Do We Need to Worry About Missing the Train?

I give such an update with much caution. I know all too well that a message like this can cause reckless abandon in those following my calls. So, please oh please hear this word of caution before you move on. No excuses for risking more than you can handle.

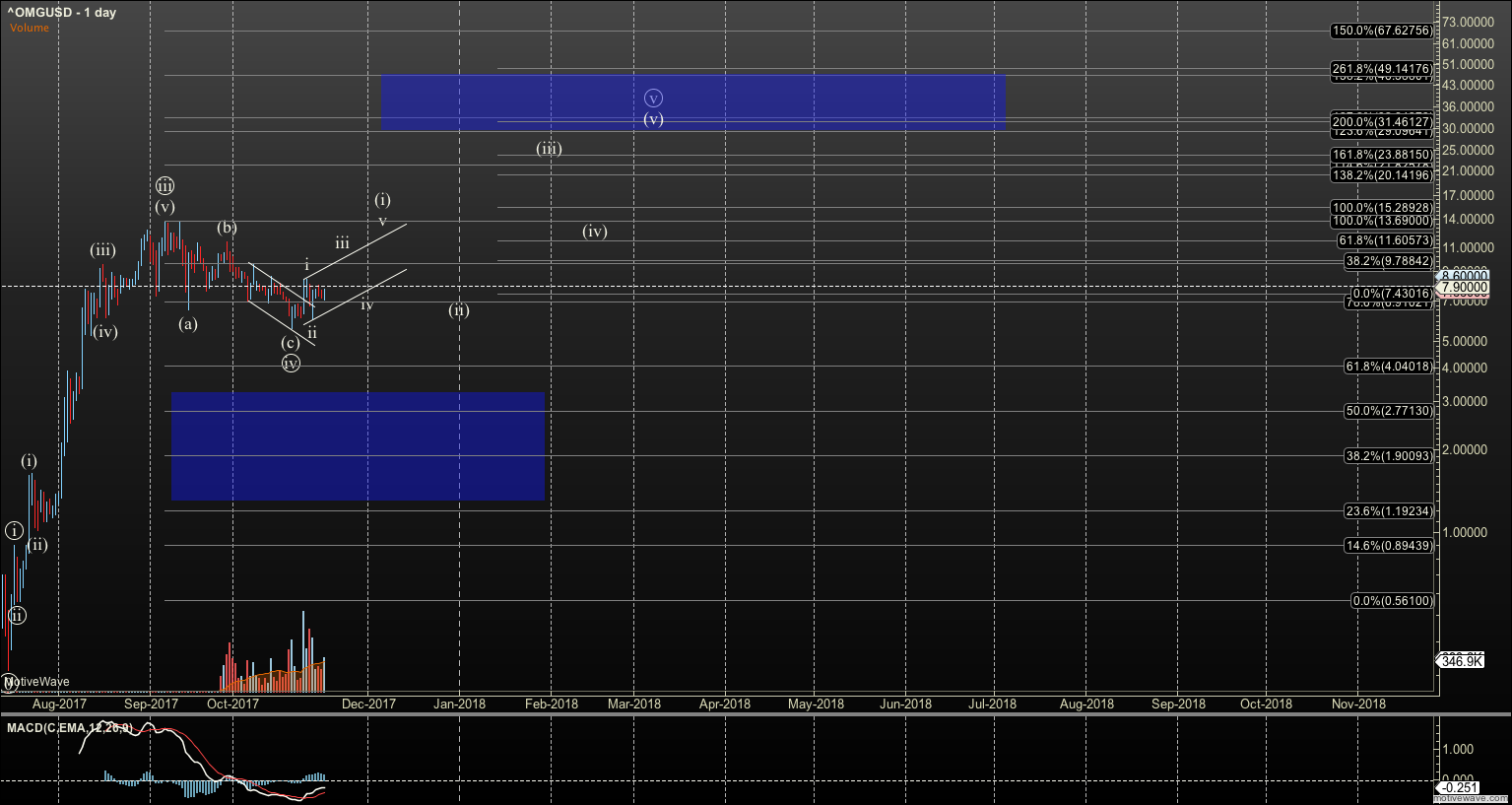

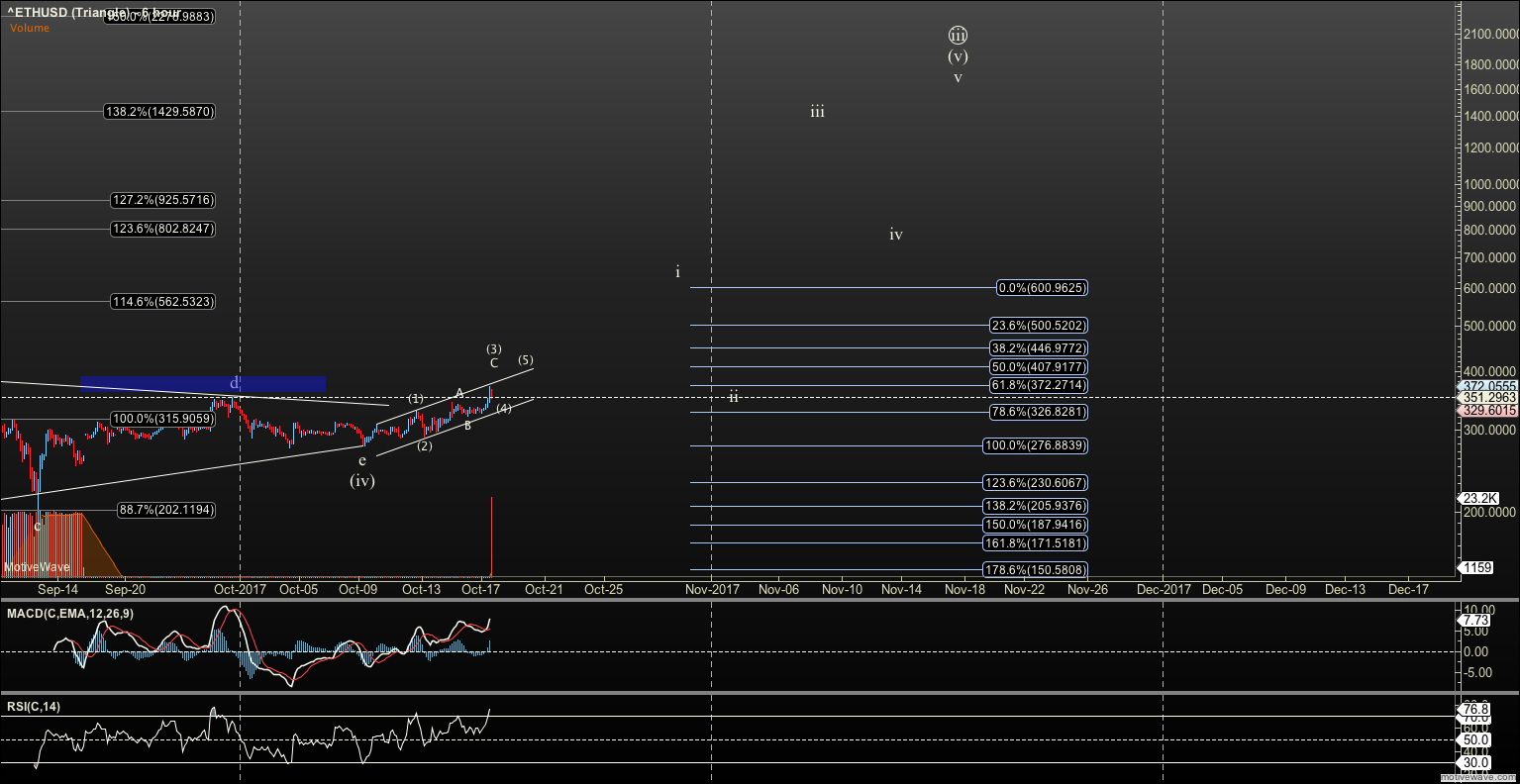

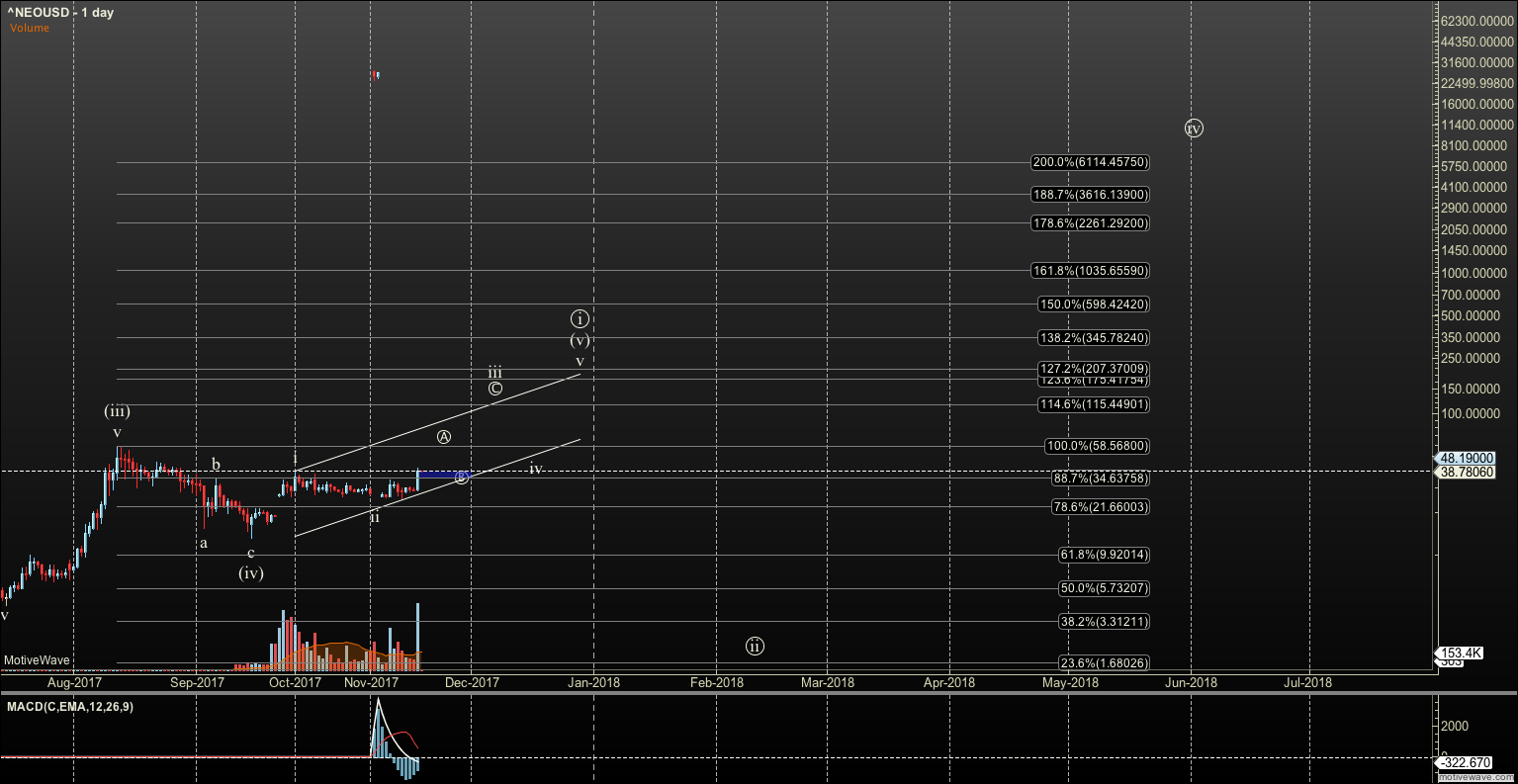

In my opinion we are starting to see a big shift in the condition of the crypto market through the Elliott Wave lens. The first warning signs were the failure of a few downside targets. NEO is glaring. While it full filled my preferred downside in BTC, it did not in USD and turned around. OMG has failed to follow through. It hasn't invalidated more downside, but is looking unlikely. And, if we rewind, Ether failed to give me my $115 C Wave, and Litecoin, so far avoided my preferred $15 target. That's all bullish. Even EOS resurrecting from the dead is a sign the market is awake.

So, this is where I personally start to evaluate a different trading strategy. I have learned too well in 17 years that market phases require a shift in approach. While I've been making profit and cushioning my portfolio playing Wack O' Mole game, I'm more cautious on that approach now because that mindset may knock me out.

Let's consider sentiment. I think we've heard a lot of crypto traders expressing a feeling of being warn down. I imagine that those trading small caps and even some large caps are tired of getting excited by a pop only to see a sink. This is where I'm blessed to know Elliott Wave. When the first wave has an A wave, we know the second pop is a C wave and so will not hold up. So, we took profit, playing the game of Wack O' Mole. If you didn't realize the reason I was doing this, now you know.

So, I might take some selective profit, here and there, but I am far more cautious about doing that. I know that impulses are much quicker in general than corrections. Unless we get diagonals for the fifth waves, they will go quick.

I am starting to wonder if the market does continue in a 'staggered fashion'. By that I mean all boats rise, but one after another and not in unison. There are continued signs of that. If so, I will likely make use of rotation opportunities.

What will make me bearish again? I'll be more cautious when supports don't hold, and then turn to solid downside setups. I don't see many right now even warning of that. I still find the diagonals we're getting as difficult grinds. It's disappointing that Ripple looked ready to launch and then settled into a probable diagonal. But a diagonal at this phase is not a downside setup. NEO may grind its way to daily targets in a diagonal. Not fun, but not bearish.

The area I still think we need caution are some of the new tokens. I just don't have the price history to suggest that my targets are reliable. IOTA, ADX, LUN, PAY are really the top four to be most cautious on because they haven't held impulses in the past so I'm imagining a large diagonal. But we don't enough history to rely on that. That said I don't see them as bearish right now. So, take this for what it is and risk accordingly.

If this take does pan out, I'll soon be looking forward to the top. Believe me, just like G, Zac, and I were talking about the caution zone in Bitcoin, I'll be on it when it becomes important. Tops are hard to spot, more difficult than bottoms for many reasons. This means you're less likely to hear a 'sell all call' then a 'Be careful call' and 'consider taking some off the table'. Again, I think it will be between 3-6 months from now. And at that point I do expect a bear market much more brutal than the one we endured since June. This is because in most coins it should be a wave 2 not a wave 4. While wave 4's get you frustrated by chop and 'tease rallies', wave 2's destroy net worths and we should hear talk about the end of cryptos before it completes. And, then we load up the truck.

Note: Posting a few of the key charts in a sec.