World Markets Round-Up: Asia & Pacific

ASIA/PACIFIC

N225: The Nikkei continued initially lower last week, breaking below the .618 retrace and .764 retrace before finally bouncing. Since price is still above the August low, the 1-2 start to wave (5) now shown in red remains valid. However, considering how deep wave 2 is it has been reduced some in probability. The alternative is that the September high was the B-wave of a wider flat (4), placing price currently in a wave iv of C bounce with 28445 – 28810 as resistance that should hold if more downside is setting up as wave v of C. Above 28810 and especially above 29180 and the 1-2 start to red wave (5) can be viewed as getting back on track.

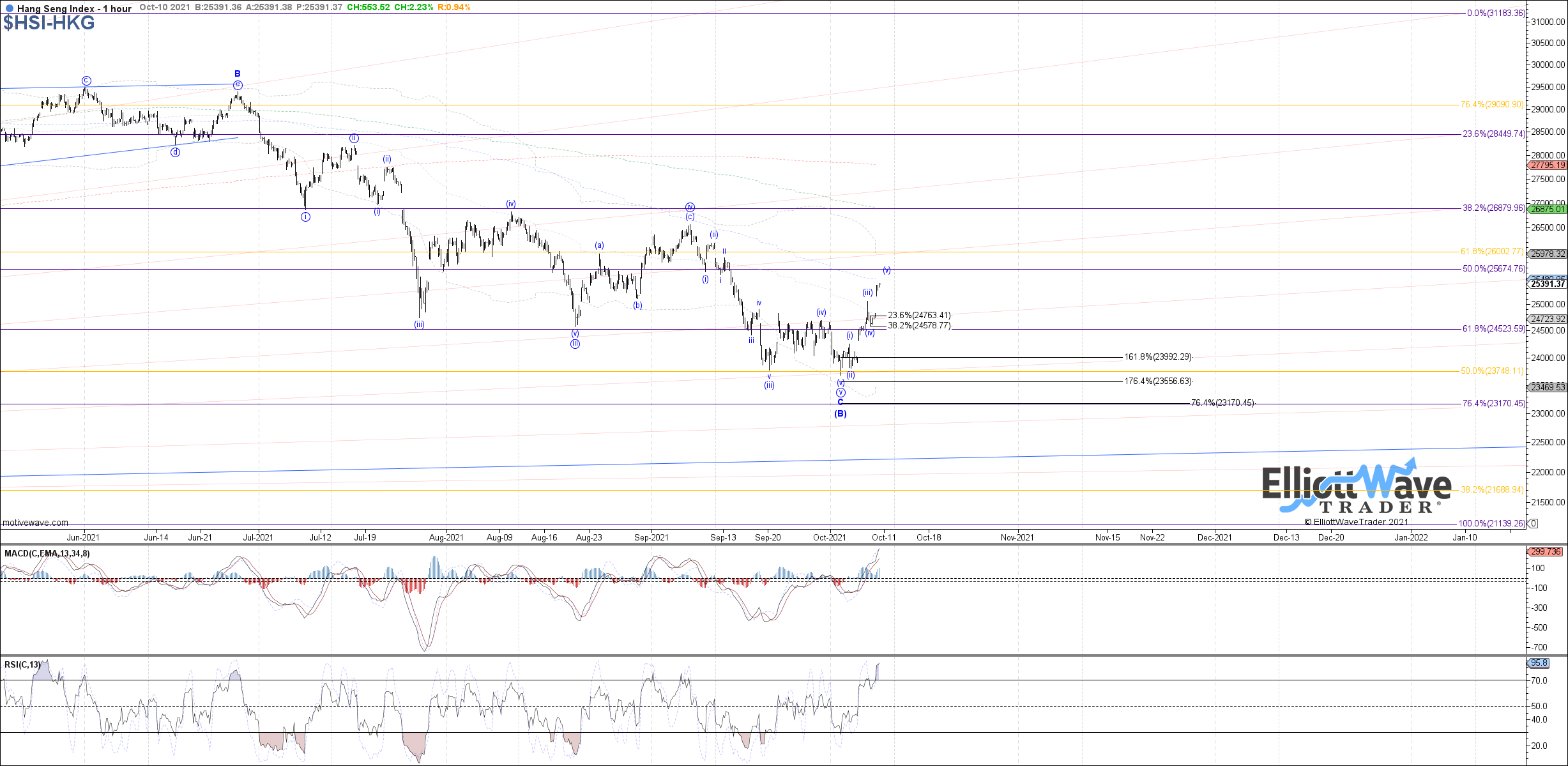

HSI: The Hang Seng continued down to a new low last week, following expectations for wave v of C and since turning strongly back up. Therefore, price appears to be attempting a bottom as wave (B), with what can count as a micro 5 waves up from last week’s low filling out. If so, then a near-term consolidation as wave ii or b should follow next.

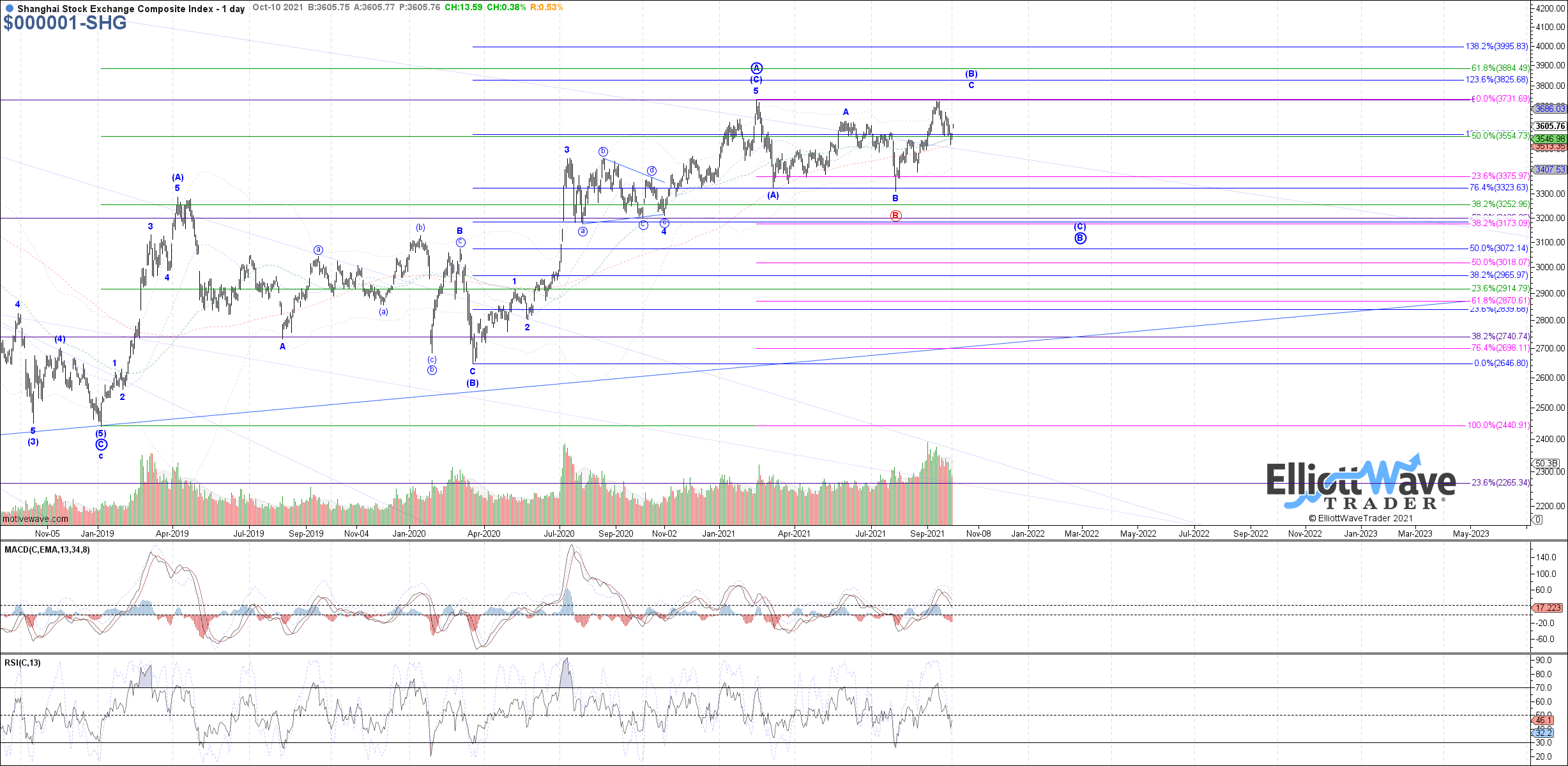

SSEC: The Shanghai Composite was closed the majority of last week, but once open it continued to turn up from the September low where price ideally completed wave iv of a diagonal off the July low. Under that assumption, price should currently be working on wave v of C/(1), with better confirmation above 3670 after which 3785 becomes the ideal target to reach before wave v completes.

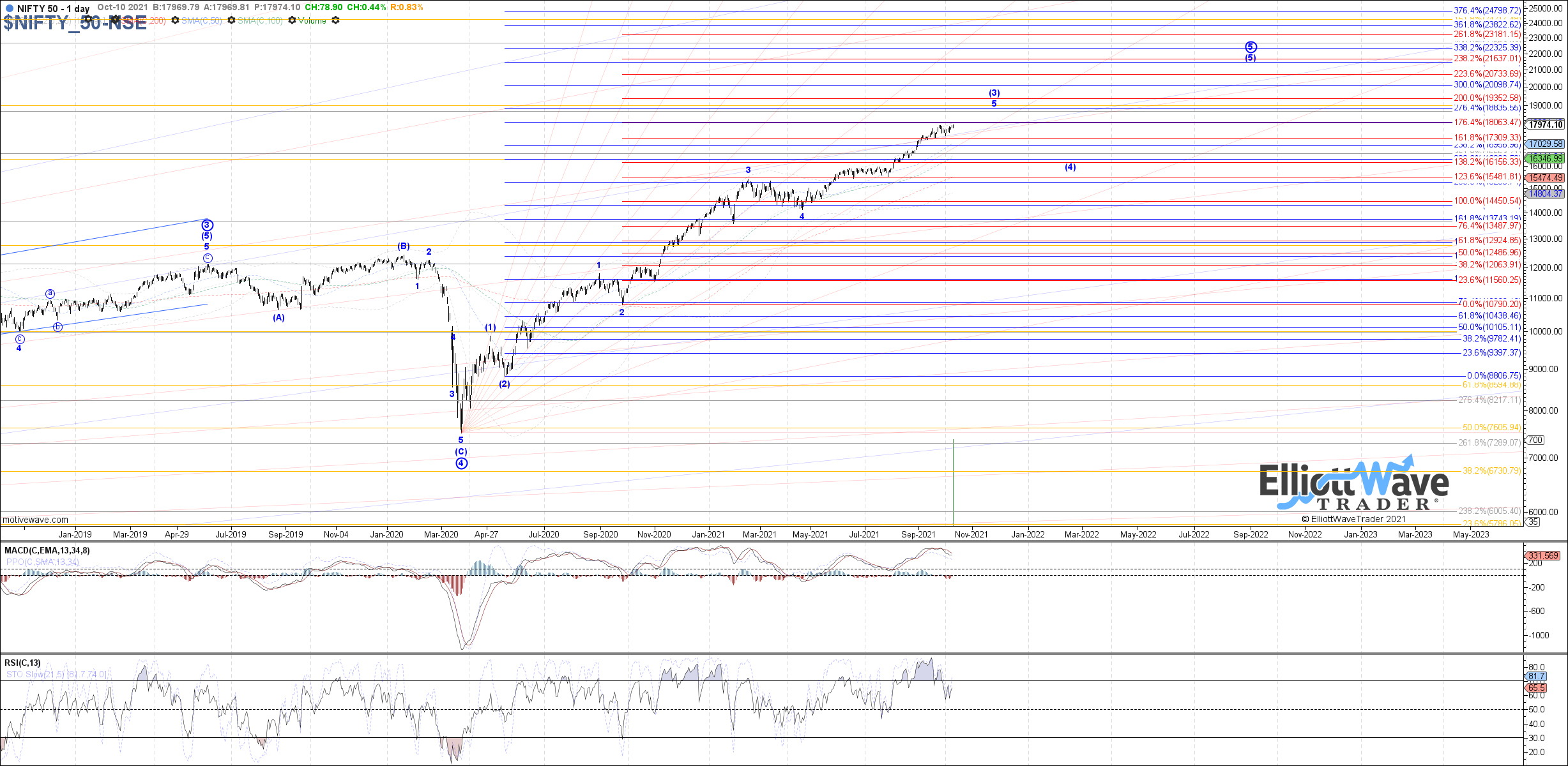

NIFTY: The Nifty turned back up last week, keeping price above the 17320 signal support and therefore still not providing evidence that wave (c) of iii has topped. Price has since exceeded the prior September high, confirming another extension and opening the door to 18155 as the next fib target above.

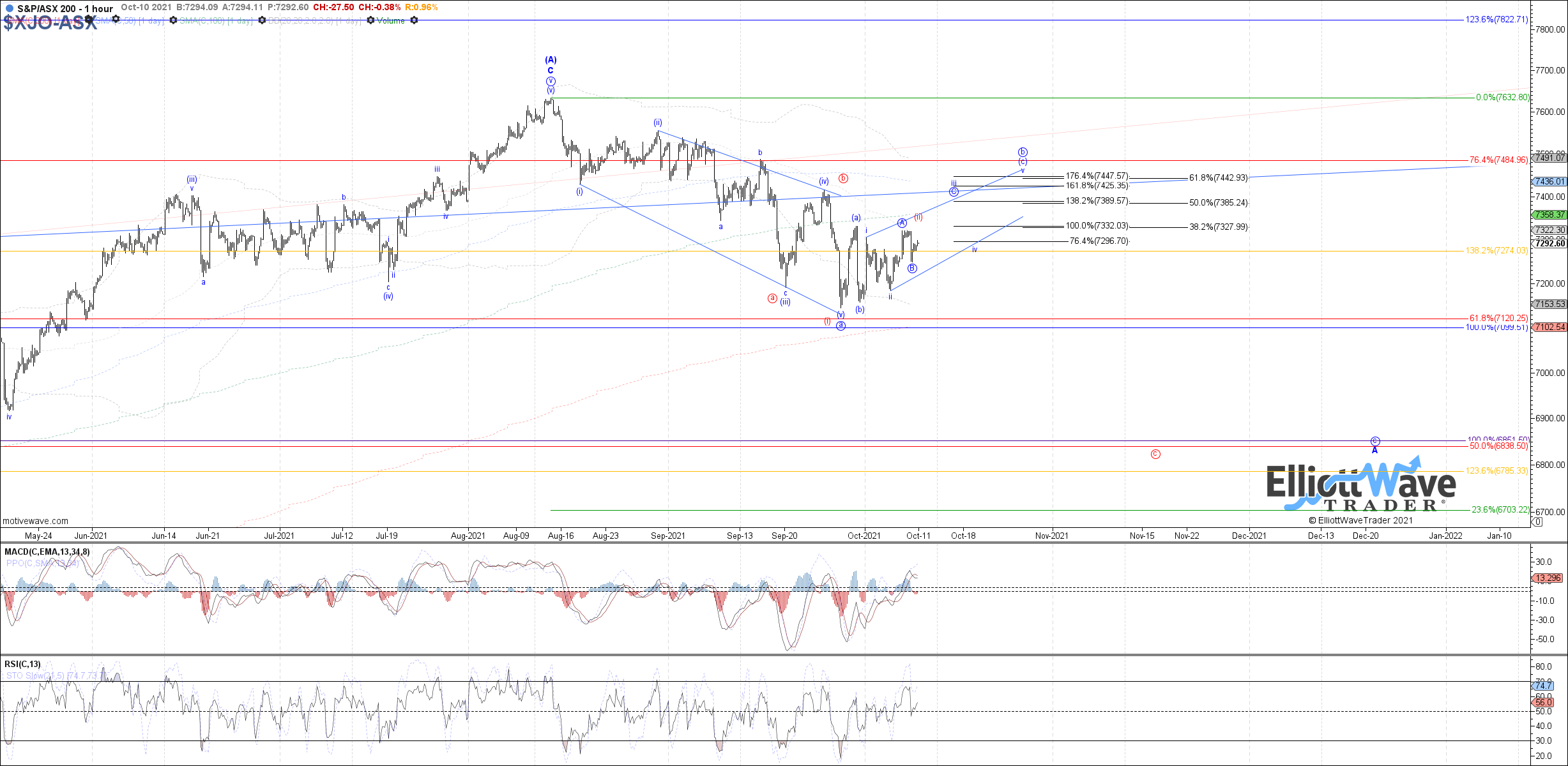

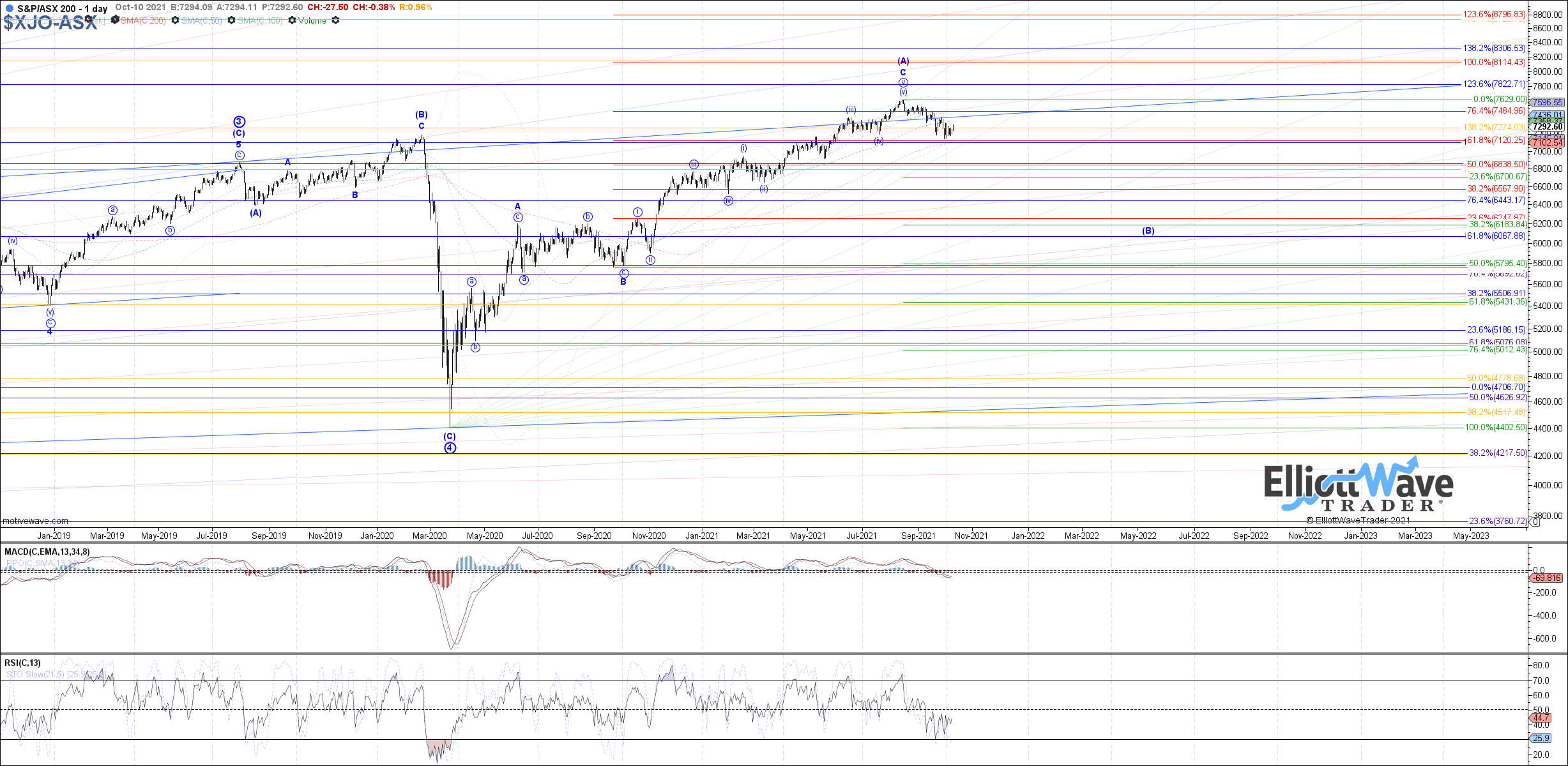

XJO: The ASX mostly chopped around sideways last week, for now maintaining above the September low but overall an inside week. That keeps the blue count as a b-wave bounce currently filling out on the table, with wave (c) of b filling out as an ending diagonal. If price does continue to head higher from here, 7390 is the next potential target to reach as wave iii of (c). Otherwise, below last week’s low and the September low can trigger a (i)-(ii) start to a c-wave down already in progress shown in red.