Big Boyz Coming In.

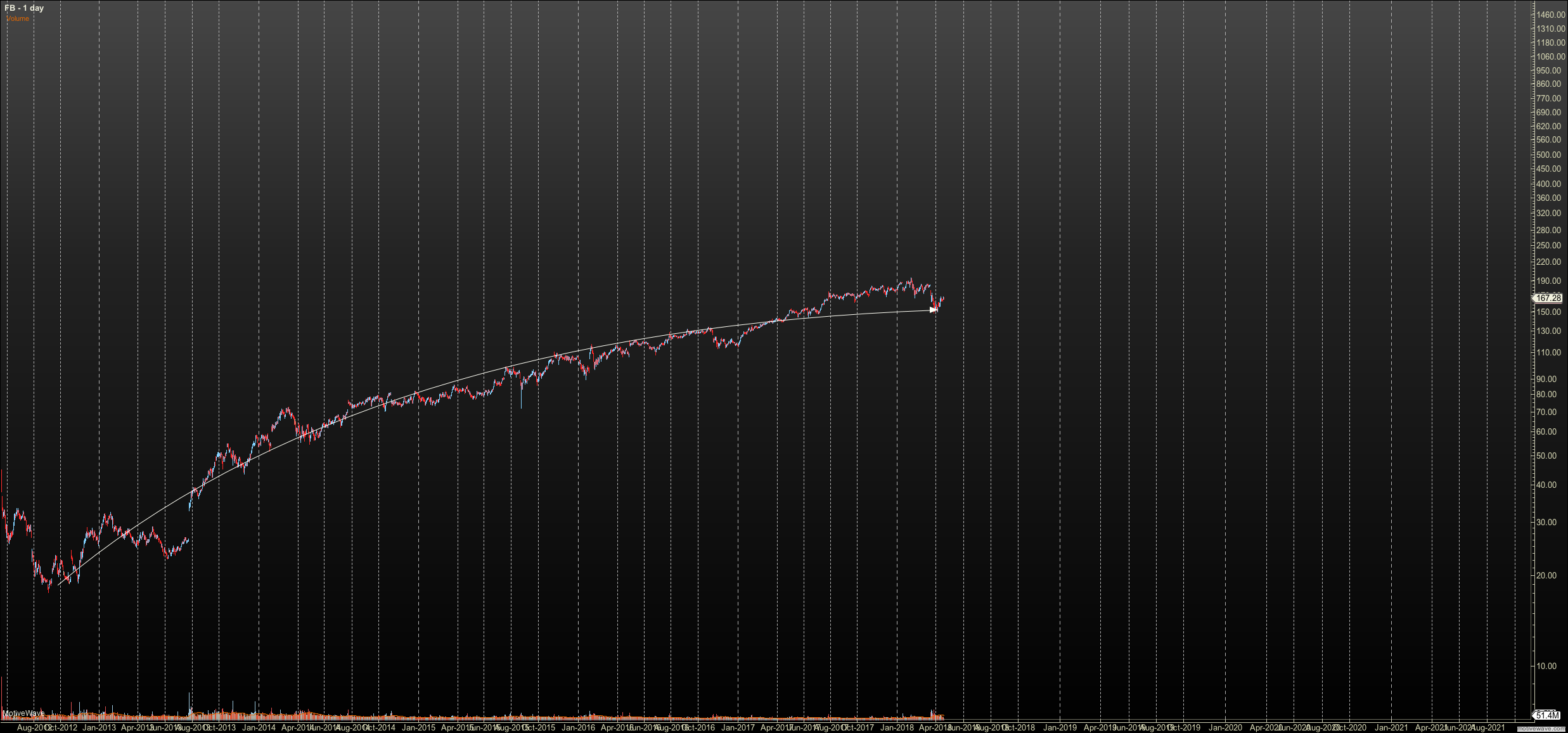

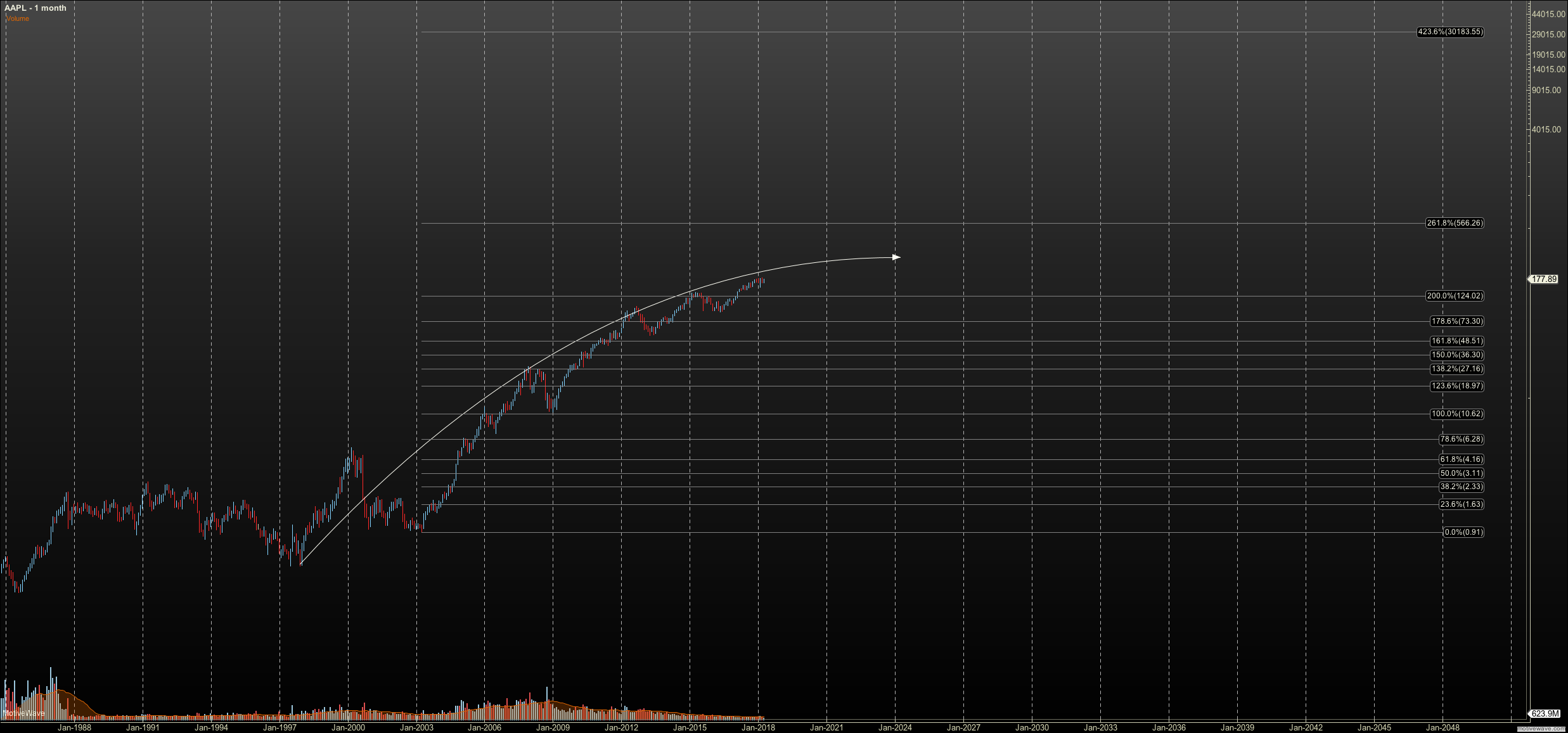

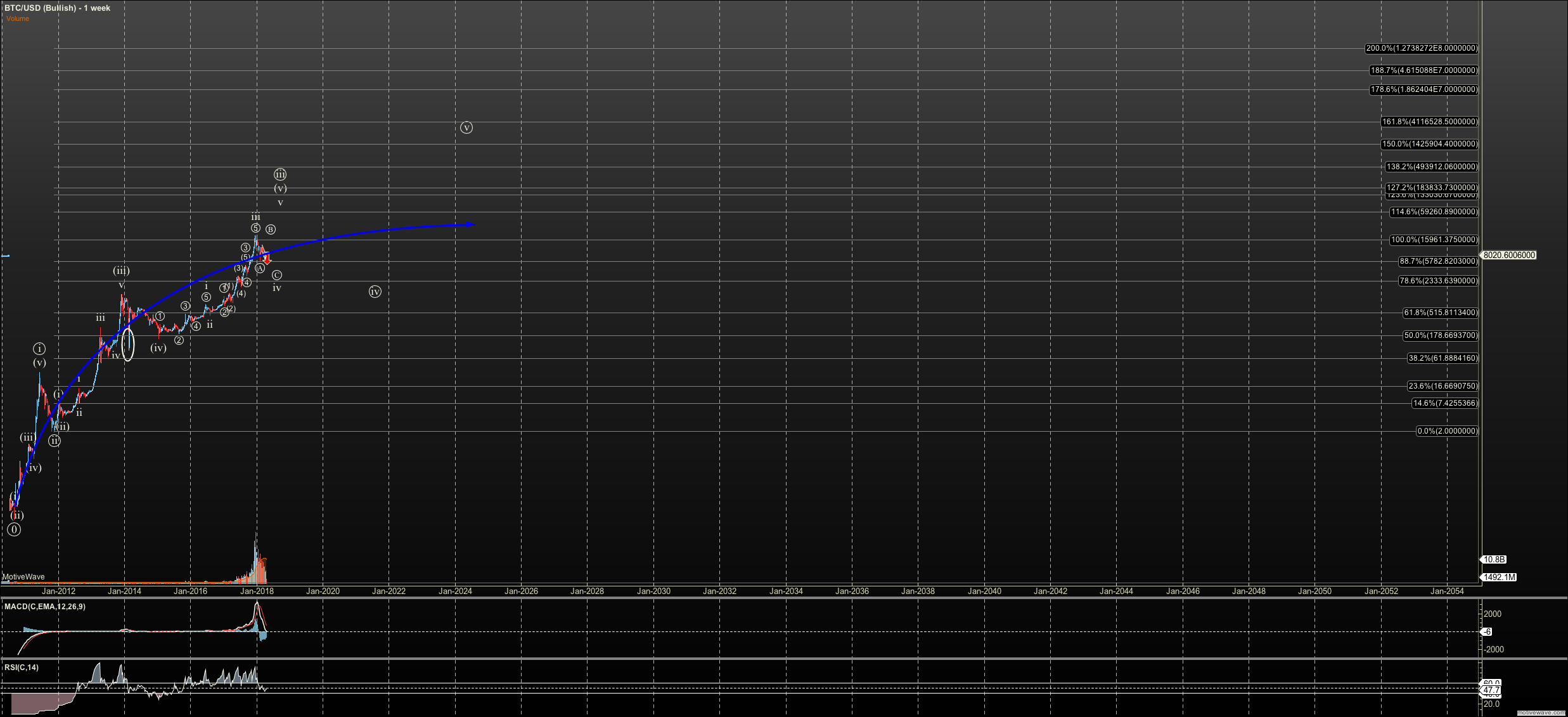

I've been asked this a lot over the last few months. How does the big boys (banks, hedge funds, EFTs, and the like) coming into this market affect the counts? My answer has been 'they won't change but they'll slow in time.' As liquidity enters the market bull runs take longer, and the 3month to 6month bear markets and the 18mo + for the higher degree Mt. Gox bear will give way year long to 5 year bear markets eventually. Yes we'll make money in cryptos but slower over time. See the chart of BTC below, and you'll see that 'mean curve' is slowing. Compare it to the long term charts of Apple and Facebook. Both are still volatile for stocks, but maturing in liquidity and interest as well.

So, to get the volatility we like as traders we'll have to mix our mature cryptos with small caps, and new issues with all the accompanying risks that come with mature counts. This is the same in the equity market where you can chase penny stocks for high return with the risk they go to 0. But consider that the big boyz coming in and give liquidity also makes a market for the long term, and EW gives us an edge in a mature market just as it does in a new market.