Positional Edge - Market Analysis for Sep 17th, 2018

I have often said something to the effect of ‘positional edge is as important as directional edge’. And, everytime I’ve said that, I imagined some of you saying, ‘what the hell is he talking about now?’ I thought I’d expound on this concept a bit here, but more than that, I want to express how Elliott Wave as a tool that can give directional edge but more than that, it gives a positional edge as well. Yet this latter concept is much harder to learn. The long term members at EWT know this, even if they don’t express it with such a nerdy term as ‘positional edge’.

Positional edge, is simply placing your chips where they have the greatest advantage skew wise when right, while minimal in loss if directionally wrong. In my point of view, to maximize positional edge, the levels one is watching in the market need to matter. It’s not a matter of saying, I’ll stop out if I lose 5% and take profit if I get 15%. That is arbitrary if those are not real numbers, but chosen for comfort's sake. No, Elliott Wave gives us real levels where real market structures ‘play’, and where the market differentiates one path from the next- the primary count vs. the alternate count if you will, and that is why Elliott Wave gives us a positional edge, even if an analysts says ‘I see even odds of both paths’. Why do we often see our levels not just cut into but see acceleration and follow through when they break? Because they matter.

So, let’s back up a second on some gambling principles. I’ve heard it said that the stock market is a big casino. Is it? I’m not a huge gambling man, but let’s keep it simple. Let’s say you’re betting on coinflips. There’s a 50% chance you win. If you win, let’s say you get 100% your bet, and if you lose you lose your bet. Can you see the odds of making money? The rule of large numbers says that you’ll lose your bet half the time, and when you win, you’ll only get your bet back X2. This means, statistically that you’ll break even at best, unless you get a run and have the self control to walk away when you do.

Now let’s say your playing against a casino, and the game is based on 10 flips, and a tie goes to the house. You need 6 flips to win. Would you ever play that game? You shouldn’t. And, yet this is how most casino games are designed, with a very small statistical edge in favor of the house, so that via the rule of large numbers, the house comes out on top.

Is this true in markets? Is it a casino? Not at all.

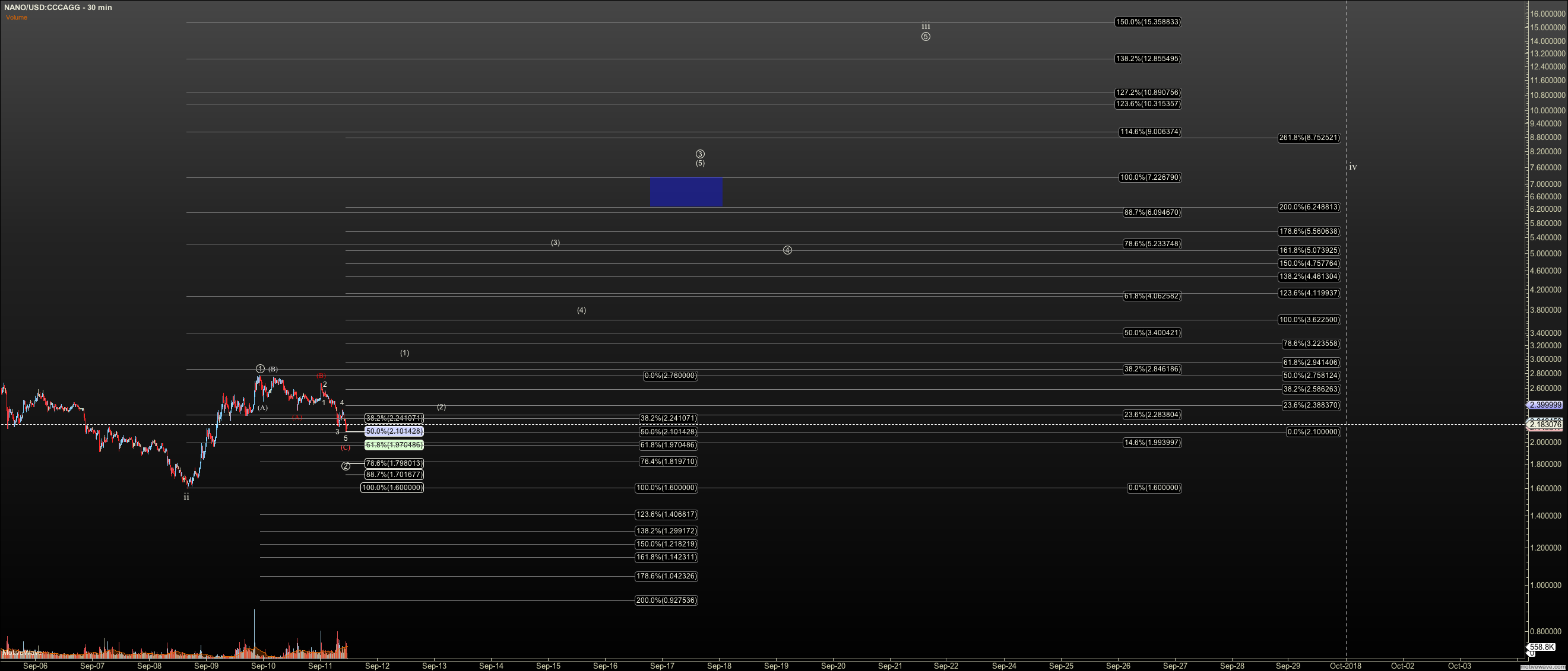

The most important difference is that none of your bets are binary- that is your are not losing all of your bet if you lose, and gaining only your bet if you gain. Note that even if a casino gives you an opportunity to gain more via odds, they still are creating a statistical edge for the house. In cryptos, via EW, we are never making a binary bet. For example let’s examine the Nano Trade. We had an entry at $2.10, and a possibility to hold off entering until $1.80 with a stop at 1.69 and we are playing for $28.63. That is giant skew in our favor. Risking .31 cents for over $26. Silly if you ask me, but that is cryptos.

Now let’s say we are making a series of 200 ‘coin’ bets on similar bets. How many can we get wrong with these odds before we make money? This means we are making $420 bets, with a risk of $62 for a gain of $5200. Let’s imagine we have far more money than a series of bets requires. Bankroll size versus bet size is another matter and I simply want to simplify the lesson. Now we don’t see the full target on many of our trades but if we did on all when they go, we would have to lose this trade 200 times, before, we would not make money on a similar trade. Granted we are not afforded the same trade over and over. But I also hope this shows why risk management edge, that is not wasting your entire bankroll on one trade, will generally produce better results over time...because you can play again over and over and over until you catch the big fish. But more so it shows that positional edge gives you a chance to play again...over and over and over. And, in this trade, let's say you made the entire trade after 5 losses...well you hit pay dirt.

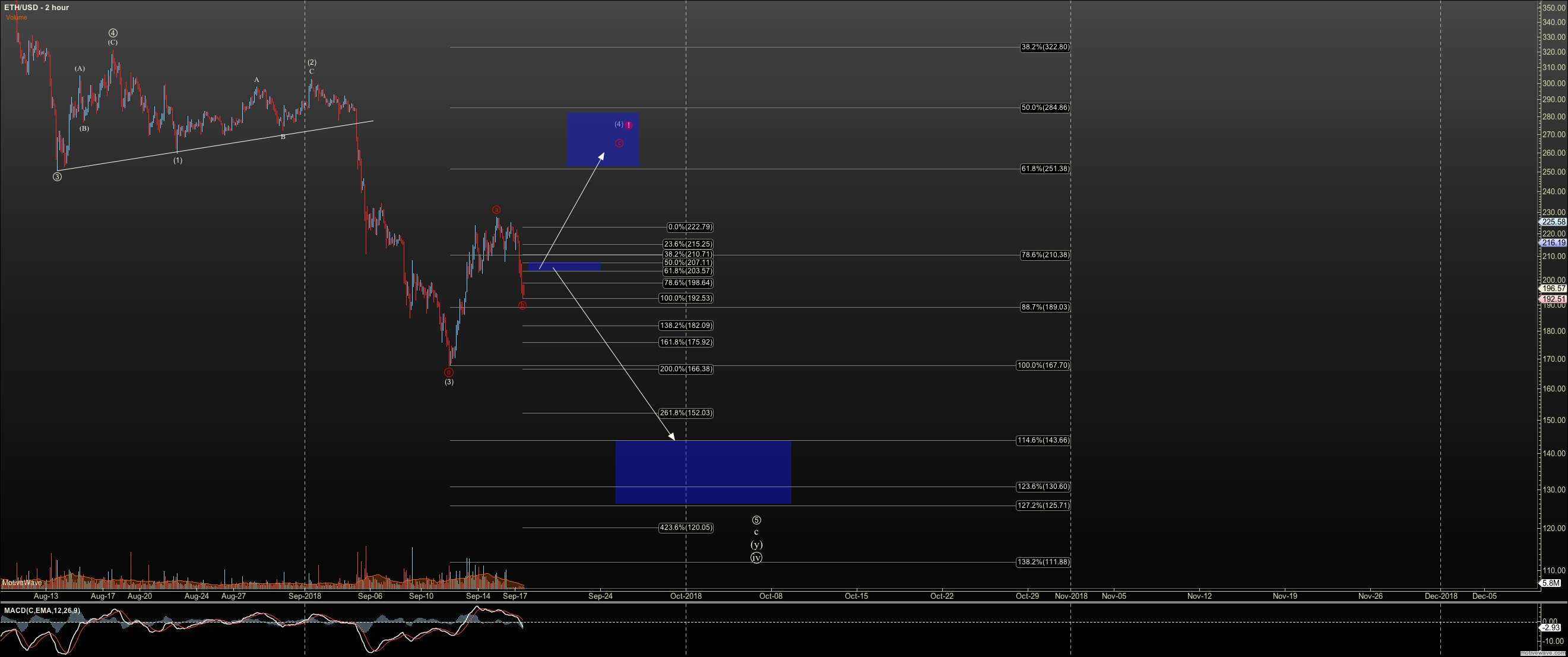

Now, what if we are dealing with a bullish and bearish possibility? One of the most important things I try to do, and sometimes it is difficult, is to mark the pivot between a bullish and bearish trade, as best I can. Why? Because it is simply in that resistance zone where the directional edge is maximized. That is if you shoot for one count, you want to position the maximum size you intend, as close to that pivot as you can. Even if you really don’t have a directional edge on the trade, if it is as close to the stop as possible you can put positional edge in your favor. And, perhaps you try the other trade, in the other directional, if need be, if you have to stop out of the first. But you can’t if you position far away from the top, and have a big drawdown.

This is the power of EW in my view far more than directional edge. Although we get a bit of both with this method. Once you start to realize this, and patiently trade where it is most advantageous both to risk and reward, you’ll start to be repeatably profitable in your trading and stop sweating bad trades. I once had a very bad quarter trading options. I had a 30% directional edge. That is my statistics showed that 30% of my trades were profitable. But I eeked out a $3000 profit. The reason is my losers gained on average in the 60%’s, while losers lost 20% roughly. Someone can correct my math. I haven’t seen that spreadsheet in a while. But you get a point.

Now, be patient on your trades. Find the best spot to position. Rinse Repeat.

I’ve attached the NANO chart here, and well as the current Ether chart. The latter, I really have no edge. But personally, it doesn’t matter. I have a decent chance of trading it to my profit.