum, or even to move existing projects from Ethereum to EOS.

However, I also challenged whether all projects needed this speed and offered a perspective where many players can exist in any product space, including platform coins.

The perspective last week was from the viewpoint of my life and experience in design and product strategy. In this installment, I wanted to come at this question from the perspective of a trader, not just that of a retail investor like I am, but also from the perspective of large and institutional traders.

Many investors look at prospective blockchain investments from a fundamental perspective: Which projects are compelling? Which projects have a great team in place? Few investors seem to come at the market by asking which coins will be a good trade, or have the mechanics to work as a tradable asset

Liquidity is King

If you are a large trader, you don’t just spend your time looking at a project, or only studying its chart. You have to concern yourself more deeply with liquidity than retail investors and traders. Can you move into the trade without moving the price too much? Can you exit a trade based on the liquidity available, or are you likely to get trapped in a position?

On this basis, hands down, Ethereum has an advantage over EOS. I looked at 30 days of volume as listed on CoinMarketCap. Ethereum had an average 24 h turnover of over $1.8 billion, whereas EOS came in averaging over $700 million. This means that over 2.5 times more volume was turned over in Ethereum every day. Further, Ethereum trades in more fiat pairs than EOS. This is important if a large trader needs to escape a sector-wide downdraft.

I am, however, not clear how much of this volume is due to Ethereum Tokens (ERC-20s), such as OMG, ZRX, and the like, and so need to dissect this further. But it’s likely that, as EOS sees more tokens born on its blockchain, it should also see a bump in volume. In my opinion, the US dollar and bitcoin paired volume is the most important metric to consider, and Ethereum still has a slight edge over EOS in this regard.

Granted, most large traders trade over the counter (OTC) through a prime broker or other institutional level service provider, like Cumberland Mining, but these service providers likely still have to go to exchanges to fill their orders, so I consider exchange liquidity a draw for banks.

One could say liquidity begets liquidity. What I mean by this is that liquidity is a necessity to bring a large player in to a trade; in the process of which they bring their own liquidity, thus causing a feedback loop. Comparing the two, while liquidity in EOS is growing, Ethereum is still ahead.

The Necessity of Hedging

Another need that large institutions have is the need to hedge, particularly in cryptos. Because many cryptos are held in a high security environment, off exchange, a US dollar hedge is needed to manage the position. Some people think the bitcoin futures market was created as a primary means to invest in bitcoin. While circumstantial in my reasoning, I think this is not the case. I think it was created more as a means for large holders to hedge as needed, and I can almost guarantee that large banks and hedge funds had a hand in the approval and design.

I’m sure there’s no mistake why the Ethereum futures market may start at CBOE, and why the CME is running a reference rate. It’s simply that large players are interested in the product.

Please don’t mistake what I’m saying. I am not saying that because institutions are entering a trade, that they are bullish. However, I do believe that institutions entering a trade precludes that market’s demise. Once large players are interested in an asset, that liquidity they bring is a lifeline, at least to keep it trading.

Price Projections

If you are familiar with my work, you know I structure all of my trading, both long and short term, using the Elliott Wave theory. It was through the use of this method that I made a call in early 2017 that Ethereum would see four digits, but I didn’t expect it to be so fast. Certainly not all my calls come true, but I watch a myriad of patterns and price levels built into the original forecast.

It is through this method that I have come to believe that EOS will see $600 and above, probably in a few years, but don’t quote me on that as I am less confident on the timing. Also, through this method, I also expect Ethereum to have much further to go as long as it doesn’t violate $122 without a strong reaction.

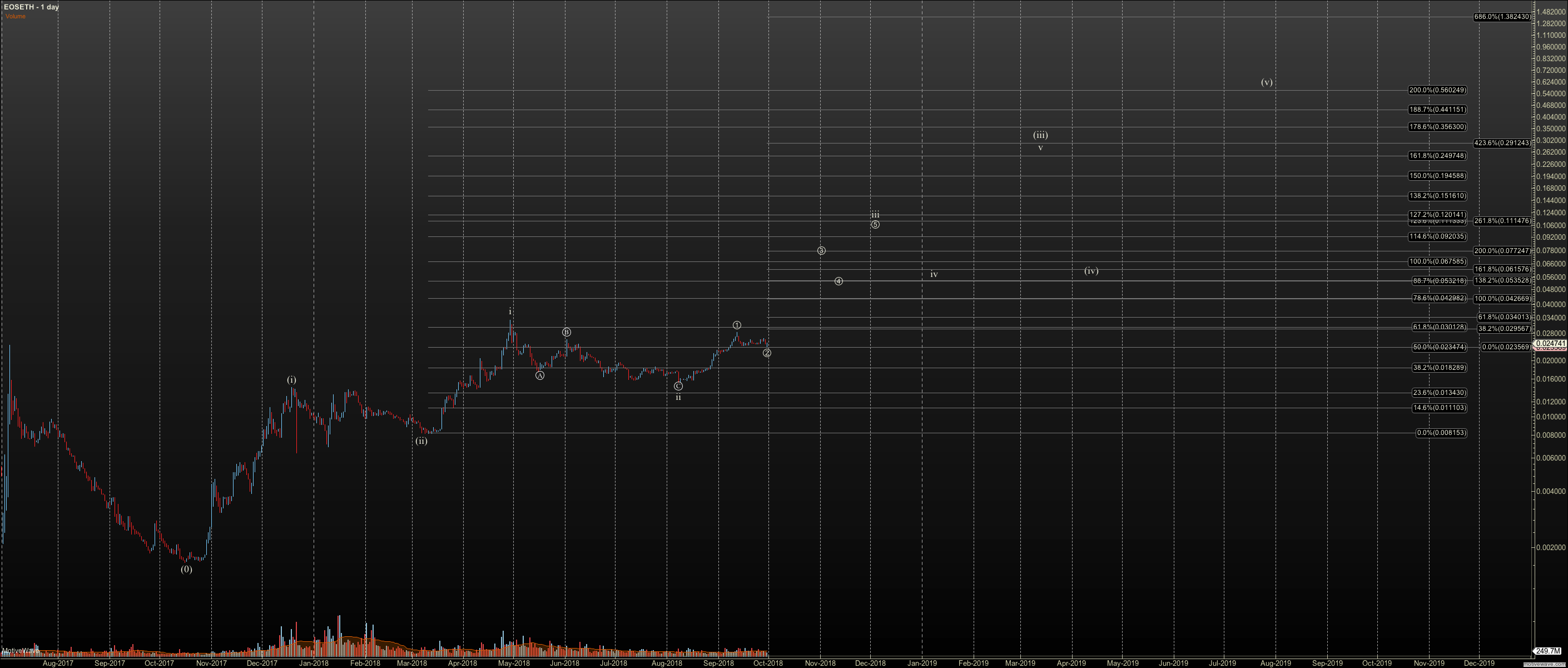

In order to compare the two in Elliott Wave, we have to ignore the US dollar price and ‘count’ a pair chart, specifically the EOS/ETH pair. From this chart, we can see that EOS outperformed Ether in late 2017. More specifically, we have the signature five wave patterns we usually look for, and so we can expect EOS to continue to outperform.

If our two waves hold, as shown, at .0082, I get .56 as the eventual forecast. Note that this doesn’t relate to the dollar price. I assume they will both be higher in US dollars at that time, but that may not be the case.

The rally I expect to start soon should bring this pair to .07 EOS to Ether from the current .02. In other words, EOS will severely outperform Ether in the short to medium term.

Conclusion

In order to wrap up this article and to go back to our beginning question, my conclusion is that EOS will not kill Ethereum. However, unless Vitalik and team can increase the scalability issues with Ethereum, EOS will take some share from Ethereum I don’t know whether this will be from project attrition or from more new projects starting on EOS. That said, this is an assertion that is limited to my own experience with both products, which I hope I made clear in the first installment.

I am currently far more confident on my price projections, at least until something new shows up in the price structure. However, so far, both the EOS and Ether charts are bullish and should be for some time, albeit with the usual deep corrections that are the norm in all cryptocurrencies. This is my wheelhouse, and so I’m putting slightly more of my investing dollars into EOS at the moment.