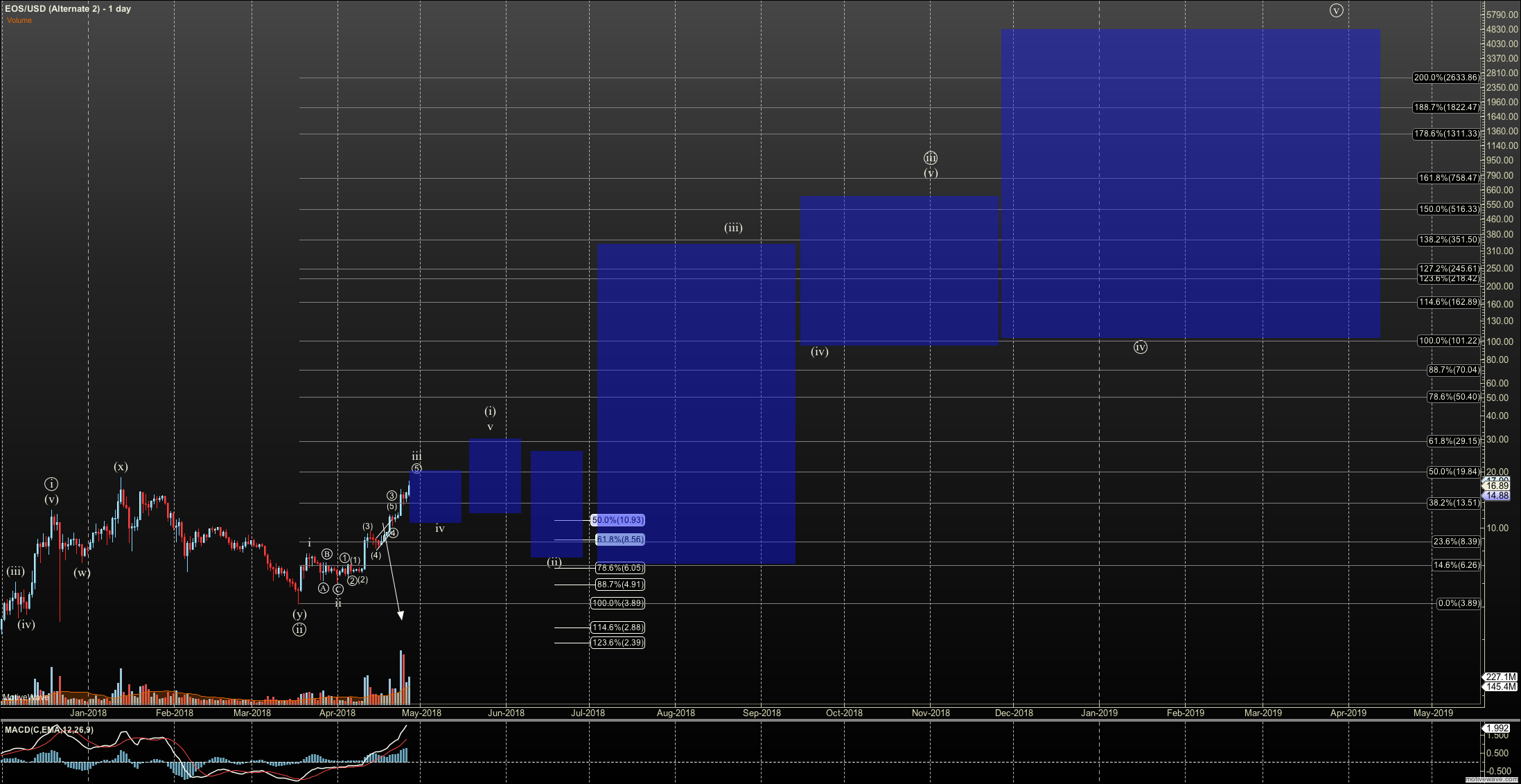

Trading the Ranges - Market Analysis for Apr 27th, 2018

As the market is slow and we wait for C down(s) or breakout, a thought hit me. Some of you, and I used to, rely way too much on directional calls.....

'market will go down to X then down to Y'.

While EW can do that, what it does EVEN BETTER is define the market by range limits that are probable. Instead, think about EW as providing a defined expected range of the market . Your job is to maximize your position (if long) at the bottom of the range, and reduce risk near the top, and never in a bull market being totally out. I promise, if you do this your trading will have a ton of tolerance, and you will slowly maximize your return. Make sure at all times you have SOME cash for opportunities, those downside surprises that give us deals. Yet likewise, always make sure you have some sort of position in a bull market. Then everything else in between is up to you.

See attached, this is how I define the 'trading ranges' loosely in EOS. maximize at the lower, then when target or support is hit, the trading range changes.

Food for thought, that if you are struggling, may change your life. Seriously. Keep it simple.