Where Fundamentals Meet Technicals: M, PM, EFA

This issue of Where Fundamentals Meet Technicals looks at some beaten-down value stocks to see if there are any diamonds among the rough in this bunch.

Macy’s

Macy’s (M) can best be described as a slow-burning dumpster fire. It’s a once-great American retail icon slowly burning down before our eyes with a bad smell. But is it investable?

I’d say no. Nothing about it looks like a good long-term buy-and-hold investment. However, it is tradeable. And I do like to buy some of my winter coats there, still. So they have that going for them I guess.

Zac has a bullish setup in place for Macy’s, with invalidation at $13.99 and a target of $40.

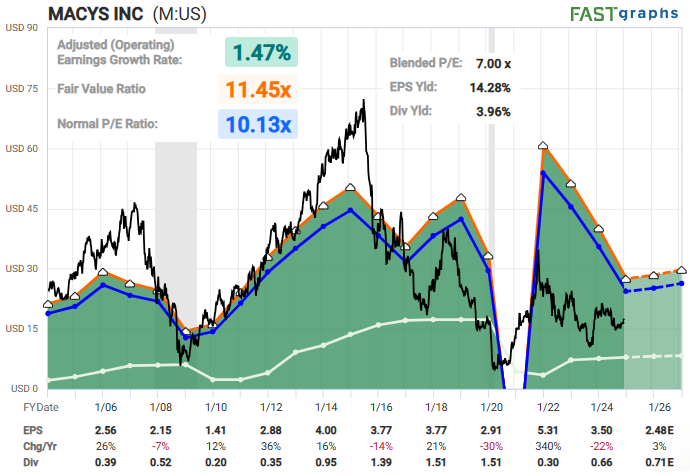

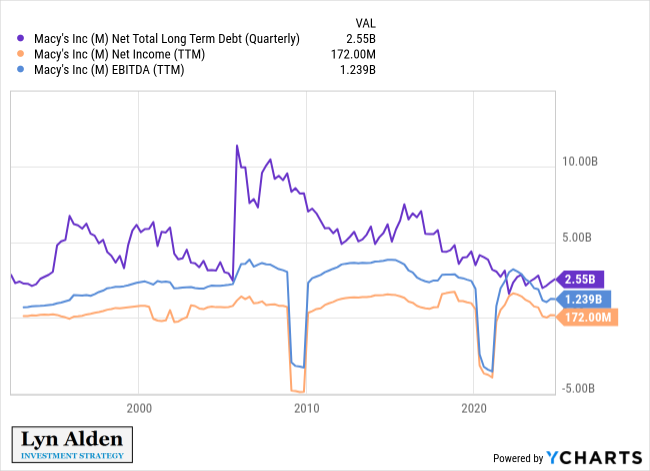

If we look at the fundamentals, they’re not the worst for a deep-value stock. Their net income collapsed during the pandemic lockdowns, and then they enjoyed a brief post-lockdown surge, which has gone away. Now they’re trying to find their footing.

The fundamentals aren’t good, but the price/earnings ratio of only 7x gives some protection. Basically, it’s a weak company at a cheap price.

As a funny example of how weak their income is, an employee was recently discovered to have gradually stolen $154 million from the company over three years by gradually extracting small delivery expenses with false accounting entries. It’s not too different than what the characters did in the movie Office Space, where they made a program to drop nearly-undetectable rounding errors of transactions into their bank account. But while this employee’s theft was only a fraction of the $4+ billion in delivery fees that Macy’s had over that multi-year period, it was worth about a year of company-wide net income. Sad.

But wait, there’s more. Their balance sheet is junk-grade, rated BB+. The good news is that nothing about their finances looks imminently problematic. I mean sure, they’ll probably go bankrupt again eventually, but not in the next couple of years.

They’ve reduced debt a lot in recent years, but their net income has stagnated as well. So, they still aren’t in the clear in terms of debt maintenance.

Overall, I think Macy’s looks tradeable. Nobody wants to own it, which is why it might be tradeable to the upside. The fundamental cheapness supports the possibility of a bounce, and at that point a trader probably wouldn’t want to stick around too long, since it’ll likely start to smell again.

Philip Morris International

I wish I could tell you the next stock smells better, but instead it smells like cigarettes.

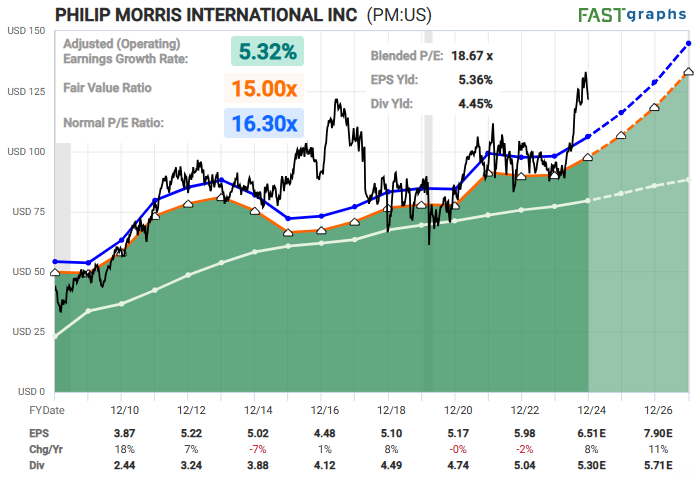

Philip Morris International (PM) is the largest and best-rated of the global tobacco companies. And like the other major tobacco companies, it generates strong free cash flows and sends most of those dollars out to investors as dividends.

The company has an A- credit rating and offers a safe dividend yield of nearly 4.5%:

The company has a global presence, which reduces its regulatory risk in any one country, and while their volume numbers aren’t great, they are able to keep raising prices and protect against inflation.

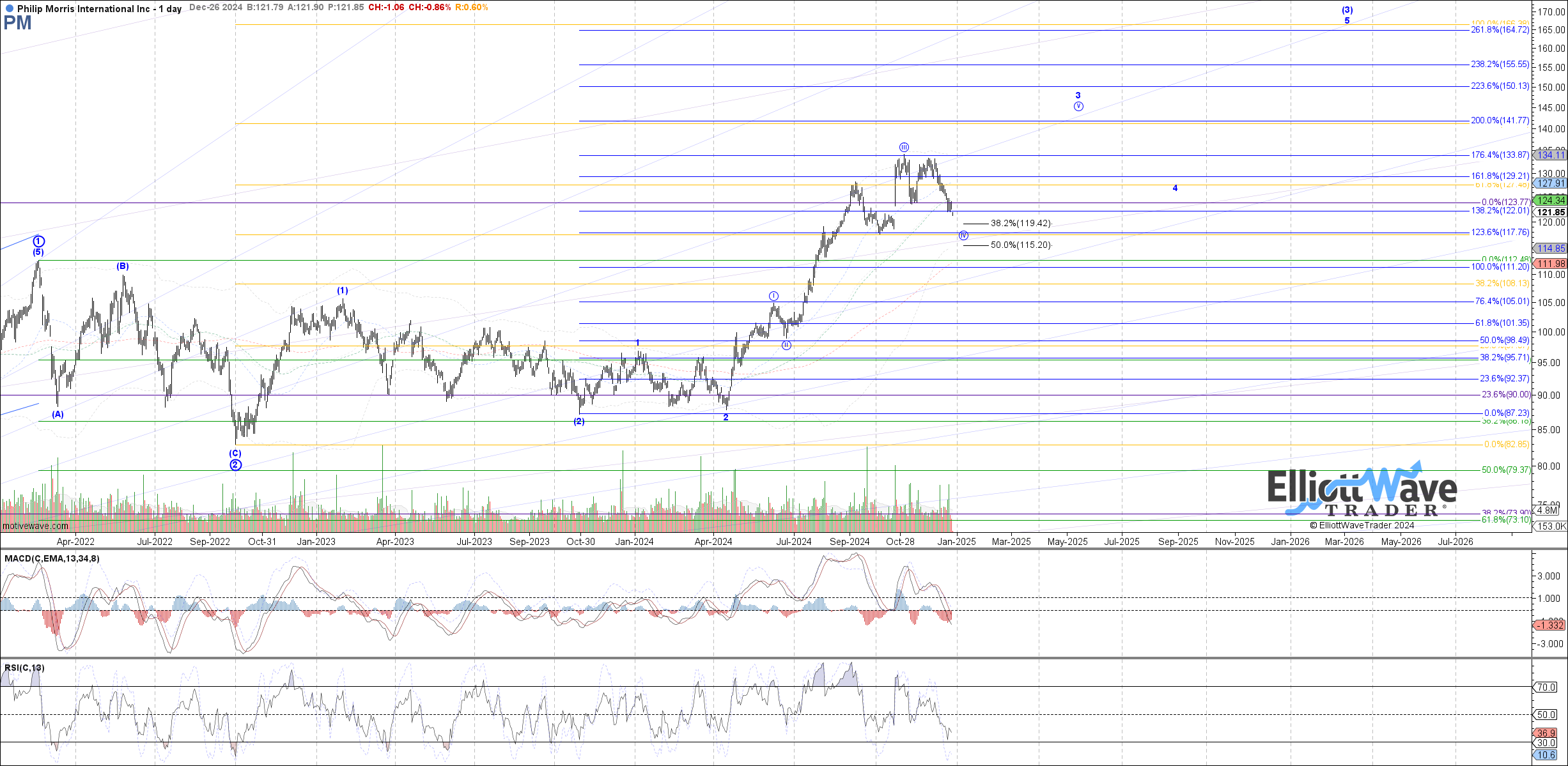

Garrett’s latest chart shows a nice bounce potential:

Overall, I like a collection of dividend stocks including the major tobacco companies, more than I like U.S. Treasuries, during any multi-year period.

MSCI EAFE

MSCI’s EAFE index includes Europe, Australasia, and the Far East. It’s a long-term widely-used international benchmark for ex-US developed market equities.

About one third of the index is in Asia/Pacific, the other two-thirds of the index is in Europe. However, most of the companies have a global presence, since they are large. Over the past decade Japan has been a decent performer, but European equities have generally been pretty weak.

The iShares MSCI EAFE ETF (EFA) provides an easy and cheap way to invest in it or trade in it.

Levi sees a possibility for a higher bounce in place, which I think is worth paying attention to as long as it stays above that recent double-bottom:

The average price/earnings of the group is under 16x, and overall it’s a pretty value-oriented index. I think it can work as a small permanent slice in a buy-and-hold portfolio, or can make for a decent trade.