Support Levels To Watch As European Indices Close Lower

The FTSE 100 started off initially higher today, but then rolled over into the close. So far price is still holding the 7775 - 7835 fib resistance for a corrective bounce as blue wave (ii) and has only produced 3 waves up from last week's low. Therefore, not a convincing start to red wave v and if price otherwise rolls over back below the May low from here, then it will likely trigger a larger drop as blue wave (iii) of c.

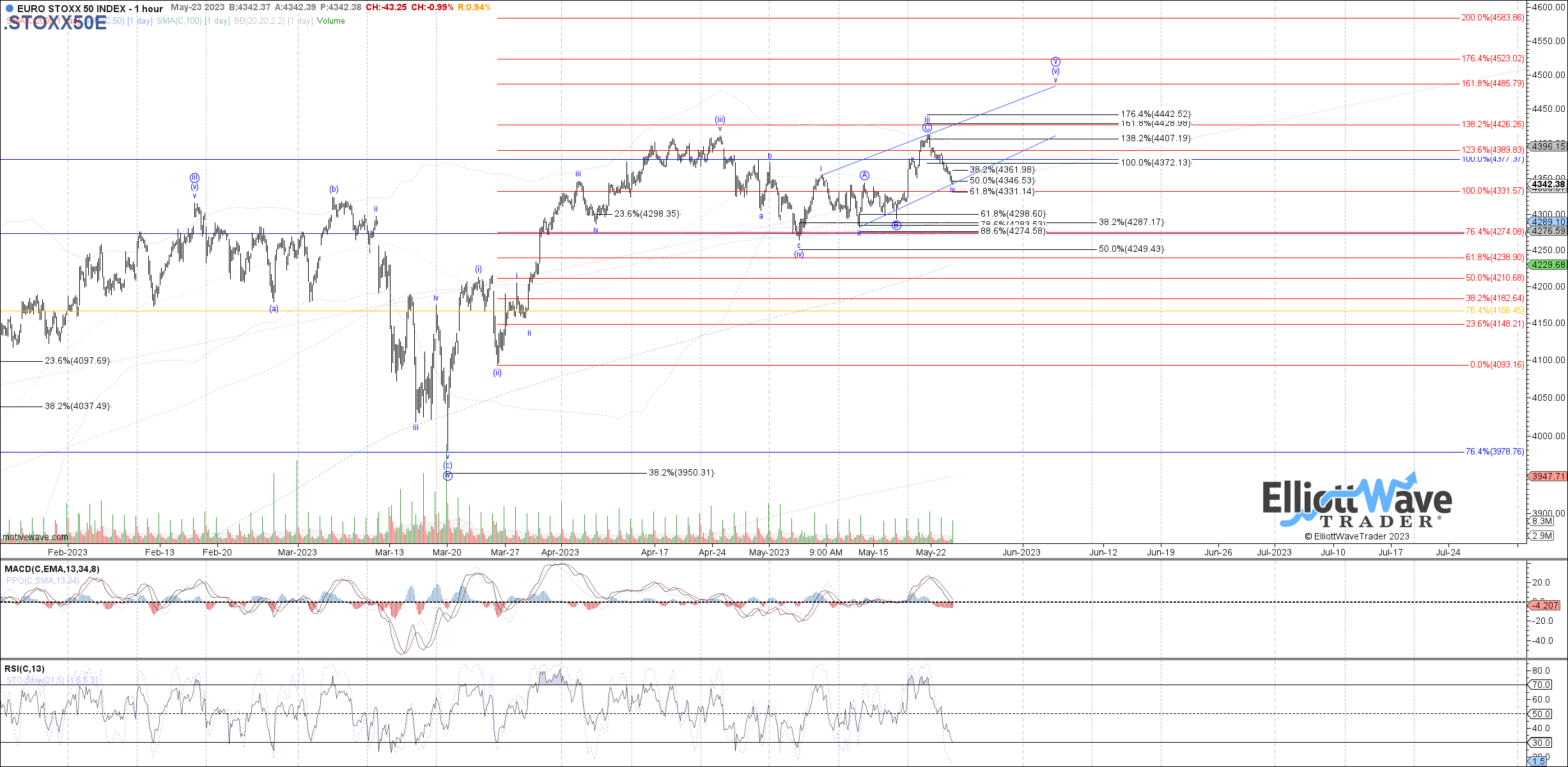

The Euro STOXX 50 traded lower today, now testing the .500 retrace at 4345 as the middle of fib support cited for wave iv of (v). The .618 retrace at 4330 is the next fib support, below which makes another high as wave v of (v) a much less reliable expectation. As long as support holds though, then one more high would still look best.

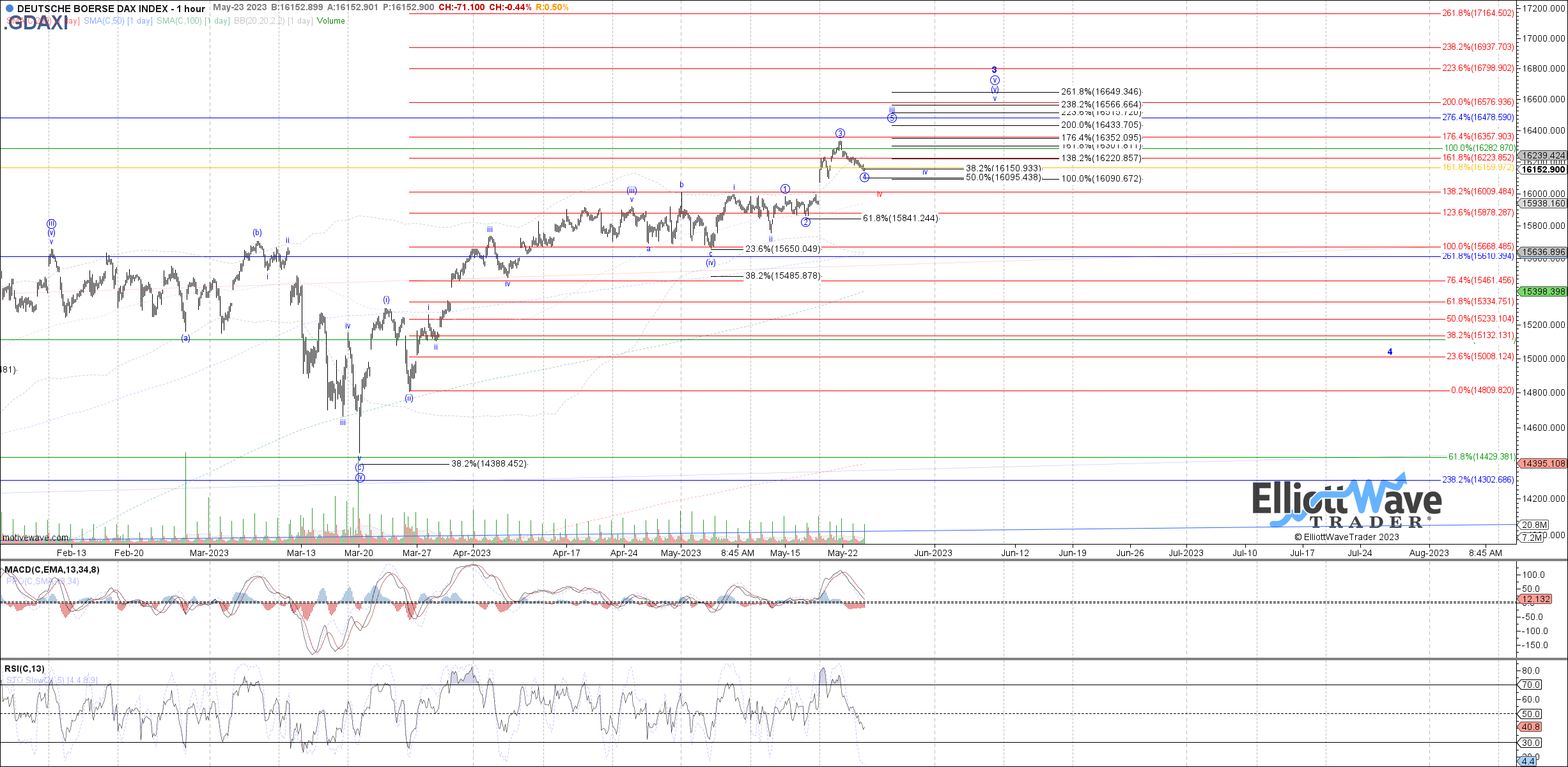

The DAX Performance Index also ended the day red, but so far is just testing the 16150 - 16095 fib support cited for wave 4 of iii. If that support fails to hold though, then price would likely be in the next higher degree wave iv already, and potentially morphing wave (v) into an ending diagonal. In that case, 16040 - 15970 would be lower support.