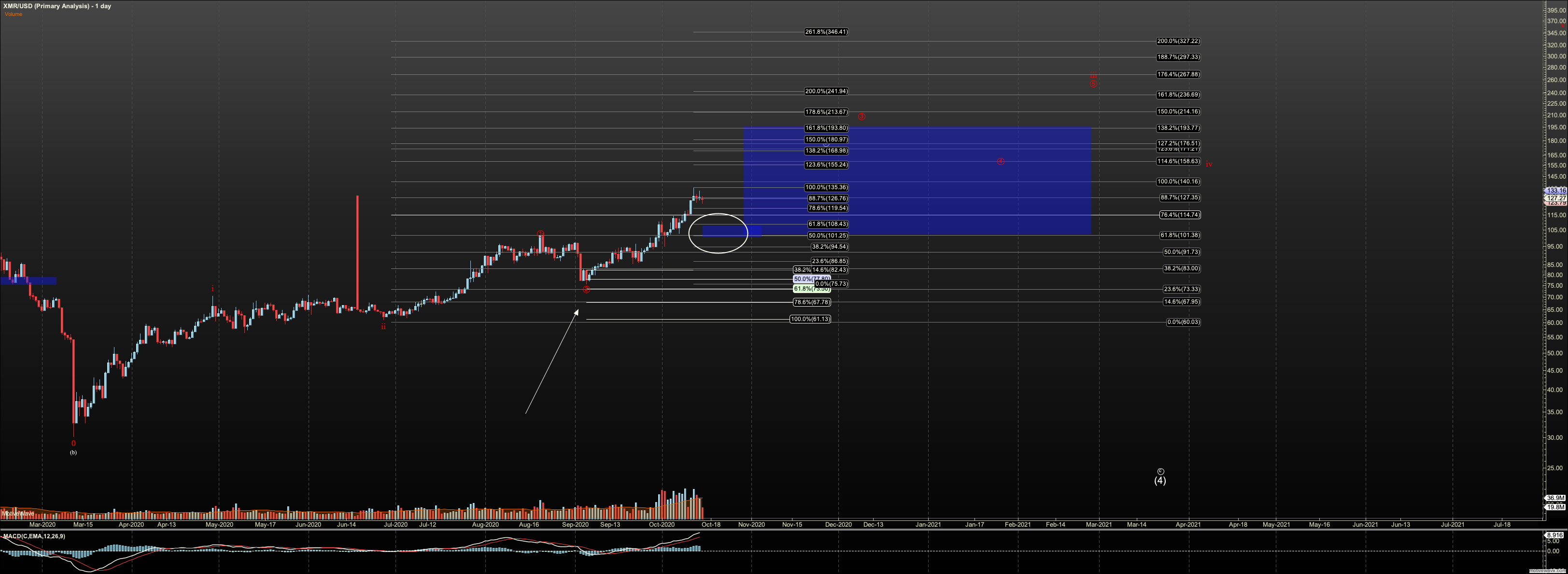

Trading Lesson Refresh - Market Analysis for Oct 15th, 2020

We're slow and I have not posted a trading lesson in a while, so time for a refresh of old lessons. This should be familiar for OG's. I'm going to pick on my XMR count which was posted below. It's a chart I am not intimate enough with to get more in the weeds so I have uncertainty in my analysis. Actually all analysis has uncertainty. That's markets but it's exacerbated when you are not intimate with a chart. But in my work, unless you are scalping, I gave you enough information to work off of. As stated, over $101 both counts are valid. This means below it, red can be eliminated, and a top in white is likely. I added the micro box here to reflect that support and the white circle so you see it.

What do you do with that? Well you can develop a plan and you might use these questions:

Are you long?

N - You can consider an entry, but $100.50 is a good stop. If that is too broad you can choose to size down, or wait for deeper in support. Remember it is wise to keep your losses to 1% of your account so that guides your positioning size.

Y - Then is the stop at $100.50 unforcomfortable? If no, then ride on, move your stop. If yes, cut your position until it is comfortable.

Trading with EW is that simple when the pivot is clear. Triangles and diagonals and other corrective structures are another matter and another lesson. But if you are new to this I would stick to true impulses until you are comfortable to try other approaches.