Where Fundamentals Meet Technicals: Stocks vs Gold

Back during the depths of the pandemic/lockdown sell-off in March 2020, it was hard to envision stocks getting back to new highs, or anything going well for that matter.

Multiple economic indicators had touched record lows, unemployment had spiked to record highs, and overall sentiment was weak.

However, due to the amount of money-printing that was beginning to happen, I wrote in a March 2020 piece that unlike the Great Depression, stocks likely won’t take too long to get back to new all-time highs. I caveated that by saying that I didn’t expect them to do very well when compared to precious metals, though:

Over the next several years, here are two similarities and differences I see vs the Great Depression for stock prices, given the massive amount of debt offset by the definition of what money is.

- Stocks will likely do better, as priced in dollars, than they did during the Great Depression. They likely won’t fall to the same depths, or take as long to hit new nominal highs, as priced in increasingly devalued units of measurement.

- Stocks may however do similarly poor, as priced in gold, as they did during the Great Depression. They will likely fail to reach new highs at any time in the near future, as priced in hard money.

From a multi-year perspective going forward, I like stocks over bonds, but I like gold and silver over stocks. Is that bullish or bearish? I’ll let the reader decide.

-Lyn Alden, March 27, 2020

Literally within the same year, stocks indeed got back to new highs. Even I didn’t expect it to be quite that fast.

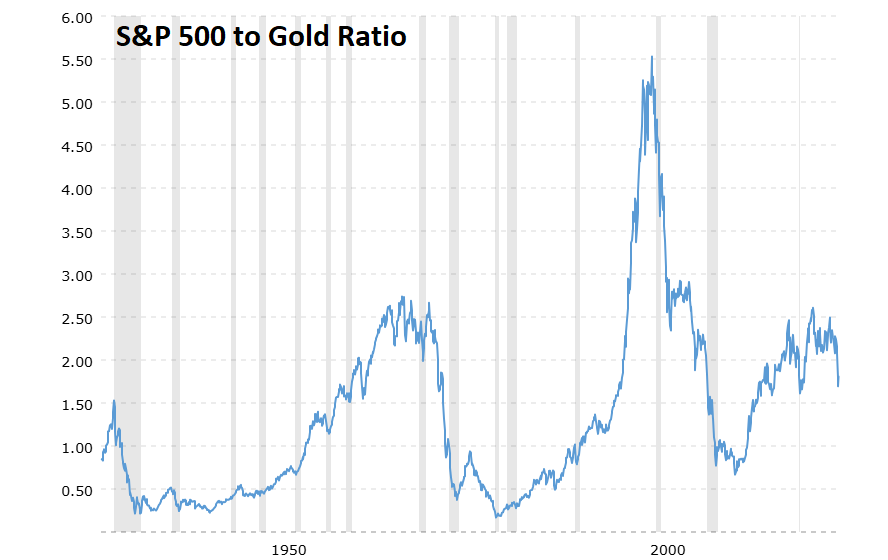

And yet, despite a rather bullish stock market, the S&P 500 pretty much just chopped along relative to gold:

Having a mix of stocks and precious metals has certainly been much better than owning cash and bonds during the past five years. With so much debasement, owning scarce things has been better than owning that which they print, which isn’t exactly shocking despite the number of bond bulls that have been arguing in favor of their preferred asset during that whole time.

Well, as a checkup over five years later, should we expect more from stocks or gold going forward? We can’t know for sure, but we can check a few things.

My base case is that we’ll see a lower ratio on the S&P 500 to gold ratio before we see new cycle highs above the December 2021 peak of around 2.61. In other words, I do still think gold has another leg of outperformance relative to stocks.

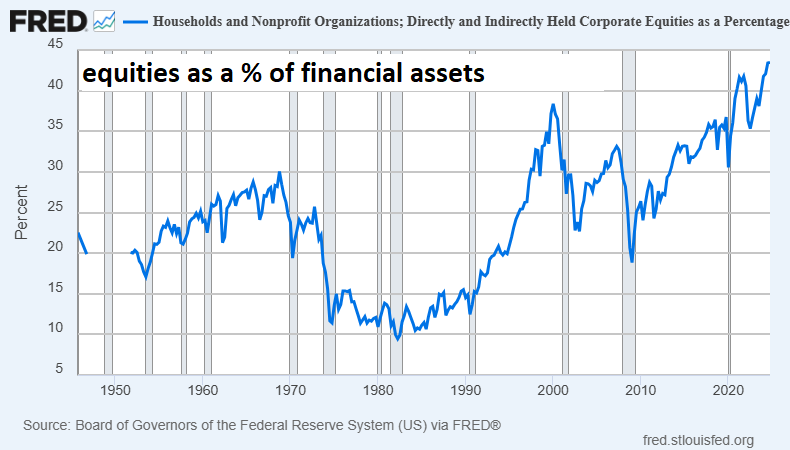

As a case in point, US households still have a record allocation percentage to equities:

In addition, the rest of the world still has record allocations to US capital markets as a percentage of global capital markets. It’s still a very crowded pro-stock trade.

And technicals point in the same direction as fundamentals. Zac sees a lower-low in the SPY ETF relative to gold in the years ahead, for example: