Stock Waves: COST, V, and SPX

This issue of Where Fundamentals Meet Technicals looks at two profitable growth stocks, but with diverging outlooks in terms of bullishness and bearishness.

Costco

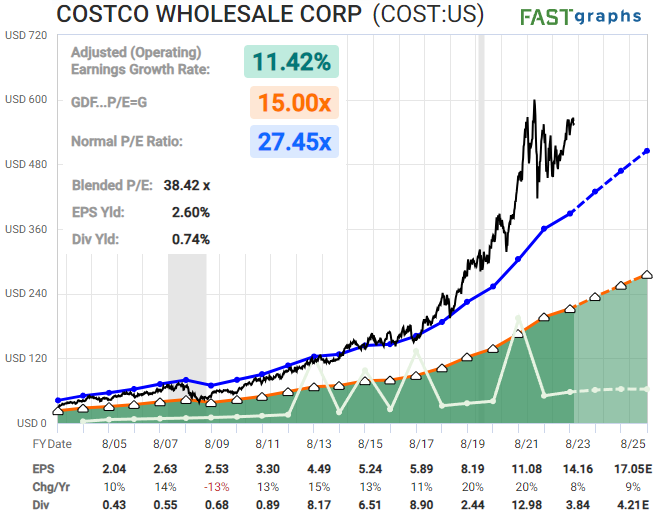

Costco (COST) has been an absolute powerhouse for decades, with great growth that continues to surprise analysts (including me!) to the upside.

The company has a great balance sheet and is known for being particularly well-managed compared to other membership stores, and it does make sense to pay up for quality.

However, the valuation has become quite high. Many people paid up for Coca Cola (KO) and Walmart (WMT) in the 1990s and ended up having a lost decade of returns because of that, even as the underlying companies continued to grow.

If Costco were to return to its historical average valuation (which is still rather high, being a premium company and all), then it could chop along sideways for 4+ years as earnings catch up.

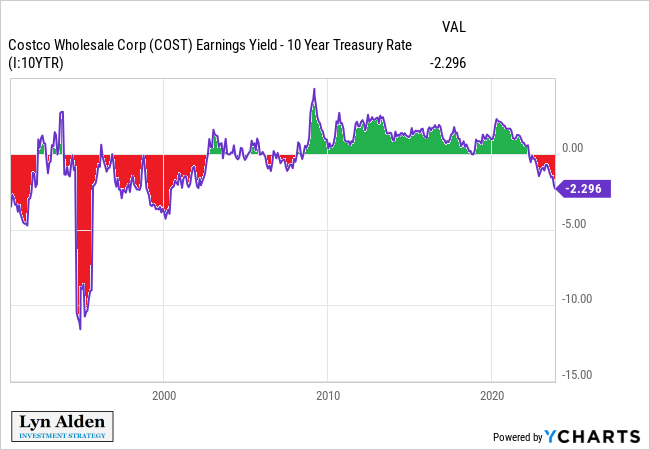

And if we factor in higher Treasury yields, then the valuation could have another point of pressure. The spread between Costco’s earnings yield and the 10-year Treasury yield is the most negative it has been for a while. And decades ago when it was more negative, Costco had a lot more growth from a smaller base. As a much larger and more mature company, it is riskier for it to have this big of a spread relative to Treasury yields.

So, am I bearish on the fundamentals of the company itself? No. Would I short it? Not personally, no. But the 5-year prospects for forward returns on a risk/reward basis are not compelling to jump into as a new long, in my opinion.

Zac’s latest technicals point in the bearish direction for the next few years:

Visa

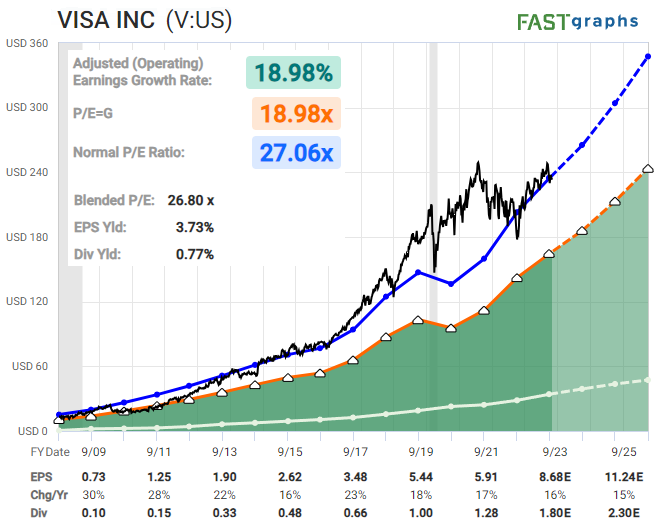

Visa (V) like Costco got ahead of itself in terms of valuation a few years ago, and chopped along with no returns for a while until fundamentals have caught up. But caught up they have.

Visa has a lower valuation than Costco, and higher forward earnings growth expectations by analysts that cover it. And even on a relative basis, Visa is closer to its own historical valuation average than Costco is to its own average.

Visa arguably has more tail risk than Costco, in the sense that attempts by the United States and Europe to introduce CBDCs or CBDC-like networks could disrupt the dominant payment networks of our day, while there’s really not much on the horizon that could disrupt Costco other than some supply chain issues here and there.

So, for the same level of growth, I would indeed pay up a bit more for Costco than for Visa, but the current gap is too wide, in my view.

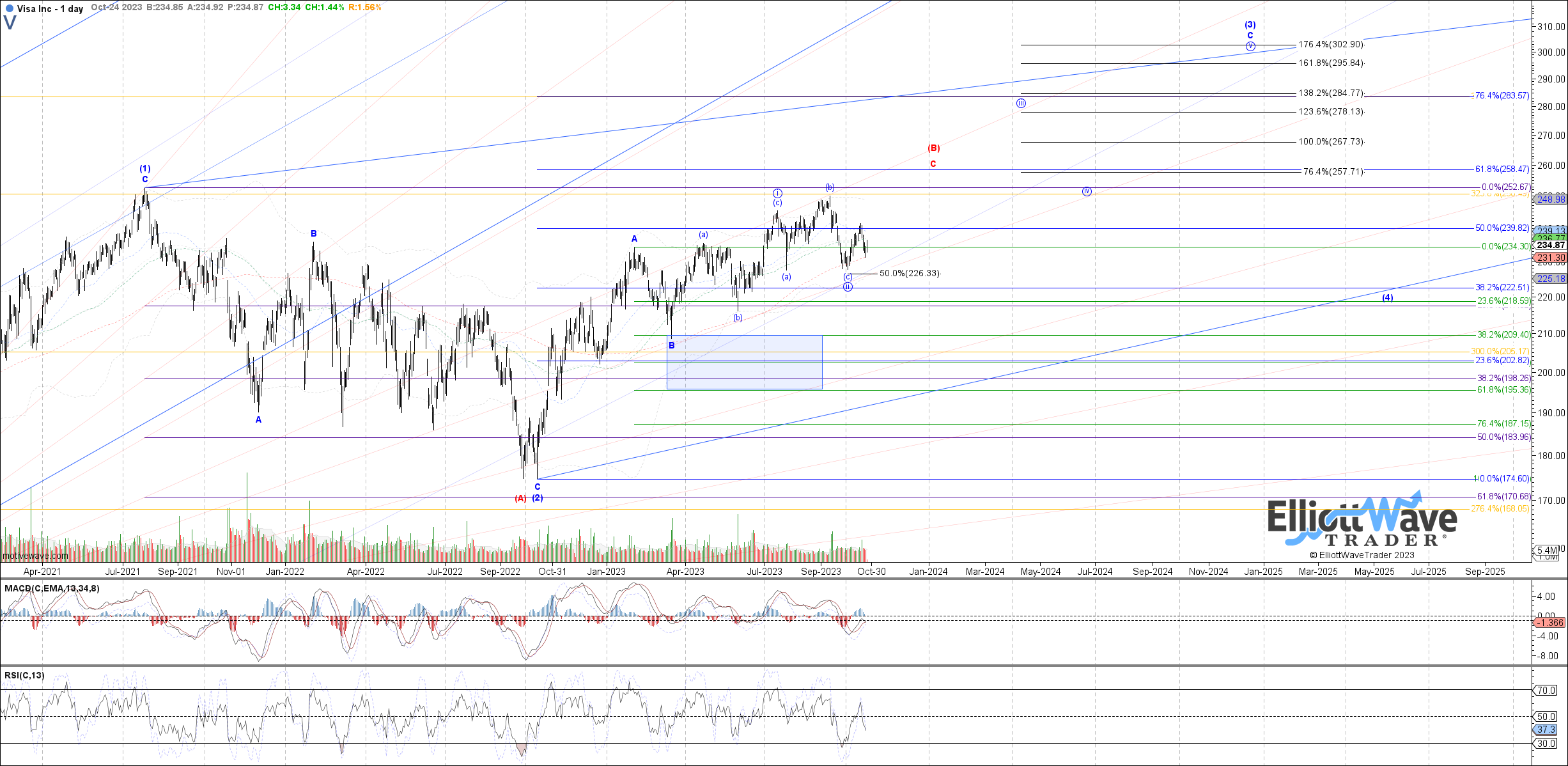

Garrett's latest charts show more potential upside for Visa before it potentially encounters a correction.

From both a fundamental and technical standpoint, I have a long view on Visa and a cautious view on Costco, even as I expect the underlying companies of both stocks to do well.

Broader Implications

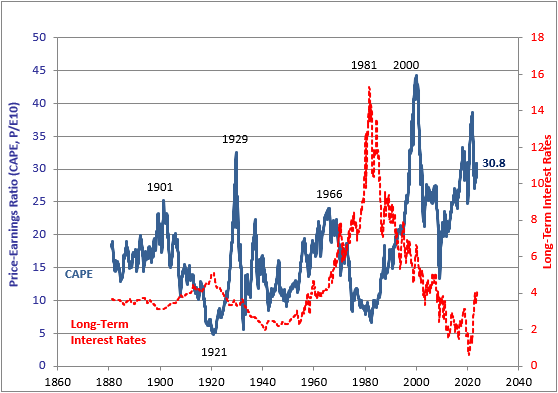

The US stock market has had four decades of steadily declining interest rates and steadily higher equity valuations, with a brief dotcom bubble surge thrown into the mix as well.

China began opening up more to the world in the 1980s. The Soviet Union fell and its territories opened up more to the world shortly thereafter. Western capital was united with eastern labor to build all sorts of new and inexpensive manufacturing capacity throughout east Asia. Cheap Russian gas was connected to Europe, which in particular powered the German industrial sector.

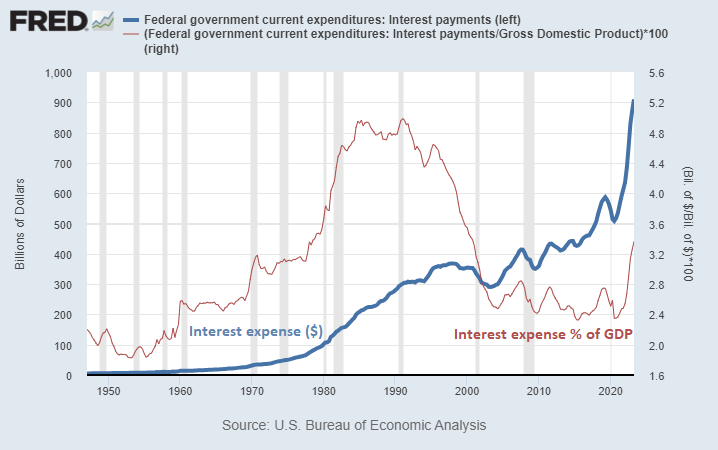

This three decade “peace dividend” enabled a strong period of disinflation, which helped lower interest rates. And with lower interest rates, the interest expense on the ever-rising public debt loads was quite manageable.

But as we enter the next era, there are two big countertrends in play.

First, interest rates have bounced off zero, and are now in a sideways or potentially even upward direction. Even if they just chop around between 0% and 6% for the next decade, in a rangebound fashion, then that’s a very different situation than the ever-declining rates of the past four decades. The tailwind for ever-higher equity valuations is gone, and has been replaced with the risk of ever-higher public interest expense instead.

Second, the peace dividend has seemingly ended, with more division between east and west. The energy ties between Russia and Europe have taken a big step back, and while the industrial ties between the US, Europe, and China remain in play, the rate of change is no longer there. In other words, the labor offset from west to east is unlikely to have the same disinflationary force as it used to have.

Zac has a rather rangebound technical outlook for the S&P 500 in the years ahead:

While I don’t try to guess highs or lows, my outlook from a fundamental perspective is similar. S&P 500 earnings could go up 50% over a multi-year timeframe as S&P 500 equity valuations get cut by a third, for example. The result would be sideways, if that were to occur.

A 5-year Treasury note yielding about 5% will produce more than 25% total compounded returns in a five-year period. Alternatively (and in my view preferably), a 5-year TIPS note gives investors almost a 2.5% real yield on top of whatever CPI will be. So the risk-free hurdle rate for stocks to beat over the next five years for conservative investors is not zero; it’s about 25% or more. If we add a decent equity risk premium, it would make sense to seek 40% or more equity returns over the next five years, in order to compete with those yields.

And for that reason, I expect equity returns to be lackluster overall. That doesn’t mean they can’t touch new nominal highs, or that they will crash, but rather just that the 5-year forward return prospects for the broad market seem to be lackluster when compared to low-risk alternatives, especially when adjusting for risk and volatility.