Sticking with the Multi Month Swing Trades

Not seeing anything to change my tune....Back out play the Daily charts (if you have a swing trader mentality).

Likely to be a bunch of noise the next 48 hours and this week with FED, NK summit etc etc....

I'm headed to New Yawk for a work deal in a bit for my flight...so won't be on much till Thursday when i return.....keeping my core swings as posted to Jan, Mar and June 2019....and some of the momo shorter dated for now...

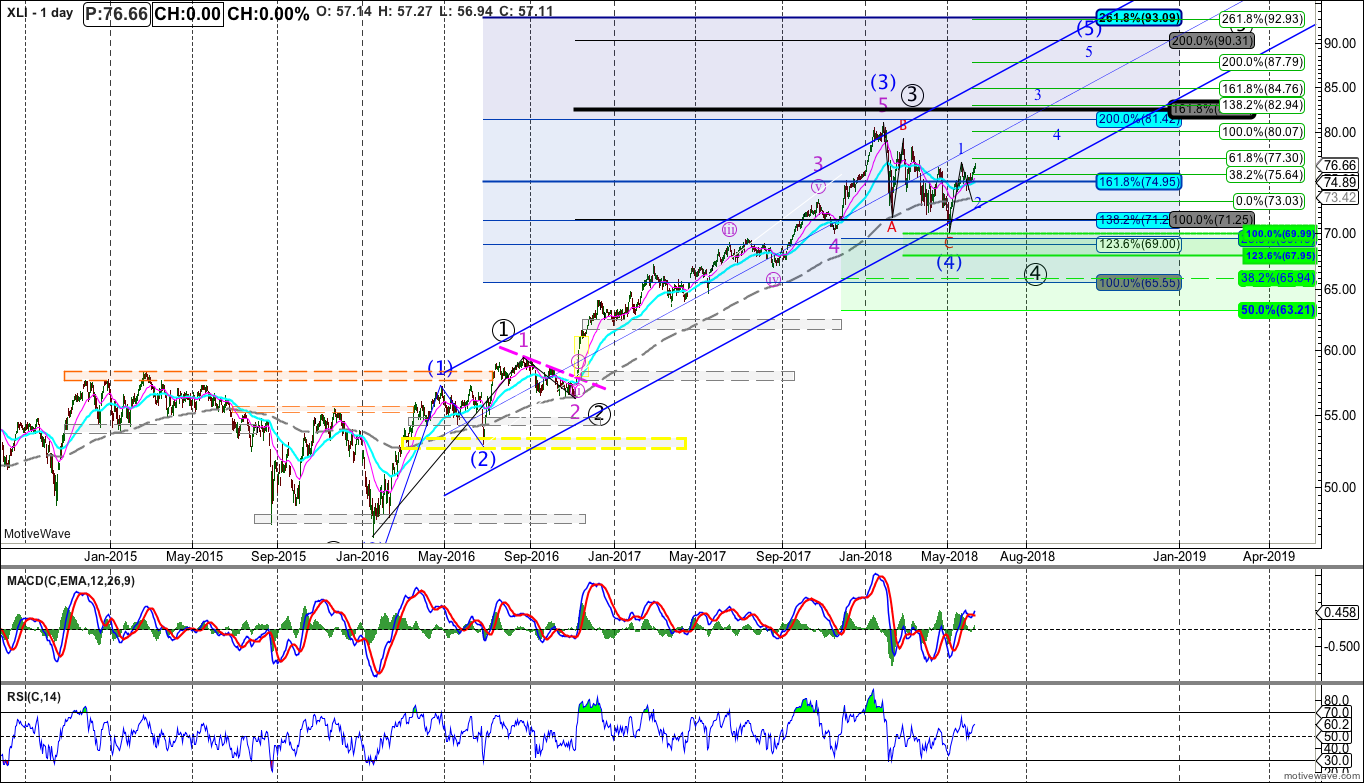

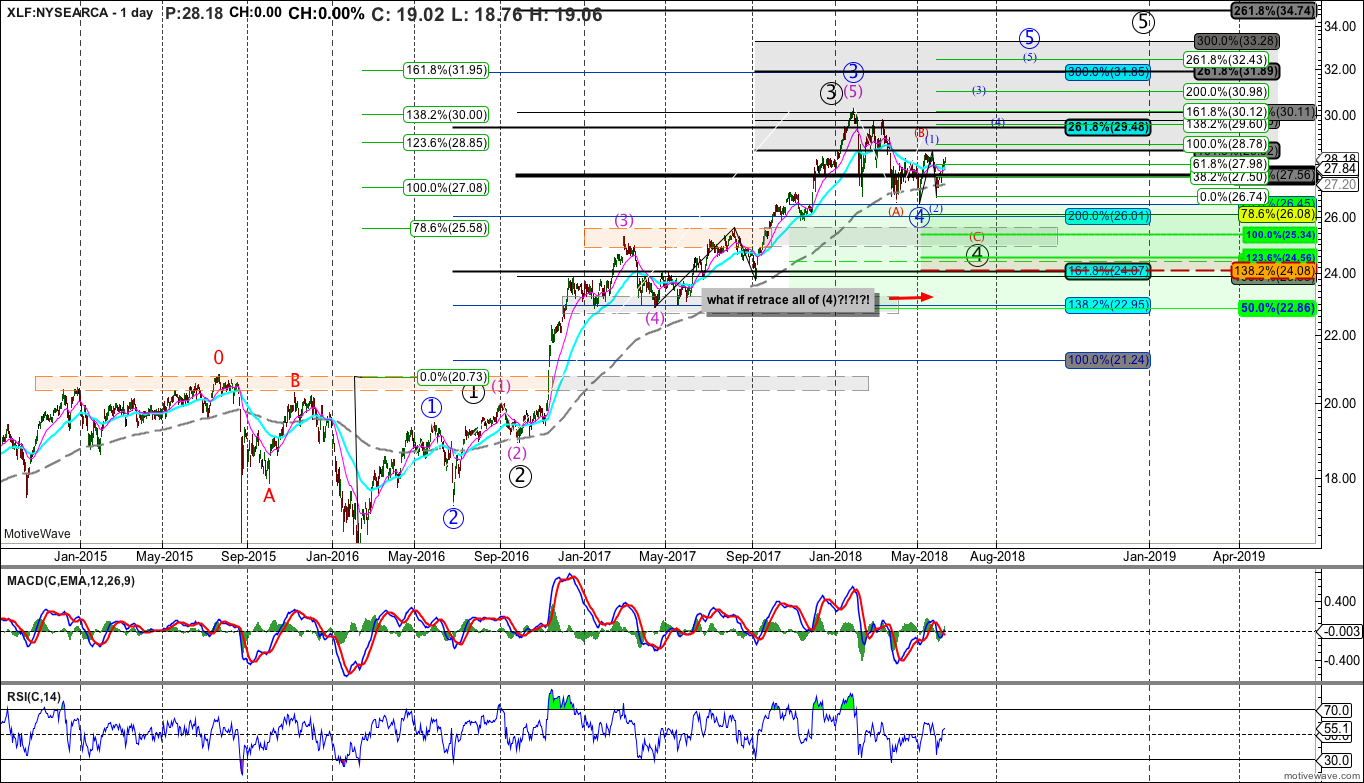

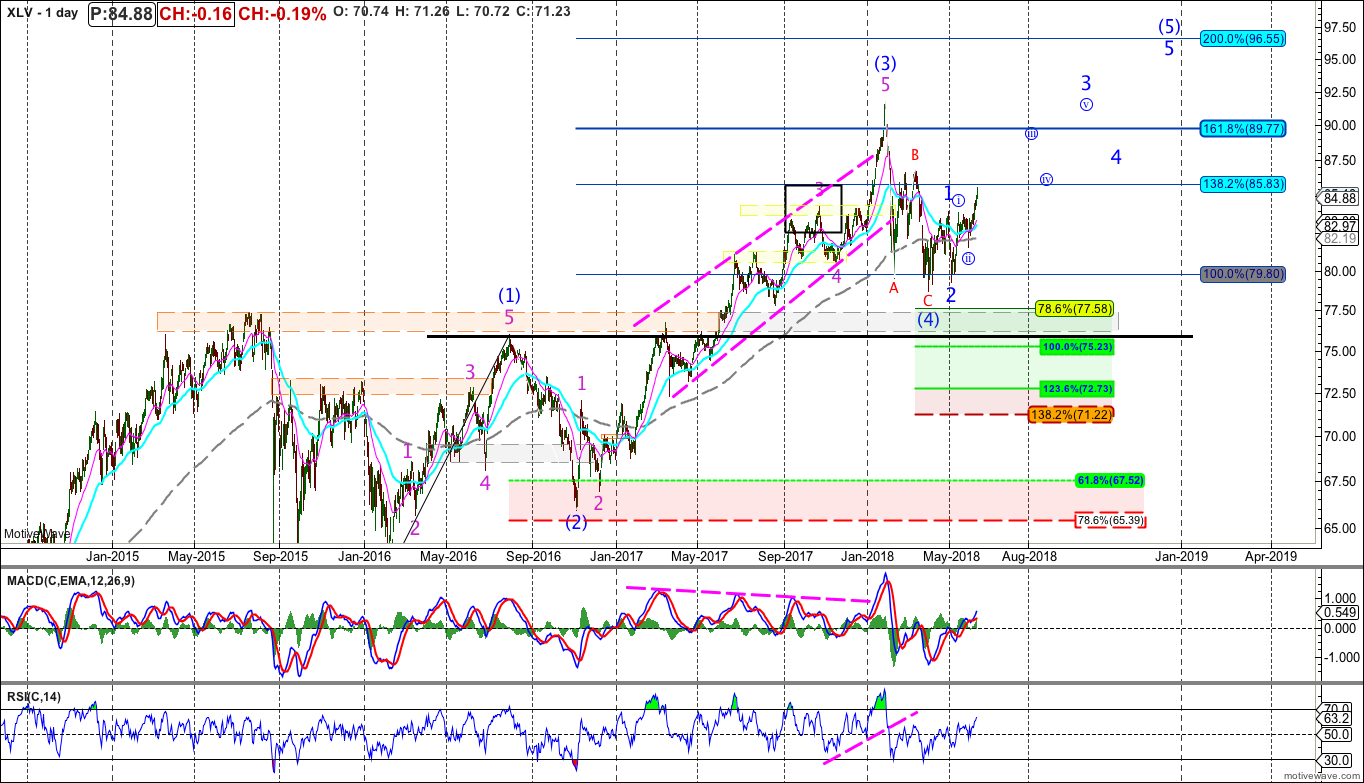

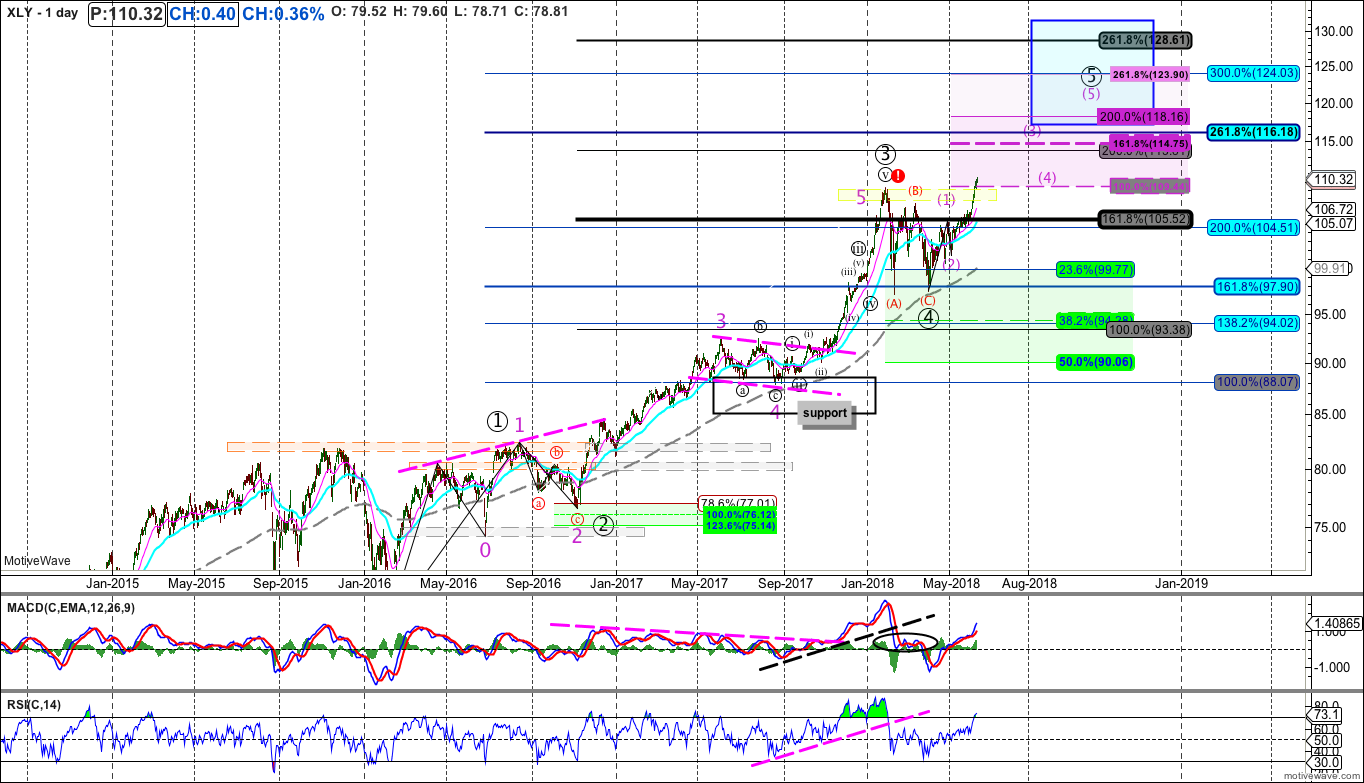

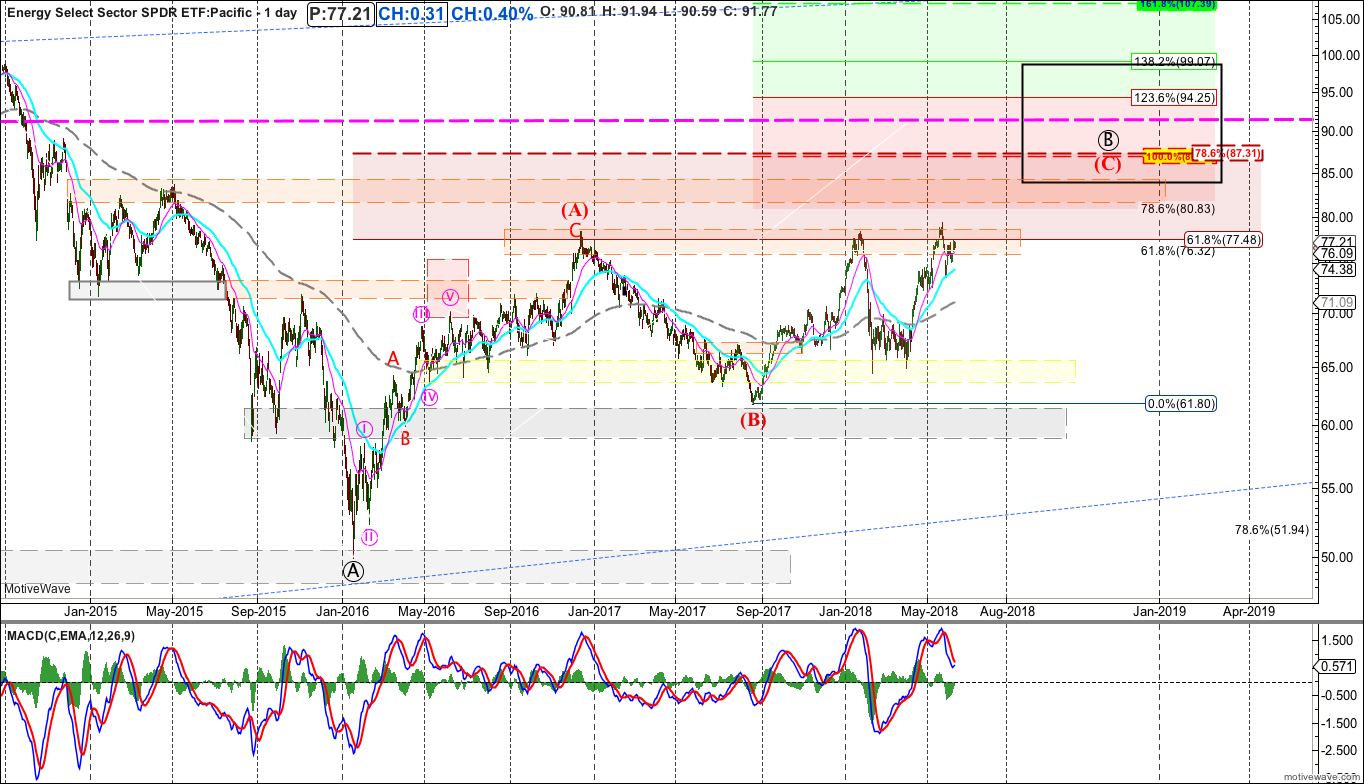

As Industrials, Materials, Financials and HC keep strenghthening I believe they will LEAD as stated a bunch of late...Consumer Discretionary and Energy just needs the continuation leadership....

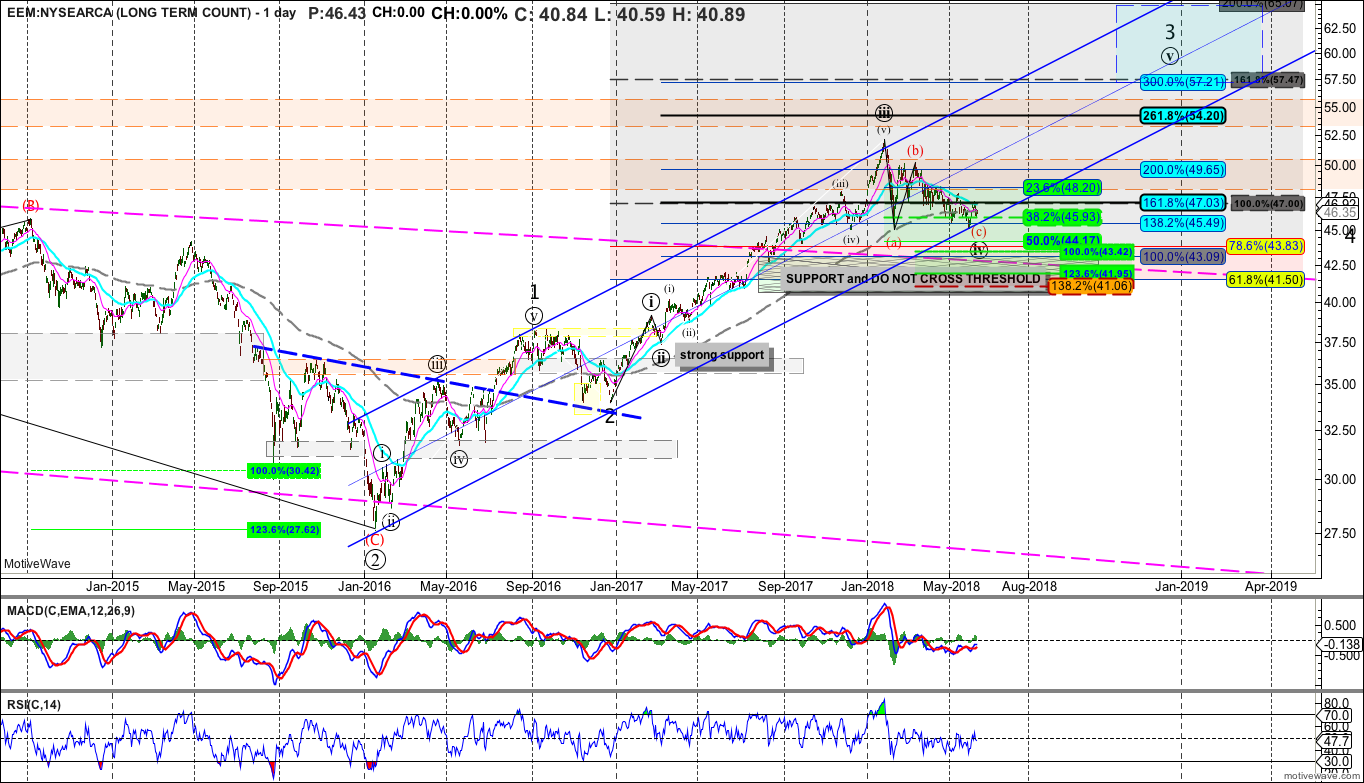

once EEM jumps on board...i think it is relentless higher...

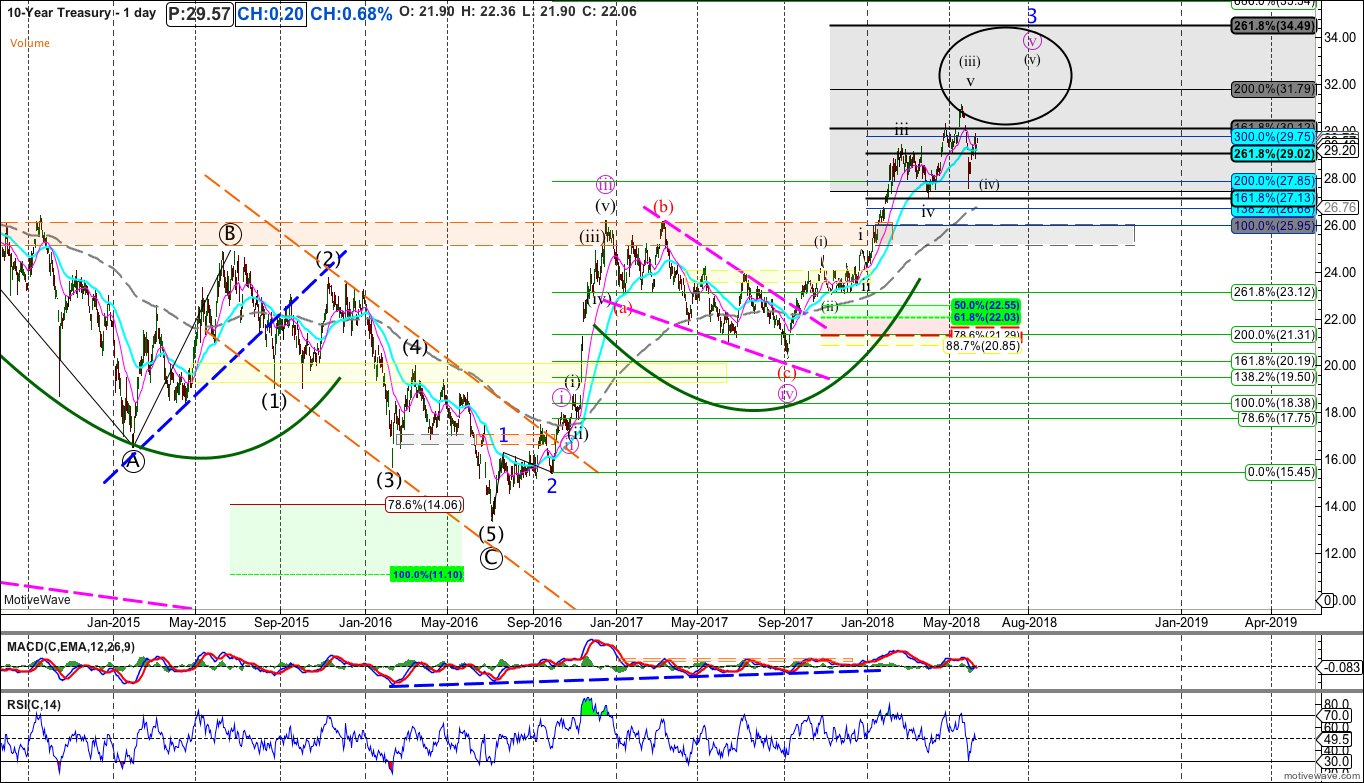

still like yields on 10;s to target 3.3/3.50 this year as stated when we shorted em last fall....that is a good thing (rates rising for my premise above)