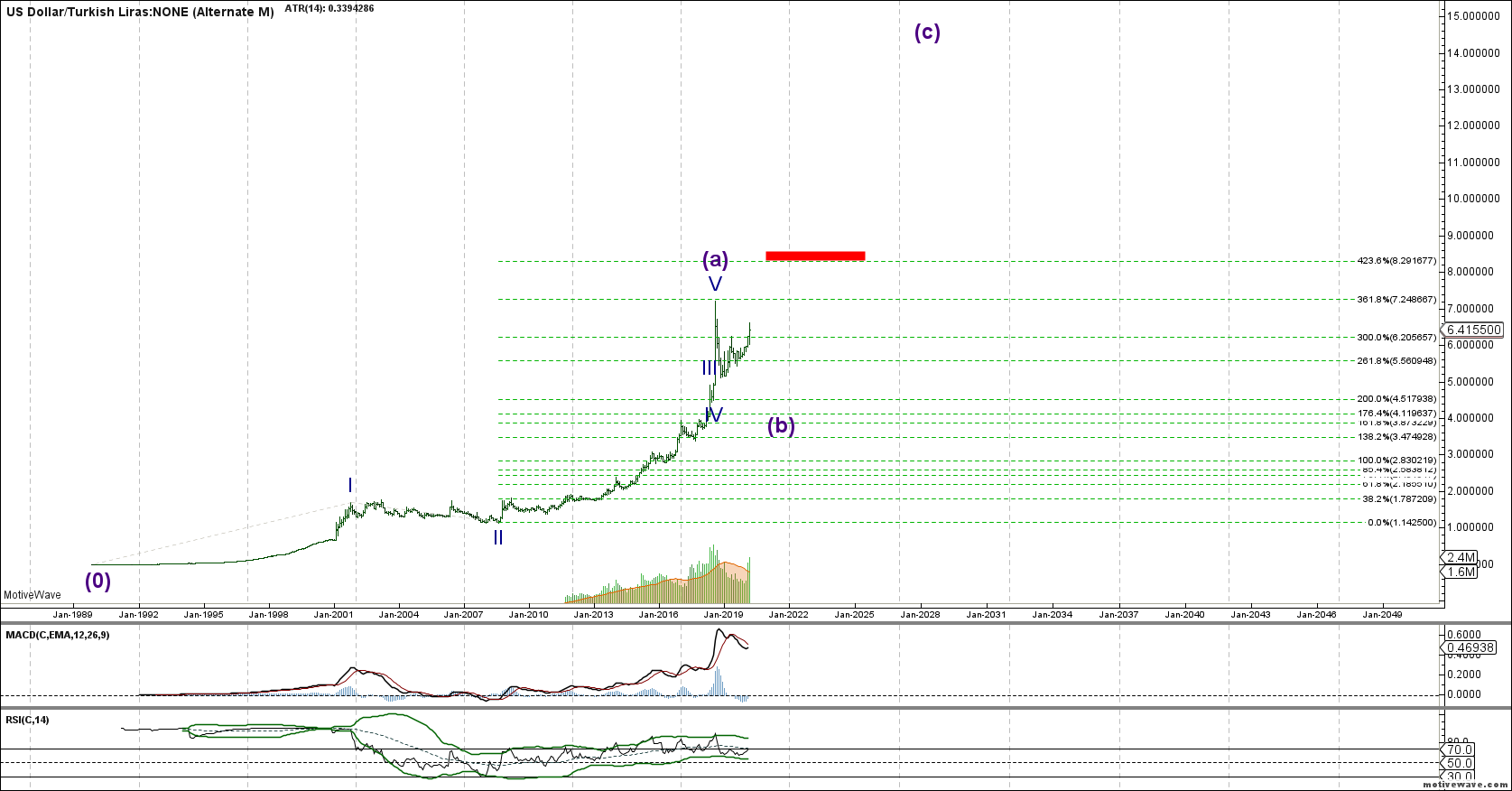

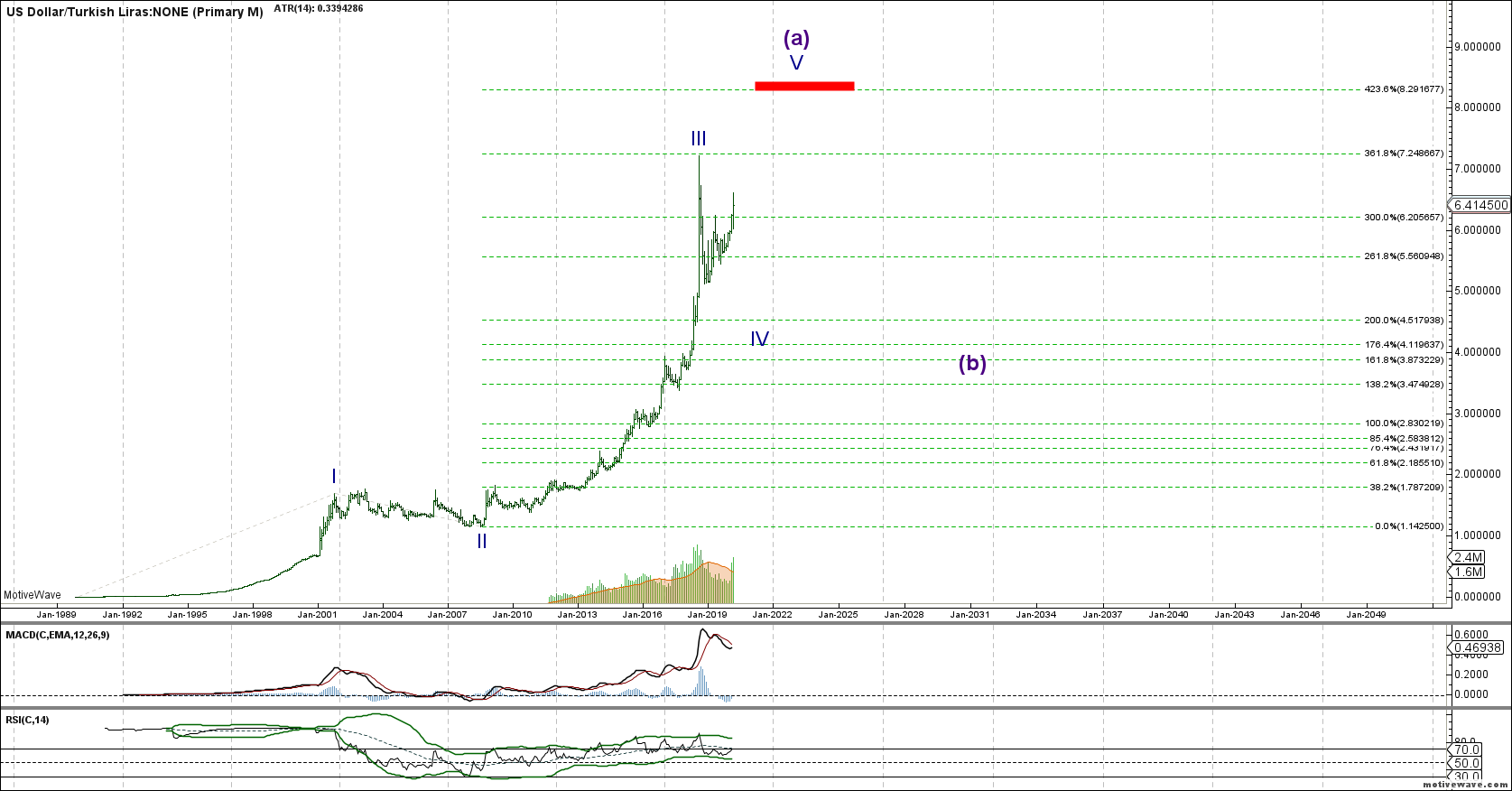

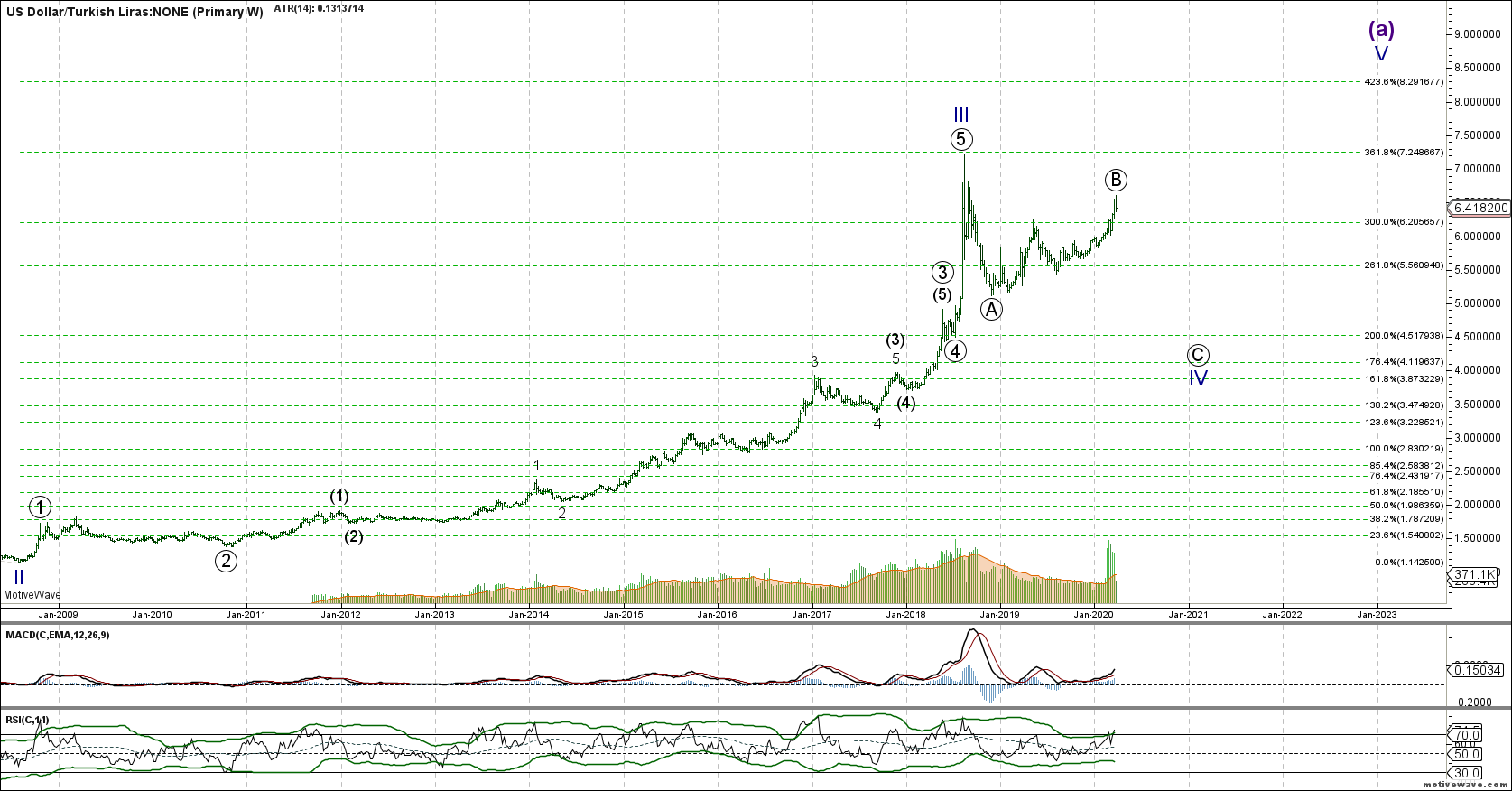

USDTRY, possible scenarios - Market Analysis for Mar 25th, 2020

USDTRY, possible scenarios.

The charts marked Primary present the scenario I consider more likely at the moment. This scenario supposes further correction within wave IV - with extension towards 8.29 region to follow afterwords, within wave V.

I assume that the circled B of IV is not complete - and until 6.135 region is broken down extension towards the 6.99 region remains quite feasible scenario. There a massive plunge could follow to fill the circled C of IV (4.9 - 4.1 area is preliminary target). In the case the pair immediately breaks down 6.135 region the count should be adjusted - and the circled C of IV becomes a reasonable operative scenario.

In the case the pair will directly break through the 7.00 resistance region my next target would be 8.29 - 8.38 area (less likely scenario at the moment).