The 'Necking Down' of Risk

You know I preach or at least trade for skew not run rate (hit ratio). To a degree when engaging my analysis, you get this tradeplan with my work. That is hard to separate. The reason I trade this way, is 1). Skew or risk to reward is more controllable. I'd rather trade what I can control. 2) Trading for skew just simply gives your more sustaining power as a trader, in my perspective, and cuts the cost of trading. Hopefully you saw HD's post in Beginner's circle.

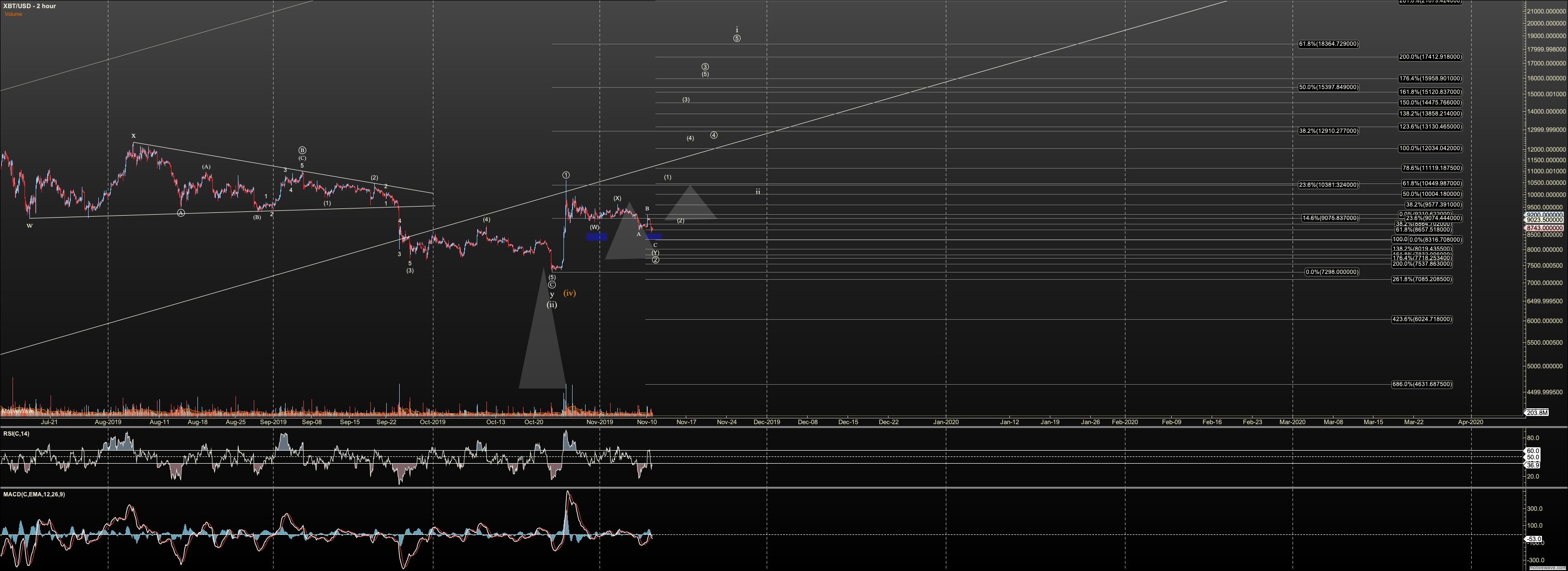

I know right now it is hard to deal with a very choppy wave two, after a larger degree choppy two, but I want to suggest it is very important to pay attention, and that is because the market is increasing our skew as it moves. That skew is increasing mainly bay reducing risk as it lays in support by putting potential impulses of lower degrees behind us. When we topped at $13,900 my line in the sand is $4300. That is a giant stop to enter against at $8K. Very wide. Now that we have a potential 5 waves off $7300, as questionable as that five waves may be, support is now $7850. Walla, skew increased. And, now we have another degree to expect. Right now it is 'sketched' to $10400 roughly. And, will be sketched until we have a local bottom. If an impulse, it will also tighten our stop, probably to around $9K. And, it likely will not get any tighter than that, unless you are trading a 5m chart.

GBTC is doing the same. $5 was the stop, now $9. Once we have 5 up here, it will tighten to this reason.

I've attached the Bitcoin chart with my famous triangles showing the position sizes in these zones. See how they are getting smaller? A they are smaller, the 'entry to stop' is tighter. Pay attention because we are getting close to where, if this setup proves its meddle, the train will take one more stop before take off. If it fails too bad, but that's why we take measured risk. I boldly take reasonable setups, as long as I do the math and am happy with the risk.