Where Fundamentals Meet Technicals: PYPL

This issue of Where Fundamentals Meets Technicals takes a look at PayPal. The company operates their flagship PayPal platform, and is also the owner of Venmo.

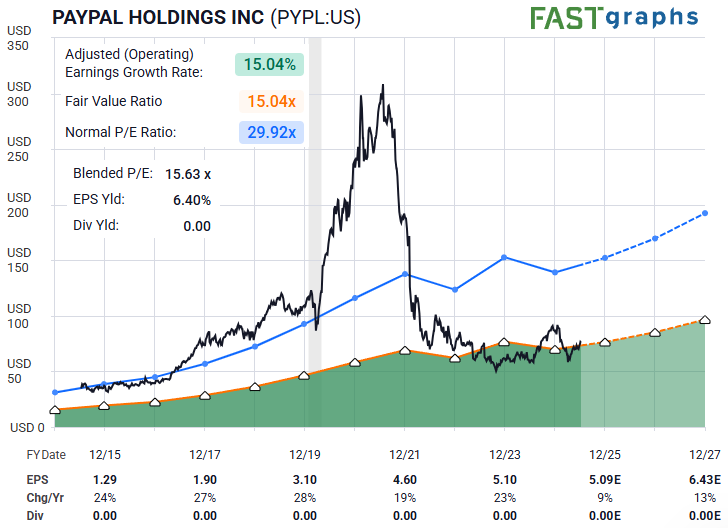

Once a pioneer in online payments and a growth stock darling, the company has experienced slowing growth in a now highly competitive field. It’s now firmly in value stock territory, trading at around 15x earnings.

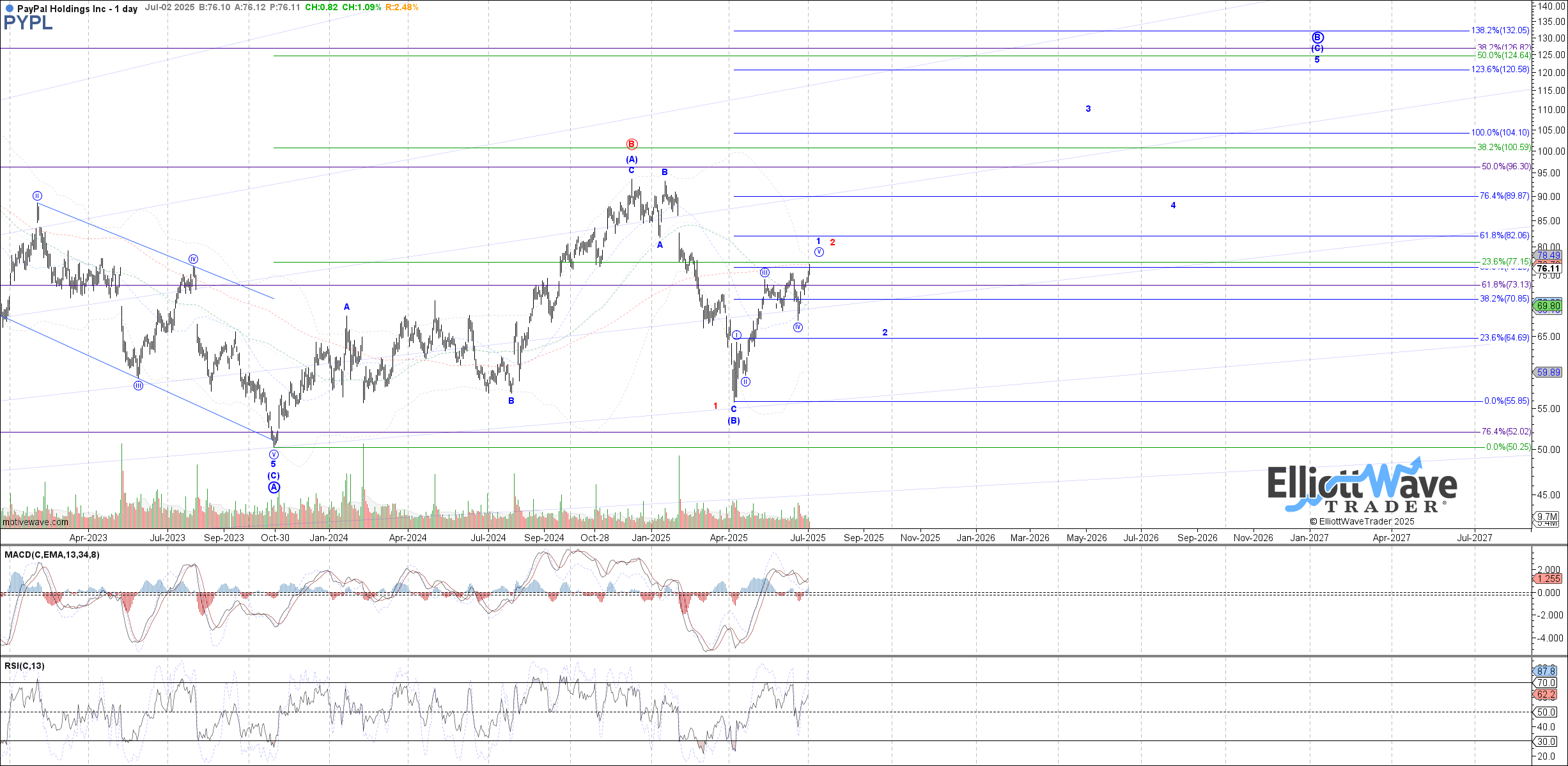

However, the stock is putting in a pretty good basing pattern here, which along with being cheap, potentially gives a good entry point. Garrett sees some turbulence ahead this autumn, but has a positive technical outlook extending to 2027:

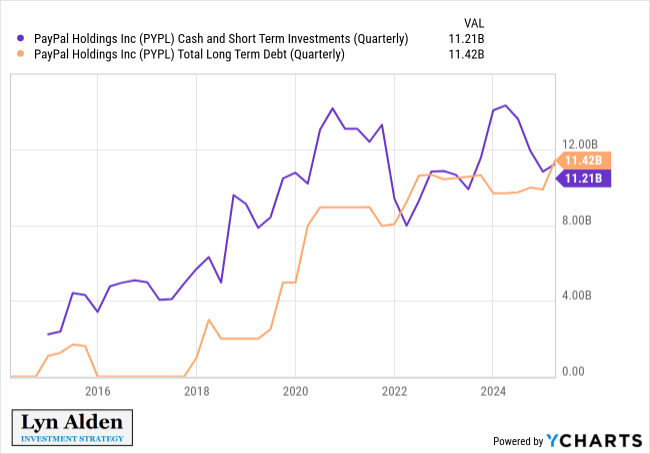

The balance sheet is in good shape, with about as much cash as they have debt:

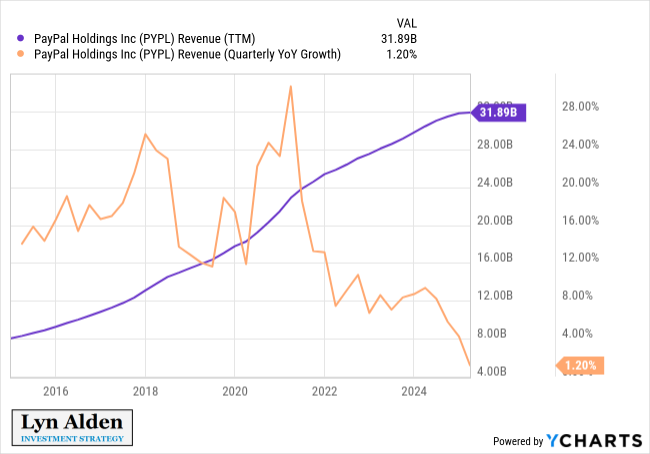

The issue is growth. The company is barely growing its top line anymore:

Some of this is a strategic decision. Rather than chasing unprofitable, low-margin growth, the company is shifting more toward higher-margin services. Thus, bottom-line is more of a focus than the top-line.

I use PayPal as one of my research business point-of-sale providers, and they’ve handled about a third of my volume for years now. The powerful network effect and high switching costs of an integrated payment solution serves as a powerful economic moat, because it would take a pretty drastic issue for business owners like me to switch to another provider. It’s often just not worth the hassle.

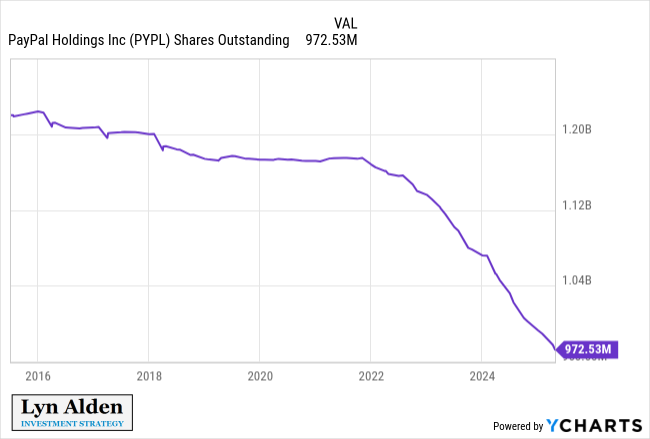

From an investor perspective, I would like to see PayPal initiate a dividend. Currently, they plow most of their earnings into buying back shares, which increases each shareholder’s ownership of the company over time. However, adding a small dividend in place of some of that would help solidify it more in the value/dividend camp and potentially attract more investors.