BTC Internals - Market Analysis for May 9th, 2019

For those of you that have membership in the main market room, or stockwaves, you are familiar with the INTERNALS WORK of Harry Dunn (HD as he is called). During the analyst meeting last week in Baltimore, I sat with him to learn this black art to the best of my ability. HD uses this work which particularly focuses on good ole RSI with MACD to first try to get ahead of price, and to see confirmation of trend change, at least that's in my own words.

We looked at BTC, and here I am trying to apply it. I plan to on a regular basis.

Further, I believe, but need further study that this can help with XXXBTC charts, which render EW partially to unuseful.

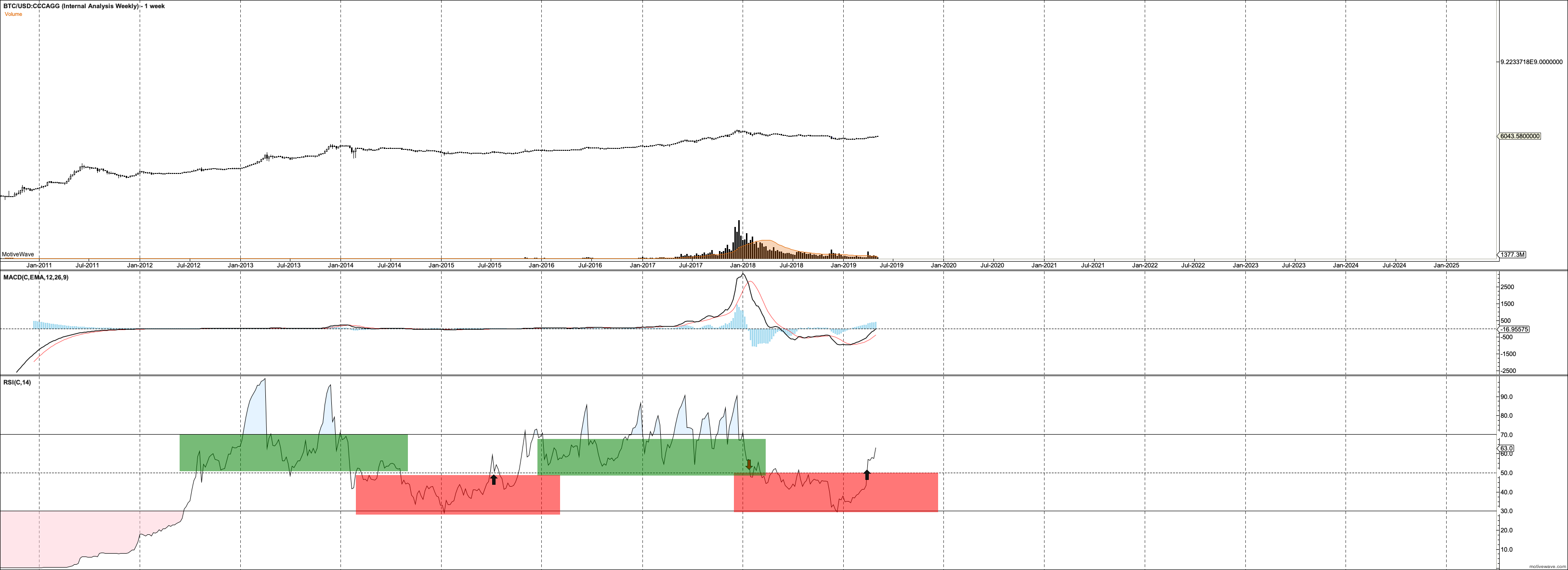

The Bottom line in both these charts is that we have the early signs of trend change but there is still work to do. If you look at the weekly you can clearly see the range RSI keeps. We have broken into the bullish range. However it is key now that we see it go to overbought to begin to confirm this trend change and then hold the upper range.

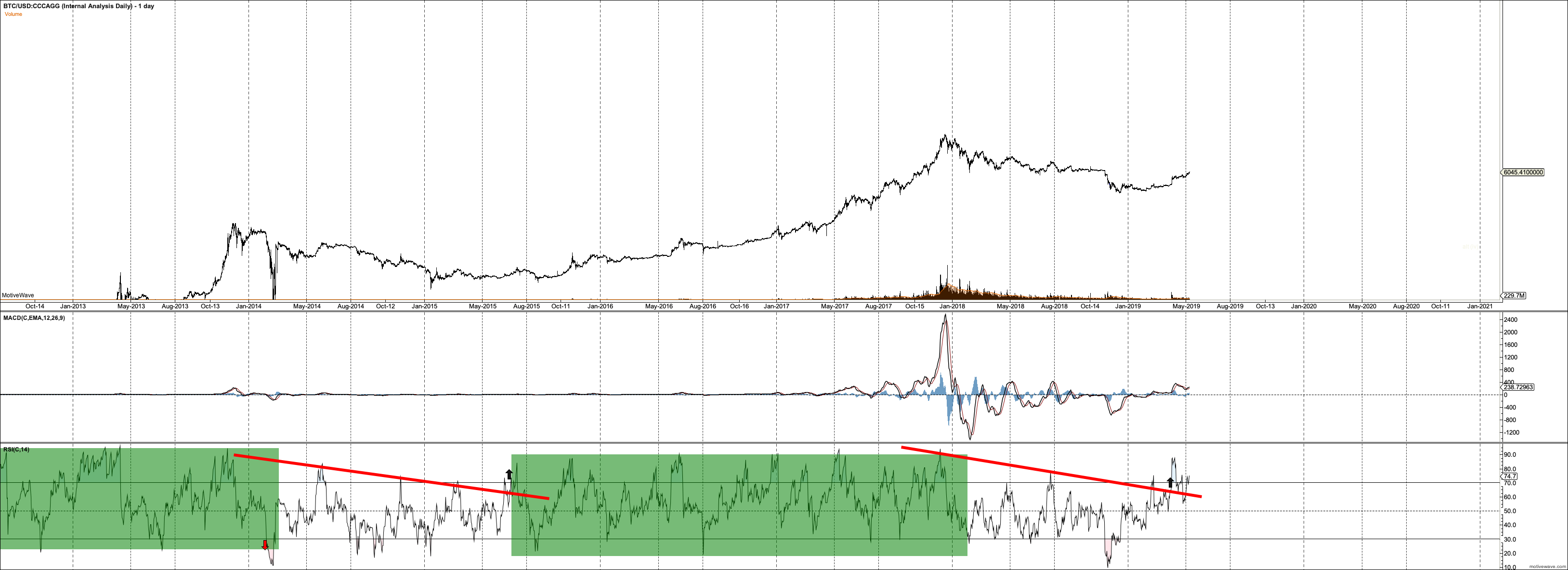

On the daily it gets more murky. Where RSI gave early signal of a protracted signal of a bear market in the weekly, less so on the daily with any level break. However we do have early signs of a break of downtrend (red line). However, you'll see that RSI is not yet as strong as it has been in past bull markets. So, we need to see RSI continue toward the upper extreme to confirm this trend change.

Note you may not be used to the white charts. I don't like them but it is much easier to see the colored boxes.

Expect more to come on XXXBTC charts

MACD on weekly has some great momentum here. On the daily we are stair stepping with price nicely and so far bullish.