World Markets Weekend: Europe / Americas

EUROPE/AMERICAS

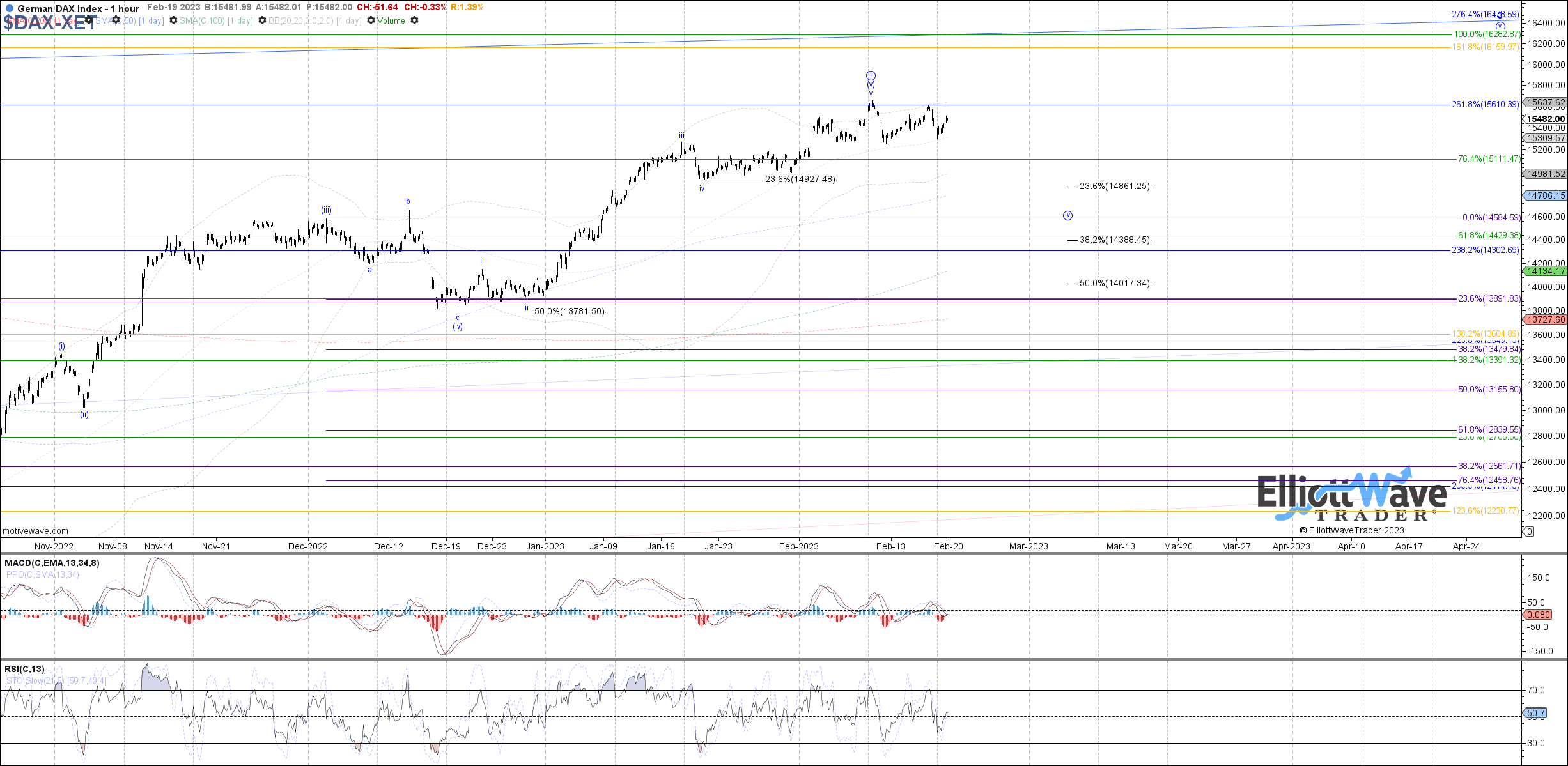

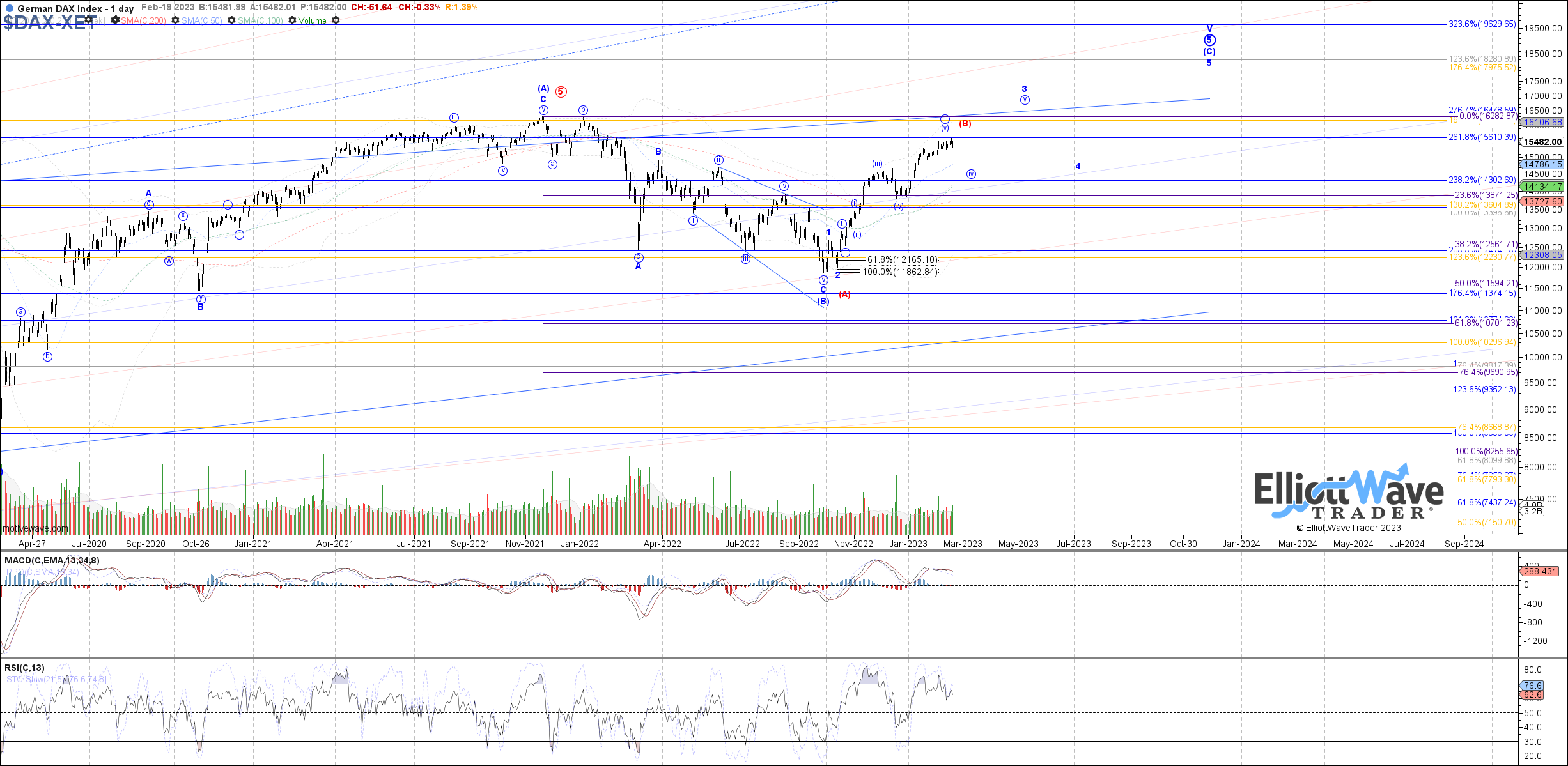

DAX: The DAX continued to bounce last week off the low made the previous Friday, but in this case never exceeded the prior high on the month. Therefore, still possible to count that high as were wave (v) of iii completed, but a break below 15235 remains needed as initial confirmation of that top and the start to wave iv. Otherwise, if price does manage to make a new high on the month from here it would likely be just a slight extension of wave (v) of iii.

FTSE: The FTSE continued higher last week, in this case making a new high on the month and reaching the original 8000 target cited for wave v of (iii). Despite reaching that target now, there is no evidence yet that wave v of (iii) has completed, which would require a break below 7920 at a minimum to consider and place price in wave (iv). Otherwise, further extension in wave v of (iii) cannot be ruled out although not necessarily expected.

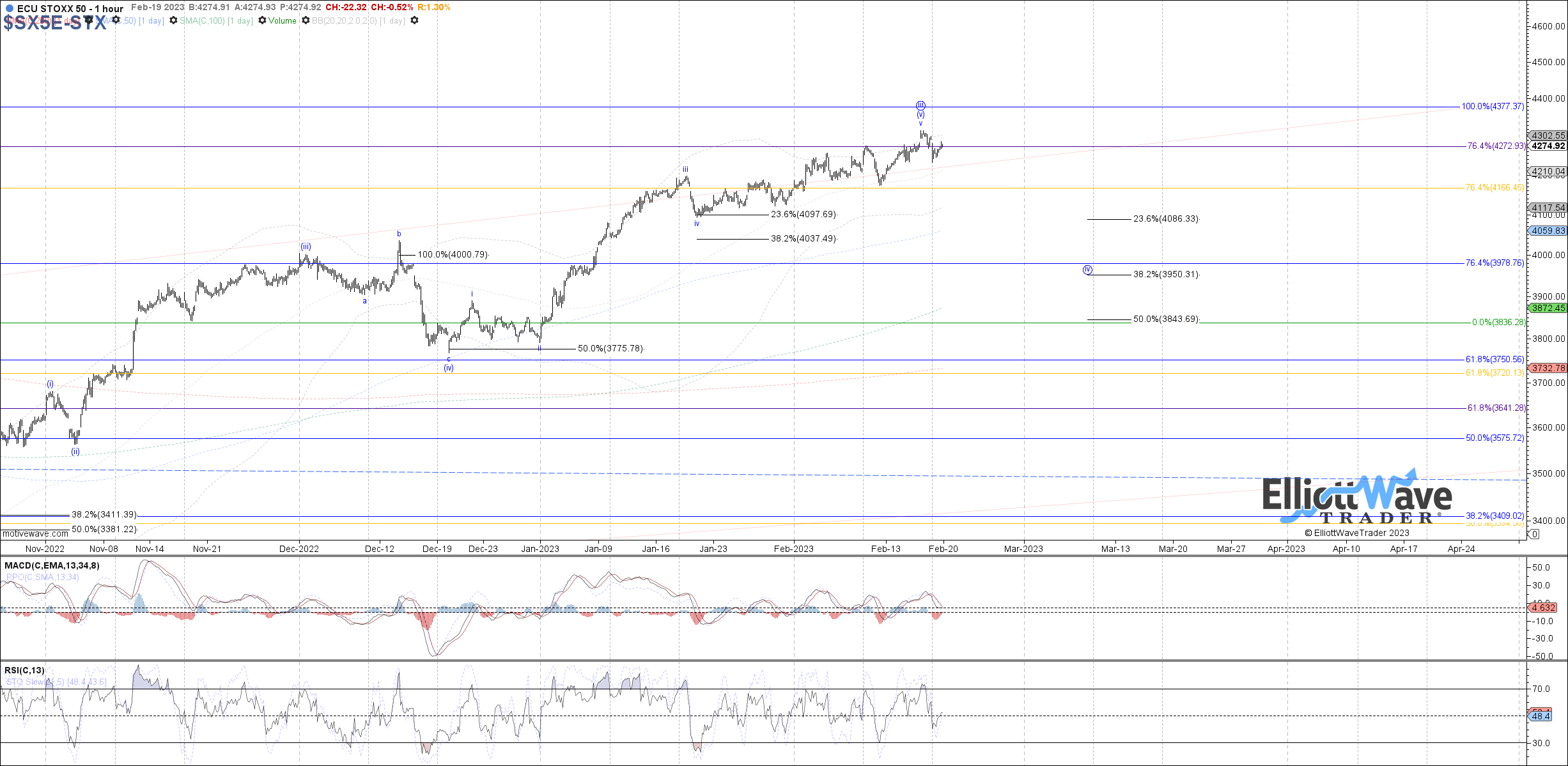

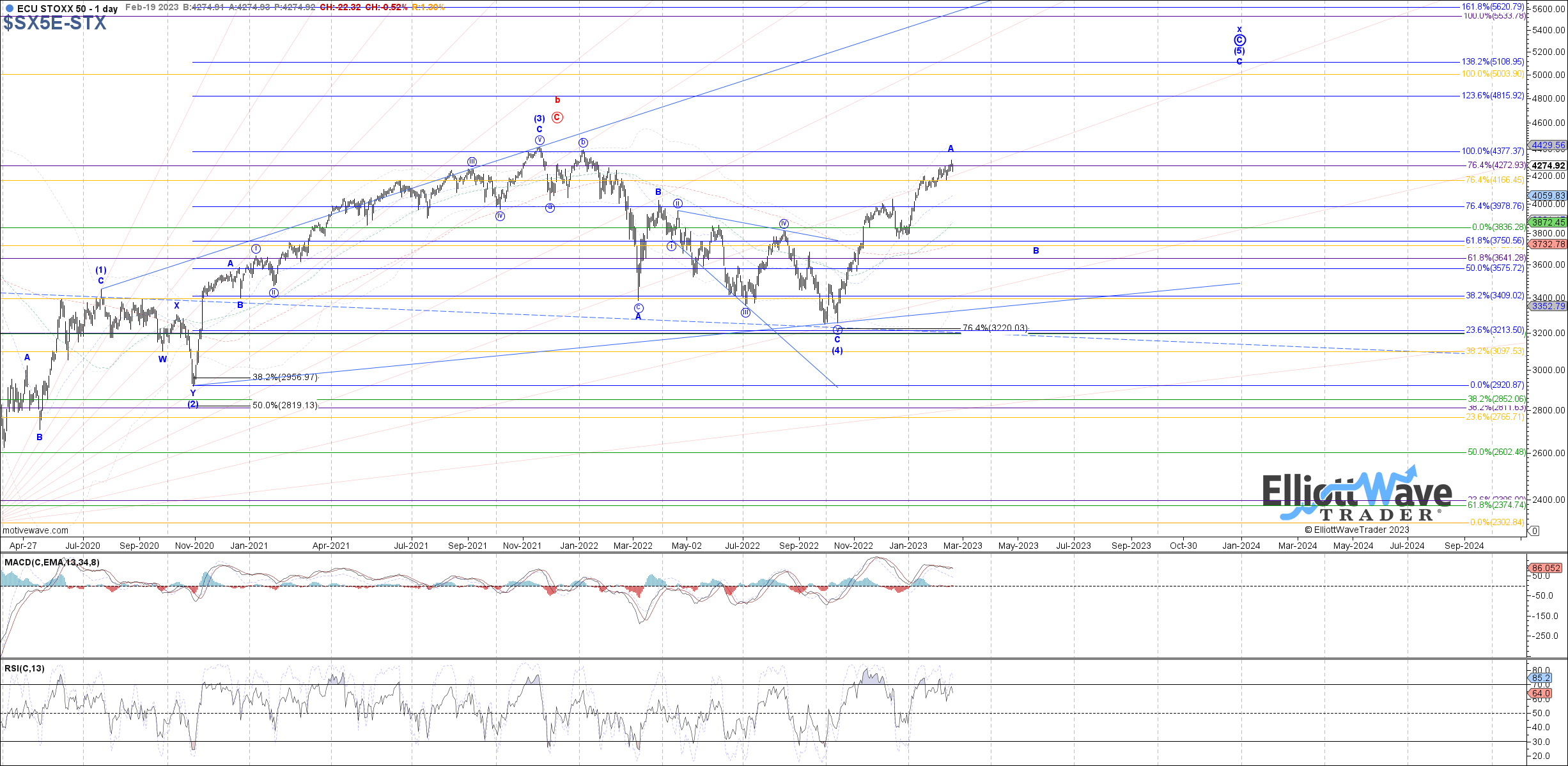

STOXX: The STOXX continued initially higher last week as well, like the FTSE making another new high on the month in an extension of wave (v) of iii. In order to assume a local top and price starting the next higher degree pullback as wave iv or B, a break below 4170 is needed in this case. Otherwise, further extension in wave (v) of iii cannot be ruled out although not necessarily expected.

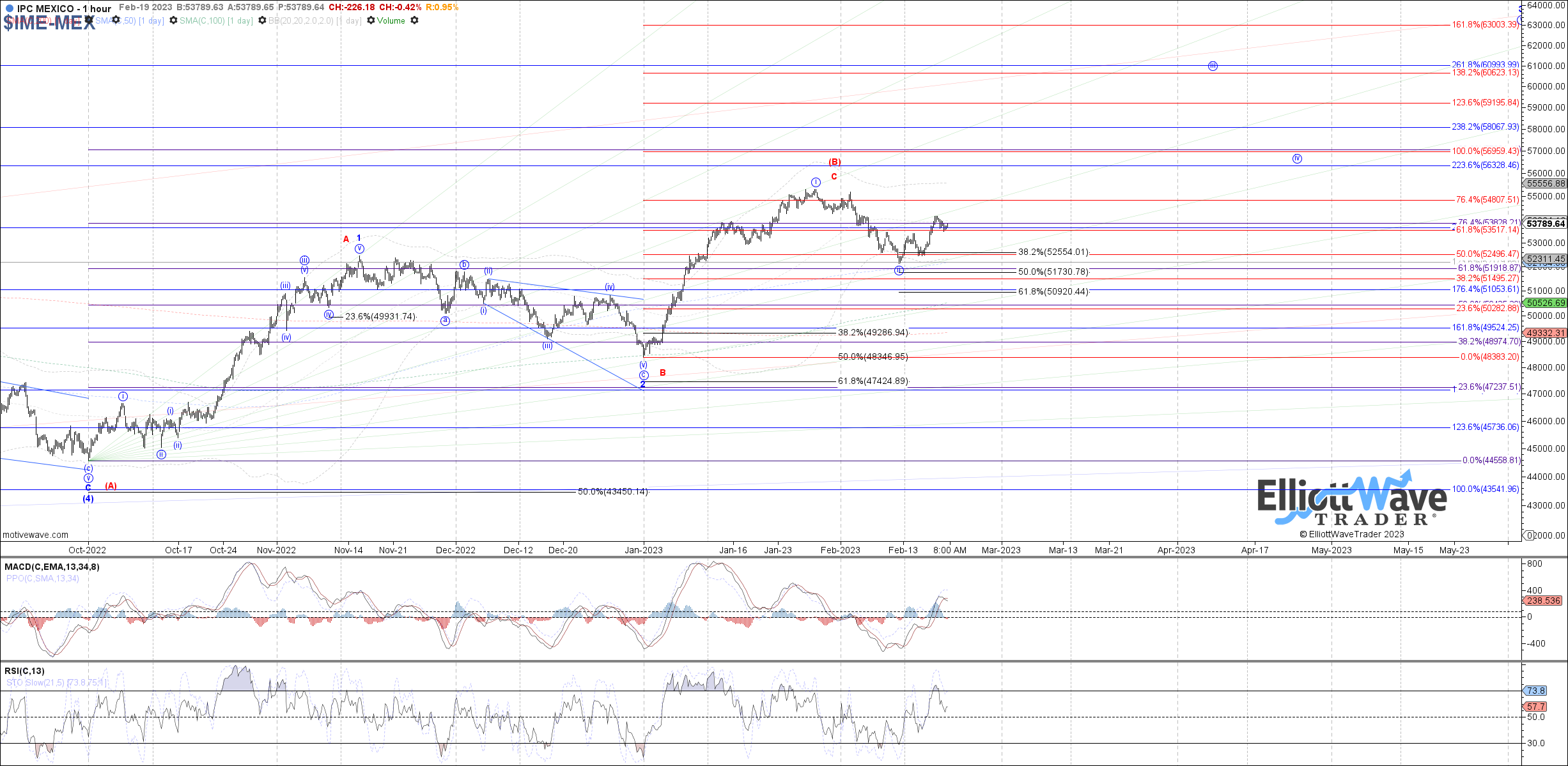

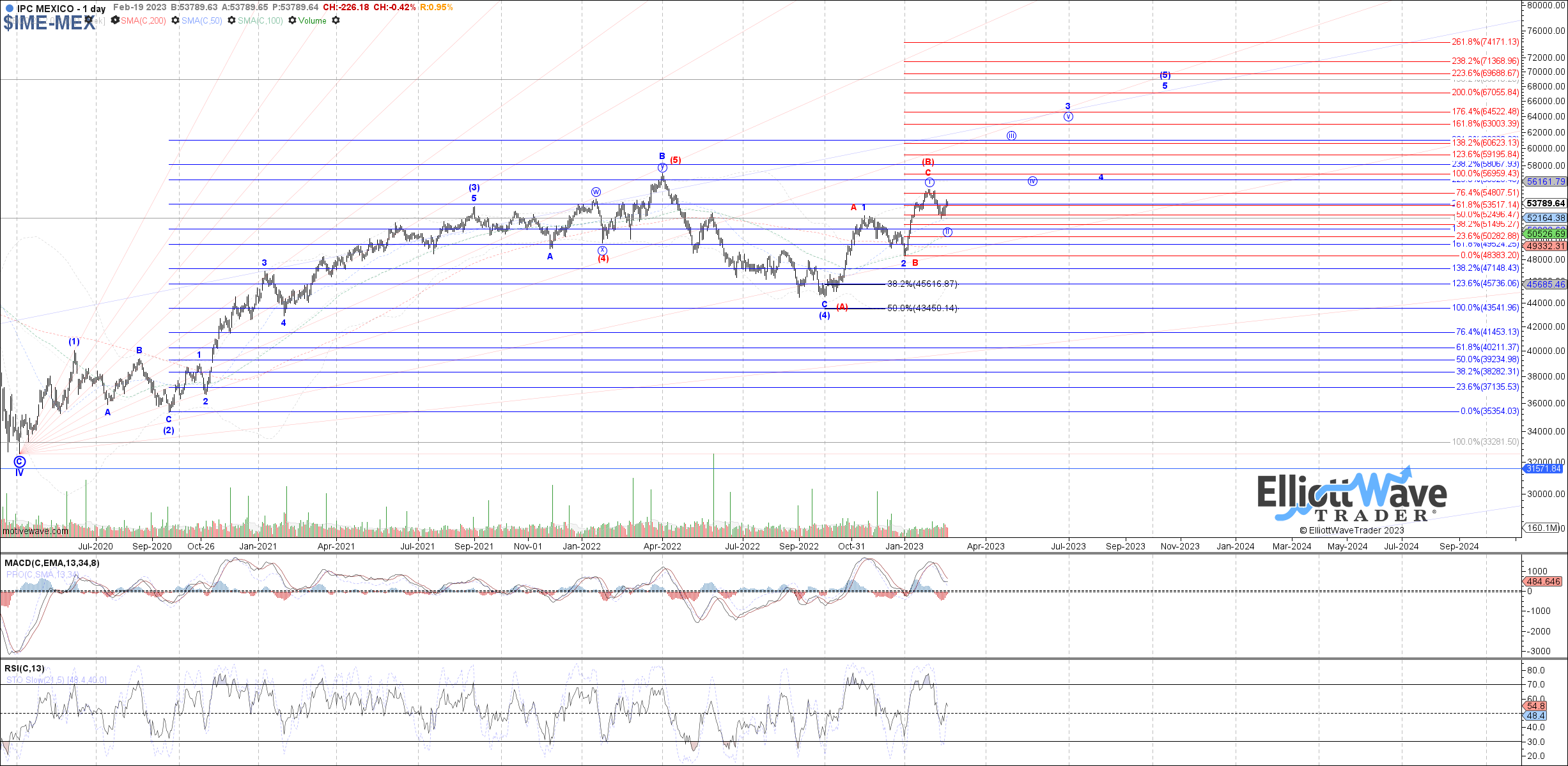

IPC: The IPC continued to curl up last week, so far holding the .382 retrace cited at 52555 as the upper end of support for blue wave ii of 3. However, so far price has only produced a micro 3 waves up from the February low, and a full 5 waves up as wave (i) of iii is needed to confirm that wave ii has completed. Otherwise, 52555 – 50920 remains the overall support range that would otherwise need to break to open the door to a more significant top in place as red wave C of (B).

IBOV: The Bovespa closed higher last week, but still has not managed to clear the 110035 fib resistance cited for wave 4 of c. Therefore, until a sustained break above that level is seen, another low as wave 5 of c to test the .618 retrace at 106430 remains possible. Above last week’s high opens the door to wave (c) of a already underway.