Summary Point of View

Where have we been? We had a very bullish April in cryptos and to many of our eyes, referring to analysts on EWT, we had five waves up. Then as we moved lower in May we fully expected to see bullish retrace levels hold. Instead Bitcoin broke as probably one of the first. Then others followed. Yet, still today, we don't have all coins broken down. In fact, we are now very likely in the final innings of this leg down in Bitcoin, based on A=C proportions and we are not seeing extensions lower in many coins. For some coins, like Ether, or EOS, we'd have to see a giant catchup drop to see the lows I have on my bearish chart.

So, let's just talk about possibilities here so we're ready.

BTC

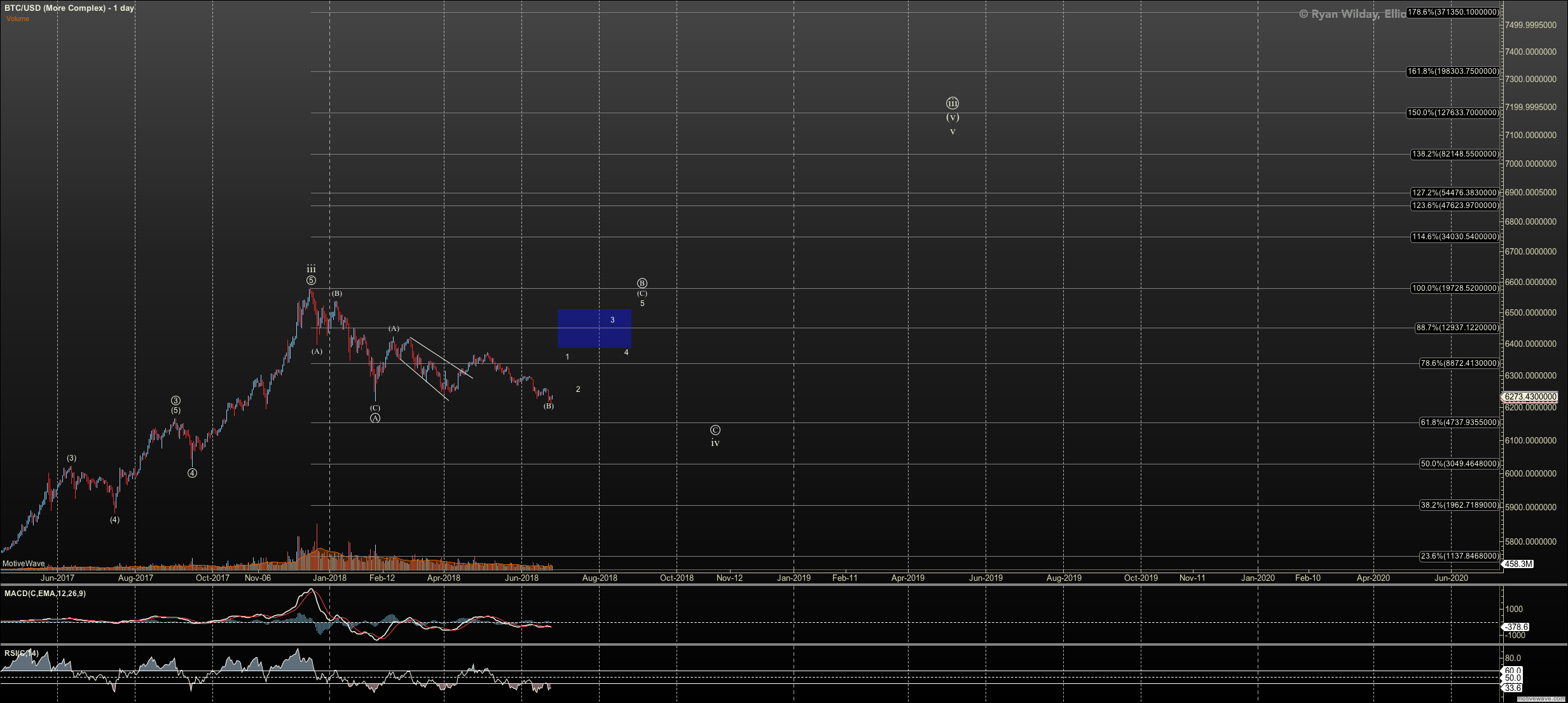

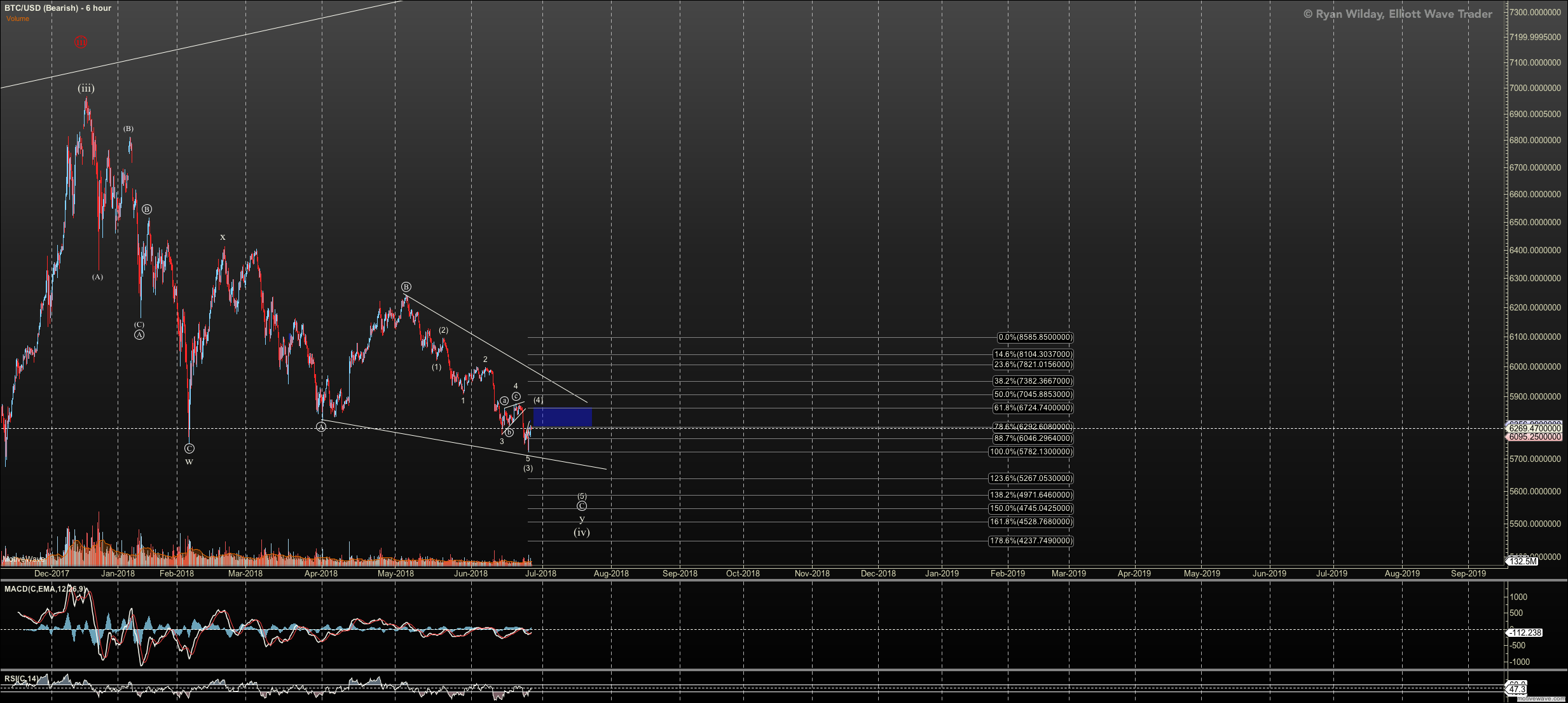

As you should well know, my primary view is that BTC is headed to $4700 with the possibility of extensions to $3000. The $3000 number is based on a common fractal BTC sees where it has an extended 5th in its Y wave. In fact, if normal pinball, we can see this downside limited to $5400 as a projection in the C wave. However we have $4700 as a key fib, the .382 retrace of the third wave that started in 2015, and we have the 'waterfall' fractal so common in BTC. So, I hold out these three levels as possible and am going to track the micro for the likely extension to be hit.

Is this the final bottom? I hope so, but due to the weird 'look' of this correction in BTC alone, I give room for a high B wave that I have called the Evil scenario. And, in my view, if we bottom here and now, It makes it more likely. Do we want more pain, like tearing the bandaid off suddenly in a flush, or do we want 'soft pain' so we can take profit and restrike lower. For most, they will do better to have the bandaid ripped off. Personally, I will make more money in a B wave to C wave evil scenario. But for most on the site, I hope the bandaid is ripped off suddenly, provided everyone doesn't sell at the bottom which happens.

ETH

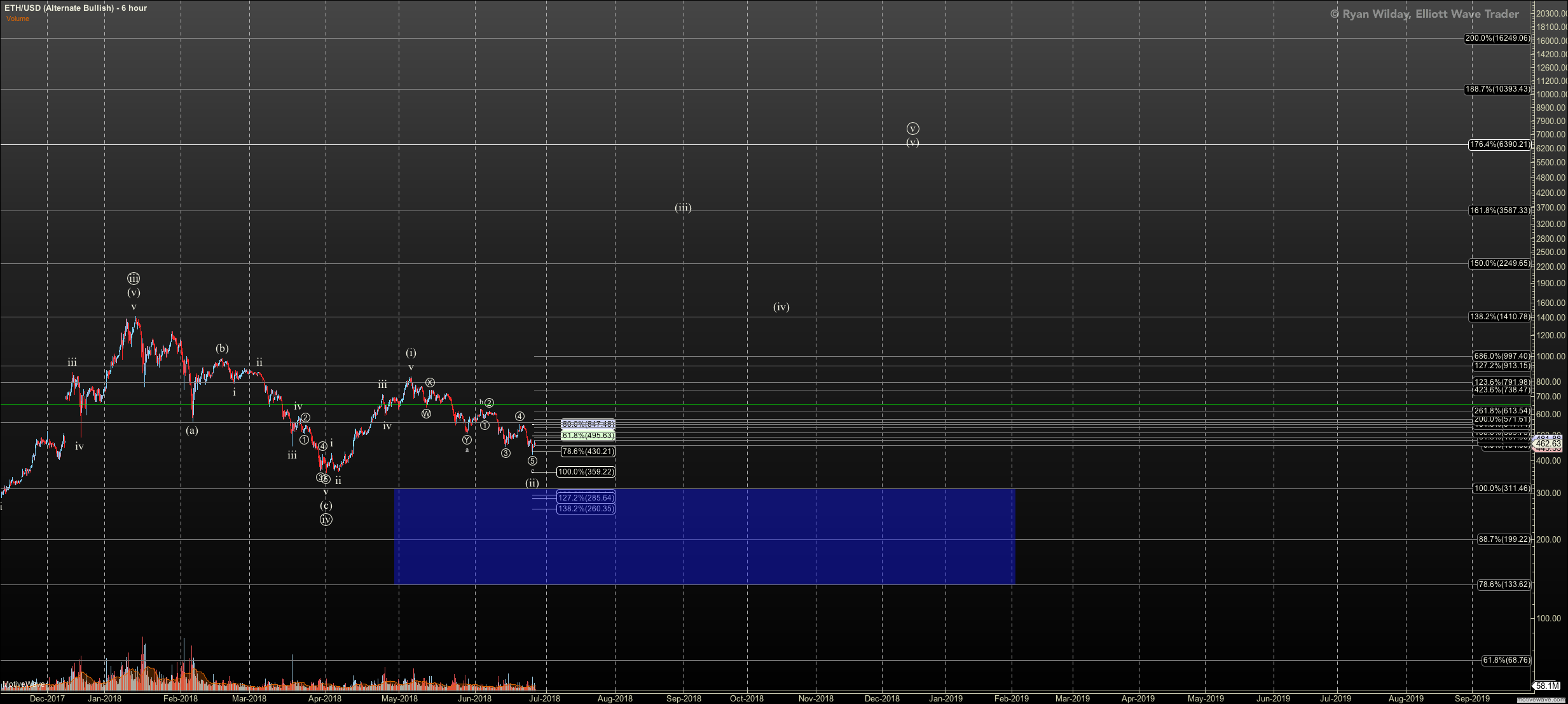

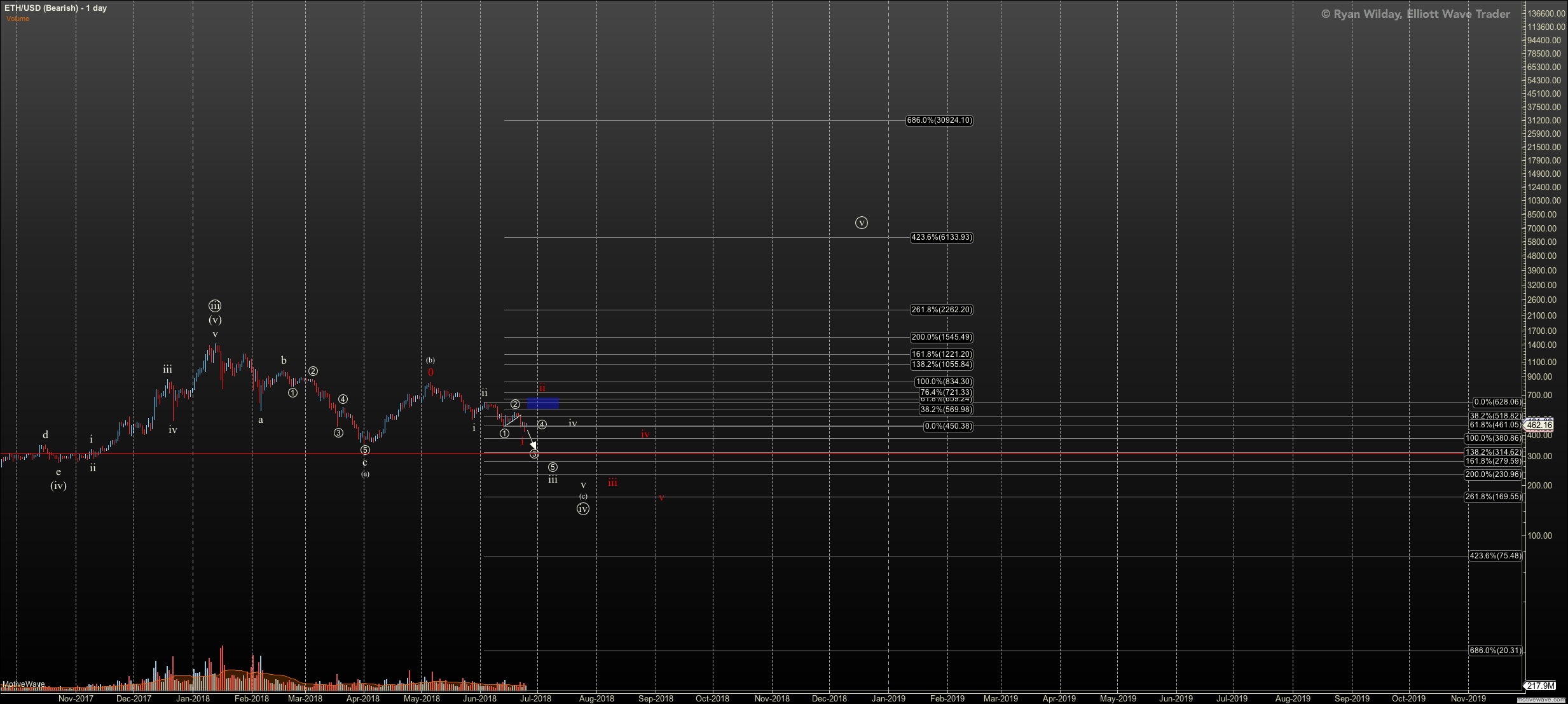

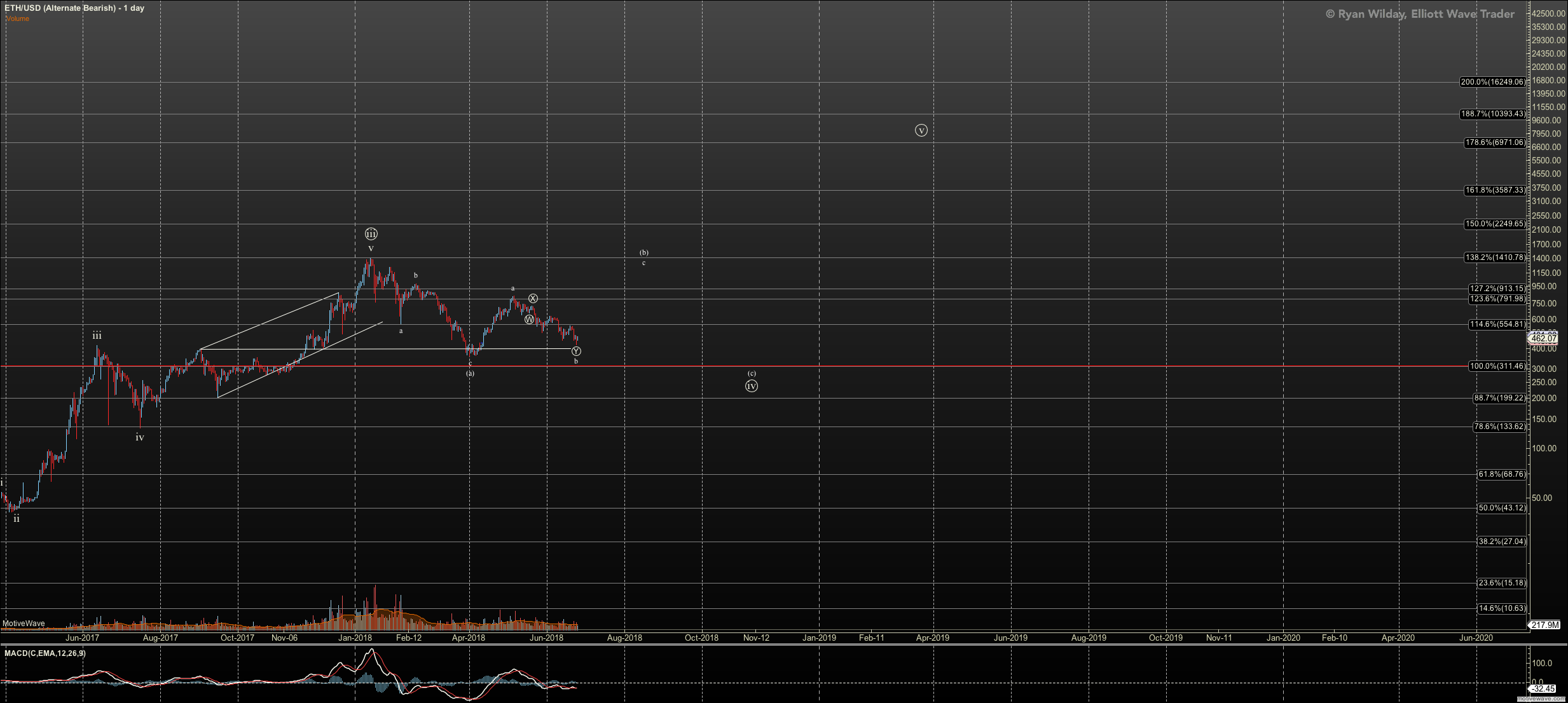

I have been bearish on Ether since early June. However, it has not minded my bearish perspective at all. When BTC was accelerating this past week, it really needed extensions to see my full bearish count. Instead it has only seen $10 below its .764. That isn't deep enough to rule out the bullish case. Further, with BTC near done, I'm scratching my head. Will it suddenly drop to $200 and below? I doubt it but you never know.

I also believe an evil scenario is possible in Ether, more so if BTC does the same thing. And, again, that's a high B wave rally that then ends in a sudden C wave to the $200's.

So I count Ether a very strong case, and along with the ETHBTC pair chart holding a very bullish setup, I have an ounce of doubt in its bearish case.

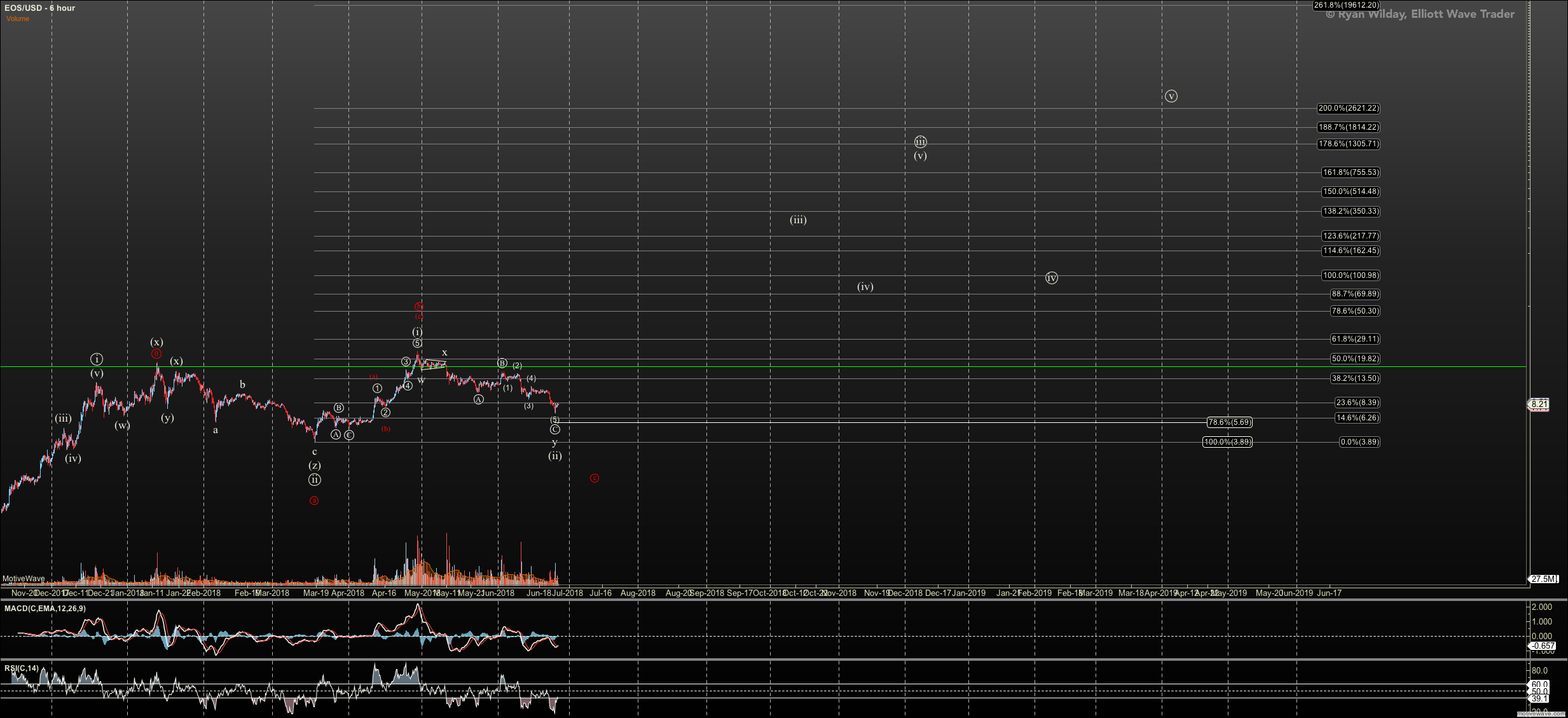

EOS

I'm bringing out EOS as probably the most bullish chart we have in big caps. It's holding a clean 1-2. The only 'wart' on this chart is that the 5up to May highs is questionable without a very defined wave 4. However, it is so extended, it is likely nothing but an impulse. We also have clear triangles within the internal subwaves on the way down. That can't happen if a large C wave, unless it is a diagonal. But if a c wave, it really needs to catch up to complete before BTC hits. $4700. Perhaps it does. But my primary view is that it is on its way to triple digits when we finally get started. Is that so amazing? It shouldn't be. Wave 1 was 6X in return.

Again, while I've heard 'winter is here' since we started this 'adventure' in January, remember that I long said that $4700 is key support for BTC, with $3000 as end of the road for the fourth of this larger third wave. My one regret is that I said that's support but didn't EXPECT the market to get there every time it put in a 'fake' rally. I should have said, don't buy until we get there. But the problem is the market is dealing with probabilities and it will throw a wrench in your best intensions.

That said, I really believe this is going to be a great opportunity for long term portfolios. But you've probably heard me say that before. The only reassurance I can offer is that this area was consistently long term support in BTC and I have not waivered rom that view. And, here we are.