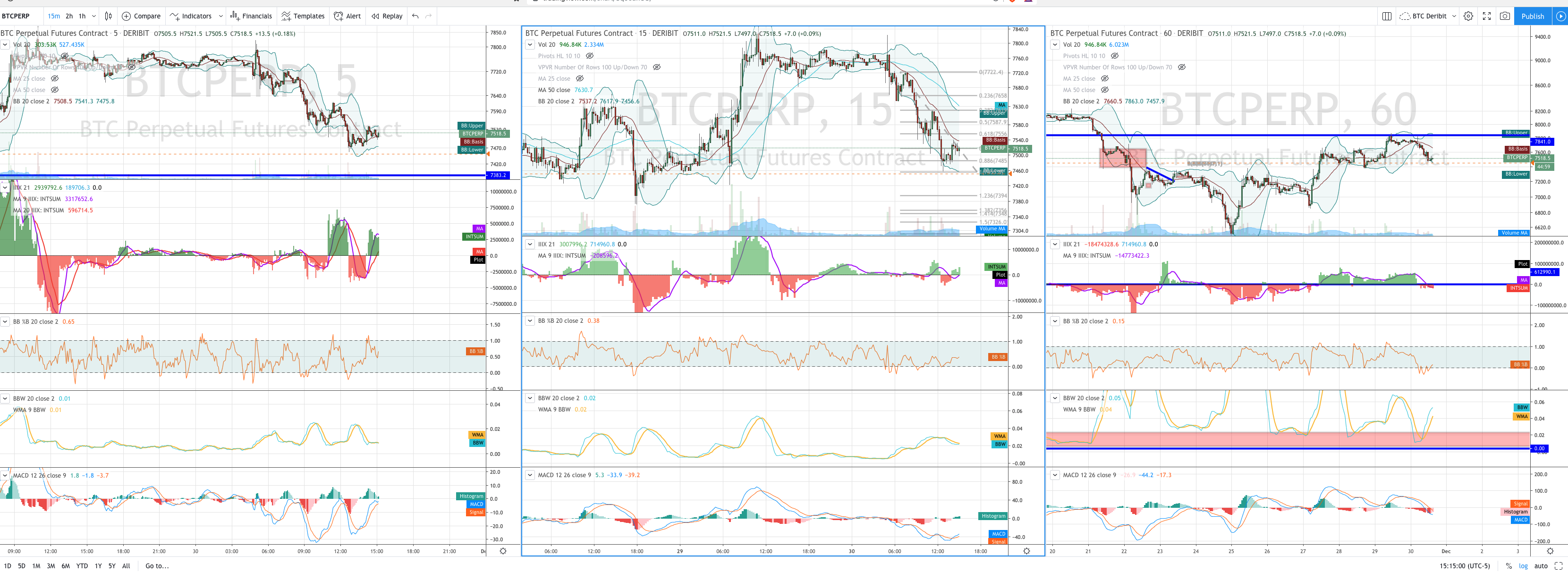

Bollinger Scalping Notes - Market Analysis for Nov 30th, 2019

1. In three days of deploying, stats were 80% successful. Skew just positive (roughly 5 unites of profit for 4 lost). Account was up 10%. Sample set was only 45 trades.

2. Repeated warning: Price makes indicators do the thing. It is mathematically impossible for an indicator to make price do anything as indicators are derived from price history. Though conditions in indicators can indicate potential in price.

3. I switch from EW to bollinger scalping when volatility is dropping. eg. Scalp the 5m chop when the 15m Bollinger Width is declining. I use a 9MA average as a visual aid on B.Width indicator.If you wish to scalp the 15m, use the 1H chart to determine volaility regime.

4. All indicator settings are 'out of the box' on tradingview

4. When B.width reaches extreme low levels consider ceasing to scalp as a volatility explosion is likely. In fact, John B. calls this the Squeeze setup but I haven't mastered how to trade it yet, but it means get ready for the big trade.

5. Basic scalping is selling at bollinger extremes. When volatility is in a low cycle price tends to bounce off bands. When volatility is in a high

6. Consider favoring trades in direction of BB median line if it has a bias down or up. Favoring could mean taking only those trades in the direction, or having smaller size in the other direction.

7. Use the Intraday Intensity indicator to support the trade. Often if for example the indicator is declining while price is hitting the top of the band, shorting makes sense. But if increasing, you might want to get ready for long as volatility may be expanding.

8. BB% divergences are helpful to support the trade.

9. Stops can be last price high/low, or you can get a tigher stop by measuring the last range and use the 1.382 extension.

For EW, I am now inclined to only trade EW support levels when there is a turn in Intraday Intensity and volatility so separate from BB scalping. I'll be looking for these signals to support a turn in EW levels.