USDNOK USDDKK USDSEK - Market Analysis for Jun 4th, 2021

Norwegian krona. Swedish krona, Danish krona

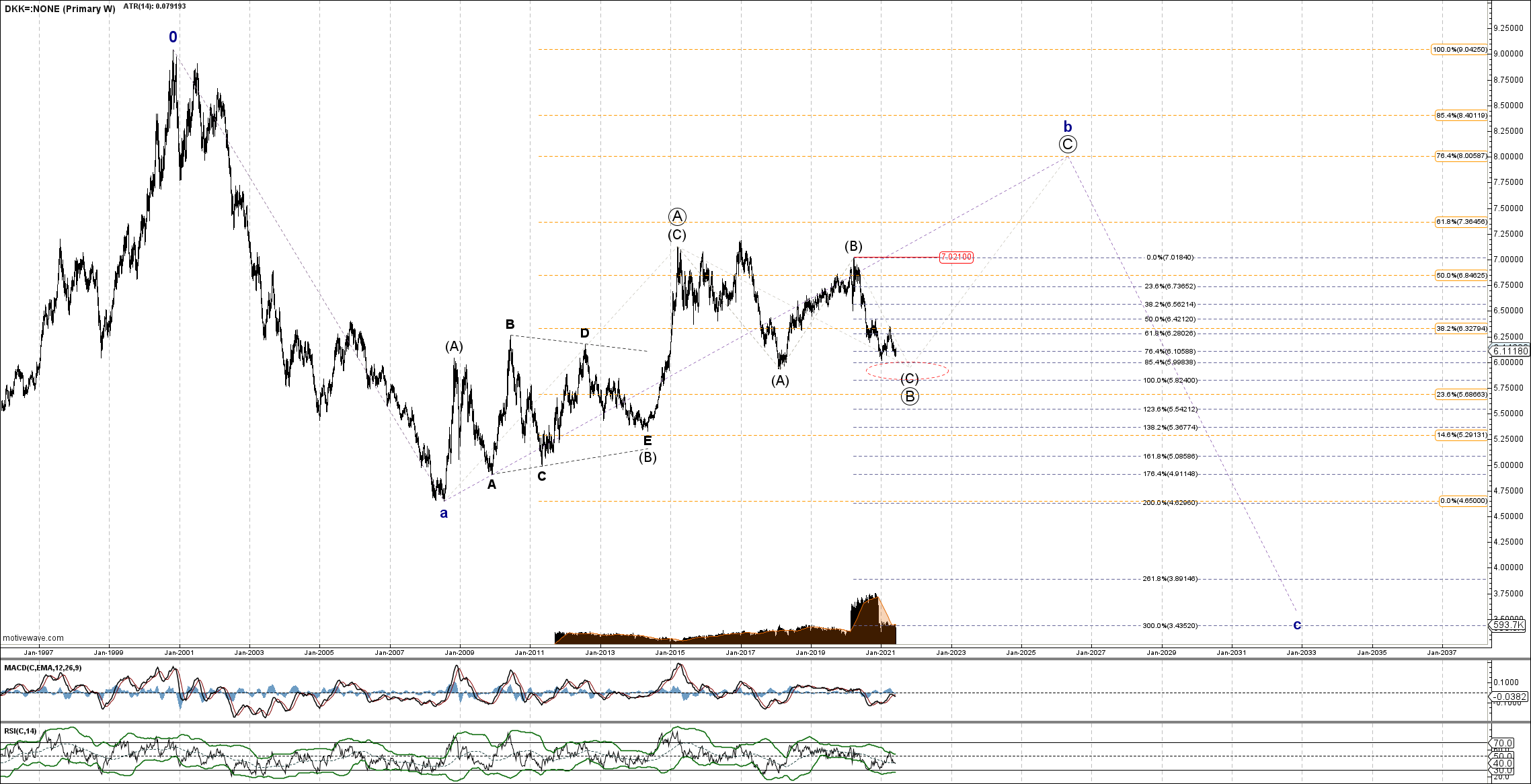

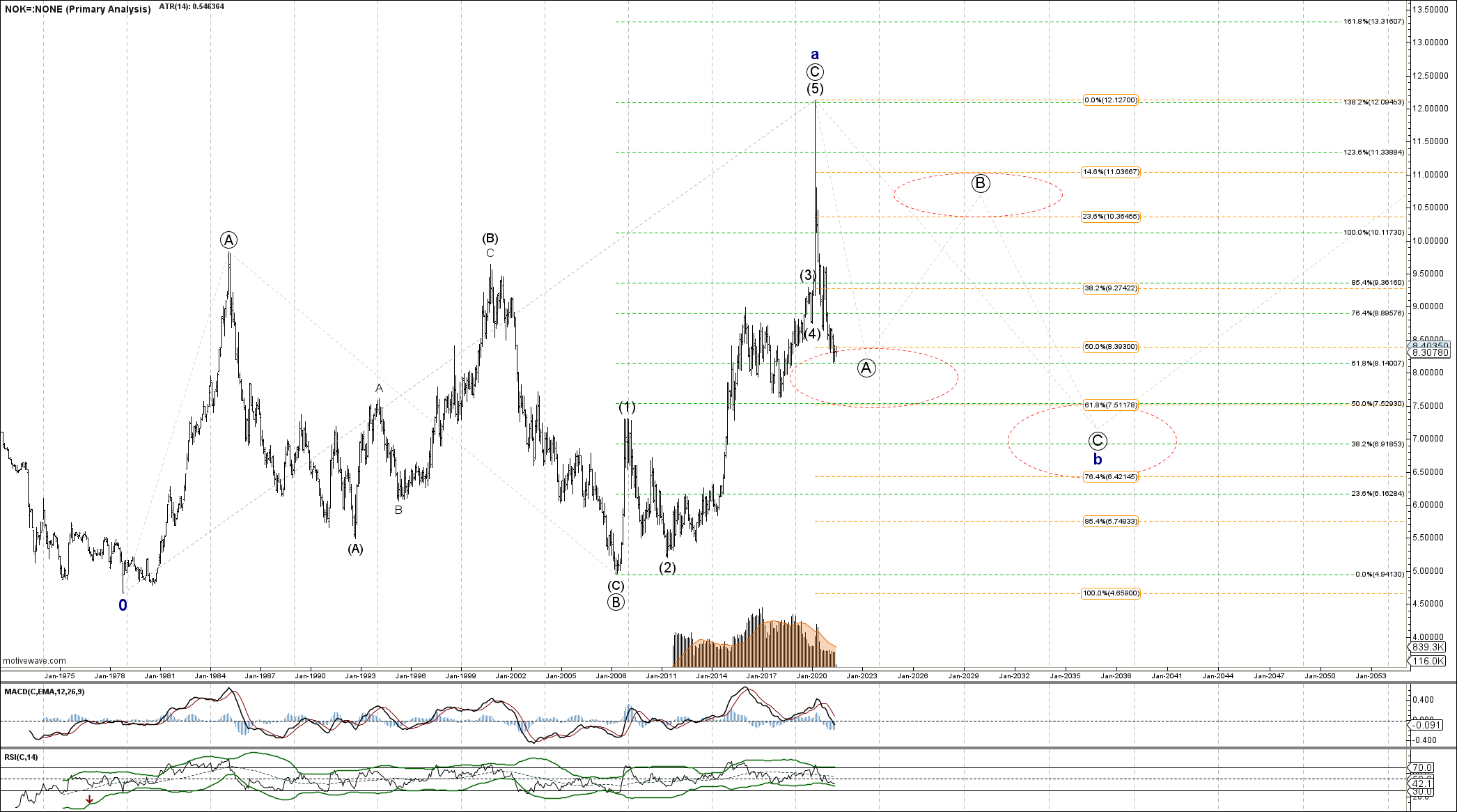

USDNOK: the pair has struck my long term target for the wave circle A. Formally, we can expect decline to 7.56 area - but I have the reason to assume that entire A-wave may have bottomed or about to bottom. 8.0878 region is the next Fib support and I anticipate at least a corrective bounce in the wave (4) - though that bounce very well might head much higher, as the circled B-wave count suggests.

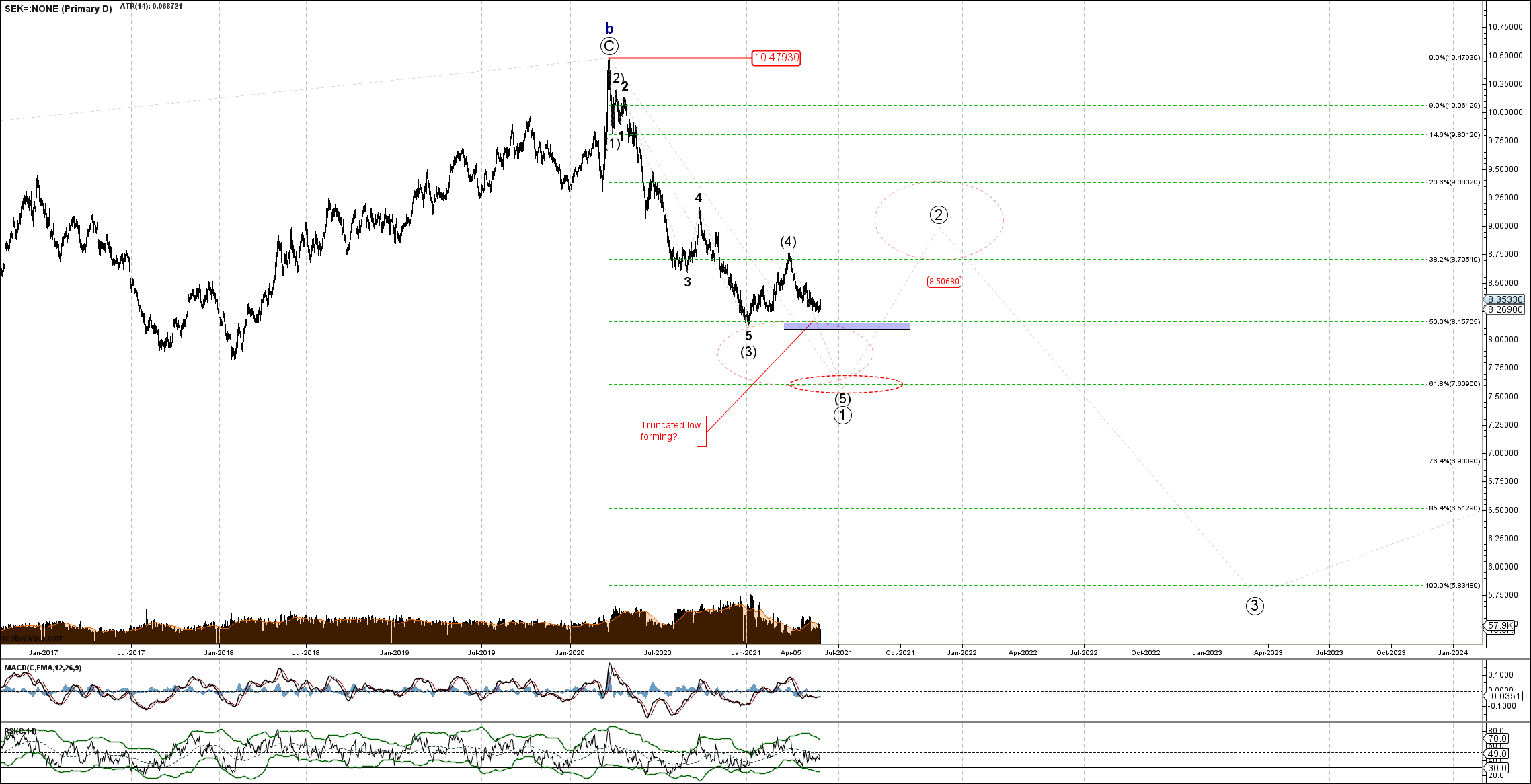

USDSEK: the Primary counts posted a while back reman applicable, with minor adjustments. The ideal target for the move down off the March 2020 top is 7.609 region and this target remains in the cards.

However, internal wave structure of the move down within presumable wave (5) is telling that decline might stop well above the ideal target - 8.157 region is the pivot support region.

Below 8.5068 decline scenario in the wave (5) remains on the table - but above this line there would be initial indication of a meaningful low.

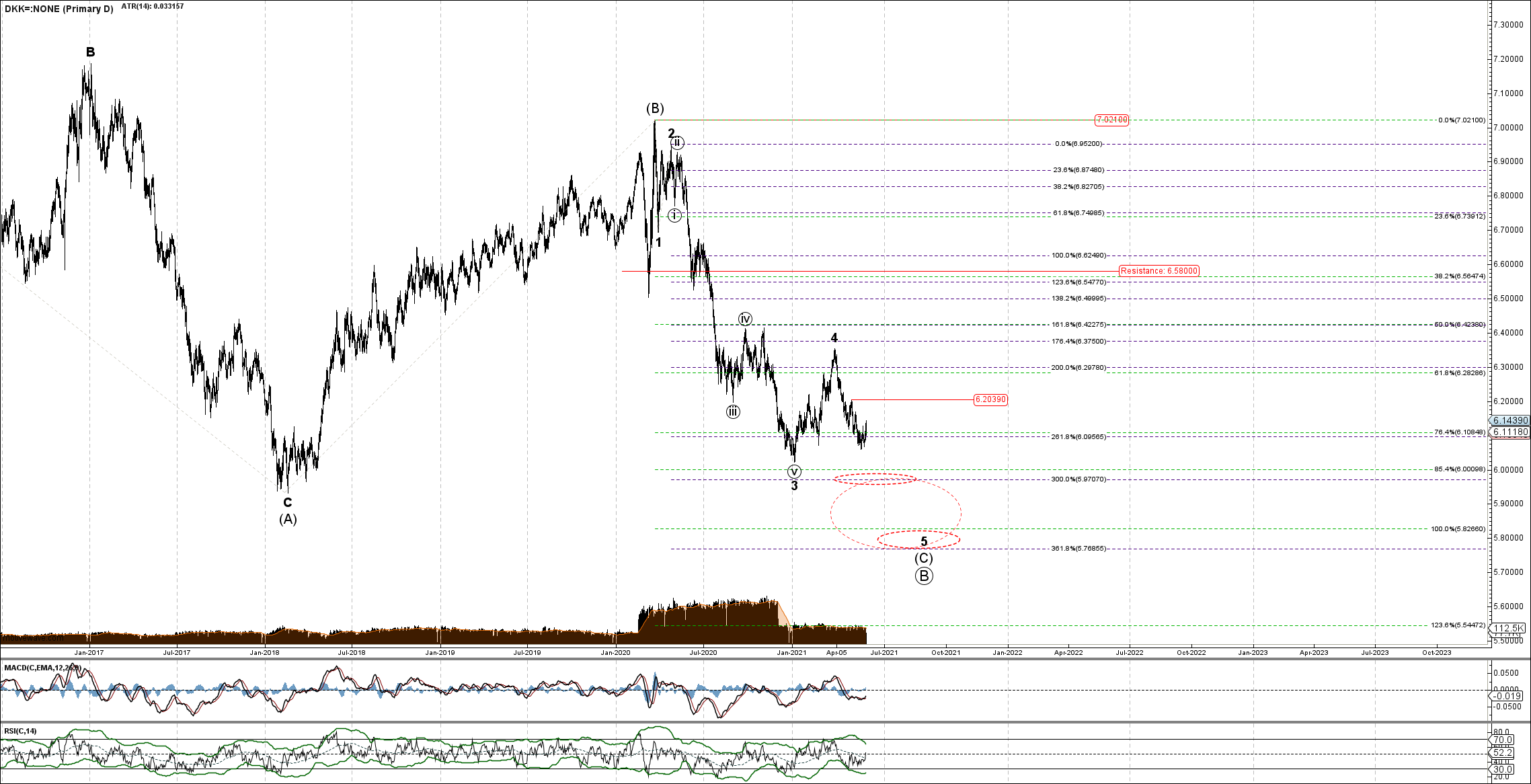

USDDKK: extension to 5.97 region remains a reasonable expectation - but I would be careful with shorts as the pair is meandering just above the major target region. Below 6.2039 I could not consider decline completed - but above this line I will have the reason to assume the larger degree decline is bottomed.