The Actionable Takeaway Of Doing Nothing

What is the role of patience in your trading and investing decisions?

Patience may be the first lesson we approach in the new Thursday Intermediate Series. As Avi mentioned, the goal of that series will be to educate in approaches to applying an Elliott Wave analysis to some trading decisions.

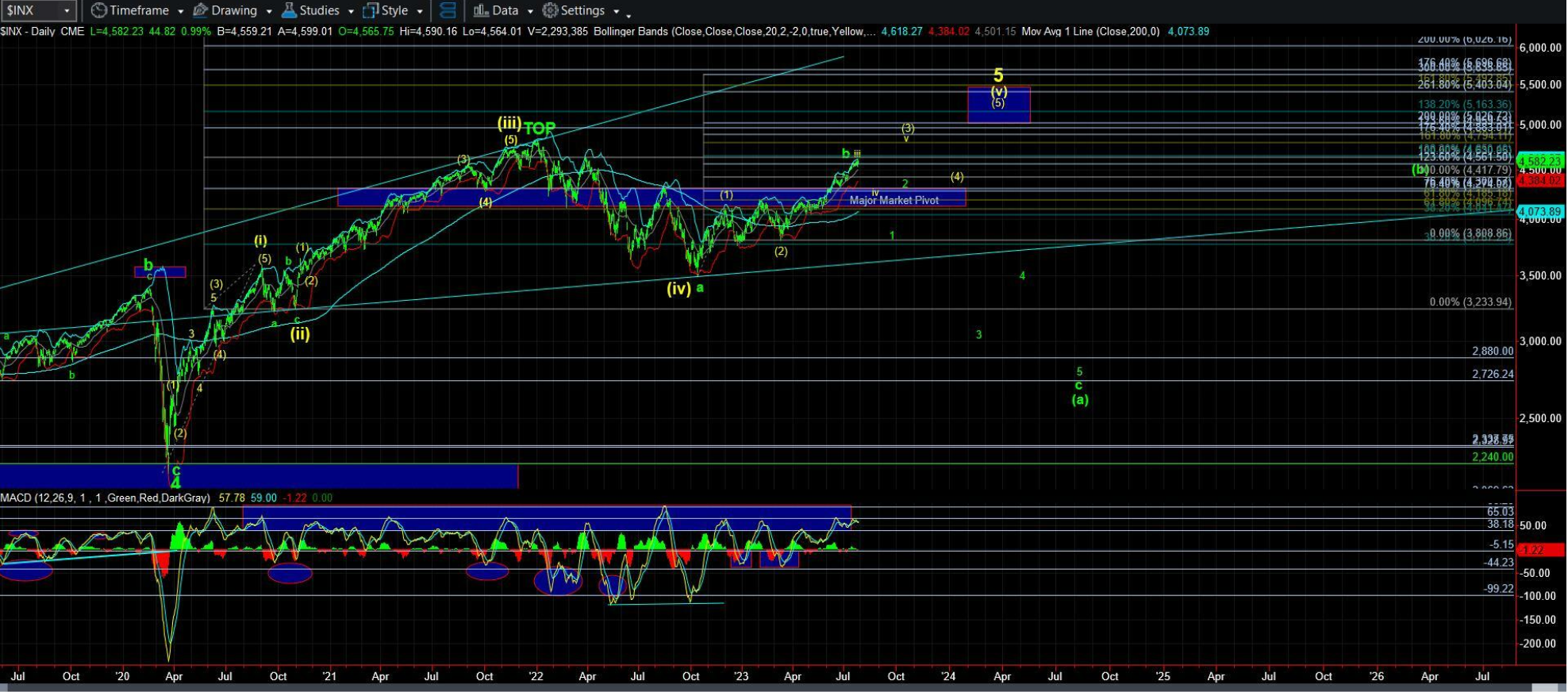

There's a growing feeling of restlessness in the room here that's manifesting in some pushiness for declaring a clear victor between the green b wave topping count and the yellow count to new all time highs in the SPX.

At the recent team meeting we discussed some of this "antsyness" and the occasional push from members for providing singular, clear, and actionable paths - rather than "if this, then this" and potentials and alts.

We continue to see "forcing" such determination upon our analysis of the markets as a major disservice. Consider that analysis that doesn't present a clear immediate actionable path is perhaps the most valuable information about a chart

The "actionable" takeaway in such instances is to do nothing. Markets are consolidating, expanding, and retracing all the time. Does that mean that everyone of those patterns warrants an overt action from us as traders and investors? I would answer that with a resounding "No". Most moves do not warrant activity from us as traders.

Using Elliott Wave analysis, we have a consistent, high quality pattern, that offers great risk to reward skew and high confidence in followthrough, and this pattern transcends asset classes. That is the 1-2, i-ii setup. When these arise, the market is "telling us" with heightened confidence what the next big moves will be. That's what we're waiting for. And, given the fractal nature of markets these will happen within different larger degree contexts but they are not happening all the time.

Of course there are many big moves that fall outside of this but why is that your concern. The goal is to make money, not to trade every move all the time and make your life difficult. Having an emotional need to trade is not going to provide you a recipe for success in this business

So, as analyst's we're posting charts in the room all the time and these charts posit different paths. Does that mean that we should go out and trade all of the different projections of every chart? No! Most of the movements in the markets do not offer obvious outcomes. If they did, our business would be among the easiest in the world.

A few comments about the Elliott Wave context for SPX:

1) While I can count 5 subwaves in the move from the 2020 low into the all-time high, the SPX did not provide a clearly satisfying 5 wave structure from a Fib Pinball standpoint.

2) The move into the October 2022 low while valid as prospective wave (4) was too deep to consider that a reliable interpretation

3) With an eye towards long term risk management in consideration of the larger degree pattern which is very full to the upside from the 2009 and 1974 and potentially even 1932 lows, we've considered the rally from the October 2022 low to be forming a larger (B) wave - meaning a bounce before continuation downwards, rather than the start to a new cyclical uptrend.

4) Though the pattern from the 2022 low is not strongly suggestive of higher highs, the continued ascent and now close proximity to the all-time high warrants reasonable consideration of that prospect, ie, the yellow count

Avi proposed 4300 as his expected target for this (B) wave and now price has exceeded it. The pattern from the 2022 low has not been terribly suggestive of a move to new all-time highs but please look back at the major B waves over the last 20 years...the 2007 high slightly breached the 2000 before the Primary C wave crash...and the February 2020 high massive exceeded the 2018 Primary 3 wave top before crashing in the (C) of Primary 4.

At this juncture, ask yourself if an analyst providing hypothetical guidance like "We definitely are topping in the (B) wave and starting a big crash into mid 2024, no chance for 5000 SPX" is a service or disservice to you? Consider this question in light of the aforementioned B waves. As the (B) wave rose in late 2019 there were people shorting the entire way up...based on the (B) wave guidance. Was it smart to do so? No. But, I like to think that the high quality lesson from that for analysts and members alike is to be patient in waiting to call a B wave top in place and even more patient in taking a short trade.

Will SPX get to new highs? I don't know. Personally I still lean towards this being a (B) wave from the 2022 lows but will not rule out the prospect of a higher high even in that context.

The SPX is in a posture that we like to call "major inflection points" where the nearer timeframe action can give us much better insight into the next 8000-1200pt move.

It behooves us to wait for clear evidence of (past tense) having topped in the (B) wave or the SPX retracing correctively to support before we take our next action. Trying to force something up here is not a recipe for success