Where Fundamentals Meet Technicals: Stocks vs Gold

This issue of Where Fundamentals Meet Technicals looks at the S&P 500 to gold ratio, now that there has been a rather significant rotation.

It has been my view for a while that the major U.S. equity indices like the S&P 500 are going to have lackluster returns during the 2020s from their 2021 peak. This is especially so in inflation-adjusted terms or relative to cash equivalents and T-bills.

This is because they are starting the period at high valuations, high domestic investor allocations to equities relative to other assets, and high foreign investor allocations to U.S. assets relative to other geographies. Everyone is heavily on one side of the boat into U.S. equities, and there is less marginal ability for additional capital to come in that’s not already here.

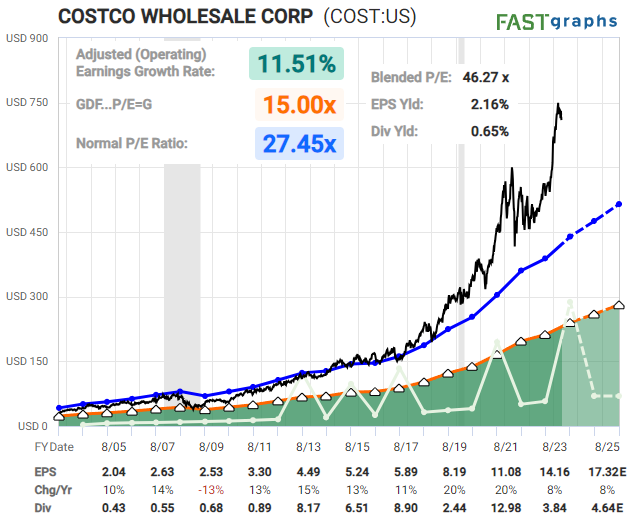

I keep picking on Costco (COST) as an example, but that’s mainly because it’s a great company that happens to be over-owned and thus has no margin of safety for investors. A lot of stocks have this current type of chart:

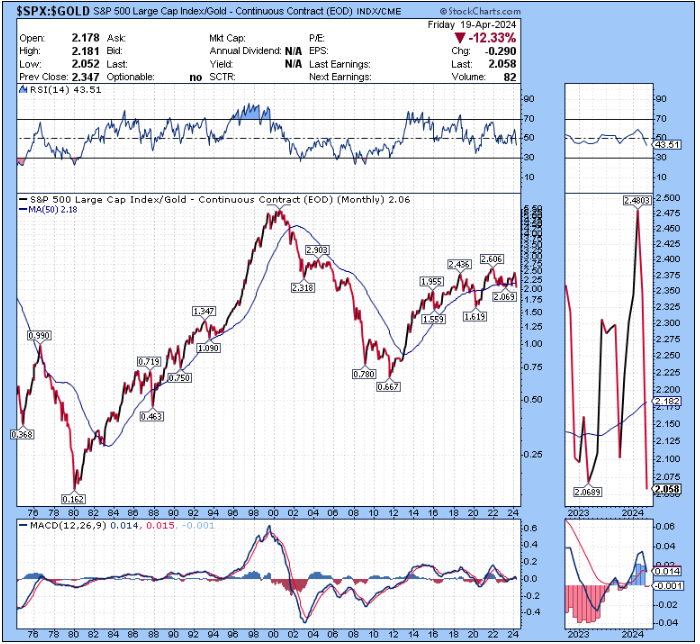

Stock indices went a bit higher than I would have expected in 2023 and 2024, but indeed still remain rangebound in inflation-adjusted terms and relative to cash equivalents and T-bills relative to their 2021 highs. And after the recent correction, Zac expects that a notable top is in place:

He has also provided a technical outlook for stocks relative to gold:

While I don’t necessarily expect stocks to dip as deeply as Zac’s outlook expects in nominal terms, I do think stocks could dip that significantly in gold terms.

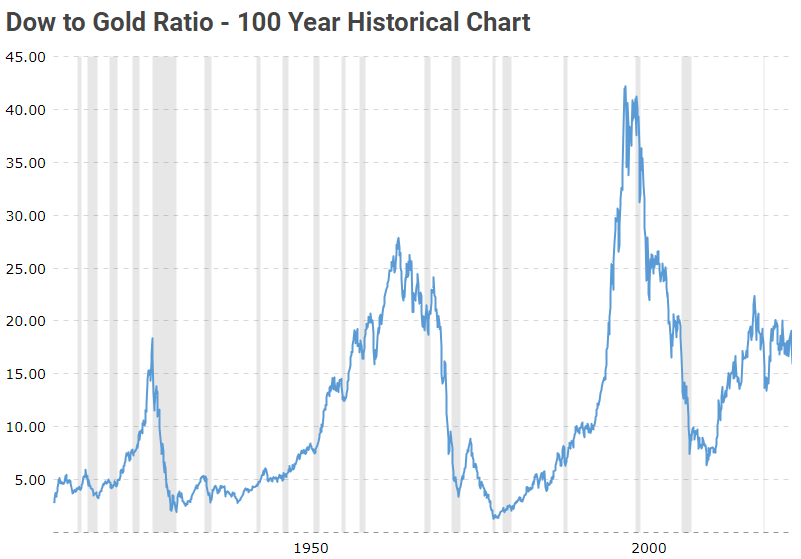

Over the long arc of time, stocks haven’t historically outperformed gold in terms of price action, or at least not by any significant degree. They go up and down relative to gold in a giant trading range. Here are 50-year and 100-year charts for the S&P 500 and Dow Jones Industrial Average respectively:

However, the accumulation of dividends from stocks is what historically led to the total returns of stocks vastly outpacing gold returns. For example, if stocks chop along relative to gold in terms of price action for a century, but pays a 3% average annual dividend along the way and those dividends are reinvested, then by the end of that period the stocks will have outperformed gold by 19x.

But there are decade-long periods where even including dividends, gold absolutely outperforms stocks. Gold has historically been a useful portfolio component to help avoid the risk of “lost decades” in investing, which refers to decades where stocks don’t reach new highs in terms of purchasing power. And the next decade has a decent shot at being one of those periods.

Fundamentally, the case for gold is pretty strong for two main reasons:

-Gold competes with U.S. Treasuries as a reserve asset among central banks. The United States is going to run larger-than-normal deficits for the foreseeable future. The Congressional Budget Office expects $20+ trillion in net new Treasuries to be issued over the next decade. It’s an enormous amount of supply and is a serious fiscal issue. Meanwhile, at 3,000 tons of production per year on average, at current prices there will only be about $2.5 trillion worth of new refined gold created over the next decade.

-U.S. securities can be frozen or confiscated during geopolitical disputes. Historically the threshold for such action is very high, but as the world becomes less unipolar overtime and as the United States runs into more geopolitical challenges, that threshold could reduce. Other countries increasingly want a higher ratio of their central bank reserves, as well as large pools of private capital, to be diversified against this type of unilateral action by the United States. Gold can be physically held by nations, institutions, and individuals.

For these reasons and more, I continue to like a gold allocation as a segment within a portfolio.