What's Ahead For European Indices?

EUROPE/AMERICAS

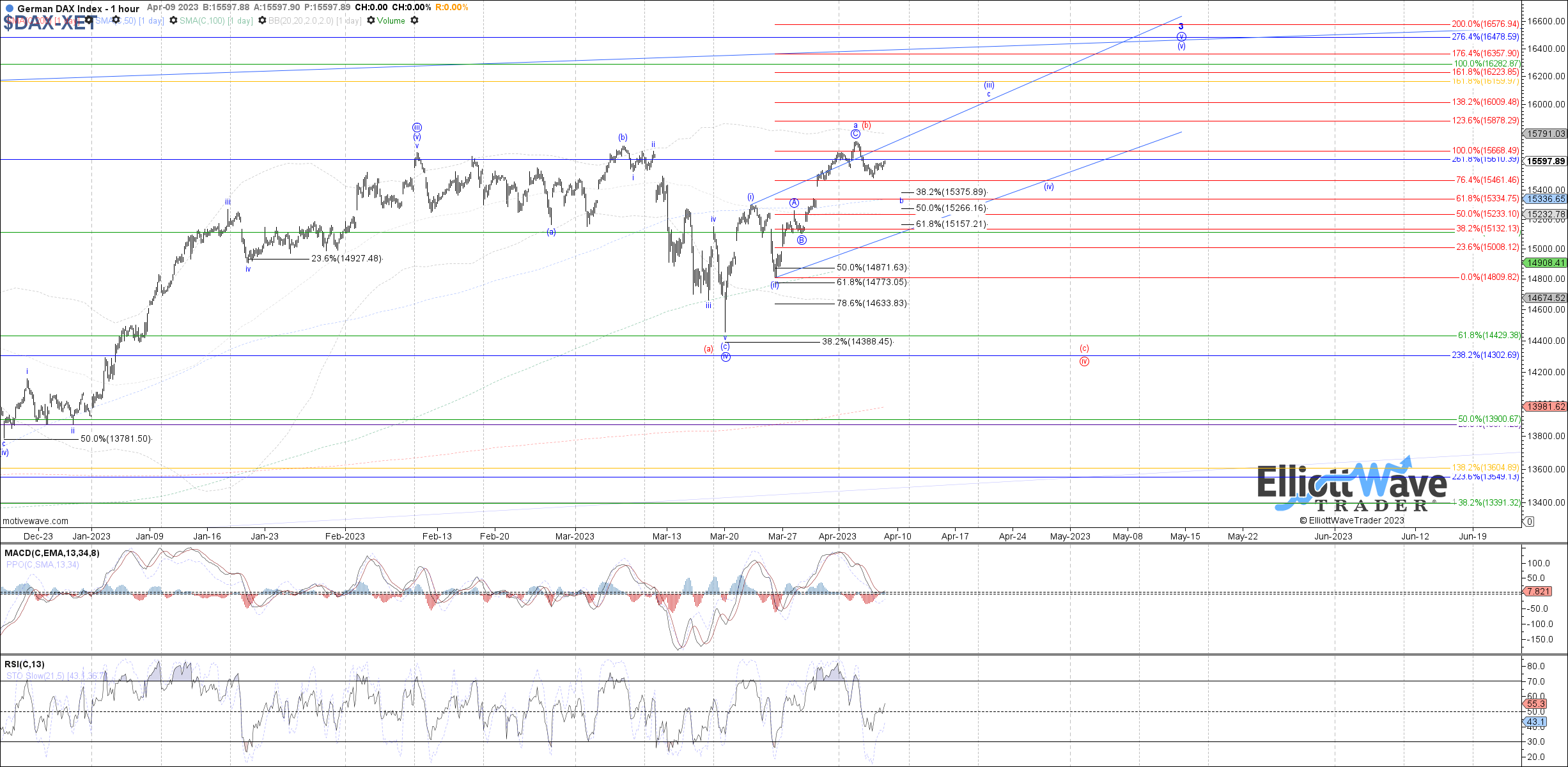

DAX: The DAX started off the week initially higher, but rolled back over during the second half of the week to still allow for last week’s high to be counted as wave a of (iii) in the blue count. If so, then more near-term downside as wave b of (iii) would look best, with 15375 – 15155 as retrace support that can be tested before turning back up again in wave c of (iii). Otherwise, a direct break back above last week’s high from here would signal that all of wave (iii) is filling out in a more direct fashion with 15875 – 16010 as the expected target range above.

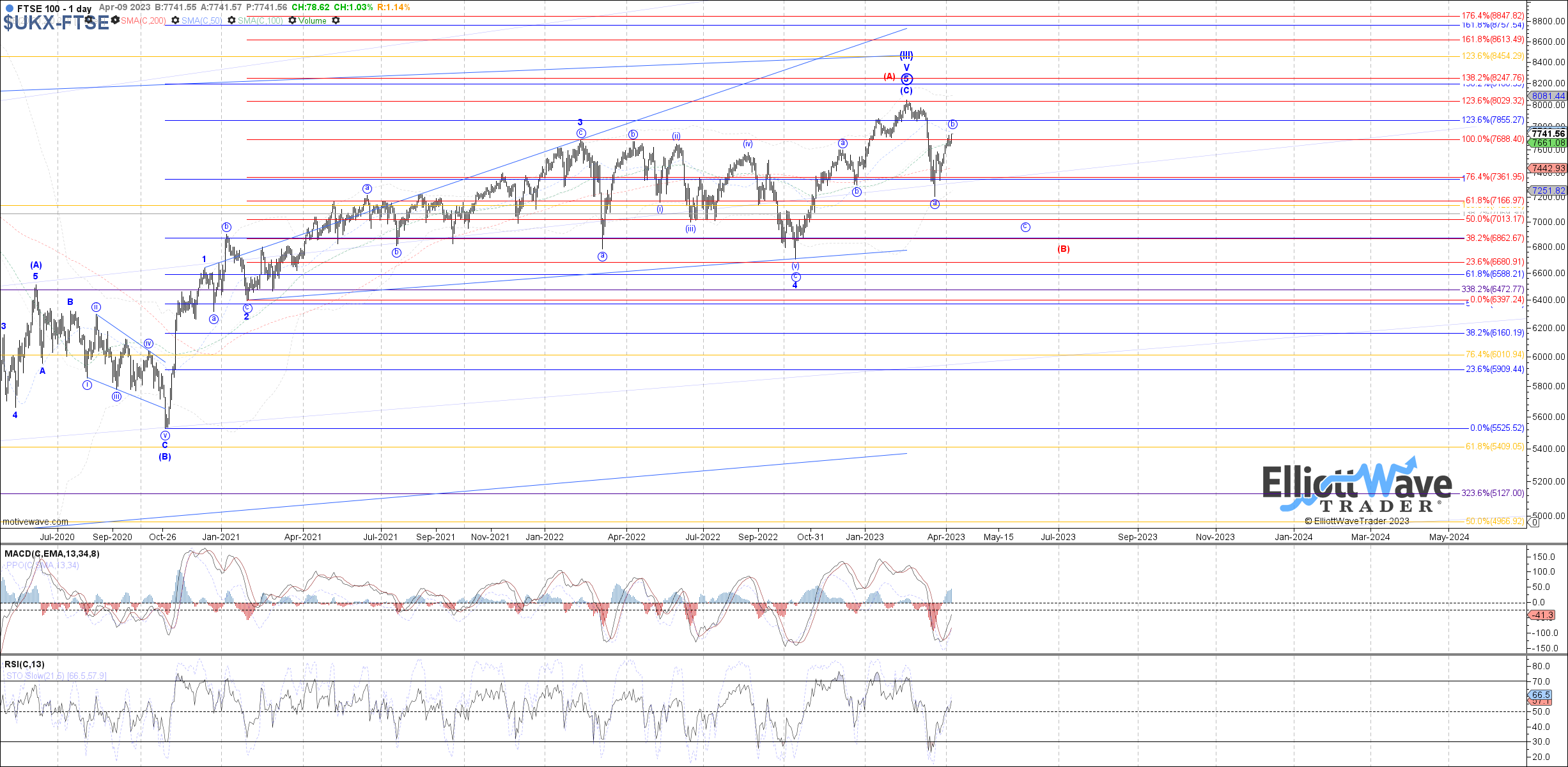

FTSE: The FTSE traded initially higher last week, reaching the 7730 fib target cited for wave iii of (c) before consolidating mid-week as wave iv of (c). Price then turned back up to end the week at the highs, favoring wave v of (c) now filling out. Under that assumption, there is room for more near-term upside before wave v of (c) completes, with 7815 as a potential fib target to test before turning back down again.

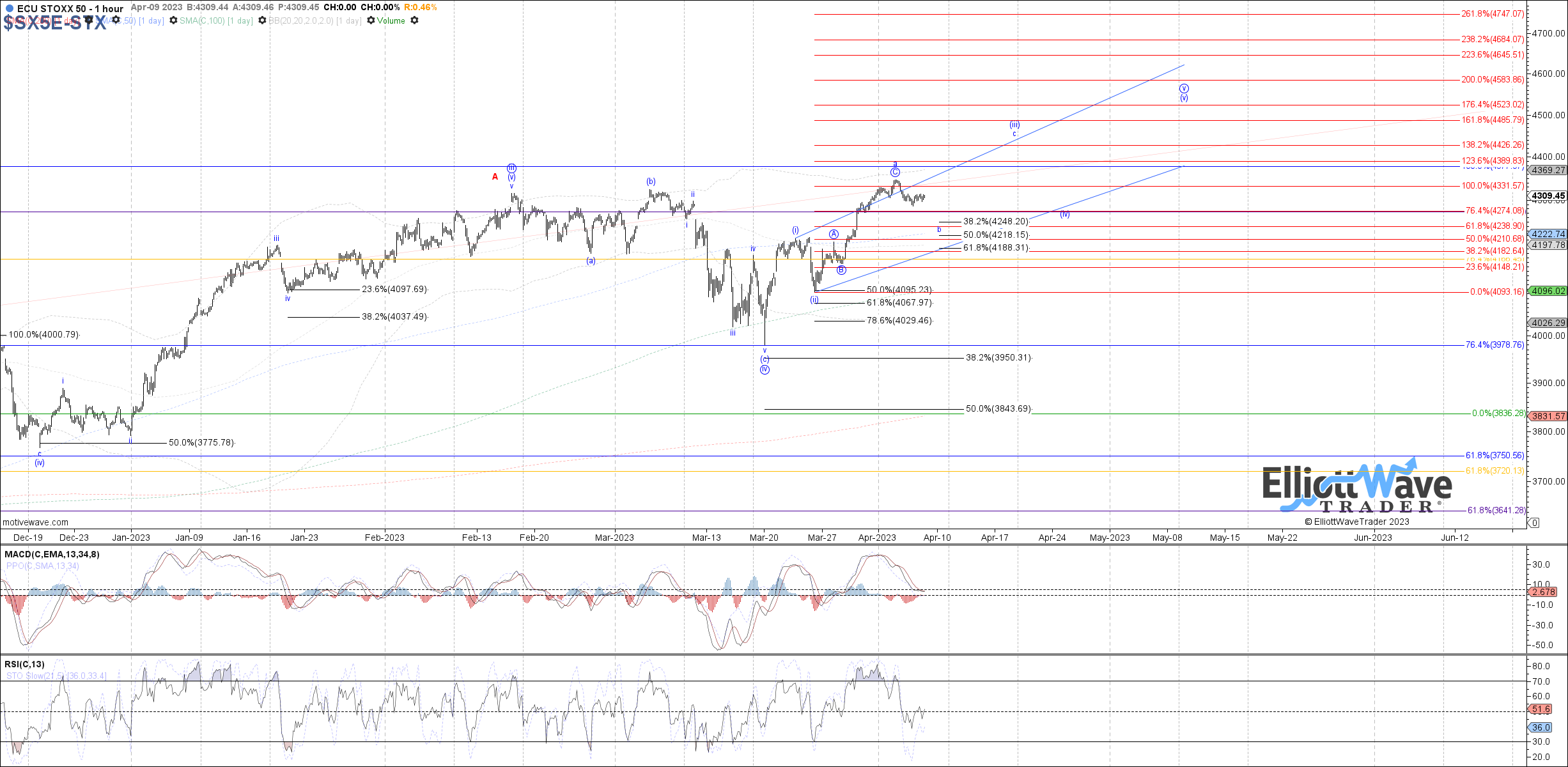

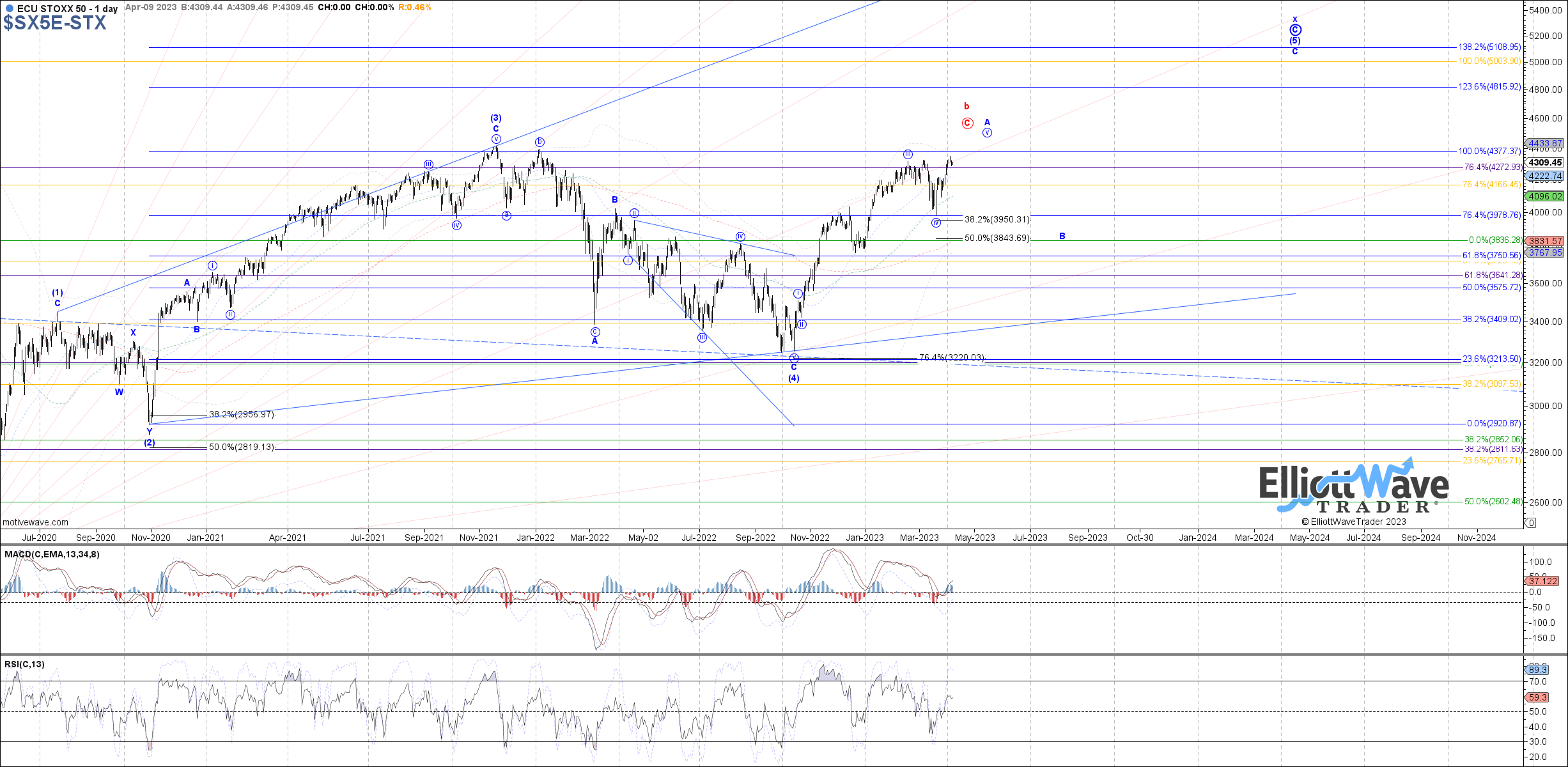

STOXX: The STOXX stretched modestly higher at the beginning of the week, but like the DAX then rolled back over during the second half of the week. Therefore, it remains possible to count last week’s high as just wave a of (iii), but in that case I expect to see more near-term downside as wave b of (iii) to test fib support between 4250 – 4185. Otherwise, a direct break back above last week’s high from here would signal that all of wave (iii) is filling out in a more direct fashion with 4390 - 4425 as the expected target range above.

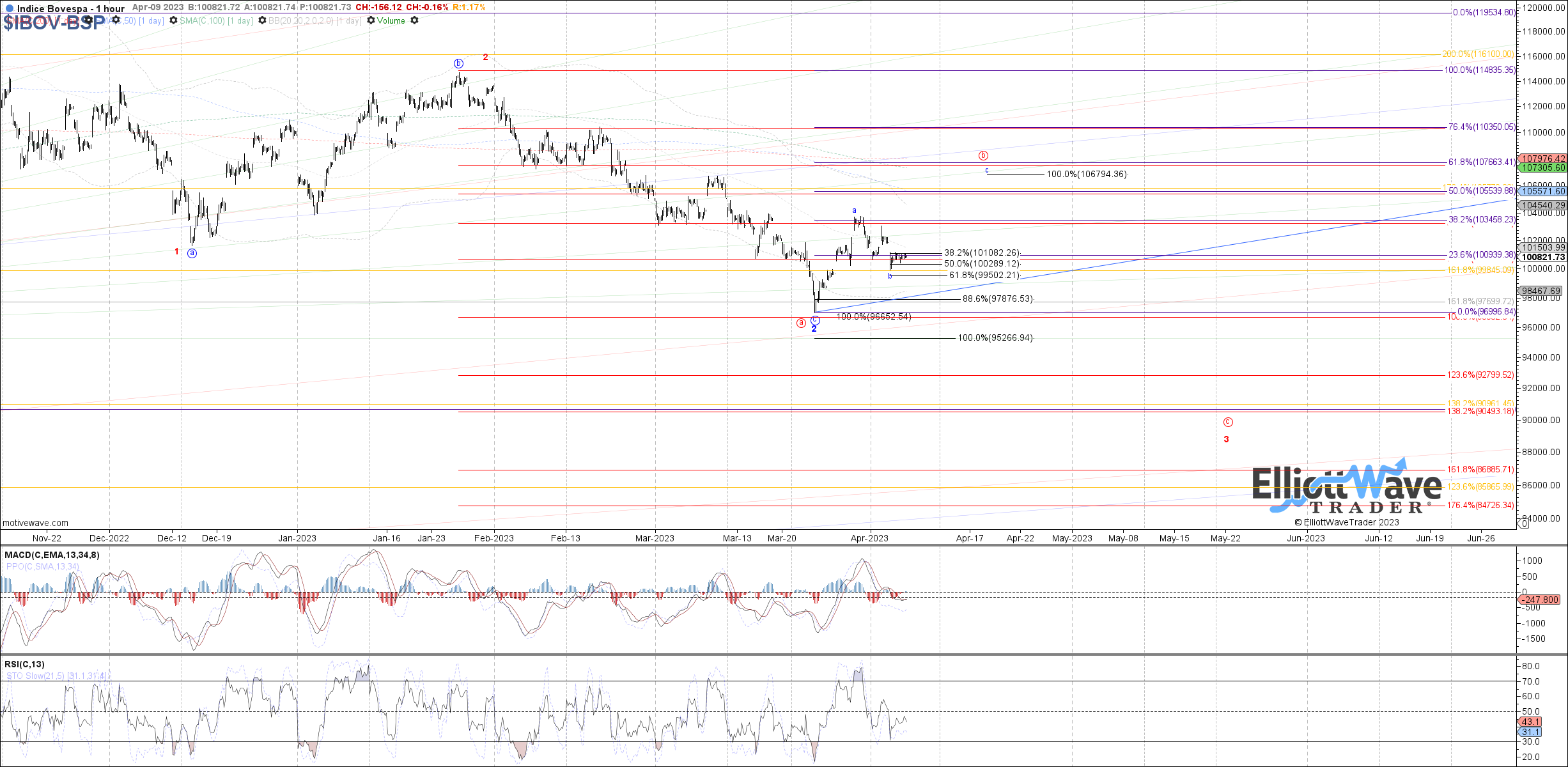

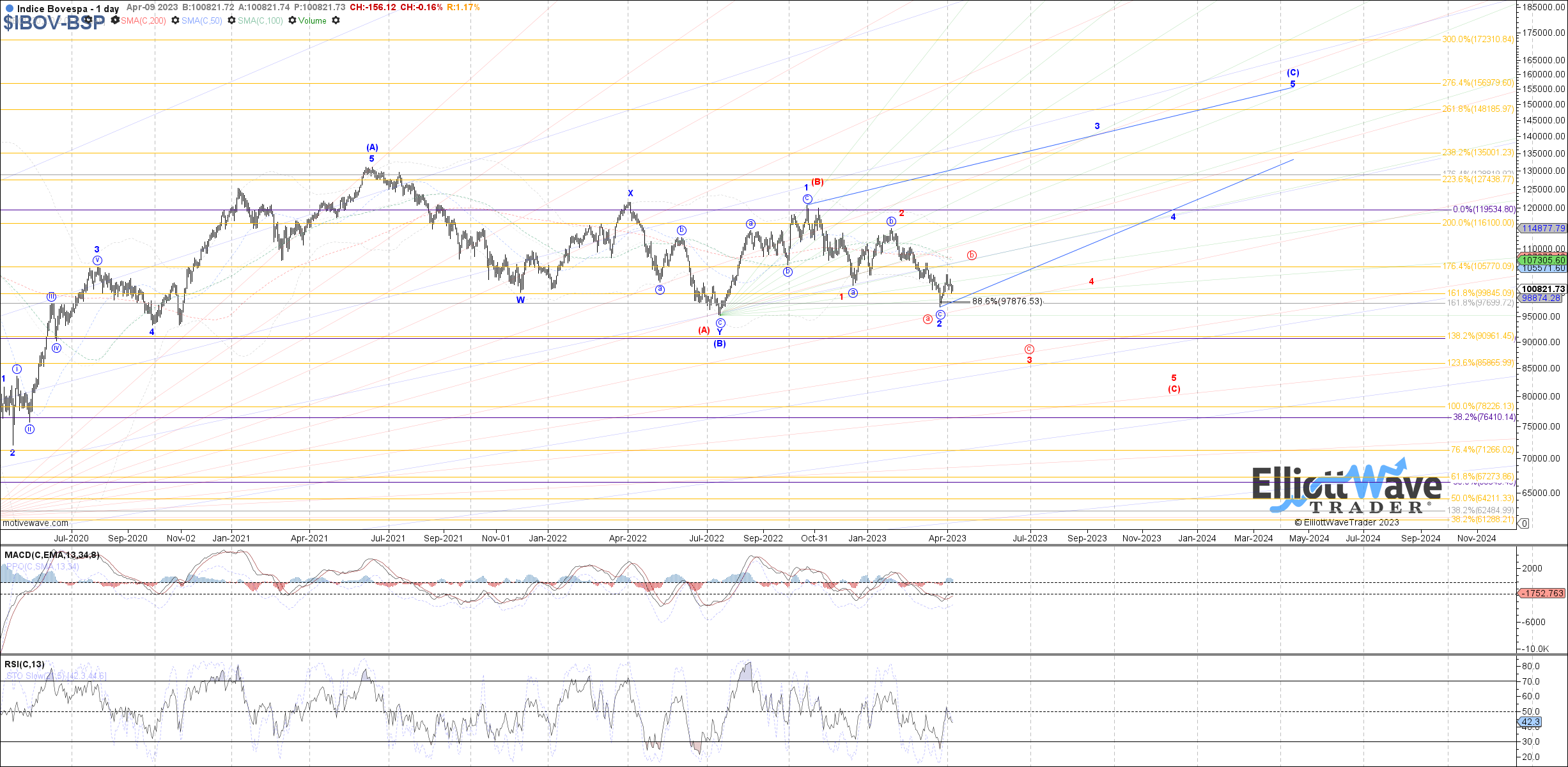

IBOV: The Bovespa traded lower overall last week, coming close to testing the lower end of fib support cited for a corrective b-wave pullback. Therefore, as long as 99500 continues to hold, then I still favor at least on more leg higher as a measured move c-wave that can target 105540 – 107665 before completing. Otherwise, below 99500 starts to open the door to the potential of a direct break back below the March low from here.

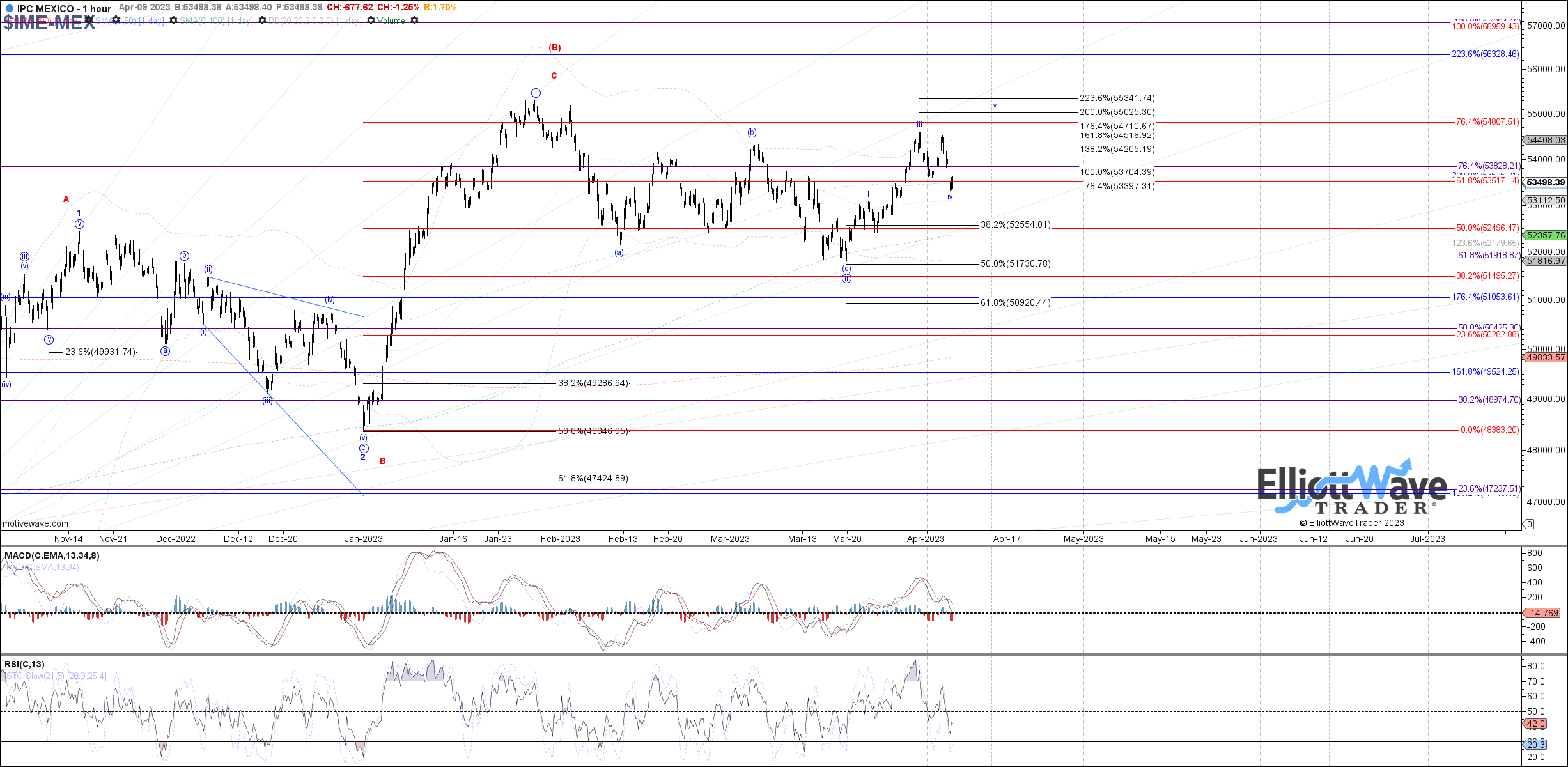

IPC: The IPC started off initially higher last week, but failed to print a new high above the March high and then rolled back over into Friday’s close. With price now testing the lower end of fib support cited for wave iv at 53395, if we are going to get 5 waves up from the March low then this is where it should turn back up from as wave v. Without 5 up, the bullish blue count is much less reliable.