Profit Taking - Market Analysis for May 31st, 2018

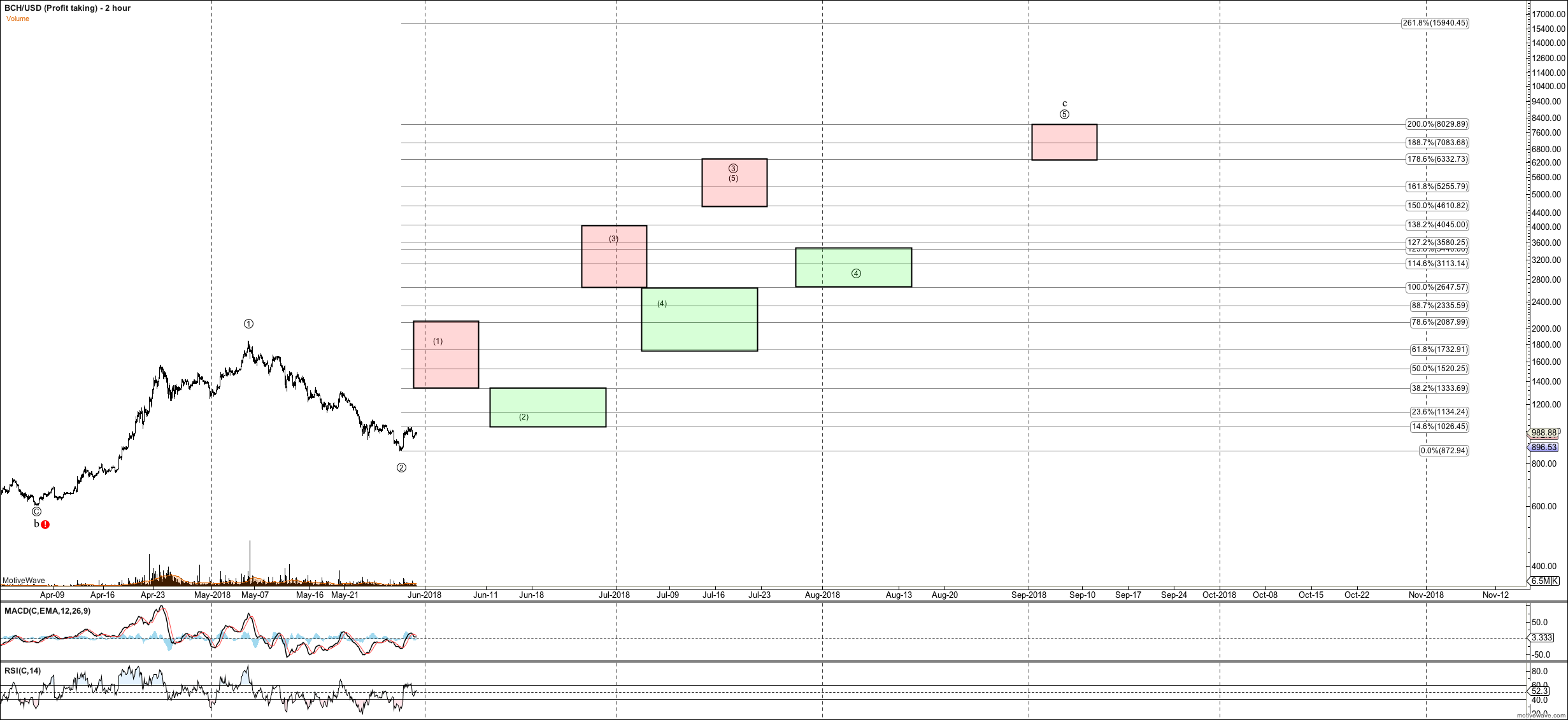

As a primer to the webinar next week which I still have to schedule, I wanted to give an example regarindg day and swing trading a third. Now, in general, I said in my tradeplan that I wait for the third to take 30% off, and may add back at the iv, and I take off half at the v's if I believe we have another degree. I'm going to take 90% off at the coming 5ths but that 's a special case. So, on this chart that is the circe-3-4-5. However you can, when the range is big, try to play the minor subwaves. the issue with that in a third those retraces are often small and you never know whether they will be or not when they start. So, it can be advised to put buy stops and move them down if you exit partial and want back in. Never exit all in a third in my view until it ends, in my opintion.

Note I put boxes where key fibs for these areas can be, but the labels are closest to the ideal fib zone. So, for example, often if we see (1) hit the .382 not the ideal .618 the (3) will hit the 100 not 123.6, and circle 3 1.382 not ideally 1.618 and so on.

To make sure you are looking at the right fibs, note how I have it pinned at circle 2 and my 3 is near the 1.618. If I have 100 at the price top, we have an extended third and I'm measuring the length of retraces- different approach. I made the sell boxes red and green for buy. I know that doesn't help color blind folks so I put a dark line around and the top boxes are sell.