Where Fundamentals Meet Technicals: AMLP, TRV, BHP

This issue of Where Fundamentals Meet Technicals looks at three stocks/sectors that seem well-positioned to handle the uncertain macro environment of 2023.

Energy Pipelines

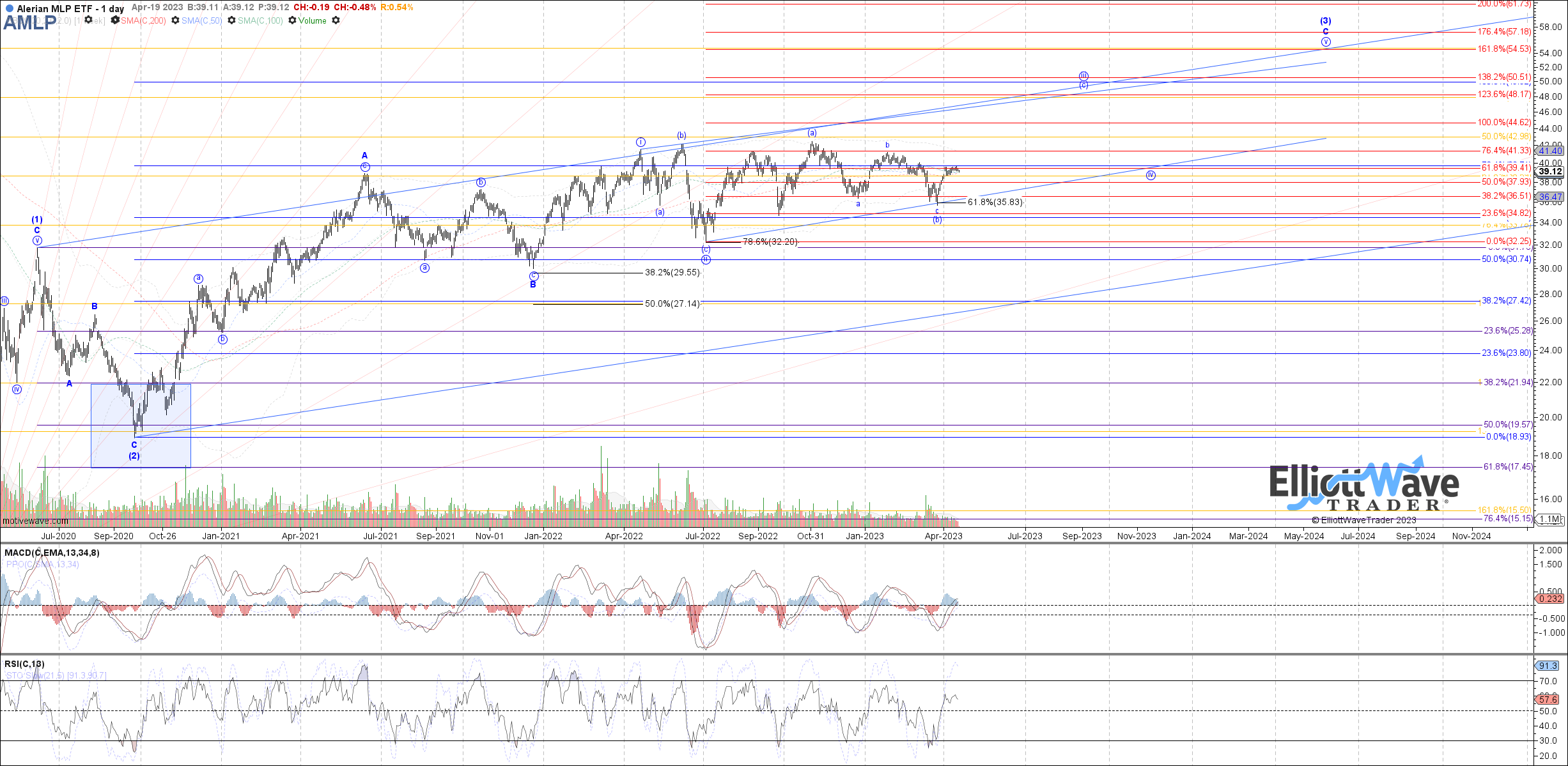

Throughout April, Garrett has been posting a positive technical setup for the Alerian MLP (AMLP) ETF as long as it can remain above the March low.

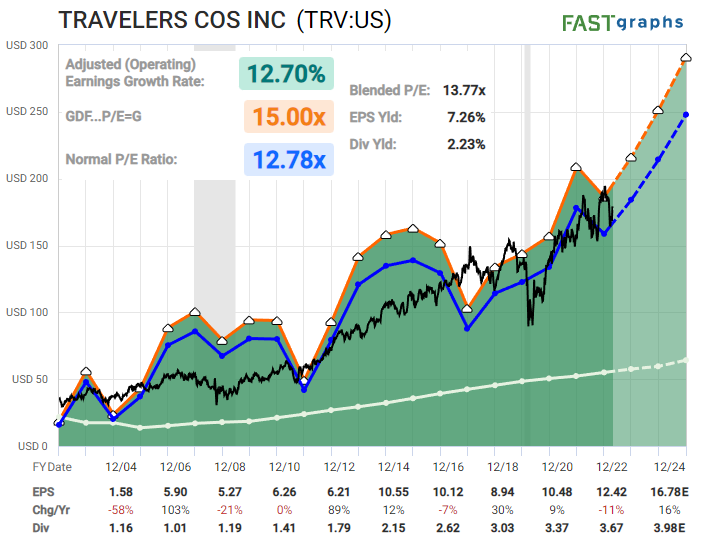

I continue to view pipelines as a relative safe haven in this environment. The 2014-2020 period washed out a lot of the industry’s bad leverage and reset valuations lower, and the industry transitioned from a growth industry to a value industry. Ever since 2020, many pipelines have been attractive, with Enterprise Products Partners (EPD) offering the best long-term risk/reward in my view.

The trend of least resistant is to grind higher in price, or at least to grind sideways while paying a very high yield that is well-covered by cash flows. It’s not about growth anymore; it’s about wide-moat businesses that generate tons of cash.

Good pipeline companies like EPD are also on the other side of the recent bank problems. Banks locked in long-duration loans and securities at low interest rates on their asset side, while EPD and others locked in long-duration bonds at low rates on their liability side.

Travelers Companies

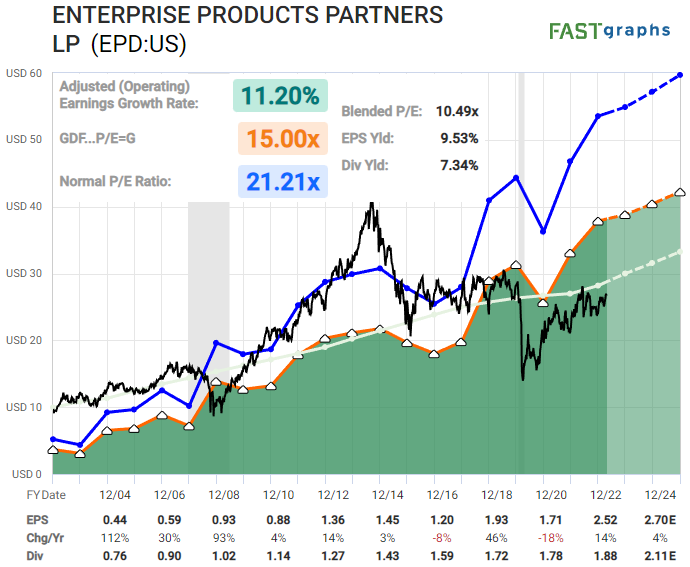

Insurance companies invest in bonds, and so they have taken a beating on their book value along with banks. However, insurers don’t face the prospect of bank runs and are not using deposits with rising rates as their liabilities, and so they are better-positioned to handle a higher-rate environment.

As insurance companies see their bonds mature and get reinvested at higher rates, their interest income ticks higher. Meanwhile, insurance companies don’t face much recession risk (insurance is a necessary service even in bad economic environments), and instead they have natural catastrophe risk which is ever-present but uncorrelated.

Garrett has a constructive technical chart in place on Travelers (TRV) that stretches into Q4 of this year:

The fundamentals point upwards. The stock is at a reasonable valuation on a price/earnings basis, recently beat earnings, and continues to hold up well.

BHP Group

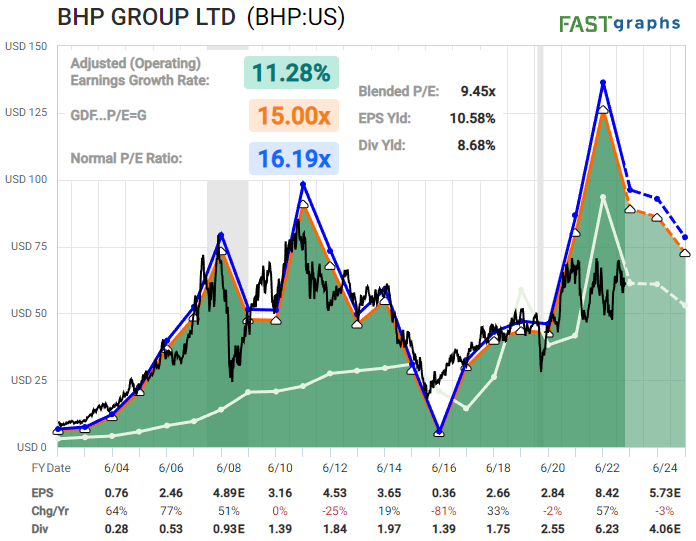

BHP (BHP) and other mining stocks took a beating today, although from a fundamental perspective it seems to be a buyable dip.

Analysts aren’t very constructive on these stocks over the next couple years, due to stagnant prospects for iron prices. However, the stock price already reflects this lackluster outlook.

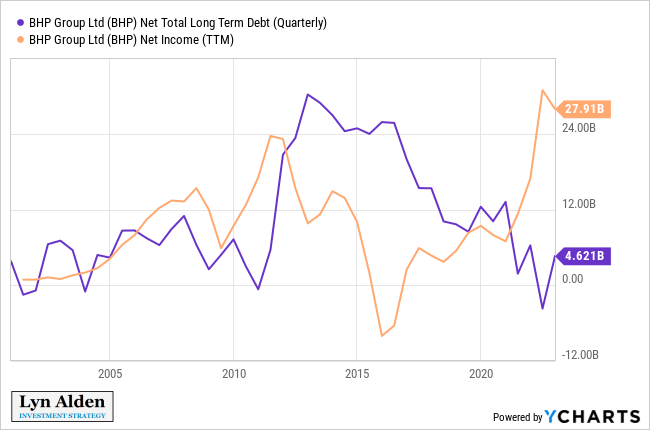

BHP pays a high dividend yield and, most importantly, it has a strong balance sheet.

The company earned $28 billion in net income over the past twelve months (which is likely headed lower for the time being) while they have less than $5 billion in net debt. In recent years, the company has used a lot of incoming cash flows to strengthen its balance sheet.

Zac has a constructive technical chart in play, which goes against consensus: