Where Fundamentals Meet Technicals: HAL and SLB

This issue of Where Fundamentals Meet Technicals focuses on Halliburton.

To set the stage, it’s worth noting that Zac has a rather bearish outlook for broad U.S. equity indices like the S&P 500:

I’m not that bearish in nominal terms, but I do think the next decade could be a poor one for S&P 500 returns relative to CPI, T-bills, or gold. Equities are starting this period from high valuations, and unlike the past four decades, they will not have the tailwind of ever-lower interest rates in each business cycle.

However, I do think there are other markets, and individual stocks within the U.S. market, that could outperform the U.S. broad stock index.

Basically, the past decade was characterized by assets that benefit from disinflationary trends doing well, whereas I think assets that benefit from inflationary trends are likely to be the leaders going forward.

Halliburton

As a basic example, many oil and gas producers, drilling companies, and service companies did poorly over the past decade. I think many of them could do much better over the next decade.

Halliburton (HAL) is one that I continue to monitor.

In the nearer term, Garrett has a bullish setup in place going into 2025:

However, he provides a specific level to watch for a breakdown of that trend to a more bearish one. He writes, “35.93 - 34.54 needs to hold if bullish off the Jan low”

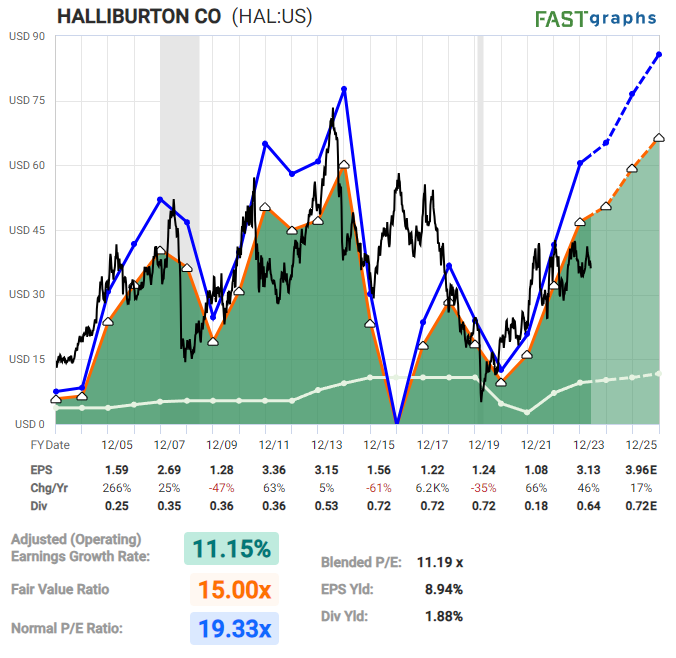

Fundamentally, HAL is inexpensive both in absolute terms and relative to its peers.

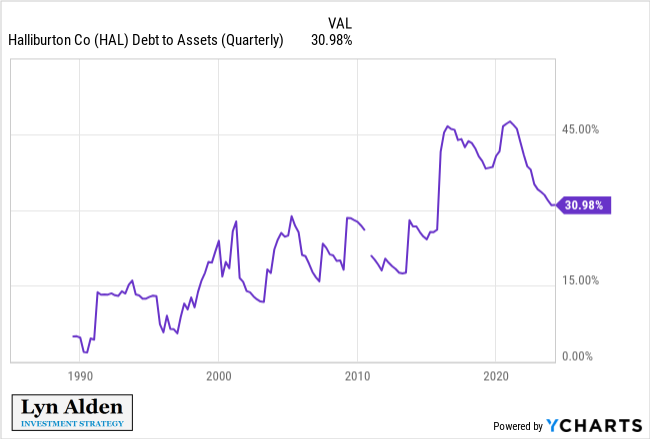

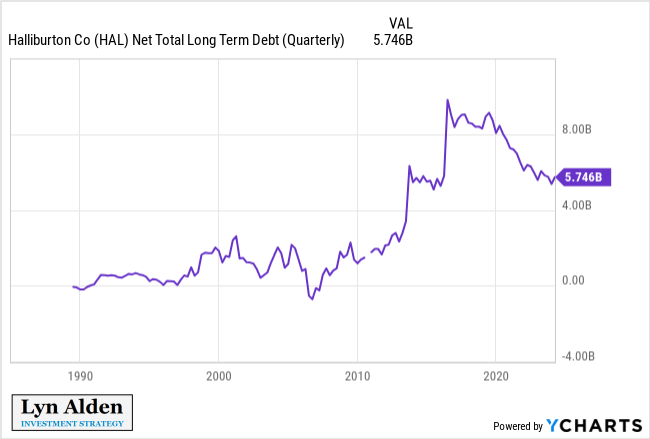

The balance sheet is heading in the right direction, as incoming cash flows help to solidify the financial position:

I continue to be bullish on HAL from a fundamental perspective, and from a technical perspective, Garrett’s level is one to watch as well.

Schlumberger

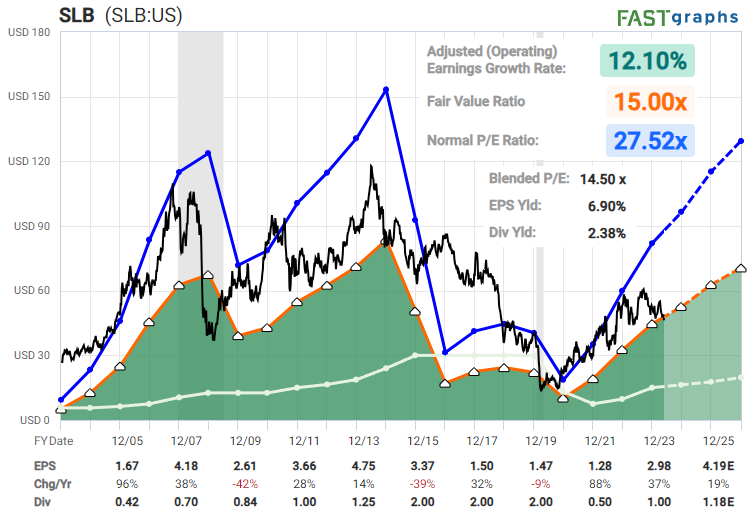

Schlumberger (SLB) is another competitor to watch. From a fundamental perspective, it’s also quite solid looking:

However, from a technical perspective, it might be prudent to wait for it to re-establish a new price floor. So, the stock takes a back seat for the moment.