Where Fundamentals Meet Technicals: LLY and EPD

This issue of Where Fundamentals Meets Technicals looks at two stocks- one bearish and one bullish. Or, fading the parabolas and buying the sleepers.

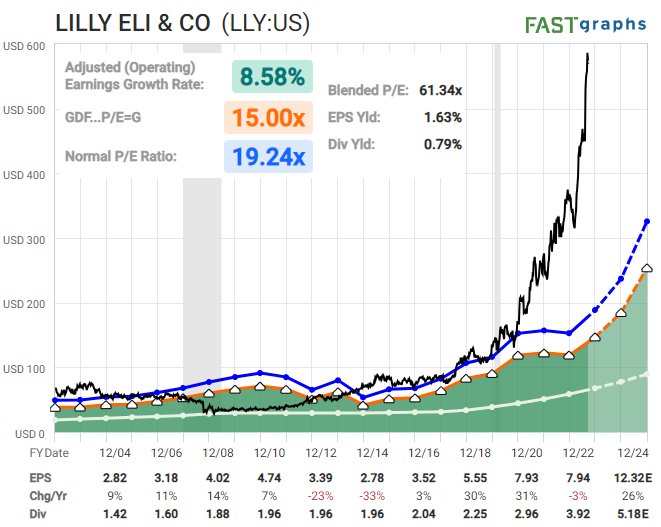

Eli Lilly

Eli Lilly (LLY) has been firing on all cylinders lately, and has strong expected growth ahead in terms of earnings and dividends. Right now, Lilly reigns supreme as the largest pharmaceutical company in the world by market capitalization. But much like Lilly from Diablo IV, I'm not sure it'll work out well in the end...

The problem in this case is valuation. The company trades at almost 70x 2022 earnings, and over 55x expected 2023 earnings. The company is expected to more than double its earnings from 2022 to 2025, and yet is still trading at well over 30x its expected 2025 earnings.

Does that mean the stock is bound to crash? Not necessarily. Fundamental growth could surprise to the upside, justifying some of this big run-up. Or the stock could trend sideways for a few years until the fundamentals catch up. But the way I would describe it is that the risk/reward setup is no longer favorable; there's more that can go wrong that can go right when it's priced for this much success.

When investors could earn zero yield on cash and cash-equivalents, they could justify almost any stock valuation. But now that an investor can get over 5.3% yield on nominally risk-free T-bills, most stocks trading at 30x or 40x earnings or higher should be seriously scrutinized. They need a lot of long-lasting growth in order to be able to justify those multiples.

If LLY was still on an up-trend, then there would be no reason to get off the train yet. But the stock recently dropped from $600 to $550. This gives a good invalidation point. As long as the stock remains below $600, it's worthwhile being cautious, since the momentum is broken until it reclaims that level. It could be shorted with a stop-out point at that level, or if an investor is long and bullish, it could be hedged as long as it remains under that level.

Zac has a bearish technical setup in play:

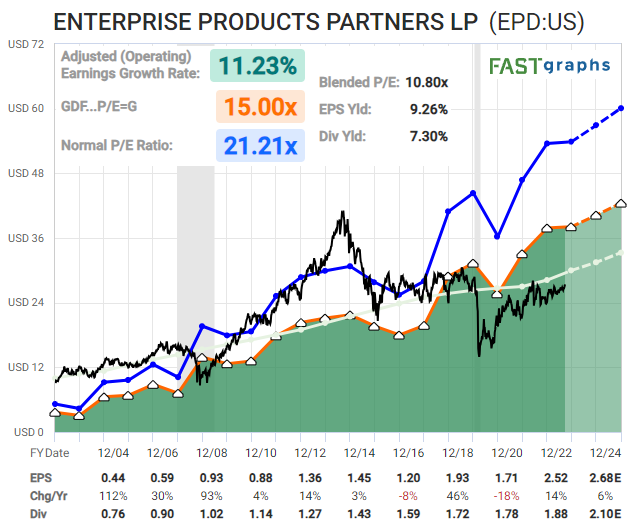

Enterprise Products Partners

I'm avoiding broken parabolas, and continuing to buy sleepers.

Enterprise Products Partners (EPD) continues to hit its expectations, with slow organic growth, an inexpensive valuation, and large distribution payouts to investors.

While EPD price action looks disappointing recently, keep in mind that investors have constantly earned a 7%+ yield from holding it. It has held up far better than long-duration Treasuries as an income play. And unlike a lot of mega-cap tech stocks that have reached high valuations lately (which threatens the prospect for good forward returns), EPD continues to offer attractive value.

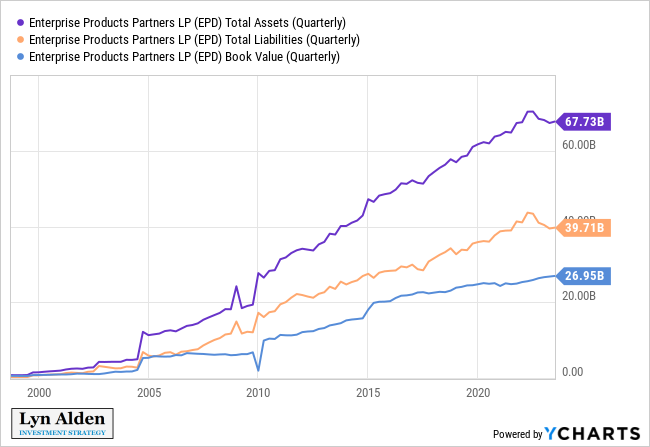

And as I keep pointing out, entities like EPD are on the complete opposite side of the rates situation from banks. Banks borrow at short durations and lend at long durations, and they can lose a lot of money if those long duration loans and securities lose value thanks to higher rates. What EPD and other investment-grade entities have done is to sell a lot of low interest rate bonds at long durations when interest rates were low. So their average debt duration is 20 years, yields lower than T-bills currently do, and is basically getting inflated away gradually. On the asset side, they hold real tangible assets (pipeline infrastructure) which they can raise the prices on the use of each year.

Zac has a bullish technical setup in play: