Where Fundamentals Meet Technicals: PEP and XOM

This issue of Where Fundamentals Meet Technicals takes a look at two non-tech blue chip stocks that have undergone significant corrections in 2023.

PepsiCo

PepsiCo (PEP) is a leading brand of beverages and snacks. This includes the namesake Pepsi, but also Lays, Gatorade, Tostitos, Doritos, and many others.

As bond yields have risen and various weight loss drugs (more-so craving-reducing drugs) have hit the market, the valuations of many defensive consumer food companies have gone down. This is good, because many of them were expensive to begin with.

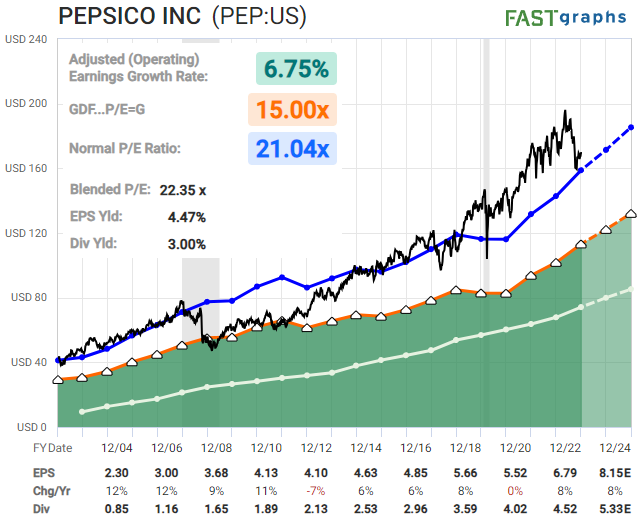

PepsiCo could fall a bit further, but now is now back into a reasonable valuation band:

Pepsico has an A+ credit rating, and like many large investment-grade corporations they’ve locked in a lot of debt at low long-term fixed rates. They’ve increased their dividend annually without fail for over five decades.

Garrett’s technicals are constructive for the next year and a half or so:

Exxon Mobil

Energy producers are shaping up to be decent portfolio hedges this decade. When energy prices and other sources of inflation fall, it allows the valuations of many other stocks to rise. When energy prices and other sources of inflation become more of a problem, it puts pressure on the valuations of many other stocks but is good for energy producers.

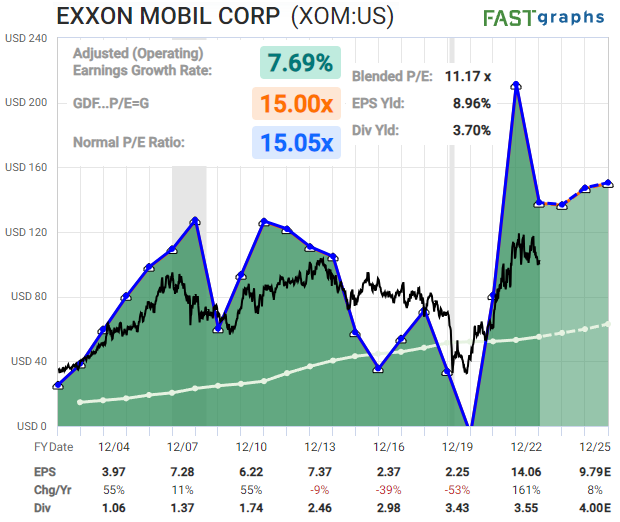

Zac has a constructive technical setup for Exxon Mobil (XOM) and many other energy producers:

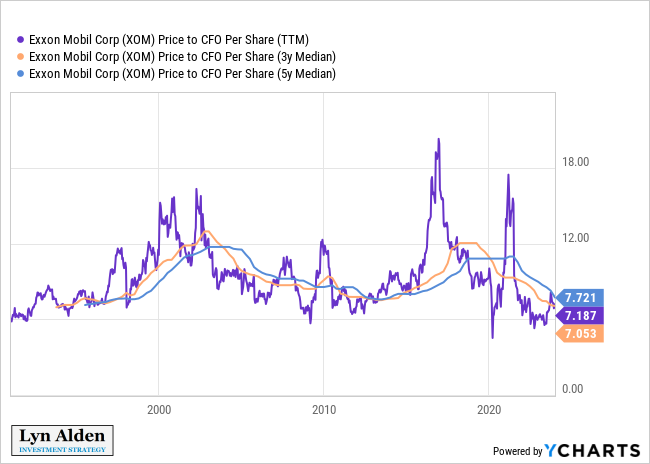

I am personally treating energy stocks as a permanent multi-year holding. I don’t intend to try to trade them much. Their valuations are low, energy prices are still low, most their balance sheets are strong, they’re under-owned, and they can keep pouring free cash flow into dividends and buybacks. They’re basically positive-carry hedges for the risk of higher energy prices again this decade.

Exxon has an AA- credit rating, which is one of the strongest around. They’ve increased their dividend annually without fail for over four decades.