Where Fundamentals Meet Technicals: XOM and CVX

This issue of Where Fundamentals Meet Technicals looks at the two biggest stocks in the U.S. energy sector: Exxon Mobil (XOM) and Chevron (CVX).

Oil prices and oil producers have taken a bit of a beating lately, but in my opinion it is likely setting up a long-term buying opportunity. Energy-intensive sectors in Europe and the United States generally remain constrained, which has put some downward pressure on oil prices. In addition, the Israel and Hamas war has fortunately remained contained thus far, and has not spilled over to cause any significant oil supply disruptions. As a result, much of the “war premium” has drained out of oil in recent weeks.

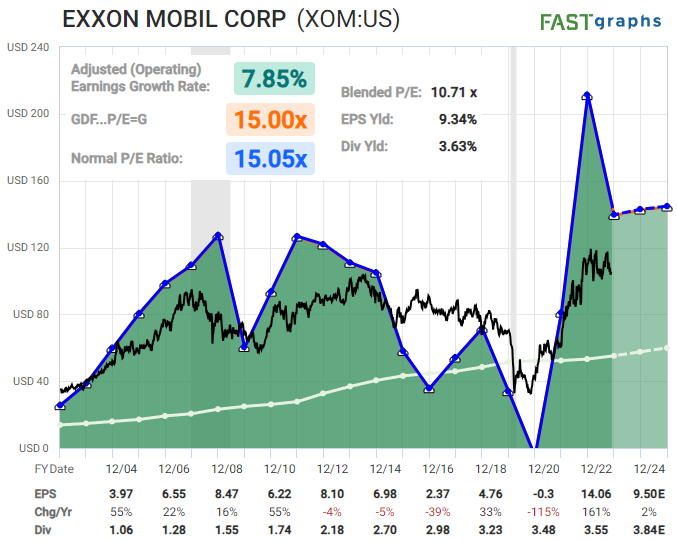

Exxon Mobil

Exxon Mobil is a vertically integrated energy supermajor, and currently has a price/earnings ratio of below 11x at current oil prices. And I think there is a real possibility that oil prices will end this decade much higher than where they are now.

Garrett has a technical outlook that suggests a bit more struggle within this quarter, followed by a strong rebound to new all-time highs:

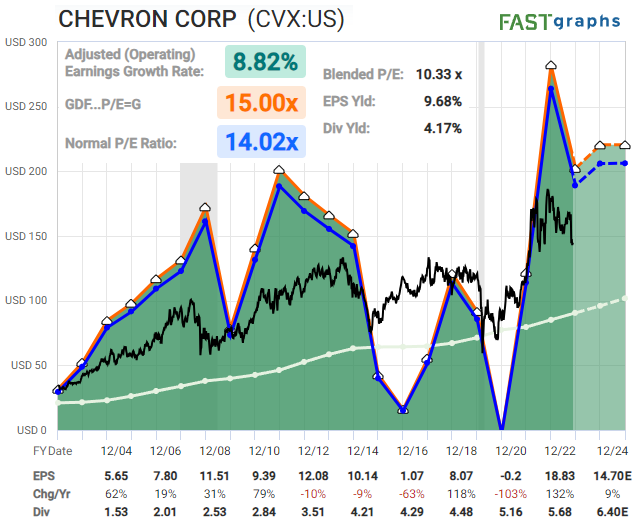

Chevron

Chevron is another vertically integrated energy supermajor and is priced at a similar valuation to Exxon Mobil.

For Chevron, Garrett also sees the potential for a bit more downward price action this quarter, but then a bullish setup from there:

Acquisitions Ahead

Balance sheet analysis is an important part of equity research. Both Chevron and Exxon Mobil have AA- credit ratings from S&P, which is one of the highest ratings that a company can have.

Both of them used the uptick in energy prices over the past couple of years to strengthen their balance sheets, either by building cash or by paying down debt. As a result, both of them are worth hundreds of billions of dollars in market capitalization, but only have $14 billion and $8 billion in net debt.

Now, this may change a bit. Both companies announced acquisitions worth over $50 billion in October of this year. Chevron announced that they would acquire Hess (HES) and Exxon Mobil announced that they would acquire Pioneer Natural Resources (PXD). Balance sheets provide defense, but they can also be used for offense.

In both of these cases, the acquisitions will be funded by issuing equity. When all is said and done, the balance sheets will become a bit more complex temporarily, until it’s fully consolidated. Having plenty of cash and low debt helps companies navigate through transitional periods.

In my view, the acquisitions were made at decent prices. Rather than occurring at the top of an energy cycle, these acquisitions are occurring while oil is still in its 15-year bear market. The Hess acquisition was a bit pricey by some metrics, but it expands Chevron’s exposure to the attractive Guyana offshore oil fields, and gives them significant tax benefits as well which help offset some of the price.

All-in-all, both of these companies are offering compelling valuations, low-risk balance sheets, and clear pathways toward growth through acquisitions, while also constantly returning capital to shareholders with dividends and share buybacks.

Whenever the technicals suggest a constructive outlook, I think both of them are attractive multi-year buy-and-holds from a fundamentals point of view.