Trend is Your Friend + Positioning.

The market is slow so I want to get this out before it speeds up....This was inspired by a PM exchange with a member yesterday. The basic content of the PM was that he was losing money short term trading this drop and so I took the time to understand why. Note I can rarely can do this so don't PM every time you are trading badly. I could talk this time between tournament games.

Really the basic reason this person was losing money was they were trading against trend. And, they were following my counts, which were expecting a relief rally, and trading for that. That was the core mistake. And, the second mistake was this person was positioning equal size for this countertrend rally. Lastly, they were too margined, using almost all of their margin. These are all three together, a recipe for disaster. But to make matters worse, this person was trading to win back what they lost, which is always a setup for failure. This means they were keepign their size the same despite continual loss.

How do I trade and how is it different?...First, I rarely play countertrend, in short term trading. I never do with margin. Lastly, if I do choose to do so, it is very small. And, finally, I have learned the hard way that using most of your margin is a big mistake. I rarely go over 20% of the margin available. And, when I have a bad run, I size down more, and know that I'll make my money back at some point if I'm diligent. I have never done well trying to make lost money back fast.

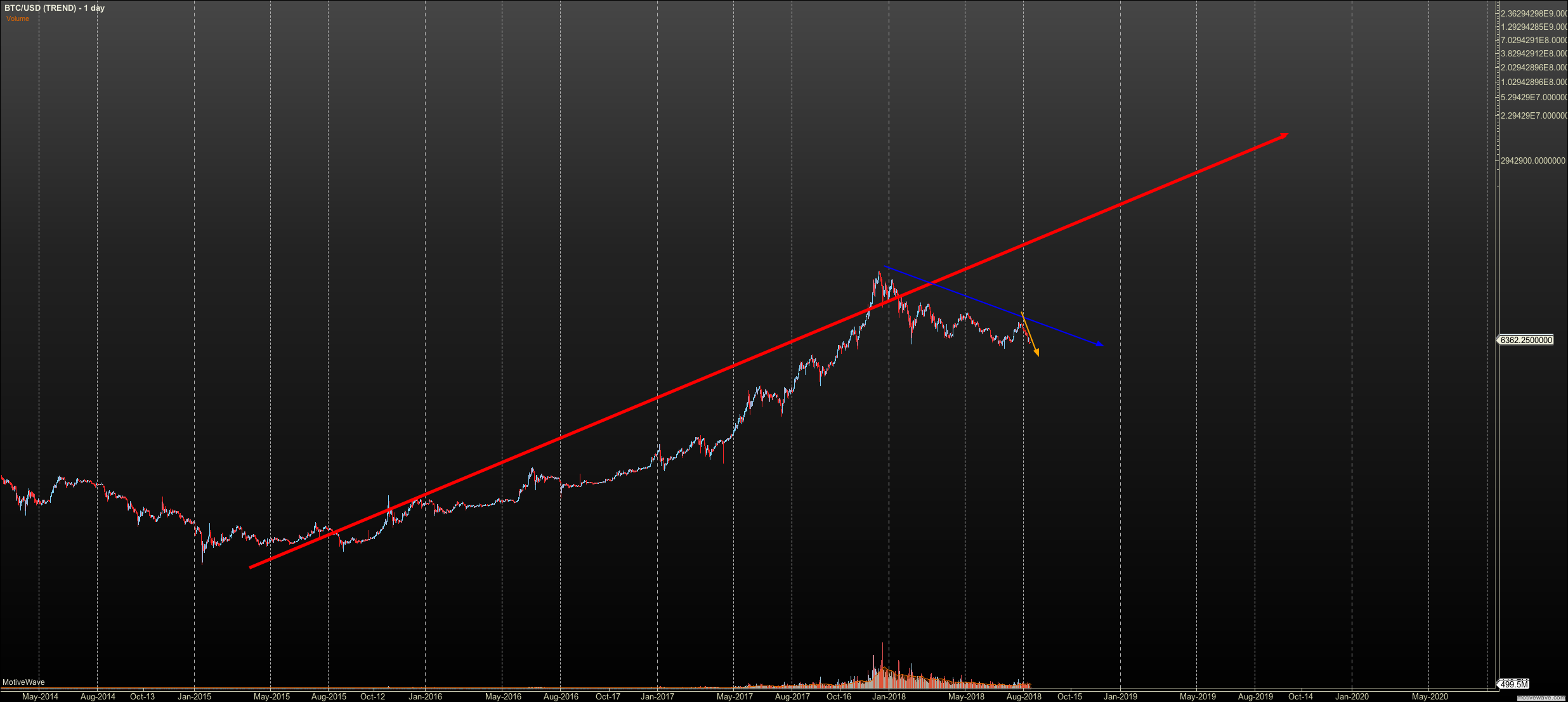

If you take a step back, be aware of the trend you'll save yourself a lot of pain. EW gives us targets where we expect trends to end and reverse. It also gives us structure to 'confirm' a trend. But even if you are not skilled in EW, you can see trend visually. On the posted chart I have three trend degrees in colors. Red is that weekly long term. When we talk about those mondo skew coins, we are talking about the red trend. It is up, but the blue is still down. Until blue and red align we can take heat. You need to internalize that. The orange trend is so clearly down. Any short term profit you want clearly must be short. We are down in the short term trend, and the medium term trend. Only in the long term are we still up.

When I get a countertrend rally within in a larger degree trend, I don't normally treat that as an opportunity to make money short term. I use it to make my position with the trend LARGER. I am usually taking off margin near short term reversals, only to add it back at key levels. And, since margin is what blows up accounts, I am so careful how much I put on. I really want to add it back on at extremes of the countertrend rally. Right now, my highest short margin will be added at $7900. But I don't know if the market can even get there right now. So, I'll have to do without. But I keep a sizeable sell stop under the lows in this trend because usualy if it breaks the recent lows it really runs hard, especially after a good retrace.

Over the last week, I've hit about 75% of my daily PnL goals. I'm really happy. I was sharing that I did that on 10-20% of margin possible. So, it's natural that I could double that and make 150% right? Wrong. I know from experience that the more margin I use, the more I lose trades. It just take less of a loss to wipe out a trade. And, even with my success rate what it is, I can lose big enough to wipe out a few good trades. It is far better to use less margin. Just enough to juice up a good trade is needed.

The Trend is your Friend, don't fight it. This is basic, but it seems to be hard to learn for some.