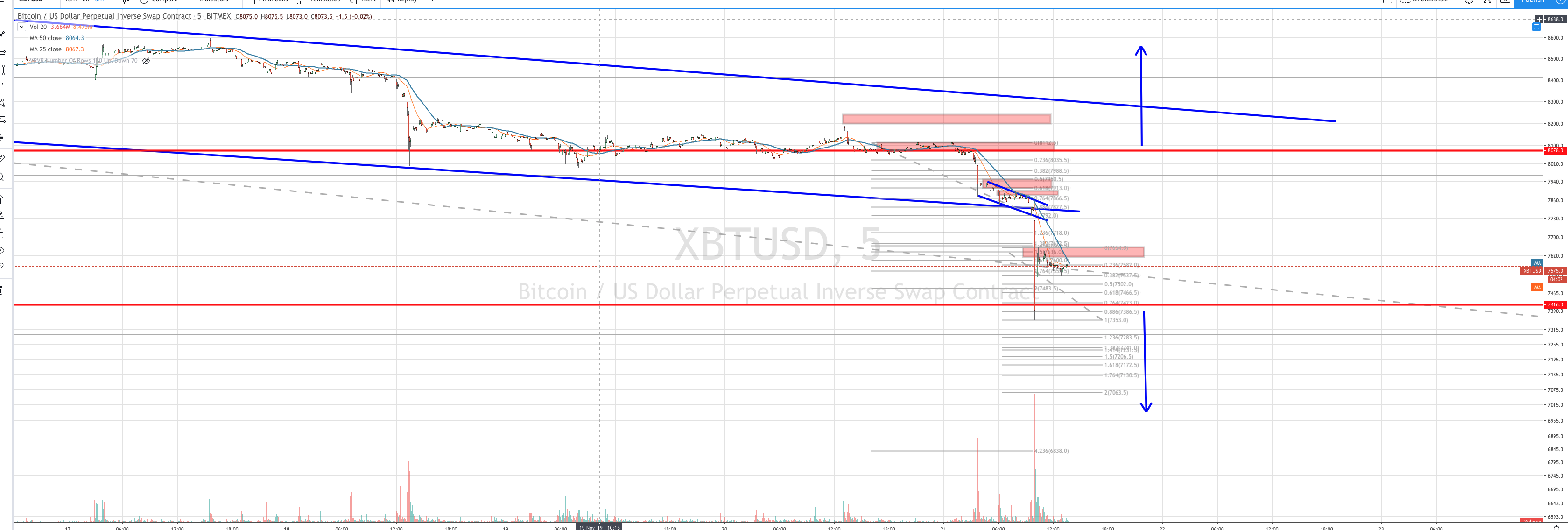

Tradeplan Switcheroo - Market Analysis for Nov 21st, 2019

I have been focused the last few weeks on my plan to 'compound the swing' as posted earlier in this education category (two weeks ago?). Today, the market threw a wrench in that plan. I now consider the market far too risky to hold large long positions, so I've stopped out and I am going to focus on short term. Right now I see a ton of overhead resistance in this market and it is still weak. The fall this morning will be hard to get over. I also see us in a bit of a no man's land here. Below $7425, I see a short opportunity, and am going to place a short sell stop. I don't mind being long over $8200 as we would have cleared much overhead resistance. I'm going to sit on my hands here between the red lines. For a very short term swing to a B wave top ($10-11K), am looking for a clear impulse over $8200 to start playing, and I may even play in GBTC. But right now, I'm only going to take small shots at the market and on both sides. I also think shorting here should be small and have a short term outlook simply because the market is quite extended to the downside without reprieve. That means it is due for at least a relief rally. And, in cryptos they can be quite powerful. In a B wave expect analysis to be quite short term in nature. That's the nature of a B wave. Long termers simply have to decide what to do with the $5 GBTC and $4300 BTC support levels. It isn't that I expect them hit, but that is our long term supported opened up by the current setup. I have no interest seeing those level with the position I took off today.