Where Fundamentals Meet Technicals: AAPL, XLK, TSLA, CVS

This issue of Where Fundamentals Meets Technicals looks at the recent tech rally, contrasted with a cheap healthcare stock.

Technology

This spring and summer so far have been very kind to tech stock sentiment, with soaring prices and valuations. The challenge is that for many of them, fundamentals haven’t kept up. Either the market is too expensive based on euphoric sentiment, or the market is signaling that fundamental analysts are way off.

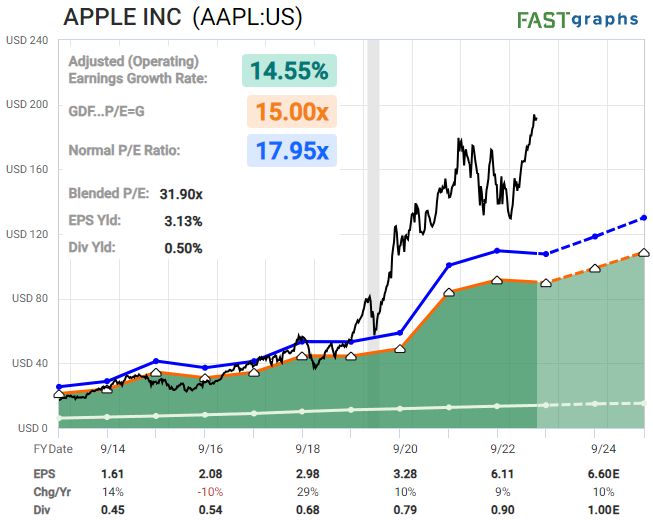

Apple (AAPL), for example, is now trading at 31x earnings but with little expected growth. While it’s a good company with good products, investors should be reminded that Apple’s huge industrial base in China gives it a big tail risk over the next few years should there be any major kinetic engagement around Taiwan. And this is at a time when an investor can earn 5% returns with T-bills.

Zac sees the possibility for a significant correction later this year.

When we zoom out more broadly, Zac is even more bearish on the rest of the tech sector, with a quite bearish chart for XLK:

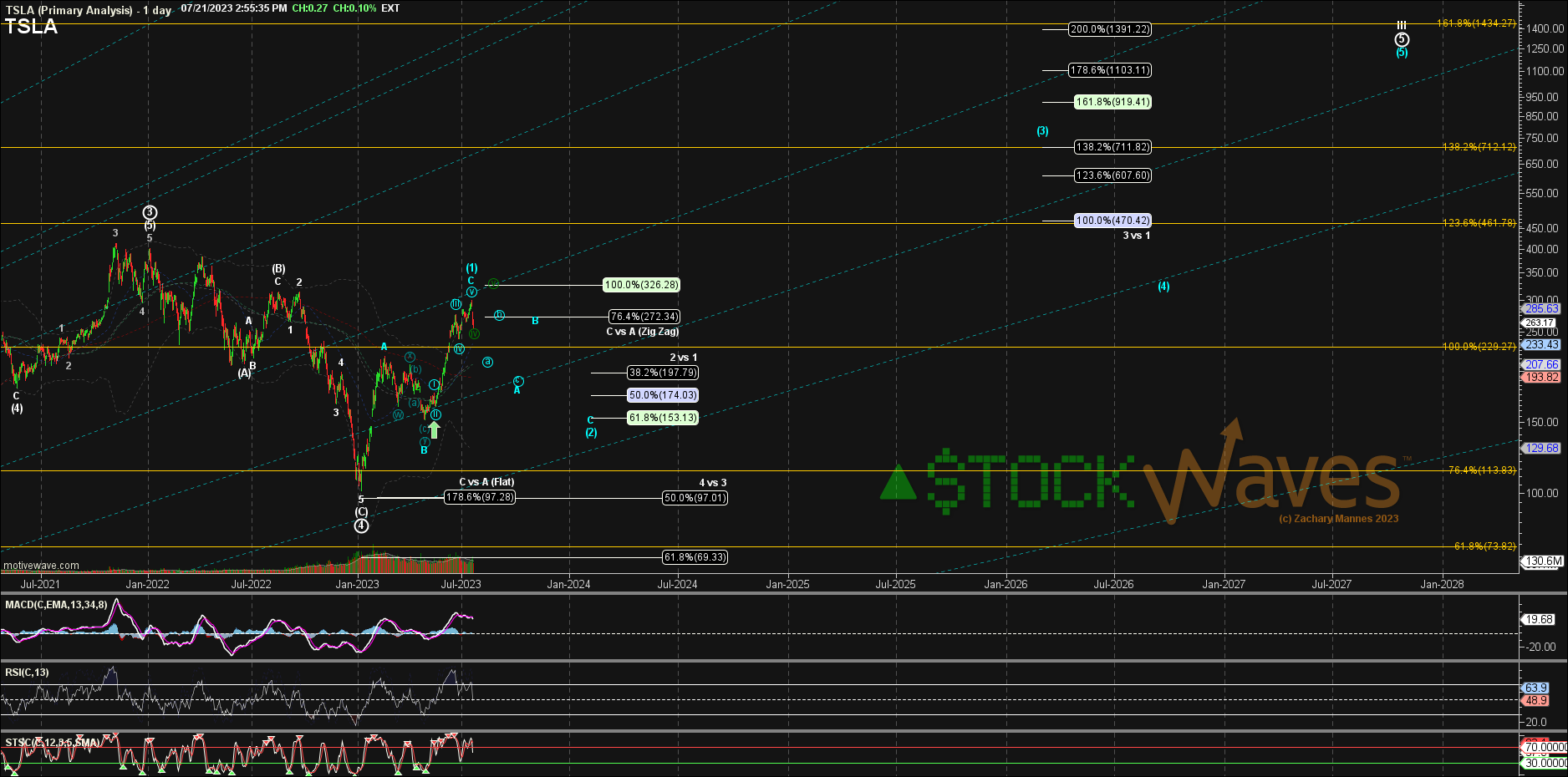

If we look at Tesla, Zac has a bullish long-term picture, but a lot of bearishness between now and 2024. I’m less bullish than him for the longer-term picture but in agreement on this next year. The risk/reward is currently better for the downside than the upside. Fundamentals will be re-evaluated as needed over this next year.

Tesla may be a good short candidate as long as its price remains below its recent local high.

Healthcare

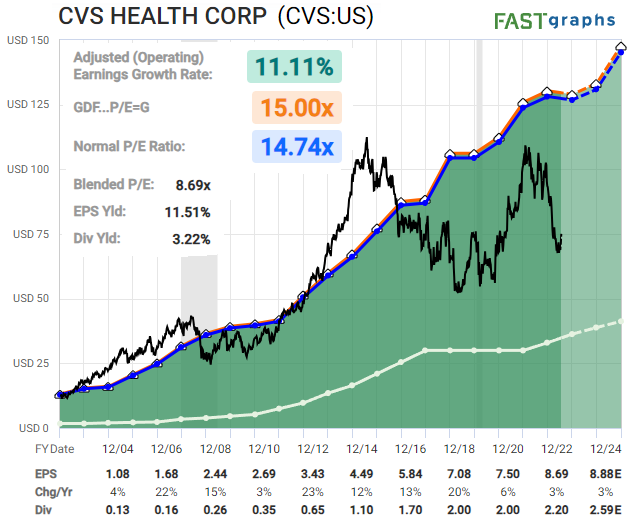

CVS Health (CVS) has been catching my eye recently with a potential bottom in place. It’s cheap on a fundamental basis, and generally resistant to recessionary conditions.

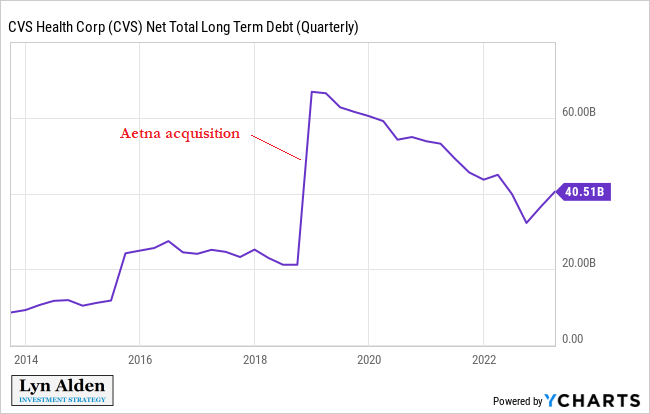

CVS is a very large and vertically integrated healthcare company, with health insurance, pharmacy benefit management, pharmacy, and on-site health services. Ever since the Aetna acquisition, the company has been using cash flow to pay down debt and consolidate its finances.

However, over the past year, they acquired Signify Health and Oak Street Health for a combined price of over $18 billion, which the market has been underwhelmed by. This has been a contrast to the prior period of debt reduction and share buybacks to make a leaner structure, and the acquisitions were not cheaply priced.

However, going forward, I expect CVS to return to a period of consolidation, which should benefit the share price over time.

Garrett’s latest chart suggests that CVS may still make one more lower-low before the bottom is in.

I am agnostic on that front, and view the current level as attractive with a 3-5 year fundamental view. A lower-low would be even more welcomed but I’m uncertain if we’ll see it or not.