USDSEK USDDKK USDNOK - Market Analysis for Jul 23rd, 2021

USDSEK: the ideal target is hit (Option 2 Micro count - my preference here). I look forward to pullback but over 8.46 support region I could not confidently consider the pair topped and extension towards 8.88 region remains a doable scenario so far (though I would not bet much money on that extension).

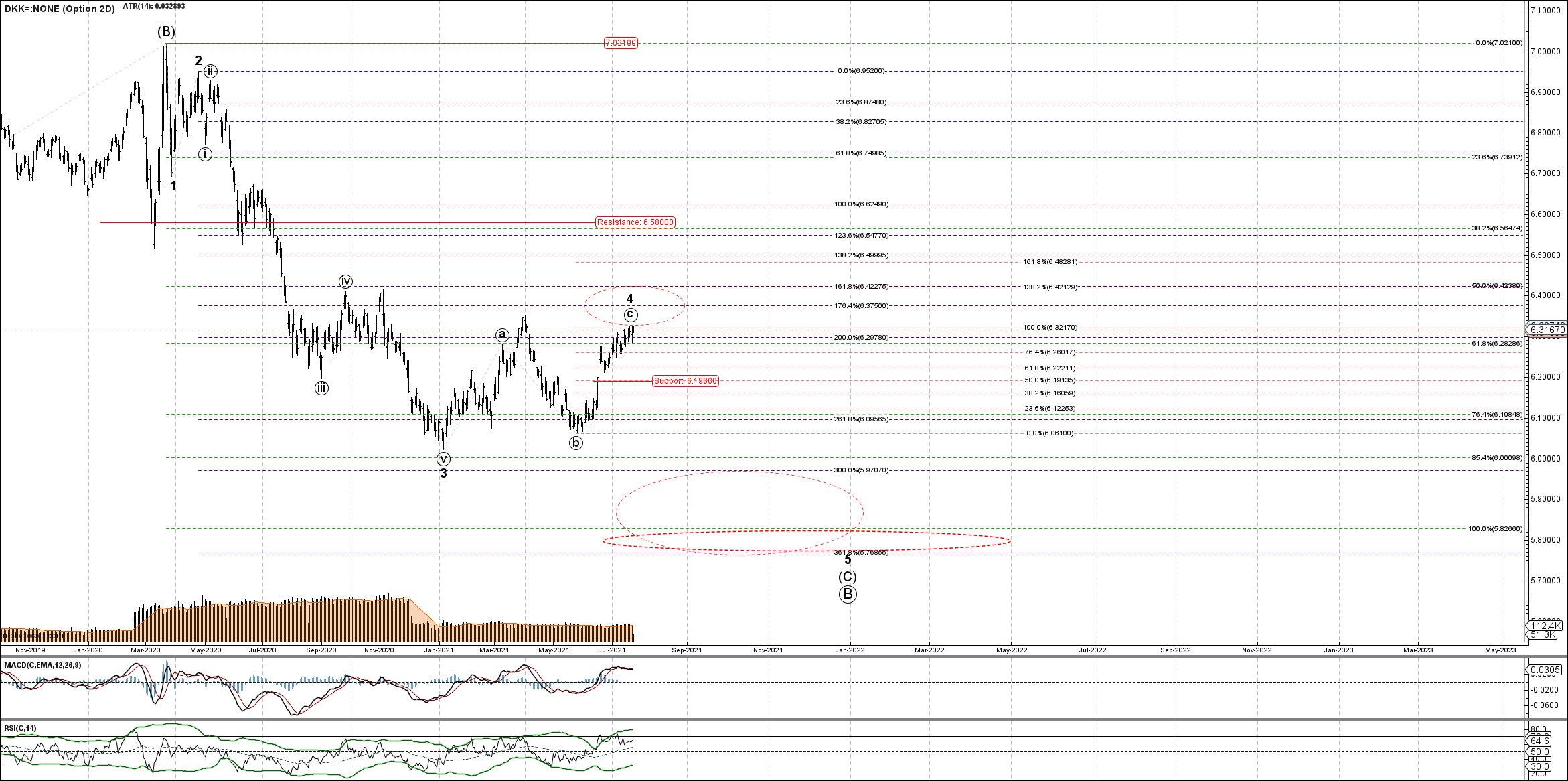

USDDKK: similar analysis applies here - wave circle c of 4 may be done (the target is reached) - but until 6.19 support region is broken down higher extension is still possible and 6.42 remains an attainable target.

USDNOK: Option 2D count suggests that corrective rally may be already topped - and the pair is heading lower within the wave (5) of the circle A-wave. Below 9.1038 that scenario is a reasonable assumption.

However, Option 2D is just one of possible scenarios and as long as 8.51 level is holding adjusted Option 1D looks quite feasible, imHo. Correction could extend lower with no harm to further move to the upside.