Intro to the Kelly Criterion

We're a little slow so doing an educational post. If you are not familiar with the Kelly Criterion, get familiar. It's a formula designed for gambling which maximizes return for an account size. It both maximizes gain, without crossing a threshhold where you can blow up. To use a calculator you need to keep rigorous statistics. I don't tend to on EW based trades, mainly because the skew is so heavy. However, when I try a new system, like my BB band approach, I test it with small amounts, then maximize later. My Oanda account for forex pumps the needed statistics out for me thankfully.

You need:

How many trades are successful (edge)

Average gain of the winning trades, vs. average loss of the losing (skew).

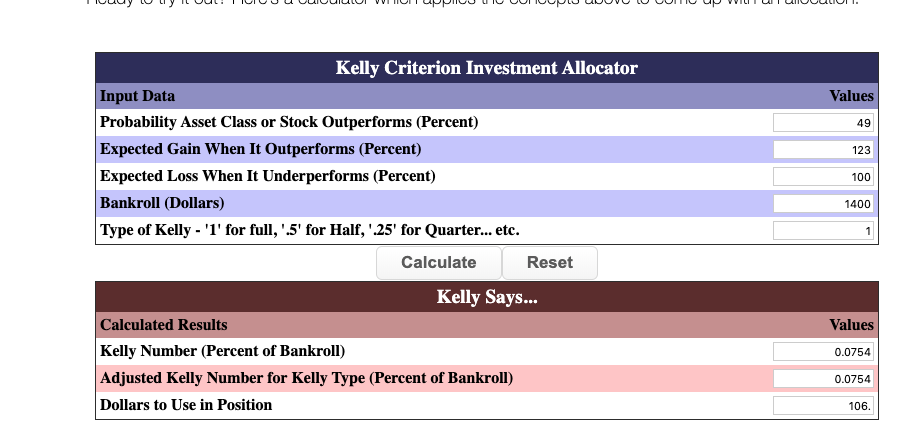

I found this handy dandy calculator online.

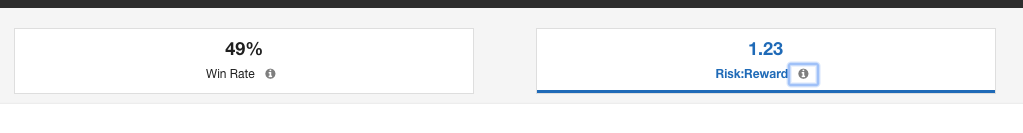

I've attached the image for the lasts 30 day performance using the BB squeeze method. It's a small account, $1400.

I have 1.23 Risk:Return ratio which I can plug into the calculator as 123% average to 100% return. Note the ratio is more important than the total. I didn't make any 123% trades. I can put in 4.92 to 4 for instance and it will calculate the same.

I have a 49% success rate.

I get a bet size of $106 per trade.

Note, if you get a negative number or 0, the calculator is telling you cannot trade profitably.

I have kept my Forex trades small, as I have not historically done well. However, if this proves out, I'll add to the account.