Where Fundamentals Meet Technicals: AXP, DAL

This issue of Where Fundamentals Meet Technicals takes a look at the travel sector.

Zac recently provided commentary on his current largest holdings:

My largest holdings rn in reg equity acct (not miners):

SWBI, XLV, BHP, AXP, UAL, CRWD, DAL, SBUX, LUV, VZ, ZUO, & ITA

-Zac, August 11th

I found this interesting because the list aligns with a lot of stocks I like from the fundamental side. Specifically, I'm bullish on many healthcare stocks (XLV), I'm bullish on BHP Group (BHP), and I'm bullish on travel companies in general. Out of Zac's twelve stocks, four of them are travel companies. Among these, I like American Express (AXP), and while I'm not a big fan of airlines (UAL, DAL, LUV) in general due to lousy business models, their fundamentals do look decent at the current time as a potential trade, and fit in with my broader travel theme.

American Express

American Express is a financial company that is well known for its travel-oriented rewards cards. Visa (V) and Mastercard (MA) operate payment network-only models and don't take on direct credit risk, whereas American Express and Discover Financial Services (DFS) operate combined network and bank business models where they manage their own credit risk. The top three of them have very entrenched network effects, and even the fourth one, Discover, has decent network effects.

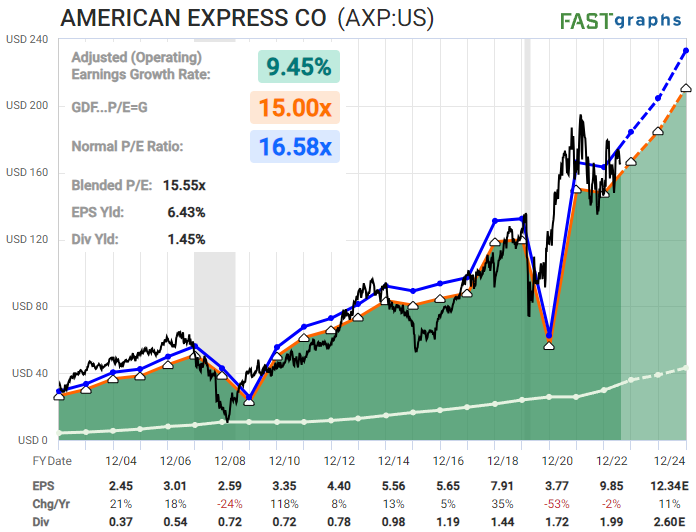

Here is one of Zac's latest charts on American Express:

In my opinion, the fundamentals agree. After about two years of flat price performance, I think the stock has some room to run in the years ahead:

For readers that have followed my work for a while, I bought American Express during its big drop in 2020. When everything was crashing during the COVID-19 lockdowns, I trimmed a few companies that I wasn't sure would recover like Carnival (CCL), and bought ones that were down big but that I was nearly certain would make it through this, like American Express. As it quickly recovered back to new all-time highs, I sold the position with significant gains. But after this lengthy consolidation, I'm interested again.

Delta Airlines

Airlines are historically terrible business models, and I'll briefly explain why. When it comes to transportation in general, we can broadly separate companies into two groups.

The first group of transportation companies own their own pathways. An example of this is a railroad; the major freight railroads in the United States have historically been solid performers. This is because once they establish their pathways, they are kind of monopolies, and they have some degree of pricing power. Another example is pipeline companies; they build their infrastructure and tend to have pretty good returns on it, because it would usually be uneconomic for competitors to build a parallel pipe when there isn't enough demand for both to be full. Usually when a pipeline company does poorly, it's because it overleveraged itself, rather than because its pipes failed to earn decent EBITDA over the long run.

The second group of transportation companies don't own their pathways. Trucking companies, airline operators, and shipping companies (tankers, dry bulk, containers, etc) generally fall into this category. These are more commoditized hyper-competitive businesses, where the overbuilding of trucks, planes, and ships can crush pricing power for long stretches of time. They can all go from point to point and directly compete with each other. In other words, they lack an economic moat. They are trading stocks, not buy-and-hold stocks.

An airline operator buys a lot of expensive planes (depreciating assets that only get worse after they are bought), and then has to compete against other airlines who have the same airplanes, with little pricing differentiation. So, would I want to own an airline stock long-term? No.

But for a trade? If the technicals and fundamentals are both in alignment, their cyclical aspect can provide some explosive moves, up or down.

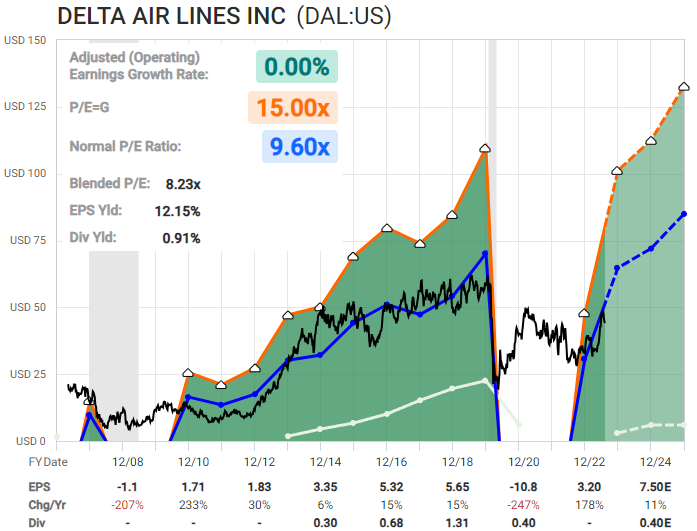

Zac has a rather bullish chart on a number of airline stocks, including Delta:

The F.A.S.T. Graph looks decent as well:

Why Travel?

I will probably cover this again in a future deep dive report, but to recap, the Fed's current raising of rates has put a lot of pressure on sectors of the economy that are sensitive to interest rates (commercial real estate, junk-rated companies, and unprofitable growth stocks that rely on high-value equity issuance). These companies tend to either have a lot of short-duration debt that has to get refinanced at higher rates, or they are not profitable and rely on constantly issuing expensive equity to finance themselves.

But, some other areas actually benefit from the higher rates. Cash-rich companies and cash-rich people, are quite fine with this environment. They either have low debt, no debt, or long-duration fixed-rate debt (e.g. 30-year mortgages and/or long-duration corporate bonds). Imagine an upper middle class 60-year old couple. They own their house outright, or they have a low fixed-rate mortgage on it, and plenty of cash-equivalents and equity holdings. In particular, their money-market accounts and Treasuries are paying much higher yields now than they used to. The Fed is not going to stop them from going on vacations, going out to restaurants, spending on their grandkids, etc. If anything, the Fed might be helping them.

This is why I have a constructive outlook on much of the travel sector. This includes companies like American Express that are adjacent to the travel industry, includes restaurants, includes airports (which unlike airlines do have an economic moat), and to some extent can include airline stocks as a trade with careful risk management.