World Markets Weekend: Wave Counts For The Asian Indices

ASIA/PACIFIC

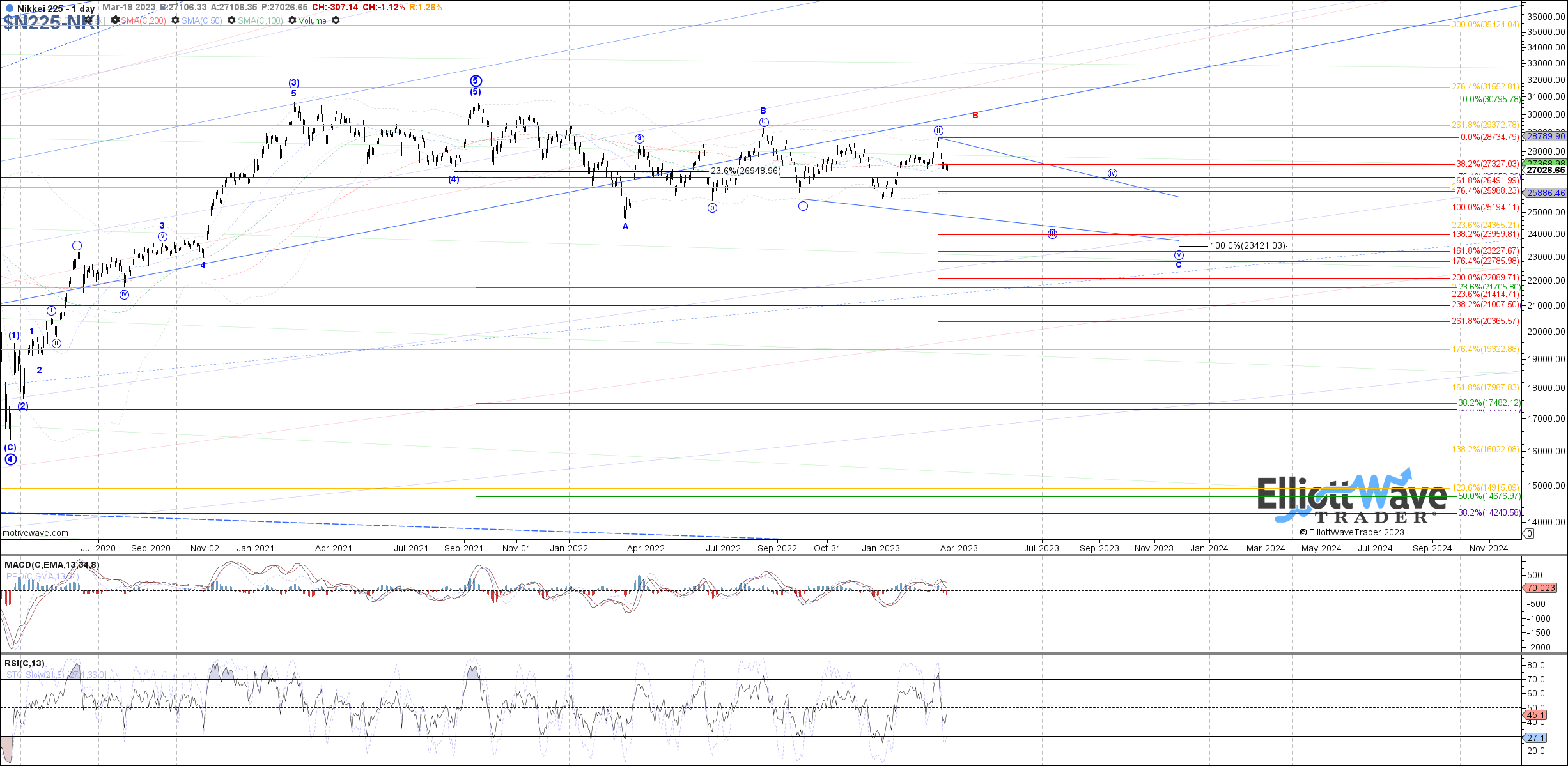

N225: The Nikkei continued sharply lower last week, breaking all the necessary support to assume that the wider flat wave ii off the October high has completed, and price is now turning down in the start to wave iii. Based on that assumption, last week’s low easily could have completed an initial a-wave down from the high, allowing for more of a near-term corrective bounce as wave b. If so, then this is likely only wave A of b so far, with 26910 as ideal support to hold as wave B of b. Otherwise, any direct lower low from here could otherwise be another extension in wave a.

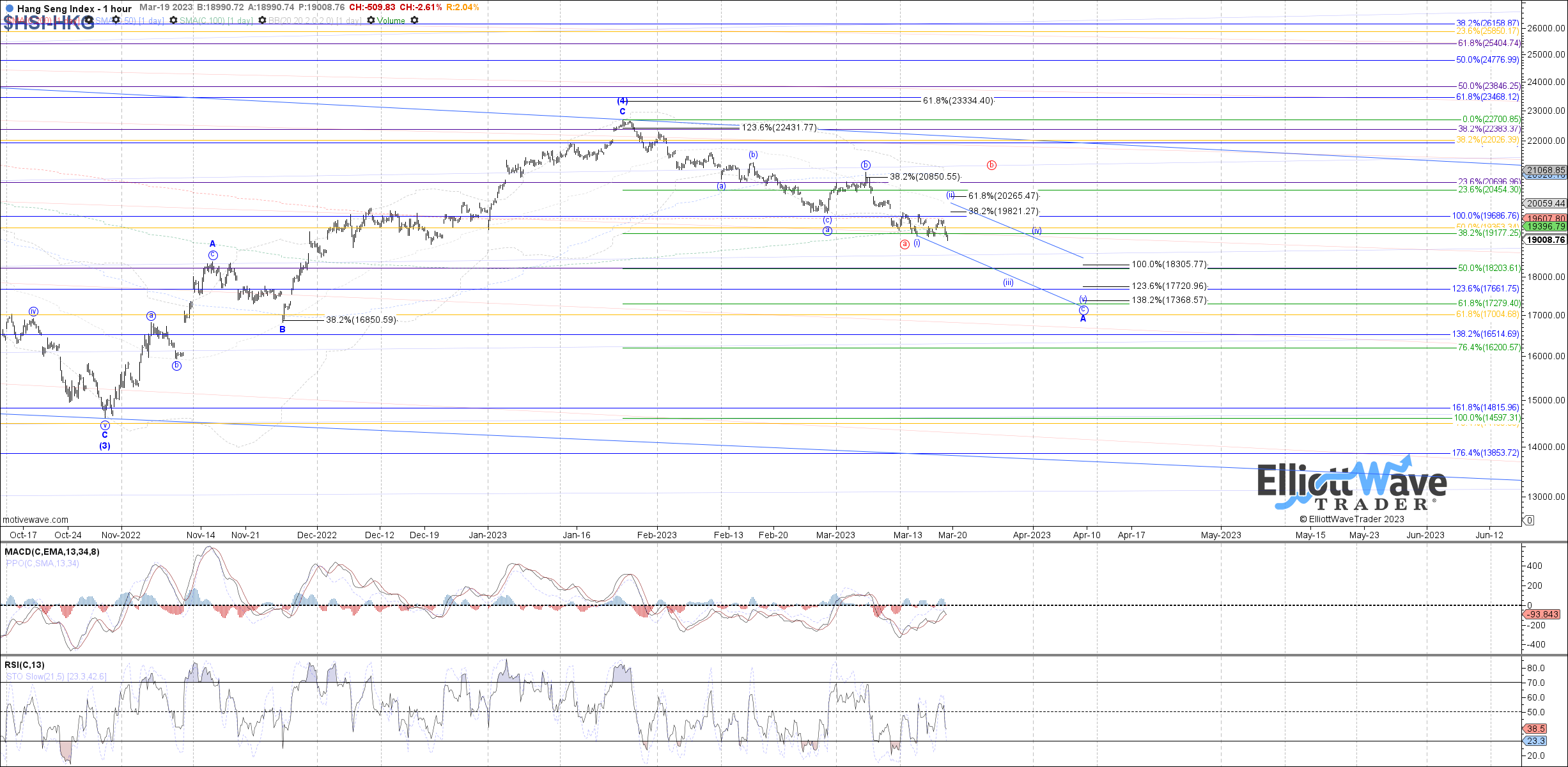

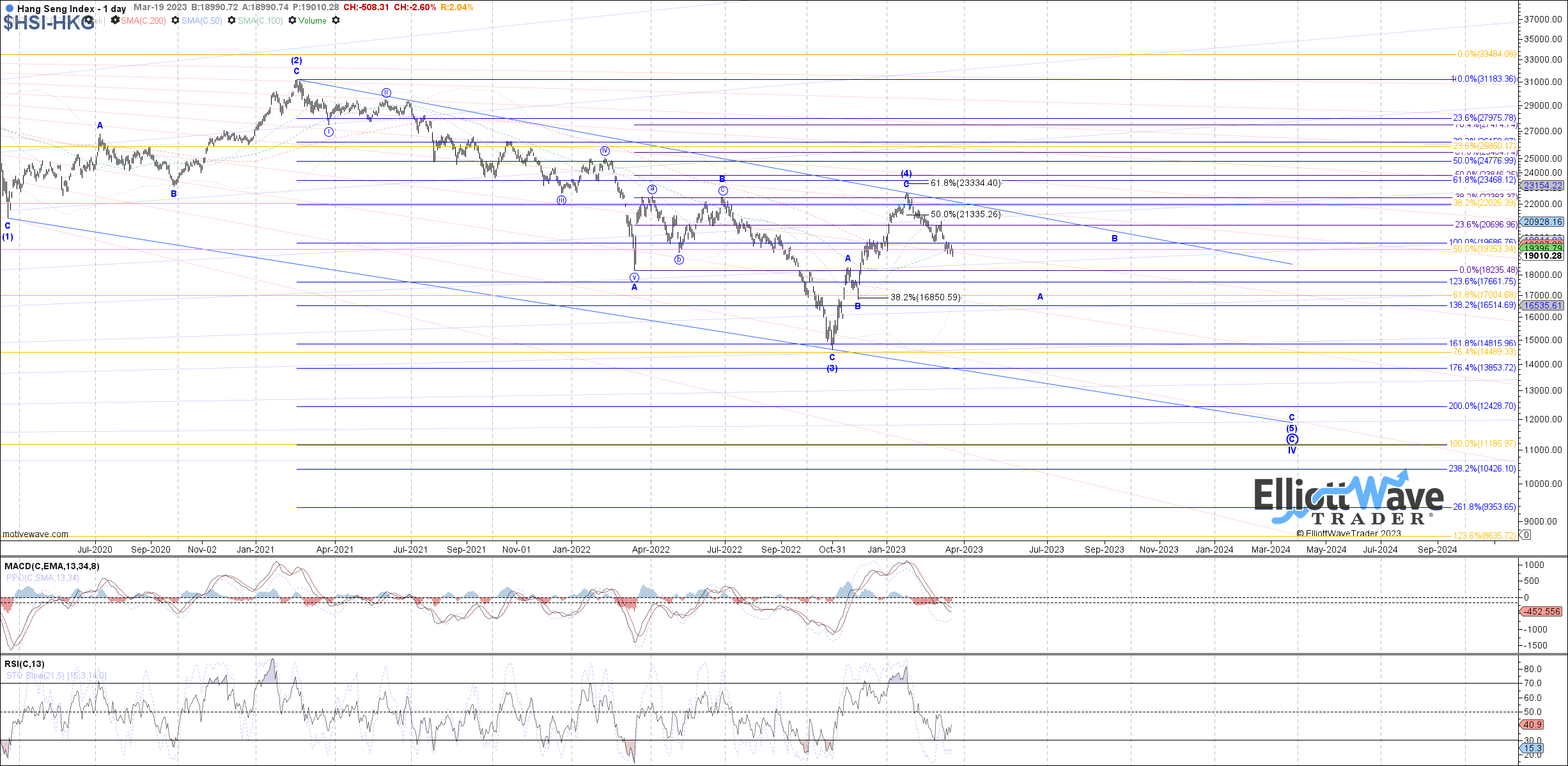

HSI: The Hang Seng traded lower last week as well, which could place price further along in wave c of A than just the (i)-(ii) still. If so, then 18305 remains the minimum expected fib target to reach before wave c of A completes. Otherwise, any new attempt at a near-term corrective bounce could still otherwise be the blue wave (ii) of c or red wave b, but overall pressure remains to the downside.

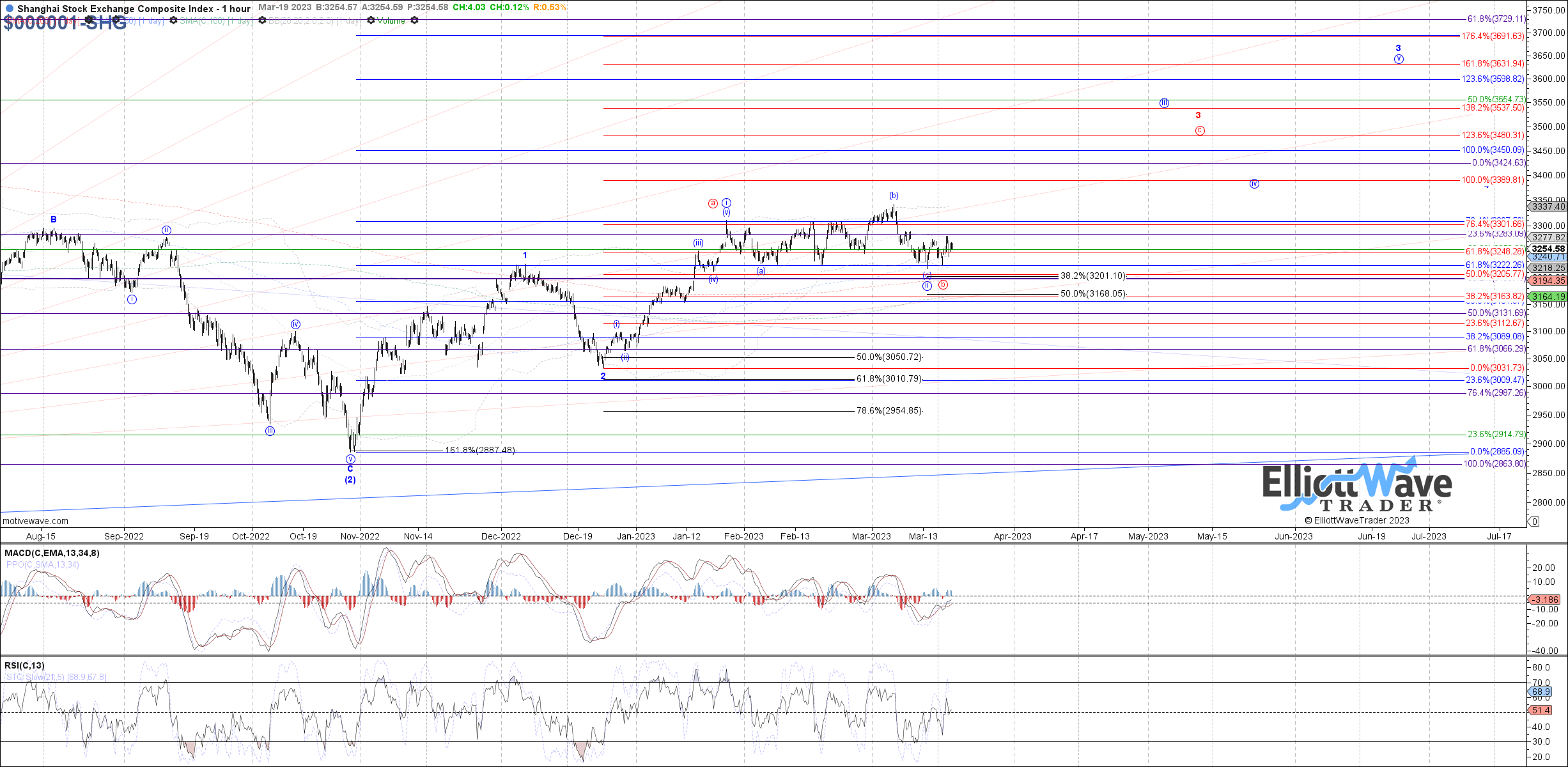

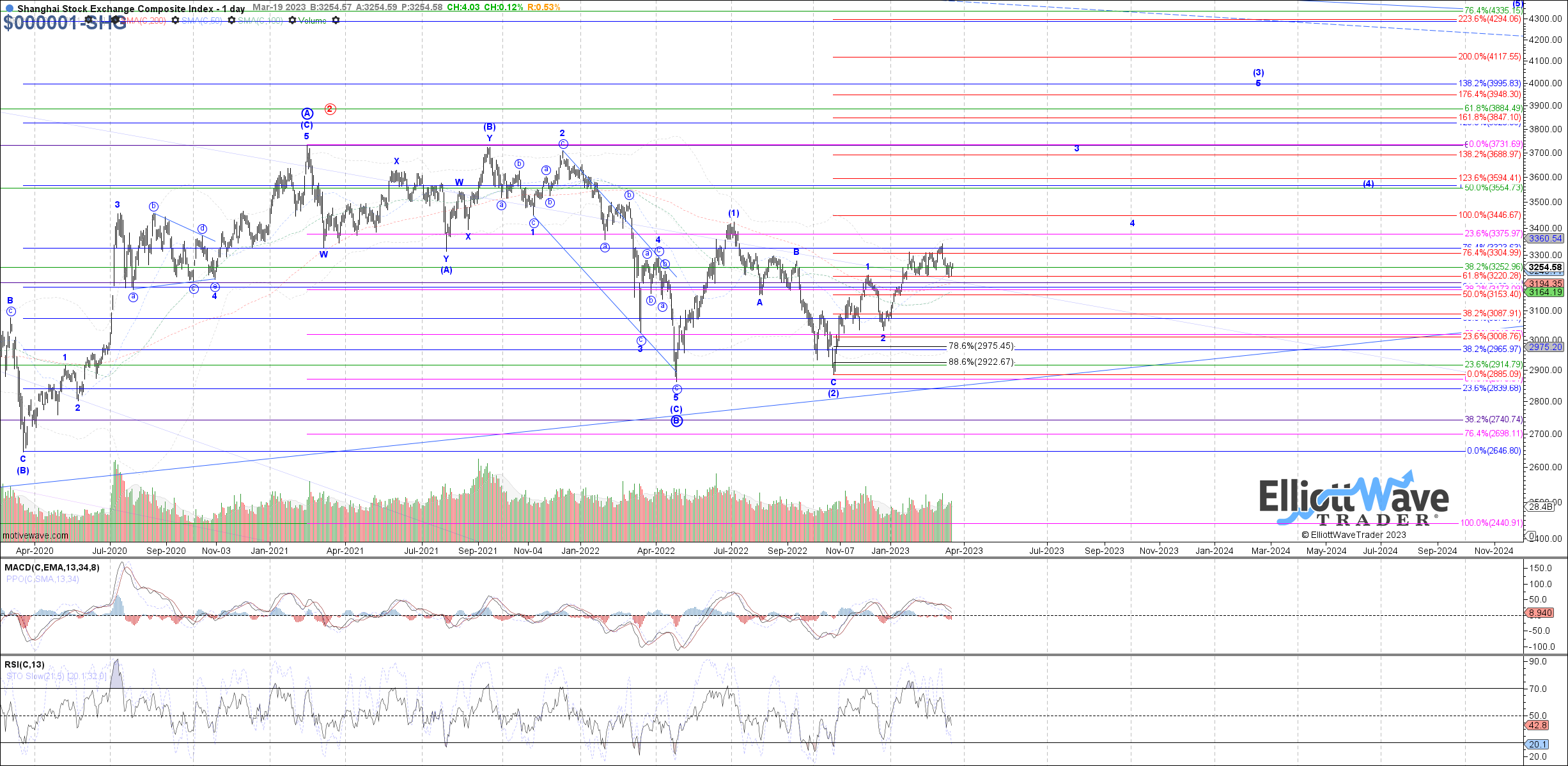

SSEC: The Shanghai Composite started off initially lower last week, retesting the prior February lows in what looks like a wider flat blue wave ii of 3 or red wave b of 3. It is possible that last week’s low completed the wider flat, and price is reattempting the start to blue wave iii of 3 or red wave c of 3. However, so far we only have a micro 3 waves up from last week’s low, so more confirmation is needed.

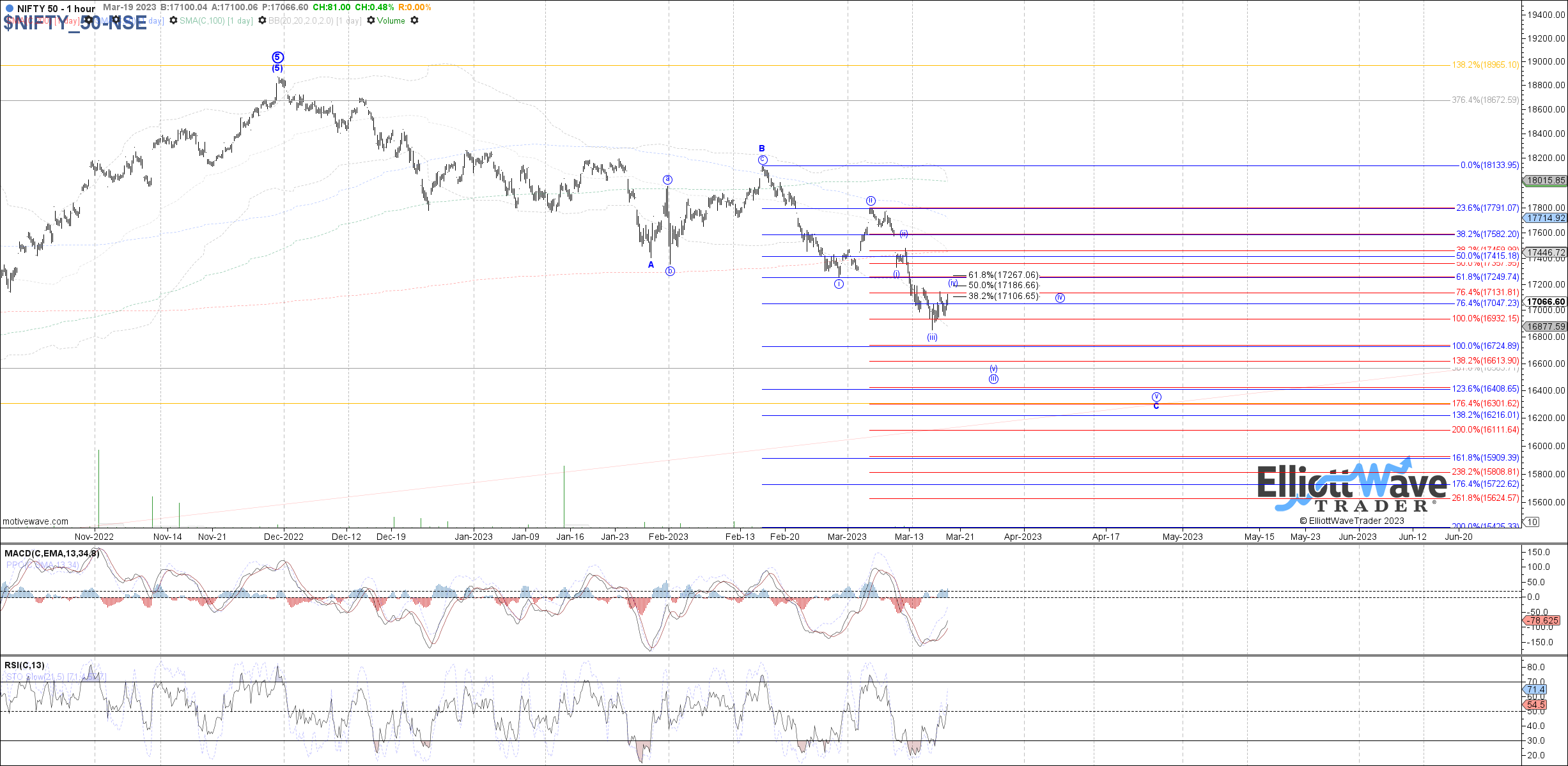

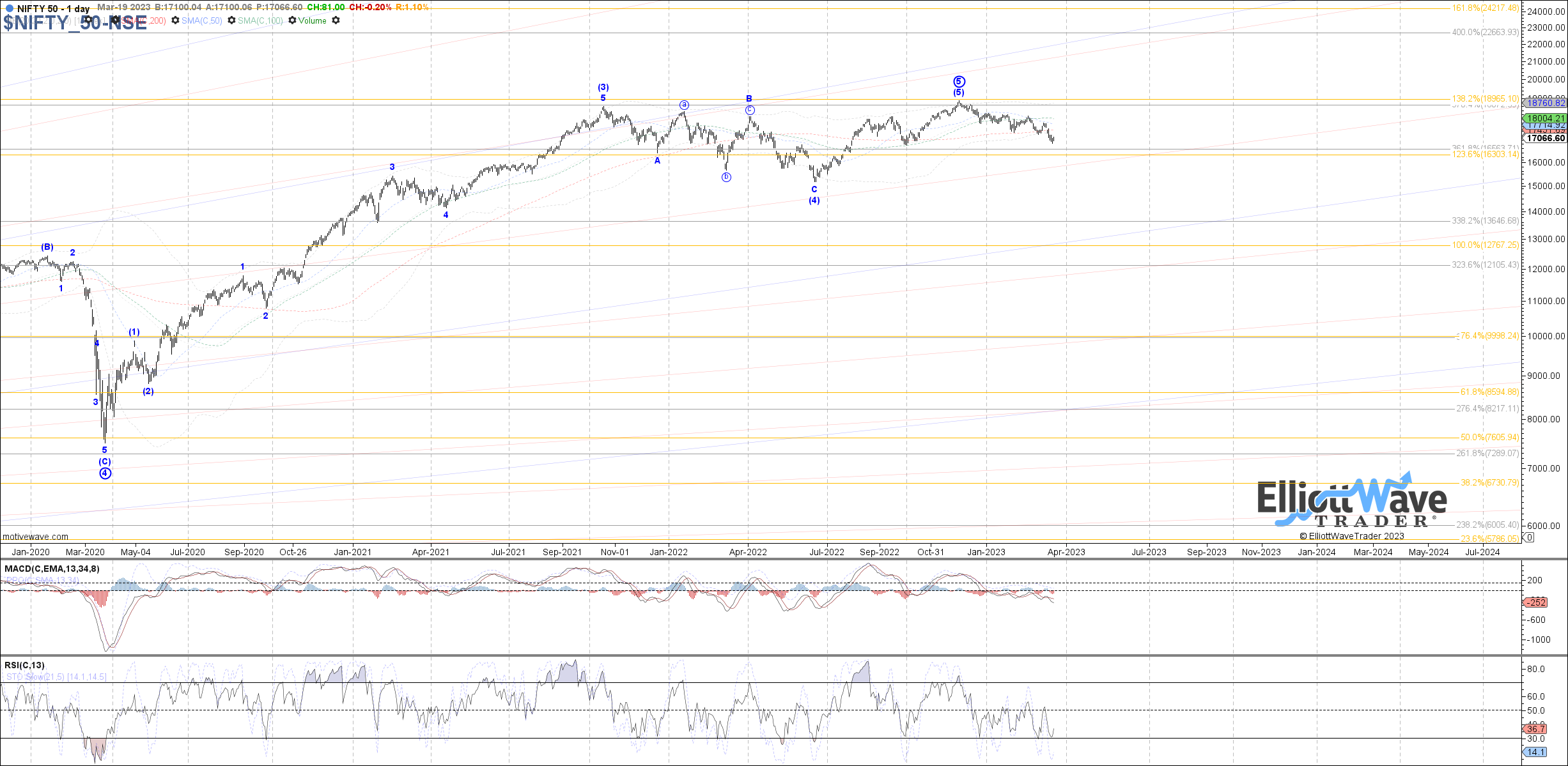

NIFTY: The Nifty ended up continuing sharply lower last week, which took price back below the February low. Therefore, support for the bullish count broke, and the door has now opened to a more muted wave (5) of 5 already topped at last year’s high. If that is the case, then this would just be the very early stages of a much larger degree correction that could ultimately retrace the majority of upside that has filled out off the 2020 low. In that case, price can be working on a C-wave down from the February high with 17185 as immediate overhead resistance for wave (iv) of iii.

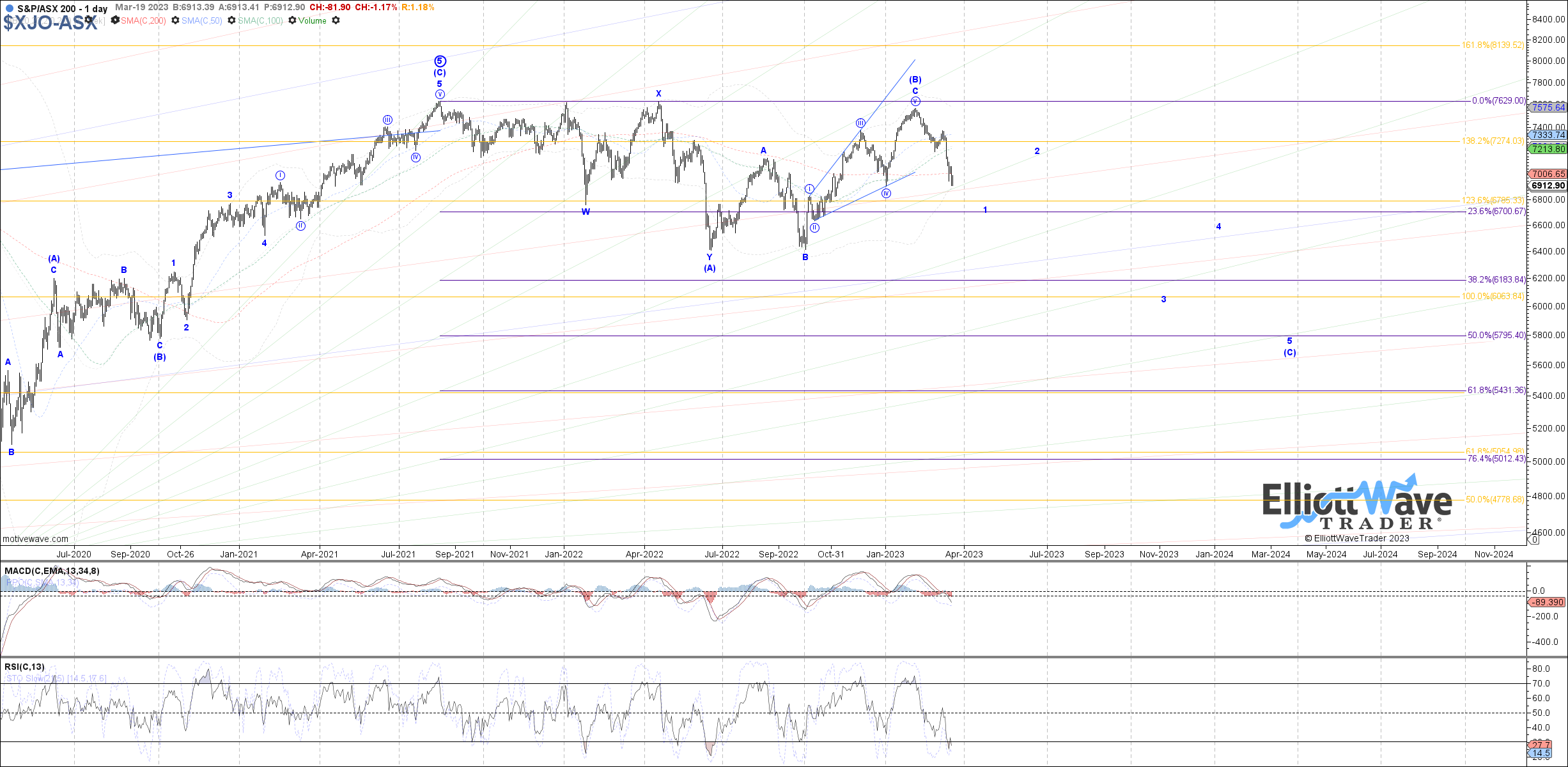

XJO: The ASX continued to trade lower last week as well, now reaching standard fib targets for all of wave iii of 1 to potentially complete at. Although price filled out an initial bounce off the 1.236 fib, that bounce has not been sustained so another low to reach the next fib target at 6870 is possible before wave iii of 1 actually completes.