Where Fundamentals Meet Technicals: AMGN, EBAY

As most people are probably aware, a partnership between Pfizer and BioNTech (US and German companies, respectively) announced successful phase 3 results of a COVID-19 vaccine Monday morning. Here is the press release.

This is still preliminary and will need approvals, but it gave investors a light at the end of the tunnel.

Here is the most notable line in the press release, in my view:

“Based on current projections we expect to produce globally up to 50 million vaccine doses in 2020 and up to 1.3 billion doses in 2021.”

This is mostly a 2021 story. Vaccines can potentially become available to the most vulnerable late this year, and can roll out to a wide audience over the next year. It's inexpensive, is apparently 90% effective based on these findings so far, and requires two doses spaced a few weeks apart. It's unclear how long it lasts, or some of the other details. It’s definitely good news, obviously, but not fully clear quite how good. Hopefully it's great.

On the news, value stocks surged, and safe havens like bonds and gold sold off. I continue to be long-term bullish on gold, but not bullish on bonds.

Energy stocks and financial stocks did particularly well Monday. Some of the popular "work from home" stocks like Zoom (ZM) were down big.

Companies that were particularly hard-hit from the pandemic, like airlines, cruise stocks, and movie theaters, soared. Many of them are facing bankruptcy risk under current pandemic conditions if they persist long enough, so this potentially helps them the most.

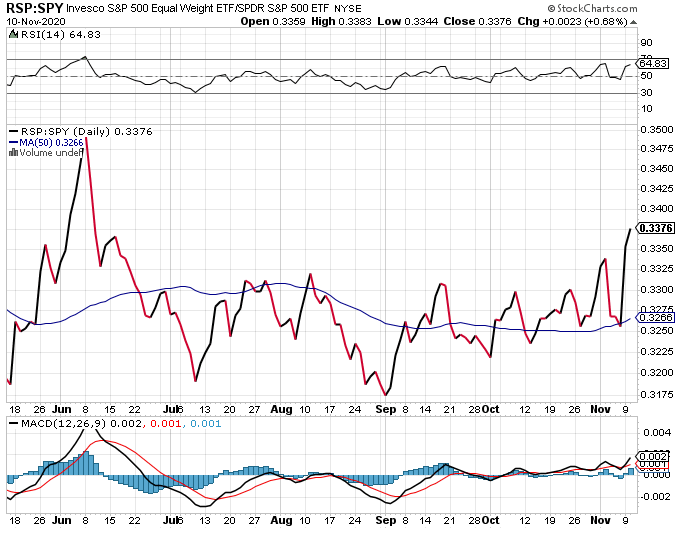

Overall, Monday was the largest single-day outperformance of the equal-weight S&P 500 vs the normal market-weight S&P 500 on record, as value stocks everywhere pulled themselves up out from their graves, while the big tech leaders sagged hard. This trend continued in a milder way on Tuesday.

Here is the ratio of the equal-weight S&P 500 ETF (RSP) vs the market-weight S&P 500 ETF (SPY). When the line is going up, it means equal weight is outperforming. When it is going down, it means market weight is outperforming. We had a recent breakout to levels not seen since June:

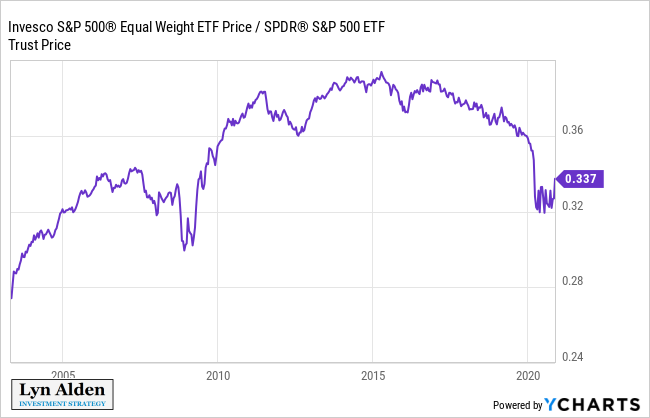

And here’s the long-term context:

It remains to be seen how persistent this is, because we still have a winter ahead with limited vaccine availability. However, looking deep into 2021, things look good for some of the high-quality stocks that have been impacted by the pandemic. I would be cautious, however, about chasing the low-quality businesses that are borderline insolvent, unless you do a ton of homework on a specific deep value name.

This week’s selections for “Where Fundamentals Meet Technicals” include Amgen (AMGN) and eBay (EBAY).

Amgen

Amgen is one of my core-holding healthcare stocks. It’s not a deep value stock with explosive upside potential, but it’s a steady dividend grower that was added to the Dow this year, and is increasingly diversified in terms of the products it offers.

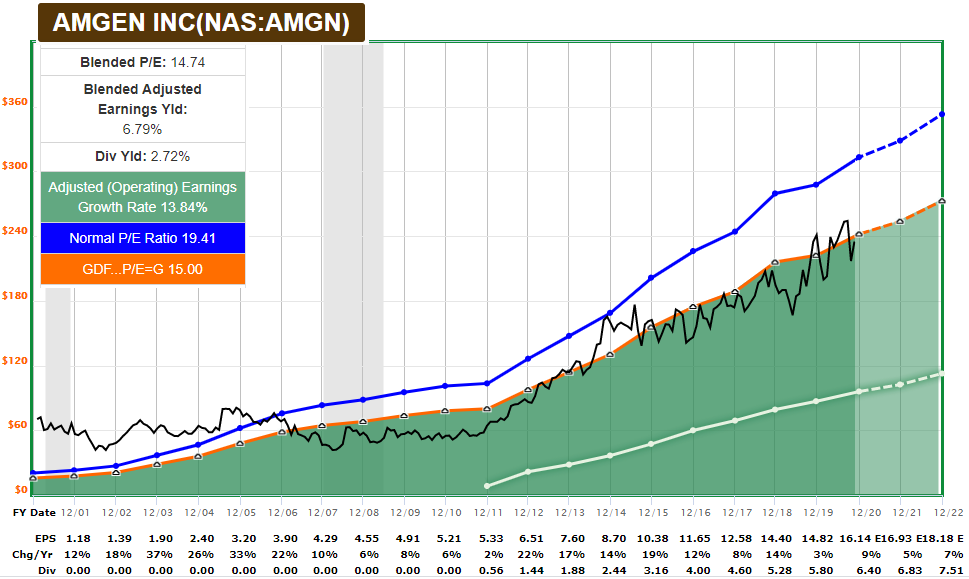

With a price/earnings ratio below 15, steady high single-digit EPS growth, and a growing dividend with a yield that ranges between 2.5% and 3%, Amgen offers exactly what a blue-chip stock should: steady long-term wealth compounding potential at an appropriate valuation.

Chart Source: F.A.S.T. Graph

It has had a nice little run since the bottom of its correction in late October, so I wouldn’t be surprised to see a pullback here or there in the weeks ahead. However, with Amgen, I invest for years.

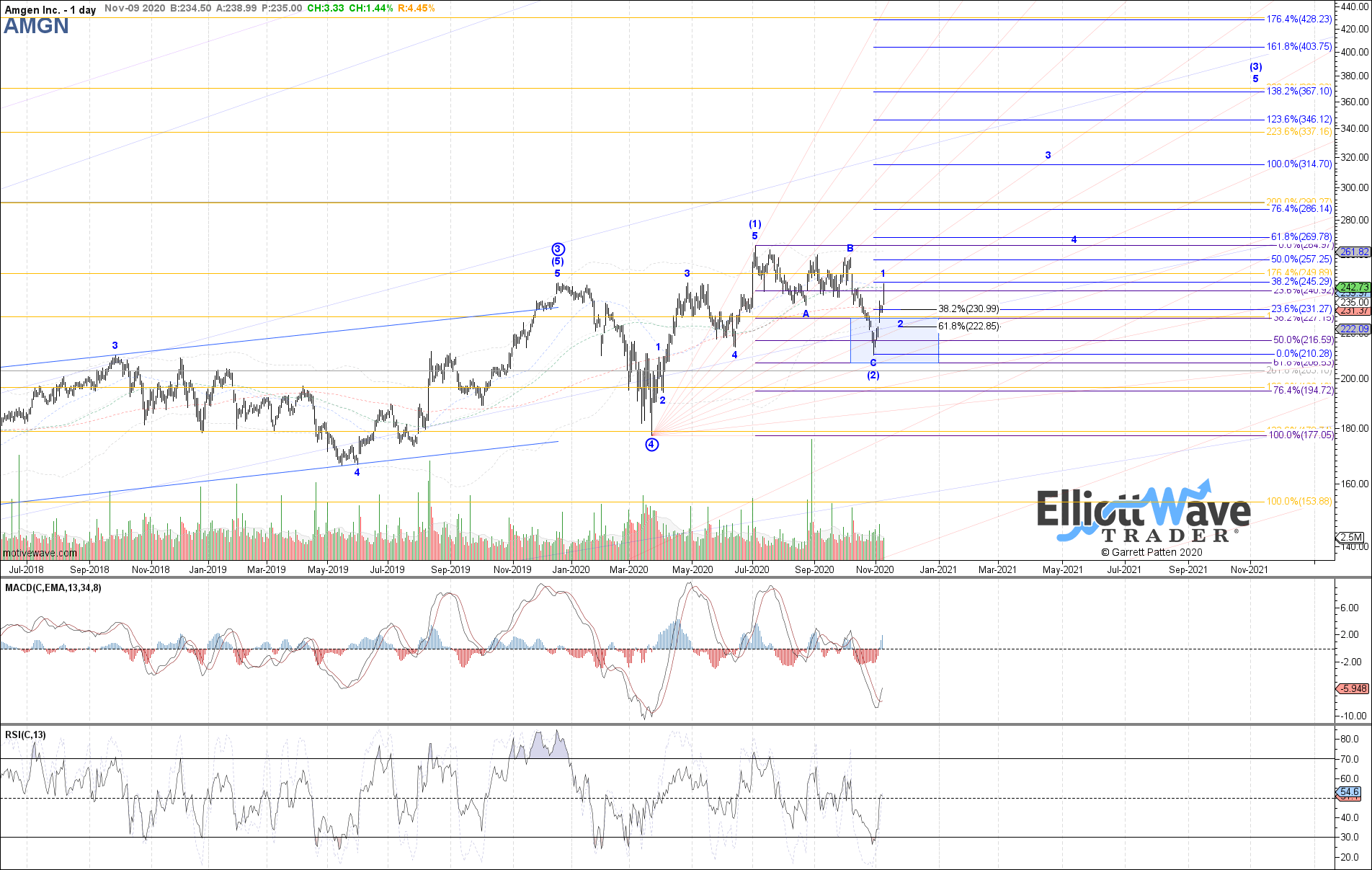

Garrett has a favorable chart on it:

His chart suggests a higher price level by 2022 than I would expect from fundamentals alone. However, it’s not out of the question that the valuation could be re-rated higher, which could help it reach some of those higher potential levels. In that case, I’d likely want to trim my position at that point. Or, if it stays at an attractive valuation and just keeps grinding up with good fundamentals, I’m happy to keep holding.

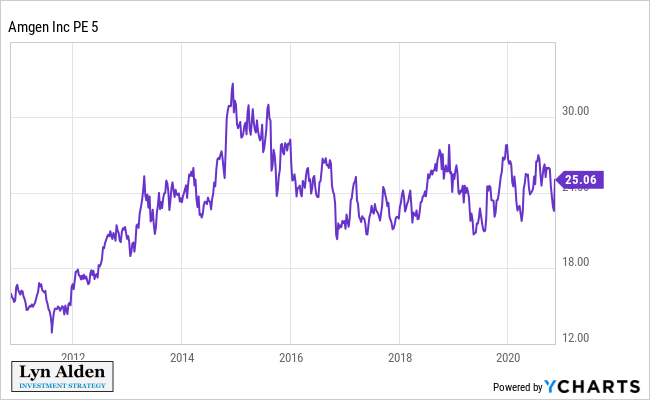

Amgen is currently trading at a cyclically-adjusted price/earnings ratio (which in this case takes into account the last five years of earnings) of 25x, which is typical of its historical average. The stock reached the high end of its historical valuation range in 2014/2015 and ended up consolidating a bit until fundamentals caught back up.

Overall, I remain favorable towards Amgen as a conservative long-term choice as part of a diversified portfolio. The balance sheet is solid, the growth is decent, and it offers an above-average yield.

eBay

eBay is currently selling off along with just about all tech/internet names over the past two days, as investors re-rate stocks to this new world of having a potential vaccine in 2021.

Most tech/internet stocks in my view are overvalued, because investors piled into them at any price this year as a safe haven. However, as the whole sector sells off, there will be some stocks that sell off despite the fact that they are appropriately-valued. When sentiment shifts, the wheat can get separated from the chaff.

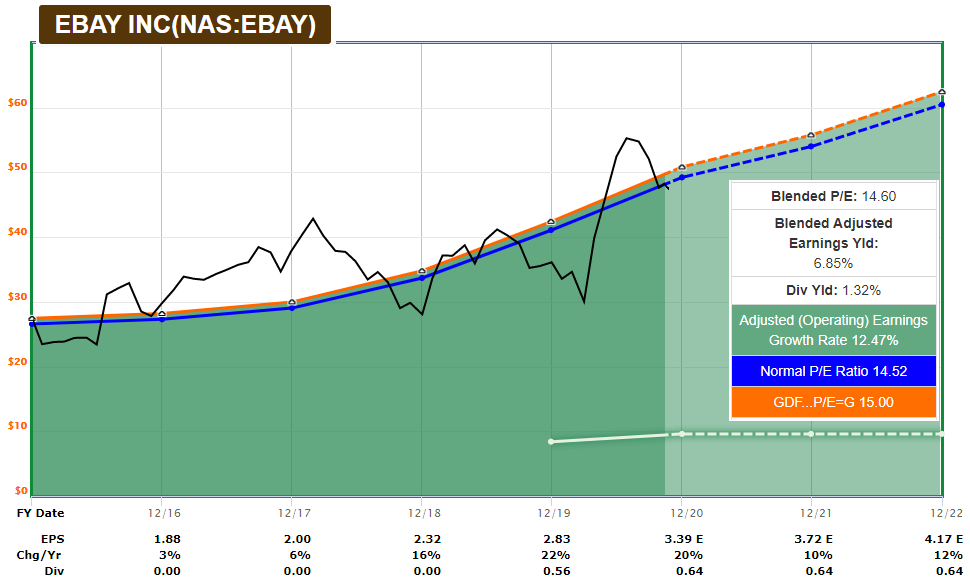

In my view, eBay falls into this category of being a high-quality stock at an appropriate valuation. It has a price/earnings ratio below 15x, with a strong balance sheet, and is growing its earnings per share:

Chart Source: F.A.S.T. Graph

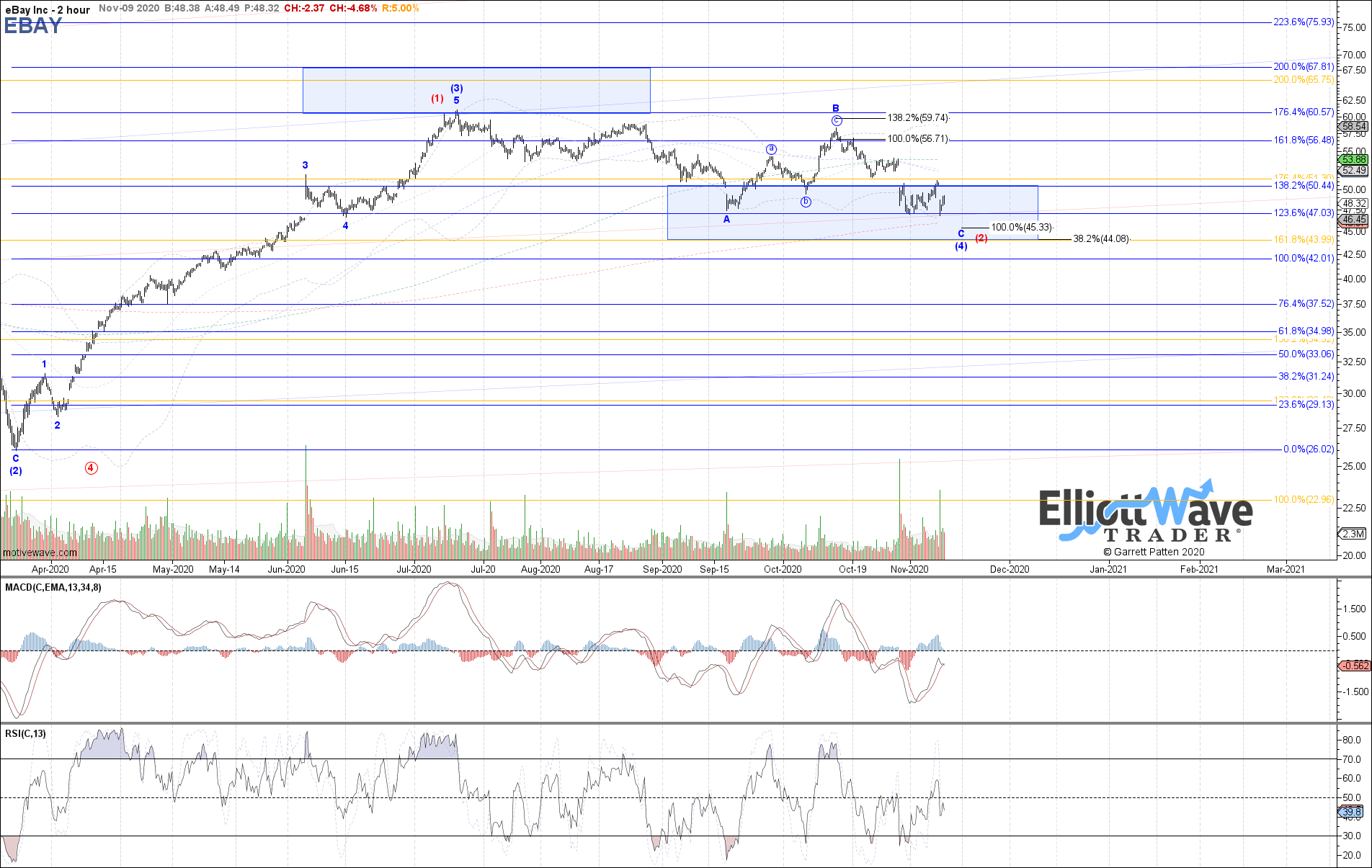

Garrett sees a potential bottom around this current level:

If the stock were to go down to the low end of its historical valuation range, it could go as low as $40, but if it did, I’d want to back up the truck at that point. In the high-$40’s, I’m moderately bullish, and long.

eBay sold off its non-core businesses and has new management in place, so it has the potential to keep growing its core namesake online marketplace.

At current valuations, it doesn’t need fast growth to outperform, though. As long as the marketplace continues to do well, it can pump out reliable free cash flows, which the company can send to shareholders as dividends and buybacks.

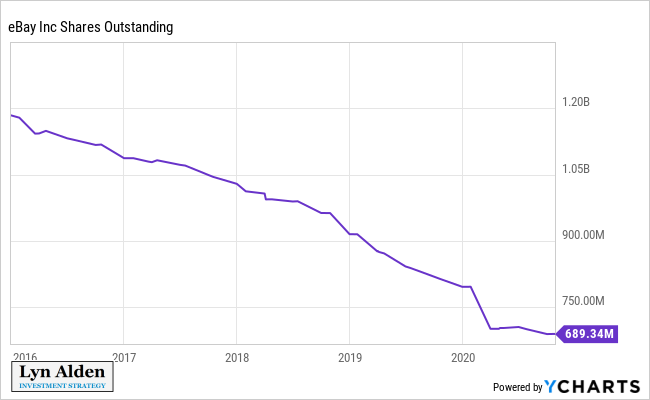

As eBay sold non-core businesses, they’ve reinvested the money into reducing the share count. So, instead of owning a small piece of a large company of unrelated businesses, investors own a large piece of a smaller and more focused company.

Share buybacks can be bad if a company is falling behind on innovation, like IBM (IBM). However, if a company is exactly where it wants to be, and can grow gradually and organically, then returning excess cash to shareholders makes sense. I’d like to see eBay eventually double its dividend, though, and ease up a bit on the share buybacks.

Overall, Amgen and eBay offer the prospects of long-term gradual wealth compounding. Their valuations are appropriate, their balance sheets are solid, and they don’t rely on stimulus, vaccines, or other external outcomes to do well.

At a time when the 10-year U.S. Treasury is paying less than 1%, which is below the prevailing inflation rate, I’d rather own a diverse basket of quality businesses, valued at less than 15x earnings in the case of these two, meaning earnings yields of over 6%, with growth rates that outpace inflation.