World Markets Weekend: A Review Of Asia/Pacific Indices

ASIA/PACIFIC

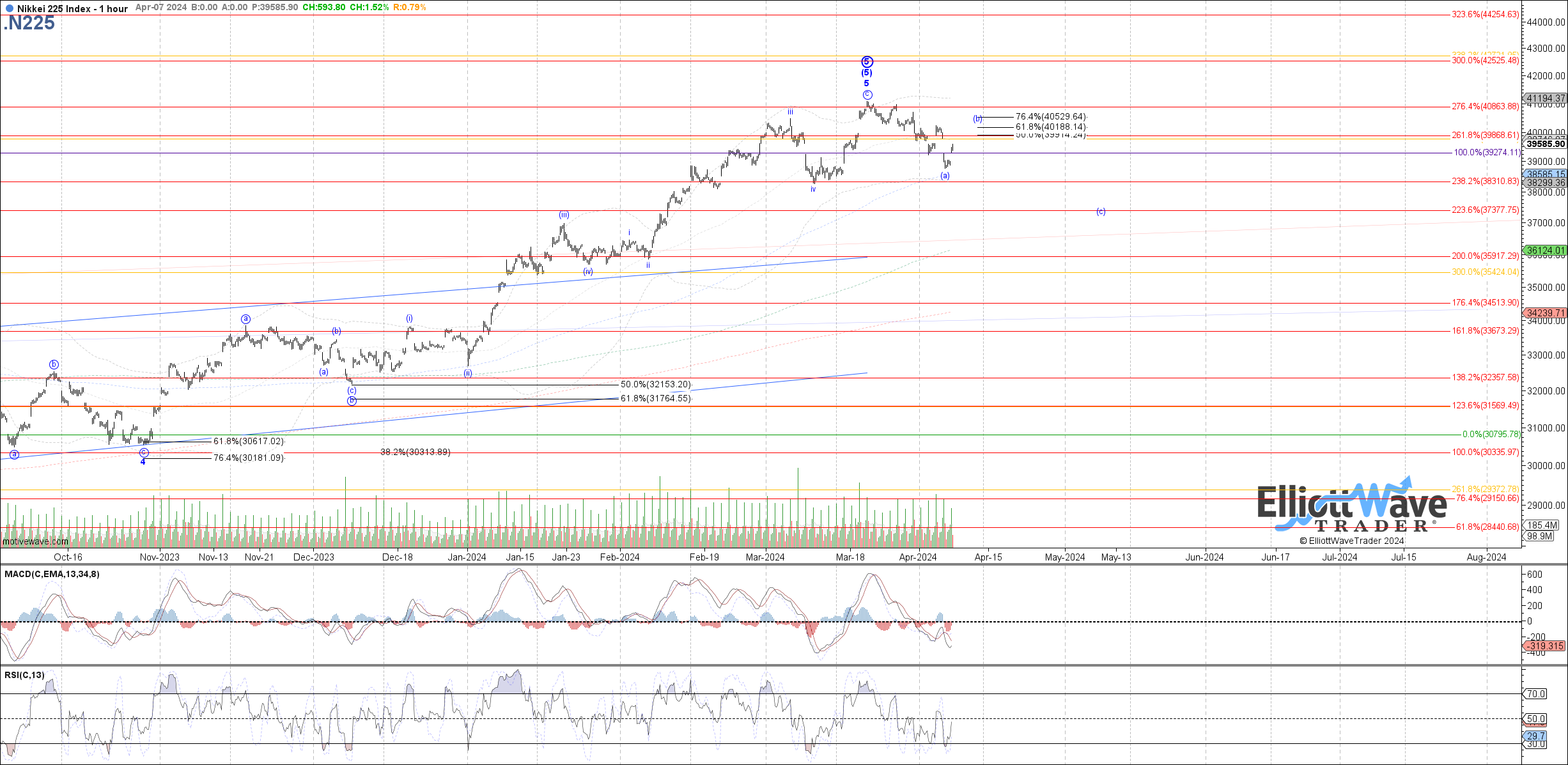

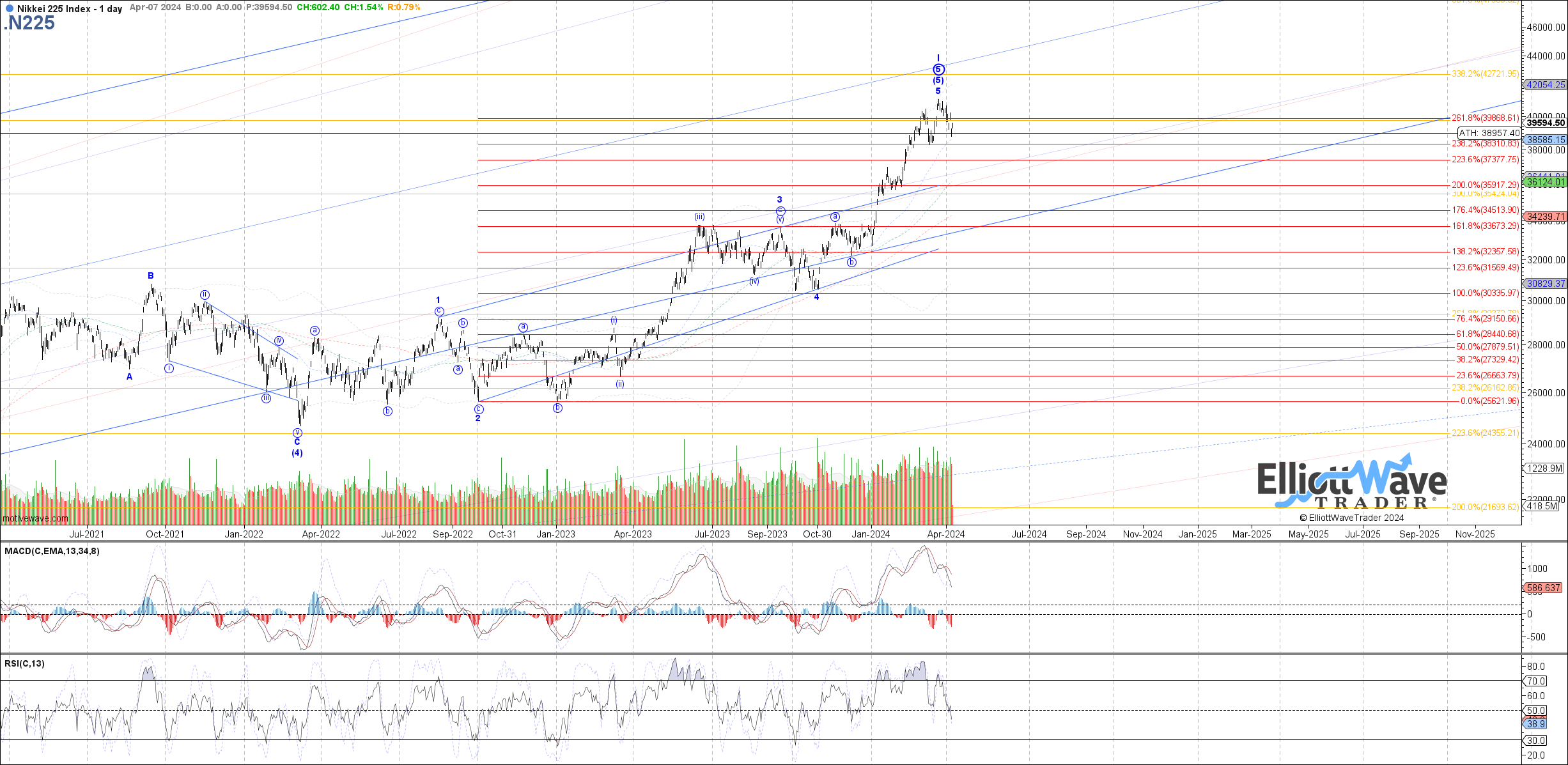

N225: The Nikkei traded lower overall last week, but for now remains above the March low. With the further downside last week, it is now possible to get a leading diagonal down from the March high as an (a)-wave, with 39915 – 40530 as fib resistance for a (b)-wave bounce. Above there could lead to a new high, otherwise a break below the March low is the next step toward confirming a top.

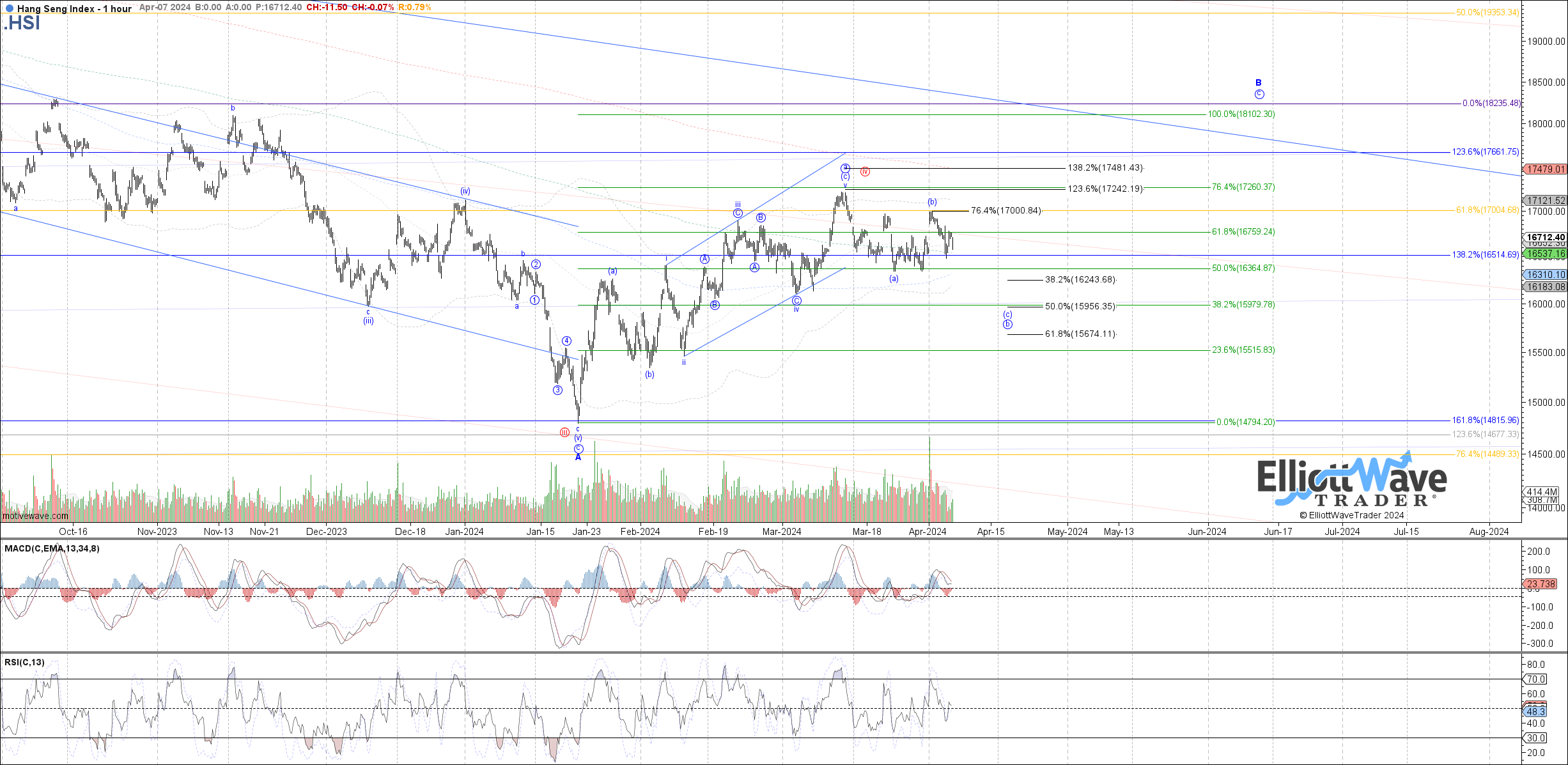

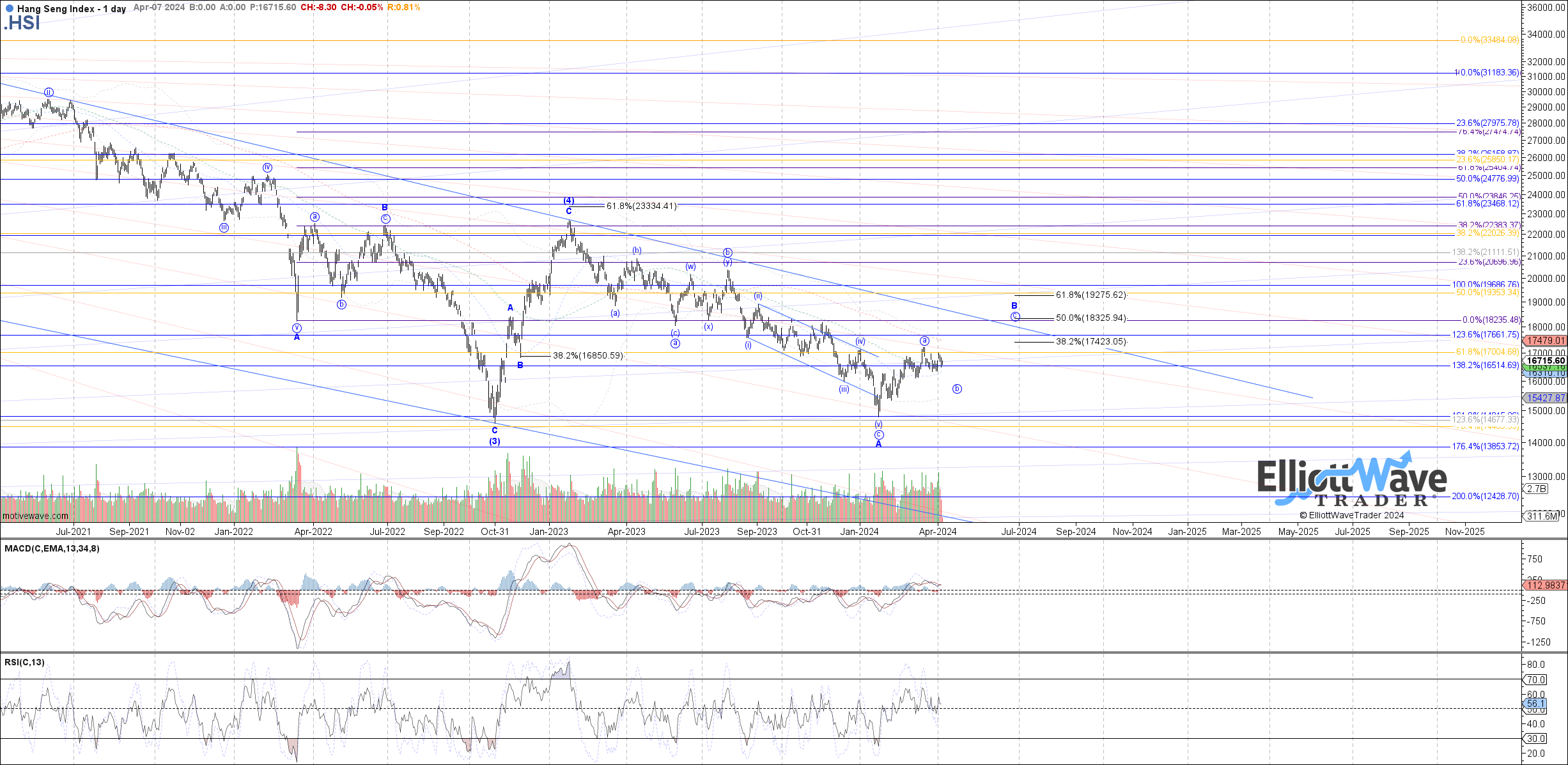

HSI: The Hang Seng spiked initially higher to start last week, confirming the larger (a)-(b) previously in red. Price held the .764 retrace cited at 17000 at last week’s high and has since rolled over in what should be the start to wave (c) of b. However, a break below 16335 is needed as confirmation, after which 16245 – 15975 becomes the target range for wave (c) of b.

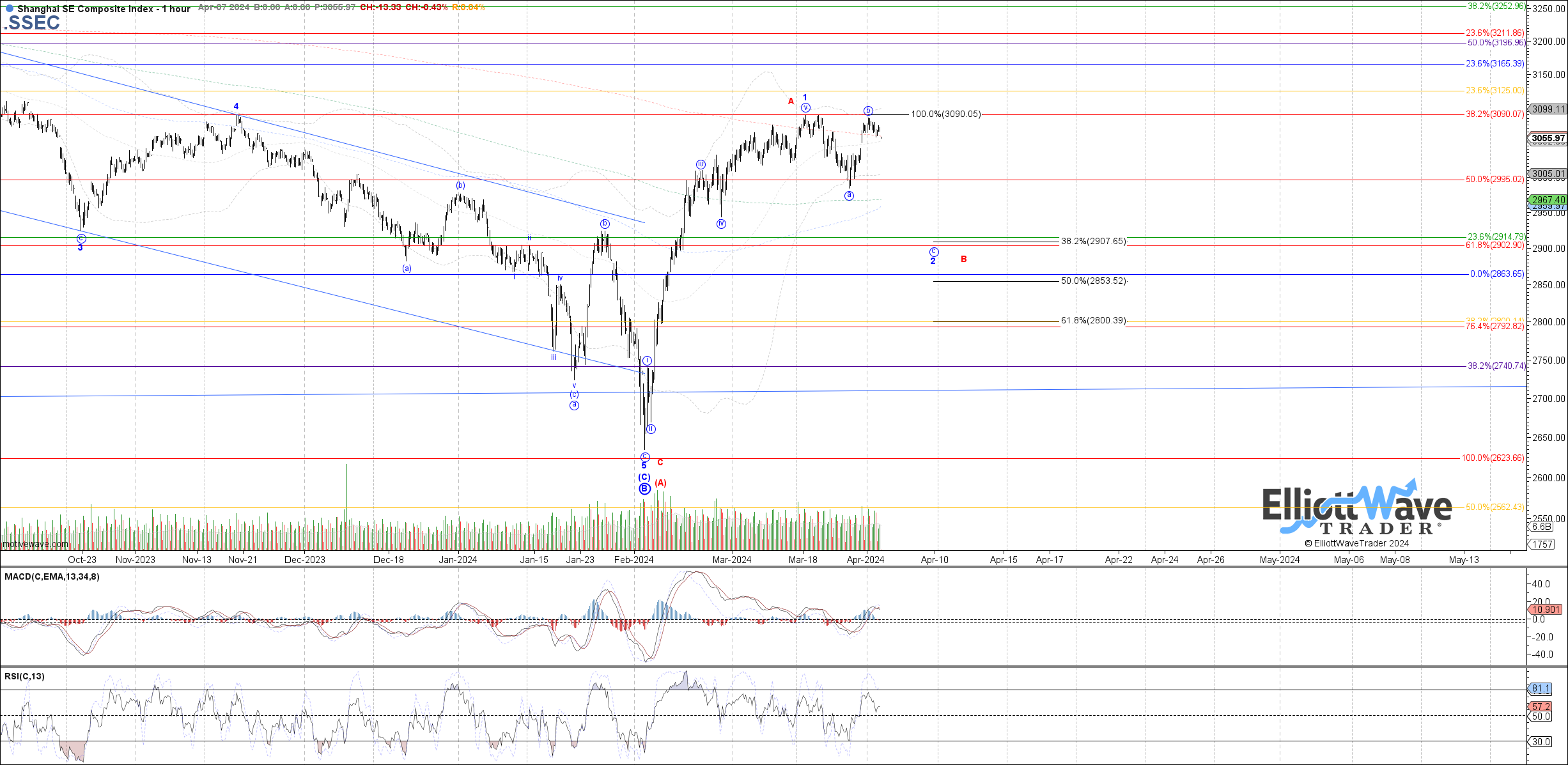

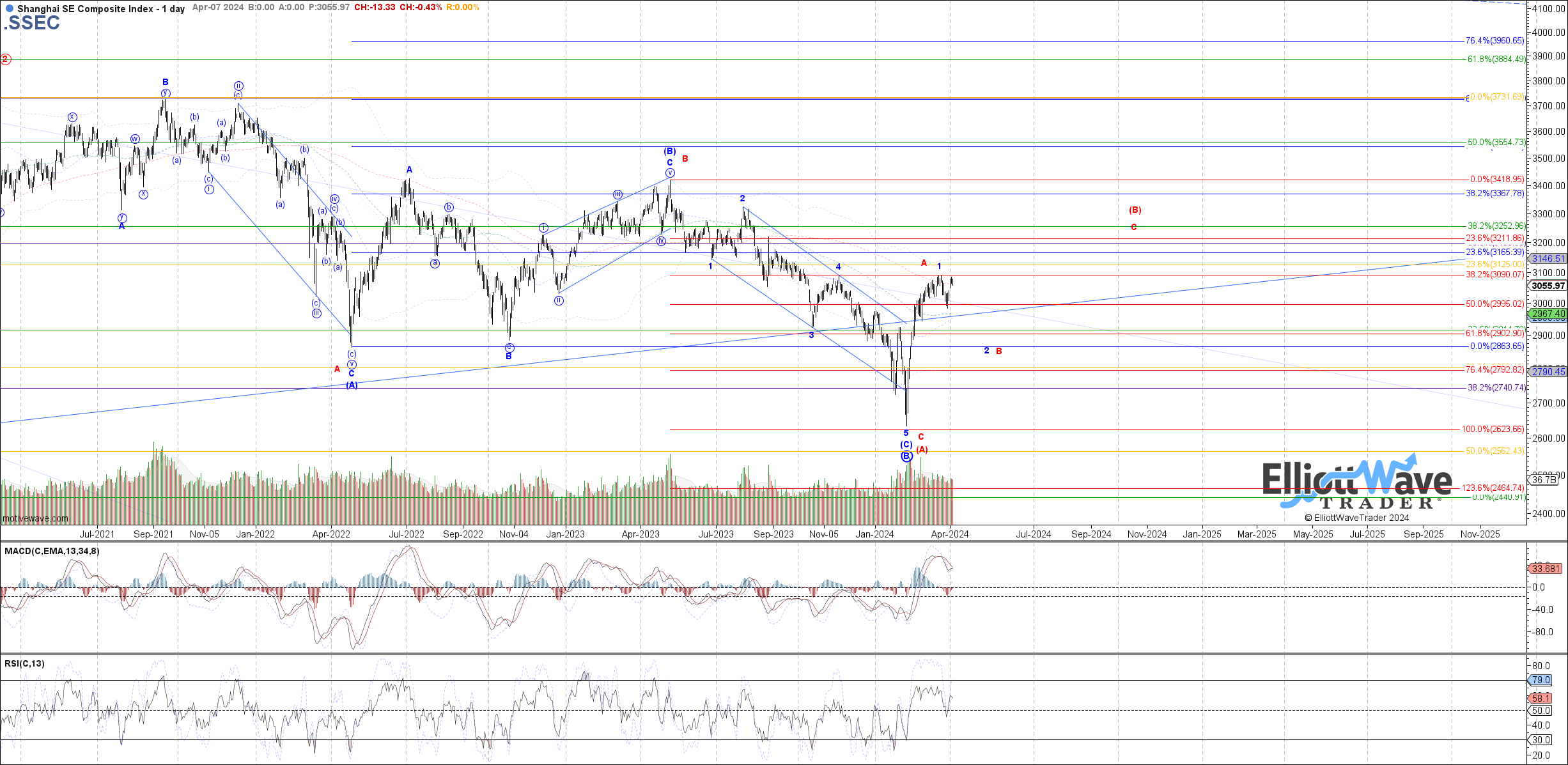

SSEC: The Shanghai Composite started off the week initially higher as well, coming close to a retest of the March high but for now still trading below there. If price does make a new high from here, I would still consider the b-wave valid within an expanded flat. Otherwise, a break below 3025 is needed to place price in wave c of 2/B.

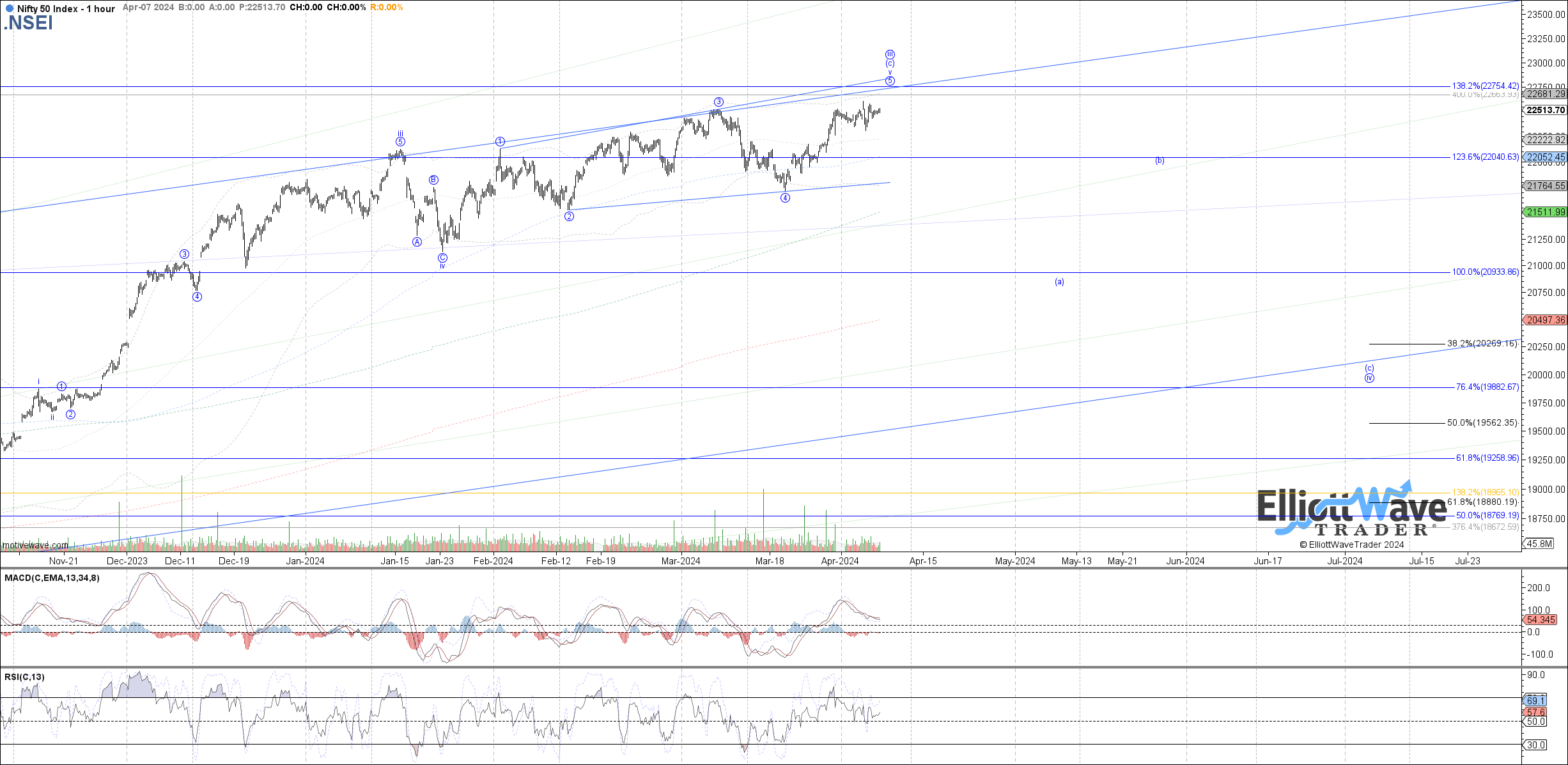

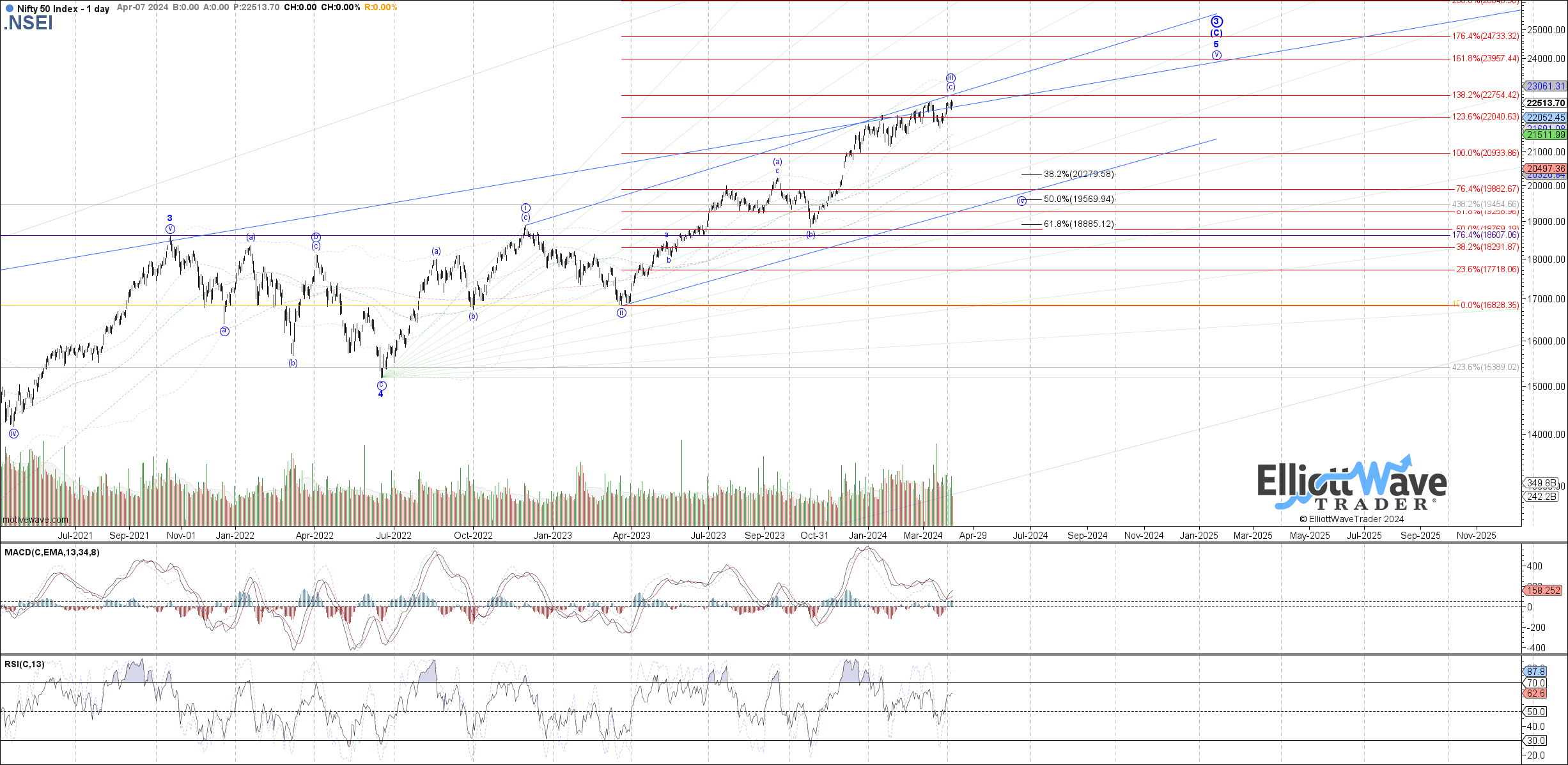

NIFTY: The Nifty continued modestly high last week, but did manage to poke above the prior March high and therefore confirm that price was not quite finished with wave (c) of iii yet. Therefore, price still has the opportunity to attempt reaching the next fib target above at 22755, otherwise a break below 22260 is needed as initial evidence of a local top.

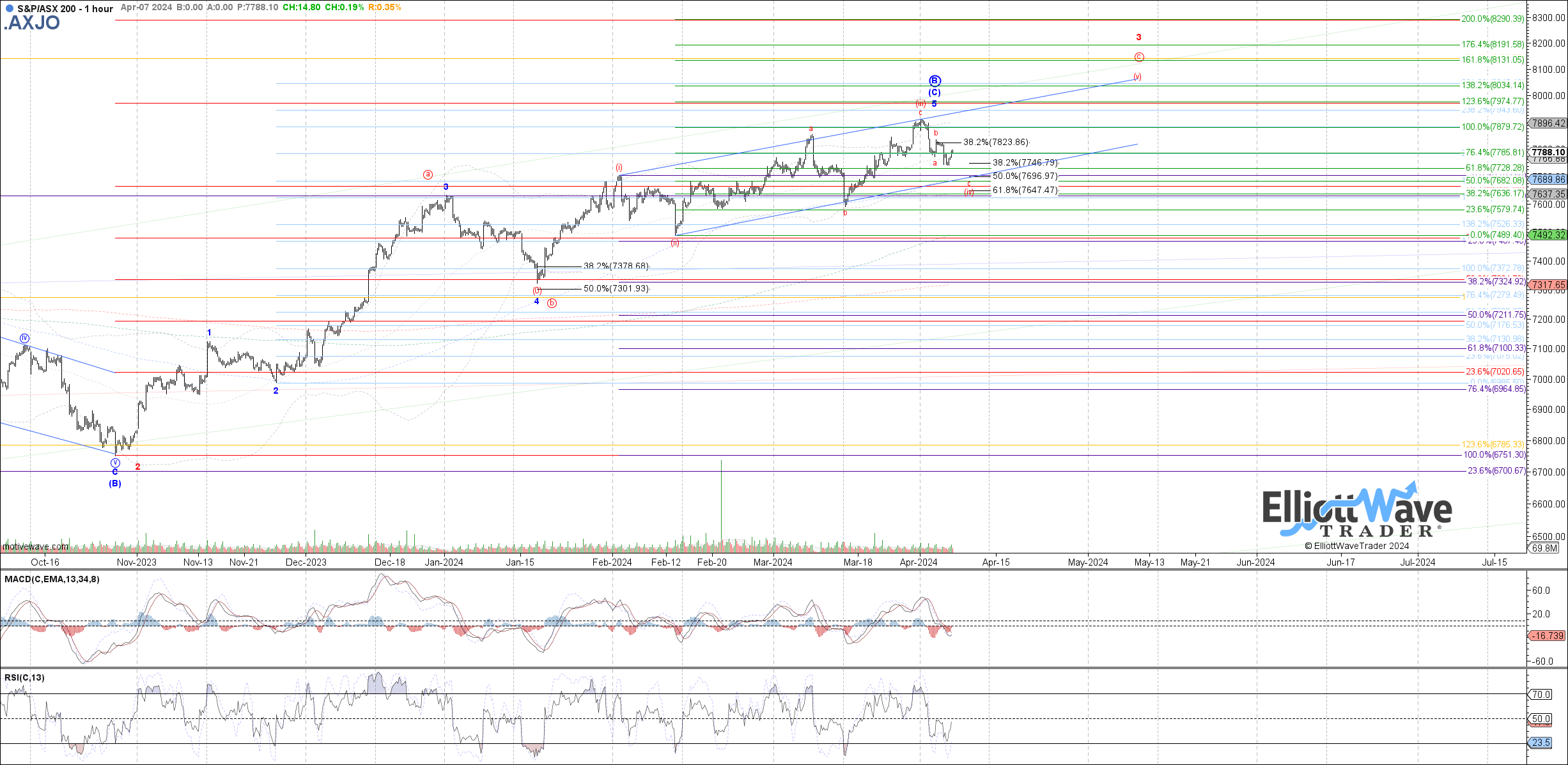

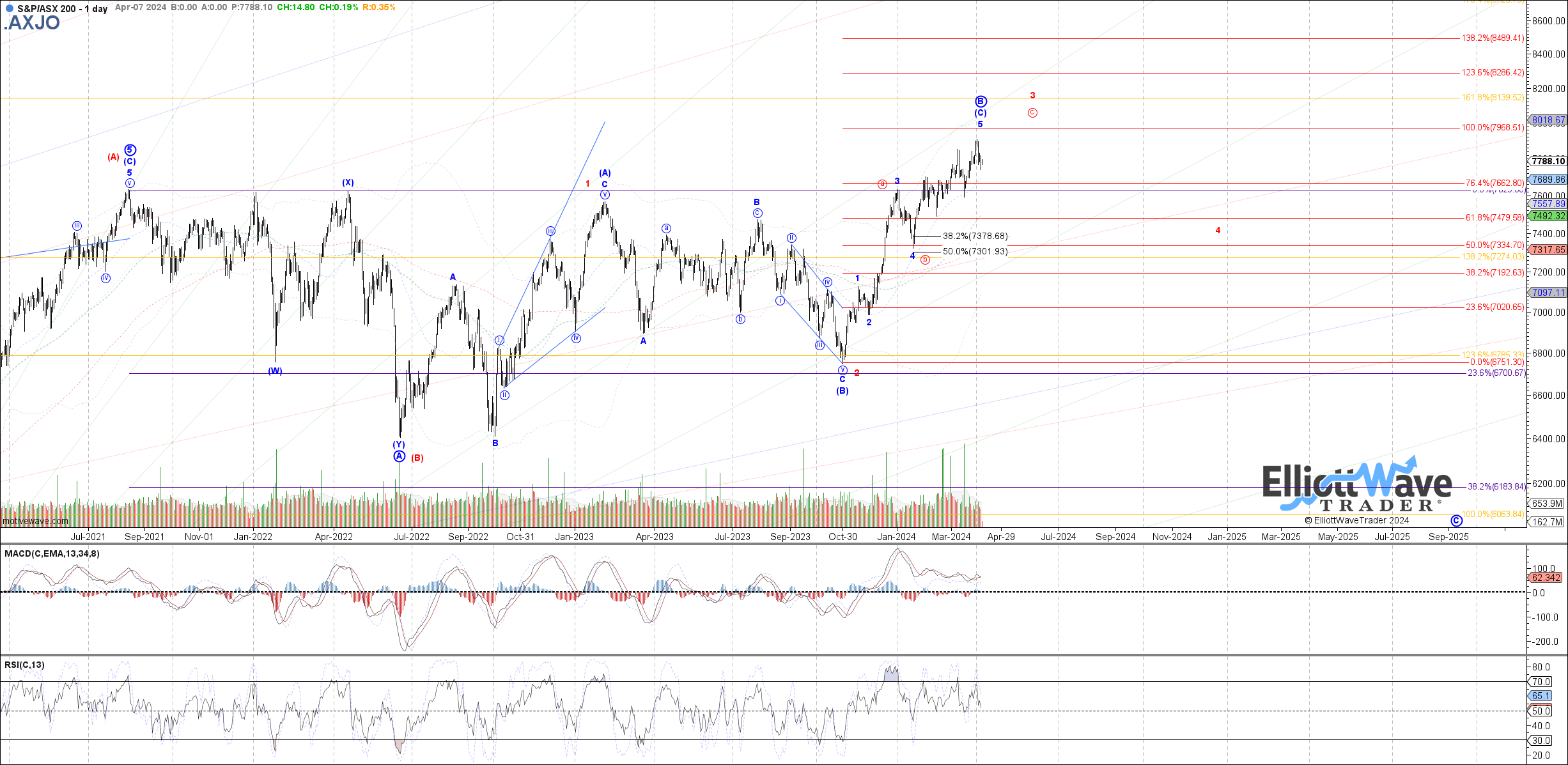

XJO: The ASX reversed back down last week, looking too big to still be a 1-2 start to wave c of (iii) and therefore suggesting that all of a more muted wave c of (iii) already completed. If that is the case, it would place price in red wave (iv) with 7745 – 7645 as retrace support that should hold to attempt another high as wave (v) of c.